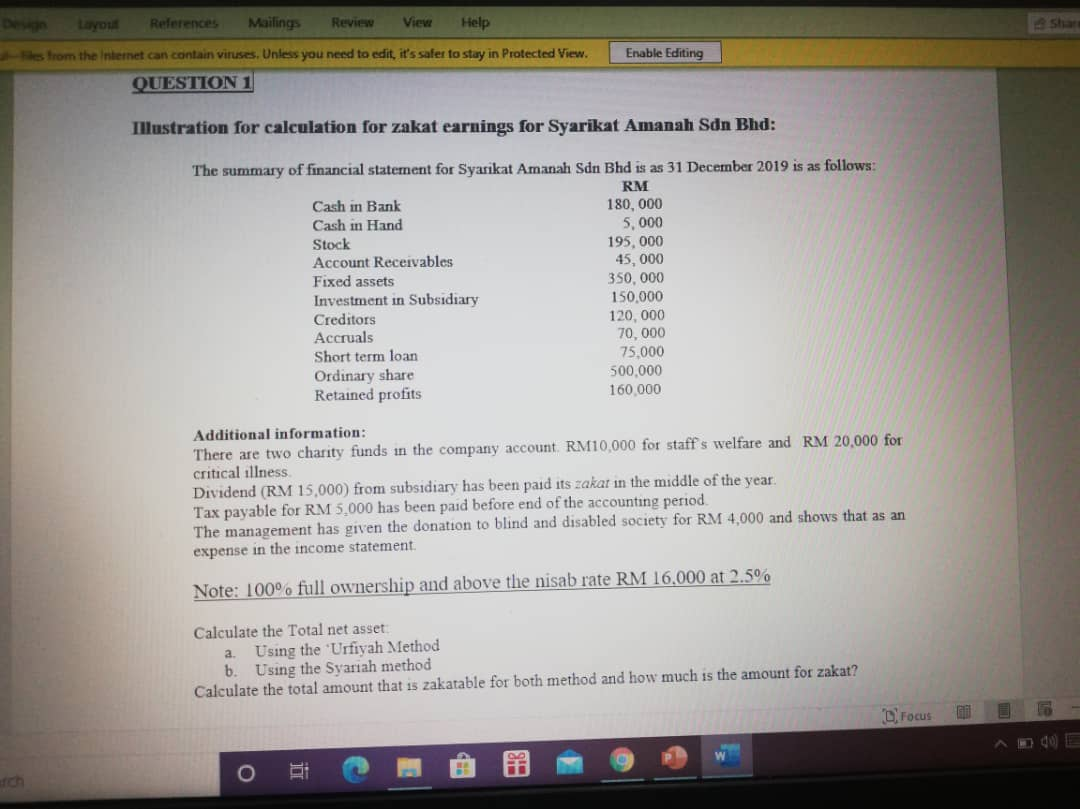

References Mailings Review View Help les from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. QUESTION 1 Enable Editing Illustration for calculation for zakat earnings for Syarikat Amanah Sdn Bhd: The summary of financial statement for Syarikat Amanah Sdn Bhd is as 31 December 2019 is as follows: RM Cash in Bank 180,000 Cash in Hand 5,000 Stock 195,000 Account Receivables 45,000 Fixed assets 350,000 Investment in Subsidiary 150.000 Creditors 120,000 Accruals 70,000 Short term loan 75,000 Ordinary share 500.000 Retained profits 160.000 Additional information: There are two charity funds in the company account. RM10,000 for staffs welfare and RM 20,000 for critical illness Dividend (RM 15,000) from subsidiary has been paid its zakar in the middle of the year Tax payable for RM 5,000 has been paid before end of the accounting period The management has given the donation to blind and disabled society for RM 4,000 and shows that as an expense in the income statement. Note: 100% full ownership and above the nisab rate RM 16,000 at 2.5% Calculate the Total net asset: a. Using the 'Urfiyah Method b. Using the Syariah method Calculate the total amount that is zakatable for both method and how much is the amount for zakat? D. Focus O References Mailings Review View Help les from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. QUESTION 1 Enable Editing Illustration for calculation for zakat earnings for Syarikat Amanah Sdn Bhd: The summary of financial statement for Syarikat Amanah Sdn Bhd is as 31 December 2019 is as follows: RM Cash in Bank 180,000 Cash in Hand 5,000 Stock 195,000 Account Receivables 45,000 Fixed assets 350,000 Investment in Subsidiary 150.000 Creditors 120,000 Accruals 70,000 Short term loan 75,000 Ordinary share 500.000 Retained profits 160.000 Additional information: There are two charity funds in the company account. RM10,000 for staffs welfare and RM 20,000 for critical illness Dividend (RM 15,000) from subsidiary has been paid its zakar in the middle of the year Tax payable for RM 5,000 has been paid before end of the accounting period The management has given the donation to blind and disabled society for RM 4,000 and shows that as an expense in the income statement. Note: 100% full ownership and above the nisab rate RM 16,000 at 2.5% Calculate the Total net asset: a. Using the 'Urfiyah Method b. Using the Syariah method Calculate the total amount that is zakatable for both method and how much is the amount for zakat? D. Focus O