Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Regan Builders Co. entered into a long-term contract to build a facility for $900,000. Regan Builders began on January 1, 2020 and was completed at

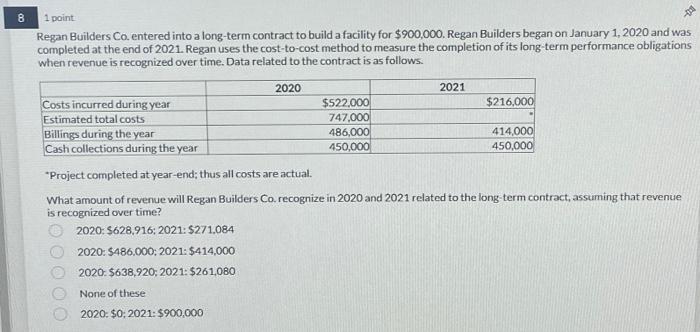

Regan Builders Co. entered into a long-term contract to build a facility for $900,000. Regan Builders began on January 1, 2020 and was completed at the end of 2021. Regan uses the cost-to-cost method to measure the completion of its long-term performance obligations when revenue is recognized over time. Data related to the contract is as follows. Costs incurred during year Estimated total costs Billings during the year Cash collections during the year 2020 $522,000 747,000 486,000 450,000 2021 $216,000 414,000 450,000 *Project completed at year-end; thus all costs are actual. What amount of revenue will Regan Builders Co. recognize in 2020 and 2021 related to the long-term contract, assuming that revenue is recognized over time? 2020: $628,916; 2021: $271,084 2020: $486,000; 2021: $414,000 2020: $638,920; 2021: $261,080 None of these 2020: $0; 2021: $900,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started