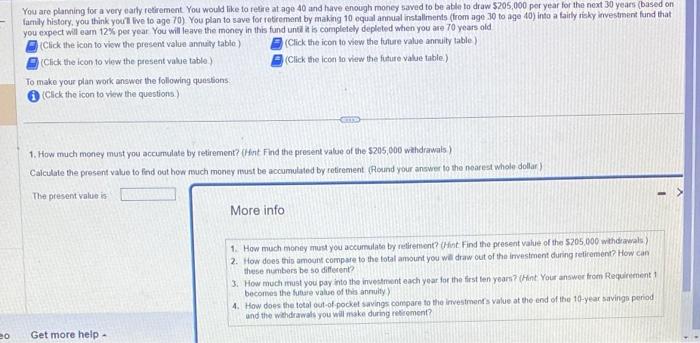

You are planning for a vory earhy retirement You would like to refire at age 40 and have enough moncy saved to be able to draw $205,000 por year for the noxt 30 years (based on family history, you think yout live to age 70) You plan to save for rotrement by making 10 oqual anmaal installments (from age 30 to age 40 ) into a failly risky irvestanent fund that you expect will eam 12% per year You will leave the money in this fund unti it is completely depleted when you are 70 years old (Cick the icon to viow the present value annuity tablo) (Click the icon to view the future value annaity table) (Click the icon to view the present value table.) (Click the icon lo view the future value table.) To make your plan work answer the following quastions (Click the icon to view the questions.) 1. How much money must you accumulate by retiement? (Hint Find the present value of the 5205,000 withdrawals) Caiculate the present valie to find out hew much money must be accumulated by retirement (Round your answer to the nearest whole dollar) The present value is More info 1. How much money must you accumulate by reliremint? (Hint Find the peesent value of the 5205,000 wthdiwels) 2. Hoa does this amouns compare to the total amount you will draw out of the imvestment during refirement? How can these numbers be so different? 3. How much must you poy into the invetament each year for the first len years? (Hint Your answor from Requirement 1 becorves the futare value of this anruity) 4. How does the total out-of pocket savings compare to the investment s value at the end of the 10-year savingo period and the whihdraalk you will make during refrement? You are planning for a vory earhy retirement You would like to refire at age 40 and have enough moncy saved to be able to draw $205,000 por year for the noxt 30 years (based on family history, you think yout live to age 70) You plan to save for rotrement by making 10 oqual anmaal installments (from age 30 to age 40 ) into a failly risky irvestanent fund that you expect will eam 12% per year You will leave the money in this fund unti it is completely depleted when you are 70 years old (Cick the icon to viow the present value annuity tablo) (Click the icon to view the future value annaity table) (Click the icon to view the present value table.) (Click the icon lo view the future value table.) To make your plan work answer the following quastions (Click the icon to view the questions.) 1. How much money must you accumulate by retiement? (Hint Find the present value of the 5205,000 withdrawals) Caiculate the present valie to find out hew much money must be accumulated by retirement (Round your answer to the nearest whole dollar) The present value is More info 1. How much money must you accumulate by reliremint? (Hint Find the peesent value of the 5205,000 wthdiwels) 2. Hoa does this amouns compare to the total amount you will draw out of the imvestment during refirement? How can these numbers be so different? 3. How much must you poy into the invetament each year for the first len years? (Hint Your answor from Requirement 1 becorves the futare value of this anruity) 4. How does the total out-of pocket savings compare to the investment s value at the end of the 10-year savingo period and the whihdraalk you will make during refrement