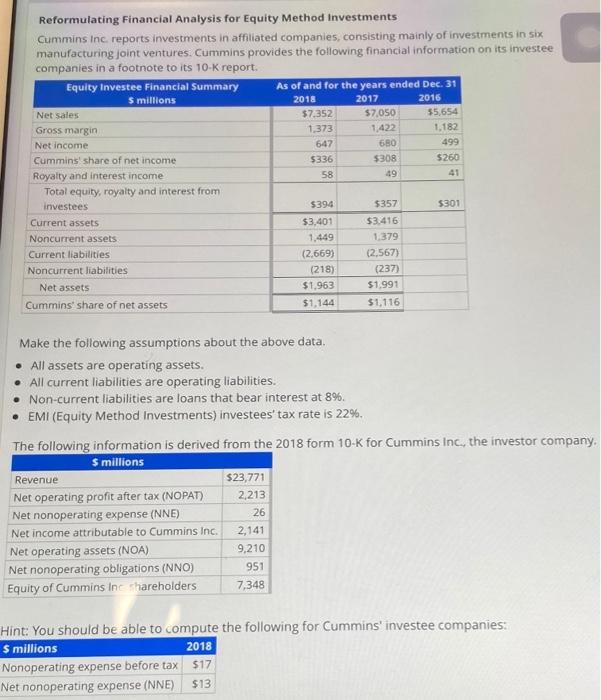

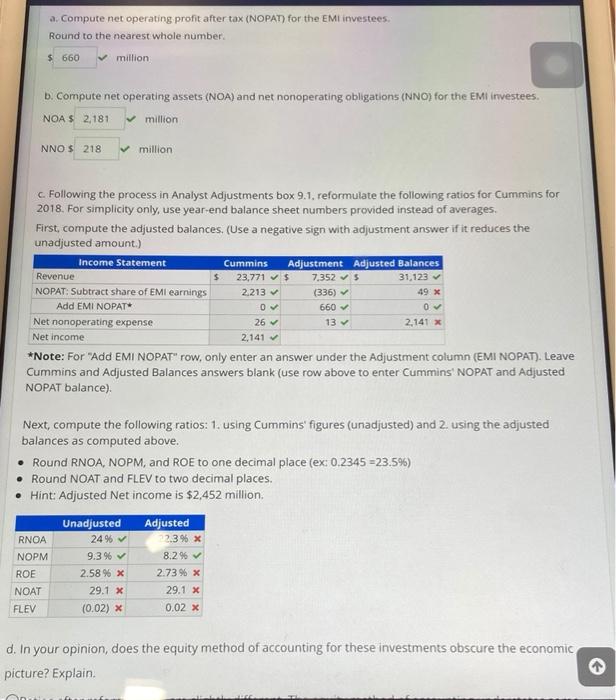

Reformulating Financial Analysis for Equity Method Investments Cummins Inc reports investments in affiliated companies, consisting mainly of investments in six manufacturing joint ventures. Cummins provides the following financial information on its investee companies in a footnote to its 10-K report. Equity Investee Financial Summary S millions As of and for the years ended Dec. 31 2018 2017 2016 $7,352 $7,050 55,654 1,373 1.422 1,182 Net Sales Gross margin Net income 647 680 499 Cummins' share of net income $336 $308 $260 58 49 Royalty and interest income Total equity, royalty and interest from investees $394 $357 5301 Current assets $3,401 $3.416 1.449 1.379 Noncurrent assets Current liabilities (2.567) Noncurrent liabilities (2,669) (218) $1,963 (237) $1.991 Net assets $1,144 $1,116 Cummins' share of net assets Make the following assumptions about the above data. All assets are operating assets. . All current liabilities are operating liabilities. Non-current liabilities are loans that bear interest at 89. EMI (Equity Method Investments) investees' tax rate is 22%, The following information is derived from the 2018 form 10-K for Cummins Inc., the investor company. $ millions Revenue $23,771 2,213 Net operating profit after tax (NOPAT) Net nonoperating expense (NNE) Net income attributable to Cummins Inc. 26 2,141 9,210 951 Net operating assets (NOA) Net nonoperating obligations (NNO) Equity of Cummins Inc shareholders 7,348 $ millions Hint: You should be able to compute the following for Cummins' investee companies: 2018 Nonoperating expense before tax Net nonoperating expense (NNE) $13 $17 a. Compute net operating profit after tax (NOPAT) for the EMi investees Round to the nearest whole number $ 660 million b. Compute net operating assets (NOA) and net nonoperating obligations (NNO) for the EMi investees. NOA $ 2,181 million NNO S 218 million c. Following the process in Analyst Adjustments box 9.1, reformulate the following ratios for Cummins for 2018. For simplicity only use year-end balance sheet numbers provided instead of averages First, compute the adjusted balances. (Use a negative sign with adjustment answer if it reduces the unadjusted amount.) Income Statement Revenue NOPAT: Subtract share of EMI earnings Cummins Adjustment Adjusted Balances $ 23,771 $ 7.3525 31,123 2.213 (336) 49 X Add EMI NOPAT 0 660 0 Net nonoperating expense 26 13 2,141 x Net income 2,141 *Note: For "Add EMI NOPAT"row, only enter an answer under the Adjustment column (EMI NOPAT). Leave Cummins and Adjusted Balances answers blank (use row above to enter Cummins' NOPAT and Adjusted NOPAT balance) Next, compute the following ratios: 1. using Cummins' figures (unadjusted) and 2. using the adjusted balances as computed above. Round RNOA, NOPM, and ROE to one decimal place (ex: 0.2345=23.5) Round NOAT and FLEV to two decimal places. Hint: Adjusted Net income is $2,452 million RNOA Unadjusted 24% 9.3 % Adjusted 22.3% x 8.2 % 2.73 % x NOPM ROE 2.58% x NOAT 29.1 x 29.1 x FLEV (0.02) x 0.02 x d. In your opinion, does the equity method of accounting for these investments obscure the economic picture? Explain