Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Regina Hitechia, the CIO of Aurora Glass Fibers, Inc., is considering whether to lease or buy some new computers in the company's manufacturing plant. The

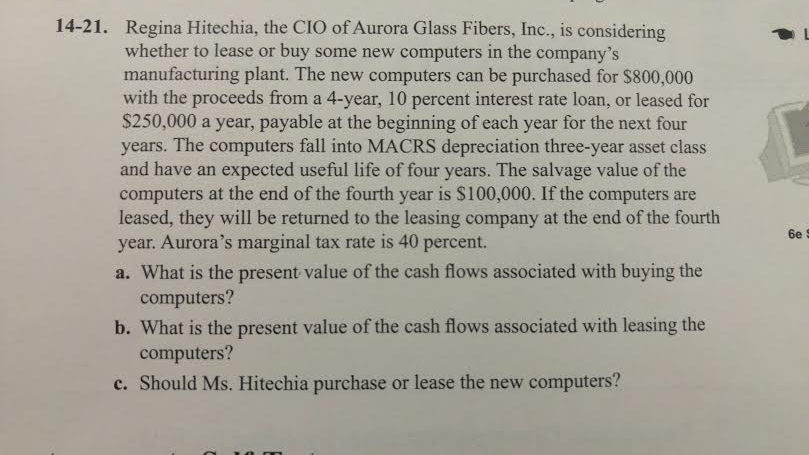

Regina Hitechia, the CIO of Aurora Glass Fibers, Inc., is considering whether to lease or buy some new computers in the company's manufacturing plant. The new computers can be purchased for $800,000 with the proceeds from a 4-year, 10 percent interest rate loan, or leased for $250,000 a year, payable at the beginning of each year for the next four years. The computers fall into MACRS depreciation three-year asset class and have an expected useful life of four years. The salvage value of the computers at the end of the fourth year is $100,000. If the computers are leased, they will be returned to the leasing company at the end of the fourth year. Aurora's marginal tax rate is 40 percent. What is the present value of the cash flows associated with buying the computers? What is the present value of the cash flows associated with leasing the computers? Should Ms. Hitechia purchase or lease the new computers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started