Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reflect on the actions taken by the Mexican Government during the crisis and discuss how they could have prevent the crisis from happening. 1. Do

Reflect on the actions taken by the Mexican Government during the crisis and discuss how they could have prevent the crisis from happening.

1. Do you think that Mexican authorities took the right actions when the crisis arose?

2. In your view, what could Mexico have done to prevent the crisis?

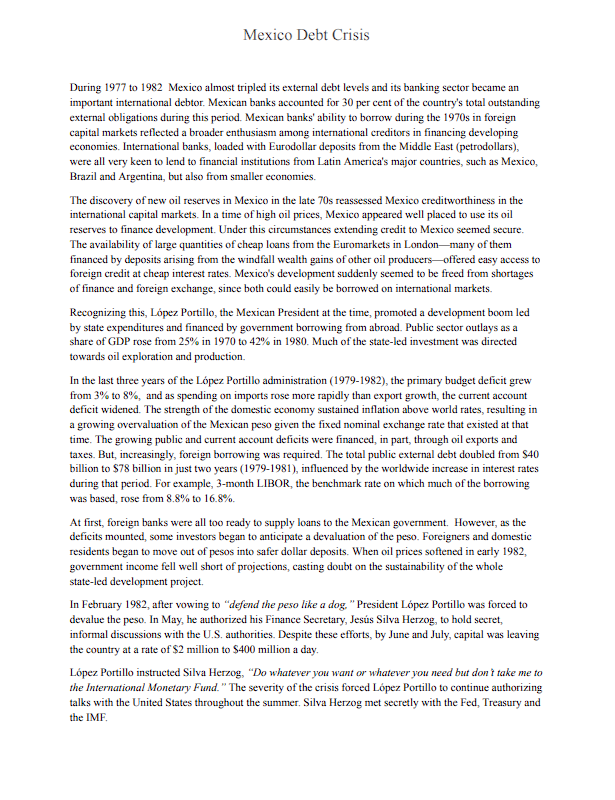

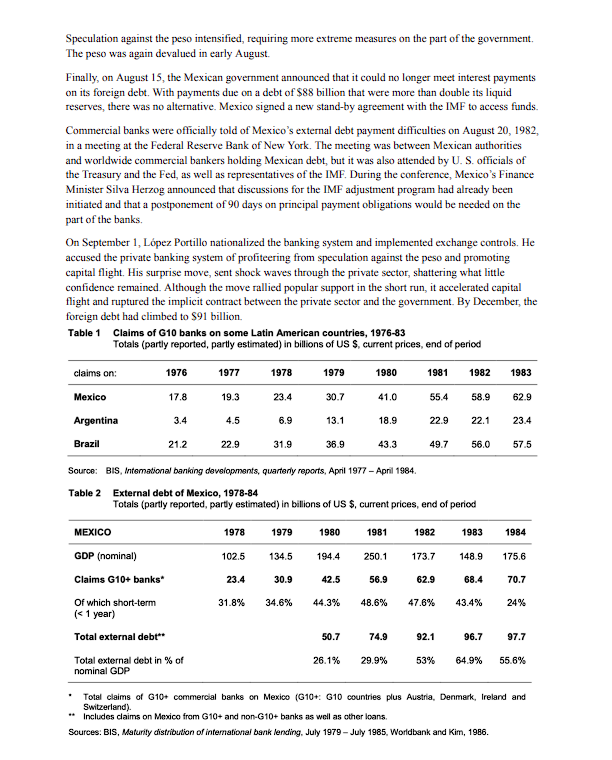

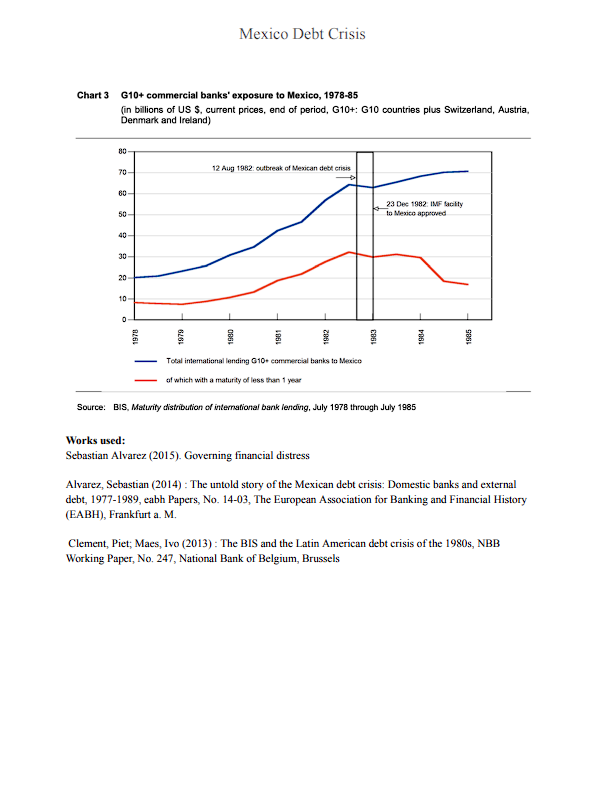

Mexico Debt Crisis During 1977 to 1982 Mexico almost tripled its external debt levels and its banking sector became an important international debtor. Mexican banks accounted for 30 per cent of the country's total outstanding external obligations during this period. Mexican banks' ability to borrow during the 1970s in foreign capital markets reflected a broader enthusiasm among international creditors in financing developing economies. International banks, loaded with Eurodollar deposits from the Middle East (petrodollars), were all very keen to lend to financial institutions from Latin America's major countries, such as Mexico, Brazil and Argentina, but also from smaller economies. The discovery of new oil reserves in Mexico in the late 70s reassessed Mexico creditworthiness in the international capital markets. In a time of high oil prices, Mexico appeared well placed to use its oil reserves to finance development. Under this circumstances extending credit to Mexico seemed secure. The availability of large quantities of cheap loans from the Euromarkets in London-many of them financed by deposits arising from the windfall wealth gains of other oil producers-offered easy access to foreign credit at cheap interest rates. Mexico's development suddenly seemed to be freed from shortages of finance and foreign exchange, since both could easily be borrowed on international markets. Recognizing this, Lpez Portillo, the Mexican President at the time, promoted a development boom led by state expenditures and financed by government borrowing from abroad. Public sector