Answered step by step

Verified Expert Solution

Question

1 Approved Answer

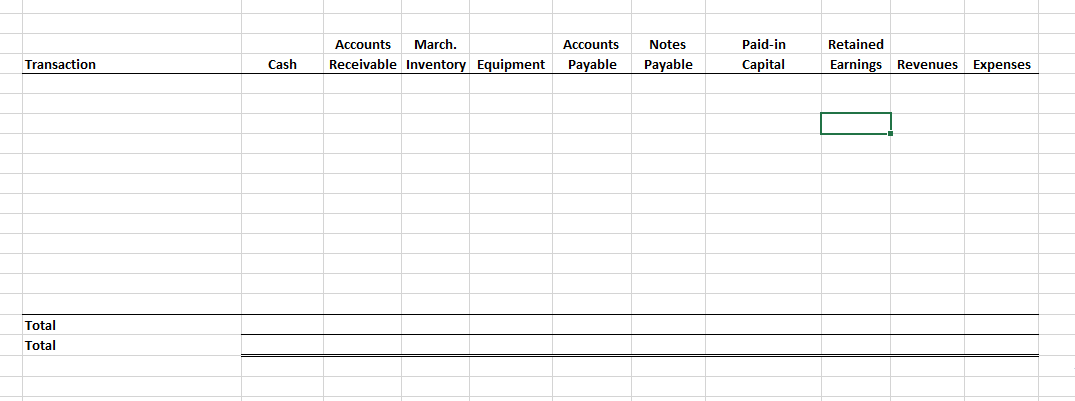

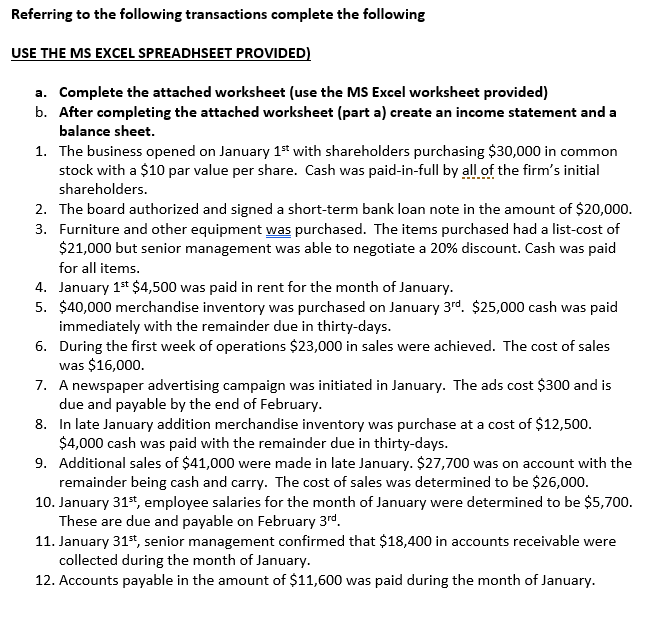

Referring to the following transactions complete the following USE THE MS EXCEL SPREADHSEET PROVIDED) a. Complete the attached worksheet (use the MS Excel worksheet provided)

