Question

Reformulating Financial Analysis for Equity Method Investments Cummins Inc. reports investments in affiliated companies, consisting mainly of investments in six manufacturing joint ventures. Cummins provides

Reformulating Financial Analysis for Equity Method Investments

Cummins Inc. reports investments in affiliated companies, consisting mainly of investments in six manufacturing joint ventures. Cummins provides the following financial information on its investee companies in a footnote to its 10-K report.

| Equity Investee Financial Summary | As of and for the years ended Dec. 31 | ||||||

|---|---|---|---|---|---|---|---|

| $ millions | 2018 | 2017 | 2016 | ||||

| Net sales | 7352 | 7050 | 5654 | ||||

| Gross margin | 1373 | 1422 | 1182 | ||||

| Net income | 647 | 680 | 499 | ||||

| Cummins' share of net income | 336 | 308 | 260 | ||||

| Royalty and interest income | 58 | 49 | 41 | ||||

| Total equity, royalty and interest from investees | 394 | 357 | 301 | ||||

| Current assets | $3401 | 3416 | |||||

| Noncurrent assets | 1449 | 1379 | |||||

| Current liabilities | (2669) | (2567) | |||||

| Noncurrent liabilities | (218) | (237) | |||||

| Net assets | $1963 | 1991 | |||||

| Cummins' share of net assets | $1144 | 1116 | |||||

Make the following assumptions about the above data.

All assets are operating assets.

All current liabilities are operating liabilities.

Non-current liabilities are loans that bear interest at 8%.

EMI (Equity Method Investments) investees tax rate is 22%.

The following information is derived from the 2018 form 10-K for Cummins Inc., the investor company.

| $ millions | |

|---|---|

| Revenue | $23771 |

| Net operating profit after tax (NOPAT) | 2213 |

| Net nonoperating expense (NNE) | 26 |

| Net income attributable to Cummins Inc. | 2141 |

| Net operating assets (NOA) | 9210 |

| Net nonoperating obligations (NNO) | 951 |

| Equity of Cummins Inc. shareholders | 7348 |

Hint: You should be able to compute the following for Cummins' investee companies:

| $millions | 2018 |

| Nonoperating expense before tax | 17 |

| Net nonoperating expense (NNE) | 13 |

a. Compute net operating profit after tax (NOPAT) for the EMI investees.

Round to the nearest whole number.

$Answer million

b. Compute net operating assets (NOA) and net nonoperating obligations (NNO) for the EMI investees.

NOA $Answer million

NNO $Answer million

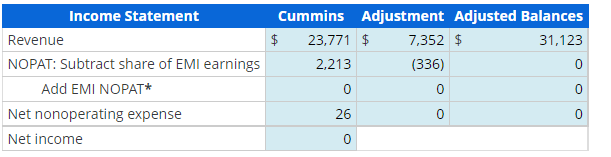

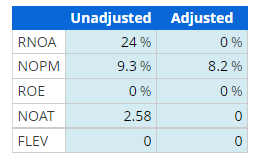

c. Following the process in Analyst Adjustments box 9.1, reformulate the following ratios for Cummins for 2018. For simplicity only, use year-end balance sheet numbers provided instead of averages.

First, compute the adjusted balances.

Next, compute the following ratios: 1. using Cummins' figures (unadjusted) and 2. using the adjusted balances as computed above.

Round RNOA, NOPM, and ROE to one decimal place (ex: 0.2345 =23.5%)

Round NOAT and FLEV to two decimal places.

Hint: Adjusted Net income is $2,452 million

Use negative signs with answers, when appropriate.

\begin{tabular}{|l|r|r|} \hline & Unadjusted & Adjusted \\ \hline RNOA & 24% & 0% \\ \hline NOPM & 9.3% & 8.2% \\ \hline ROE & 0% & 0% \\ \hline NOAT & 2.58 & 0 \\ \hline FLEV & 0 & 0 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline & Unadjusted & Adjusted \\ \hline RNOA & 24% & 0% \\ \hline NOPM & 9.3% & 8.2% \\ \hline ROE & 0% & 0% \\ \hline NOAT & 2.58 & 0 \\ \hline FLEV & 0 & 0 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started