outlays as a share of GDP rose from 25% in 1970 to 42% in 1980. Much of the state-led investment was directed towards oil exploration and production. In the last three years of the Lpez Portillo administration (1979-1982), the primary budget deficit grew from 3% to 8%, and as spending on imports rose more rapidly than export growth, the current account deficit widened. The strength of the domestic economy sustained inflation above world rates, resulting in a growing overvaluation of the Mexican peso given the fixed nominal exchange rate that existed at that time. The growing public and current account deficits were financed, in part, through oil exports and taxes. But, increasingly, foreign borrowing was required. The total public external debt doubled from $40 billion to $78 billion in just two years (1979-1981), influenced by the worldwide increase in interest rates during that period. For example, 3-month LIBOR, the benchmark rate on which much of the borrowing was based, rose from 8.8% to 16.8%. At first, foreign banks were all too ready to supply loans to the Mexican government. However, as the deficits mounted, some investors began to anticipate a devaluation of the peso. Foreigners and domestic residents began to move out of pesos into safer dollar deposits. When oil prices softened in early 1982, government income fell well short of projections, casting doubt on the sustainability of the whole state-led development project. In February 1982, after vowing to "defend the peso like a dog." President Lpez Portillo was forced to devalue the peso. In May, he authorized his Finance Secretary, Jess Silva Herzog, to hold secret, informal discussions with the U.S. authorities. Despite these efforts, by June and July, capital was leaving the country at a rate of $2 million to $400 million a day. Lpez Portillo instructed Silva Herzog, "Do whatever you want or whatever you need but don't take me to the International Monetary Fund." The severity of the crisis forced Lpez Portillo to continue authorizing talks with the United States throughout the summer. Silva Herzog met secretly with the Fed, Treasury and the IMF.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started