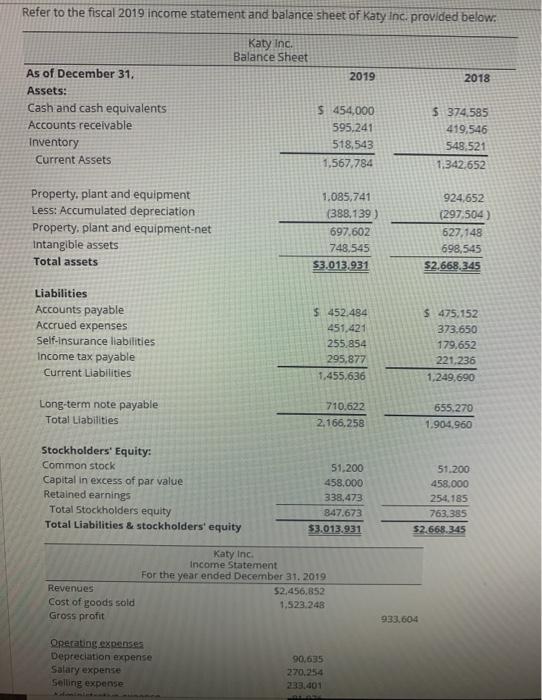

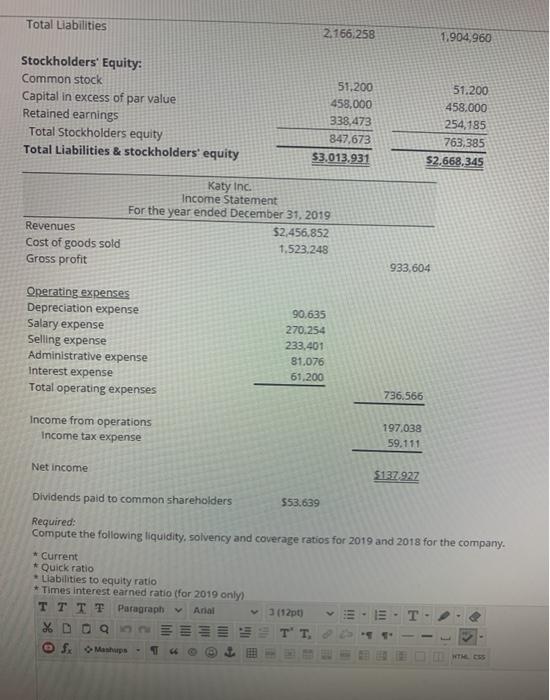

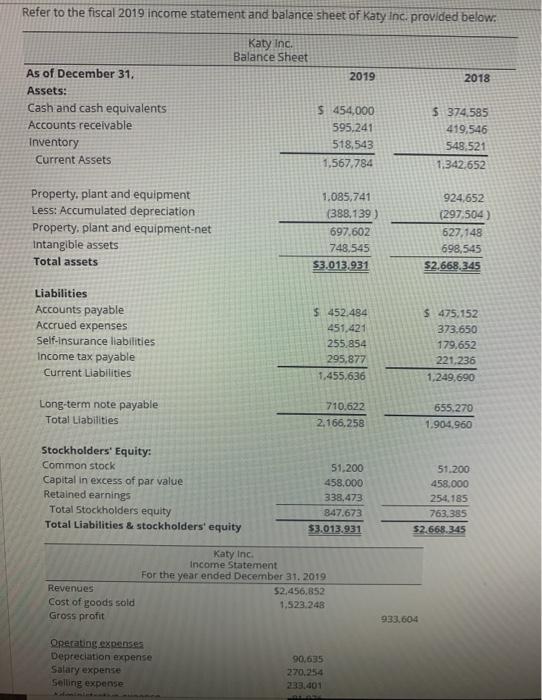

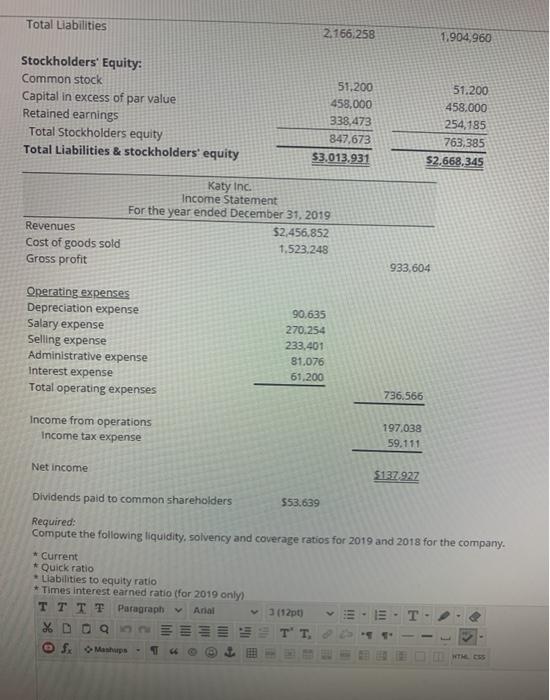

Refer to the fiscal 2019 income statement and balance sheet of Katy Inc. provided below: Katy Inc. Balance Sheet 2019 2018 As of December 31, Assets: Cash and cash equivalents Accounts receivable Inventory Current Assets $ 454,000 595,241 518,543 1,567.784 5 374,585 419,546 548,521 1.342.652 Property, plant and equipment Less: Accumulated depreciation Property, plant and equipment.net Intangible assets Total assets 1.085,741 (388,139) 697.602 748,545 $3.013,931 924,652 (297,504 627,148 698,545 $2.668 345 Liabilities Accounts payable Accrued expenses Self-insurance liabilities Income tax payable Current Liabilities $452.484 451,421 255,854 295,877 1,455.636 $475,152 373,650 179.652 221,236 1,249,690 Long-term note payable Total Liabilities 710,622 2,166,258 655.270 1.904,960 Stockholders' Equity: Common stock Capital in excess of par value Retained earnings Total Stockholders equity Total Liabilities & stockholders' equity 51,200 458.000 338.473 847.673 $3.013,931 51.200 458.000 254.185 763,385 52.668.345 Katy Inc. Income Statement For the year ended December 31, 2019 $2,456,852 1.523.248 Revenues Cost of goods sold Gross profit 933.604 Operating expenses Depreciation expense Salary expense Selling expense 90,635 270.254 133.401 Total Liabilities 2166 258 1.904 960 Stockholders' Equity: Common stock Capital in excess of par value Retained earnings Total Stockholders equity Total Liabilities & stockholders' equity 51,200 458,000 338,473 847,673 $3.013.931 51.200 458.000 254,185 763,385 $2.668,345 Katy Inc. Income Statement For the year ended December 31, 2019 $2,456.852 1.523.248 Revenues Cost of goods sold Gross profit 933,604 Operating expenses Depreciation expense Salary expense Selling expense Administrative expense Interest expense Total operating expenses 90.635 270.254 233,401 81.076 61,200 736.566 Income from operations Income tax expense 197.038 59.111 Net income $137.927 Dividends paid to common shareholders 553.639 Required: Compute the following liquidity, solvency and coverage ratios for 2019 and 2018 for the company. * Current * Quick ratio Liabilities to equity ratio * Times interest earned ratio (for 2019 only) TTTT Paragraph Anal (12pt) Y DOO T'T Fx Mashup 14