Referring to the following transactions complete the following USE THE MS EXCEL SPREADHSEET PROVIDED) a. Complete the attached worksheet (use the MS Excel worksheet provided) b. After completing the attached worksheet (part a) create an income statement and a balance sheet. 1. The business opened on January 1st with shareholders purchasing $30,000 in common stock with a $10 par value per share. Cash was paid-in-full by all of the firm's initial shareholders. 2. The board authorized and signed a short-term bank loan note in the amount of \$20,000. 3. Furniture and other equipment was purchased. The items purchased had a list-cost of $21,000 but senior management was able to negotiate a 20% discount. Cash was paid for all items. 4. January 1st$4,500 was paid in rent for the month of January. 5. $40,000 merchandise inventory was purchased on January 3rd. $25,000 cash was paid immediately with the remainder due in thirty-days. 6. During the first week of operations $23,000 in sales were achieved. The cost of sales was $16,000. 7. A newspaper advertising campaign was initiated in January. The ads cost $300 and is due and payable by the end of February. 8. In late January addition merchandise inventory was purchase at a cost of $12,500. $4,000 cash was paid with the remainder due in thirty-days. 9. Additional sales of $41,000 were made in late January. $27,700 was on account with the remainder being cash and carry. The cost of sales was determined to be $26,000. 10. January 31st, employee salaries for the month of January were determined to be $5,700. These are due and payable on February 3rd. 11. January 31st, senior management confirmed that $18,400 in accounts receivable were collected during the month of January. 12. Accounts payable in the amount of $11,600 was paid during the month of January. Referring to the following transactions complete the following USE THE MS EXCEL SPREADHSEET PROVIDED) a. Complete the attached worksheet (use the MS Excel worksheet provided) b. After completing the attached worksheet (part a) create an income statement and a balance sheet. 1. The business opened on January 1st with shareholders purchasing $30,000 in common stock with a $10 par value per share. Cash was paid-in-full by all of the firm's initial shareholders. 2. The board authorized and signed a short-term bank loan note in the amount of \$20,000. 3. Furniture and other equipment was purchased. The items purchased had a list-cost of $21,000 but senior management was able to negotiate a 20% discount. Cash was paid for all items. 4. January 1st$4,500 was paid in rent for the month of January. 5. $40,000 merchandise inventory was purchased on January 3rd. $25,000 cash was paid immediately with the remainder due in thirty-days. 6. During the first week of operations $23,000 in sales were achieved. The cost of sales was $16,000. 7. A newspaper advertising campaign was initiated in January. The ads cost $300 and is due and payable by the end of February. 8. In late January addition merchandise inventory was purchase at a cost of $12,500. $4,000 cash was paid with the remainder due in thirty-days. 9. Additional sales of $41,000 were made in late January. $27,700 was on account with the remainder being cash and carry. The cost of sales was determined to be $26,000. 10. January 31st, employee salaries for the month of January were determined to be $5,700. These are due and payable on February 3rd. 11. January 31st, senior management confirmed that $18,400 in accounts receivable were collected during the month of January. 12. Accounts payable in the amount of $11,600 was paid during the month of January

Referring to the following transactions complete the following USE THE MS EXCEL SPREADHSEET PROVIDED) a. Complete the attached worksheet (use the MS Excel worksheet provided) b. After completing the attached worksheet (part a) create an income statement and a balance sheet. 1. The business opened on January 1st with shareholders purchasing $30,000 in common stock with a $10 par value per share. Cash was paid-in-full by all of the firm's initial shareholders. 2. The board authorized and signed a short-term bank loan note in the amount of \$20,000. 3. Furniture and other equipment was purchased. The items purchased had a list-cost of $21,000 but senior management was able to negotiate a 20% discount. Cash was paid for all items. 4. January 1st$4,500 was paid in rent for the month of January. 5. $40,000 merchandise inventory was purchased on January 3rd. $25,000 cash was paid immediately with the remainder due in thirty-days. 6. During the first week of operations $23,000 in sales were achieved. The cost of sales was $16,000. 7. A newspaper advertising campaign was initiated in January. The ads cost $300 and is due and payable by the end of February. 8. In late January addition merchandise inventory was purchase at a cost of $12,500. $4,000 cash was paid with the remainder due in thirty-days. 9. Additional sales of $41,000 were made in late January. $27,700 was on account with the remainder being cash and carry. The cost of sales was determined to be $26,000. 10. January 31st, employee salaries for the month of January were determined to be $5,700. These are due and payable on February 3rd. 11. January 31st, senior management confirmed that $18,400 in accounts receivable were collected during the month of January. 12. Accounts payable in the amount of $11,600 was paid during the month of January. Referring to the following transactions complete the following USE THE MS EXCEL SPREADHSEET PROVIDED) a. Complete the attached worksheet (use the MS Excel worksheet provided) b. After completing the attached worksheet (part a) create an income statement and a balance sheet. 1. The business opened on January 1st with shareholders purchasing $30,000 in common stock with a $10 par value per share. Cash was paid-in-full by all of the firm's initial shareholders. 2. The board authorized and signed a short-term bank loan note in the amount of \$20,000. 3. Furniture and other equipment was purchased. The items purchased had a list-cost of $21,000 but senior management was able to negotiate a 20% discount. Cash was paid for all items. 4. January 1st$4,500 was paid in rent for the month of January. 5. $40,000 merchandise inventory was purchased on January 3rd. $25,000 cash was paid immediately with the remainder due in thirty-days. 6. During the first week of operations $23,000 in sales were achieved. The cost of sales was $16,000. 7. A newspaper advertising campaign was initiated in January. The ads cost $300 and is due and payable by the end of February. 8. In late January addition merchandise inventory was purchase at a cost of $12,500. $4,000 cash was paid with the remainder due in thirty-days. 9. Additional sales of $41,000 were made in late January. $27,700 was on account with the remainder being cash and carry. The cost of sales was determined to be $26,000. 10. January 31st, employee salaries for the month of January were determined to be $5,700. These are due and payable on February 3rd. 11. January 31st, senior management confirmed that $18,400 in accounts receivable were collected during the month of January. 12. Accounts payable in the amount of $11,600 was paid during the month of January Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started