Answered step by step

Verified Expert Solution

Question

1 Approved Answer

related all- its 1 ques- ans all plz The Michael Corporation was organized in 2018. It was authorized to issue 250,000 shares of $10 par

related all- its 1 ques- ans all plz

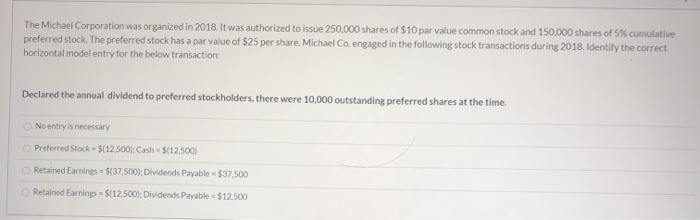

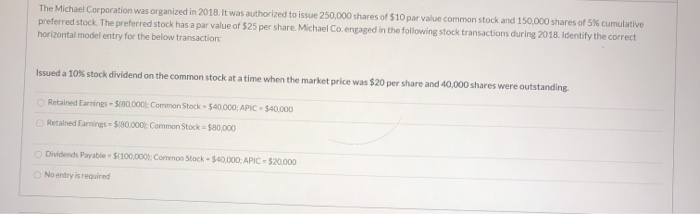

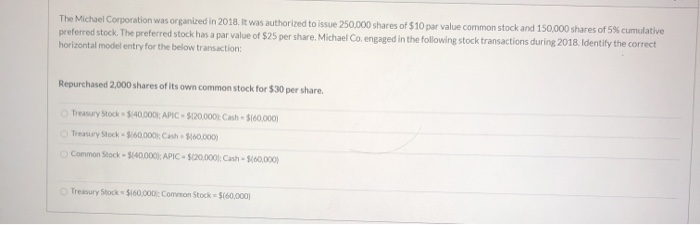

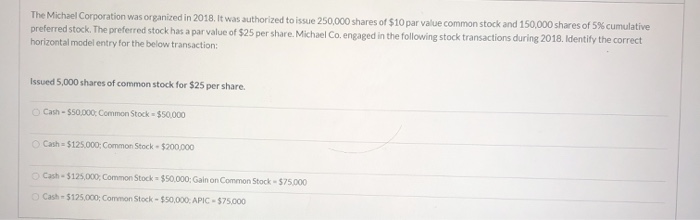

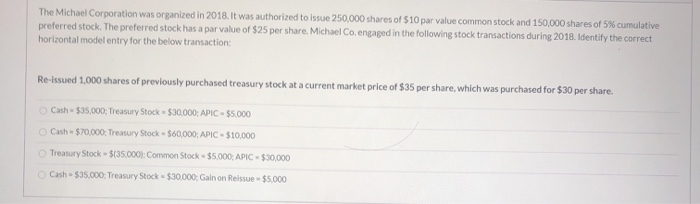

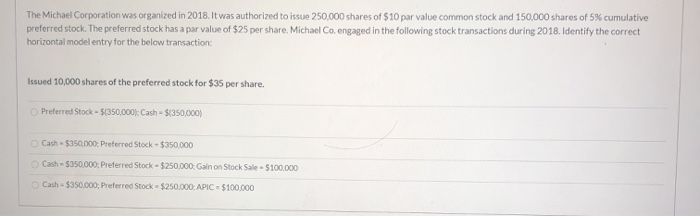

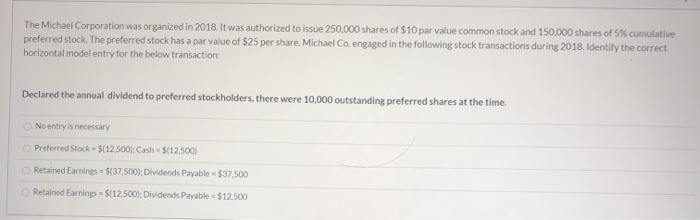

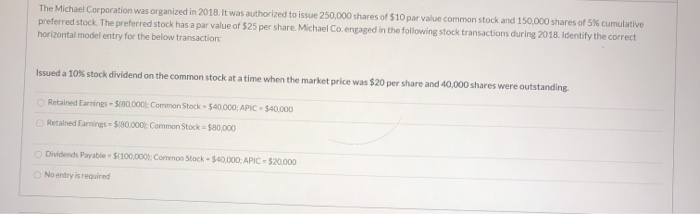

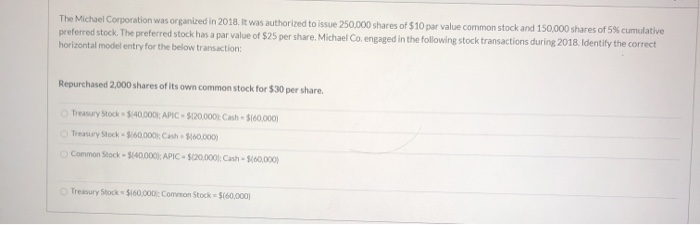

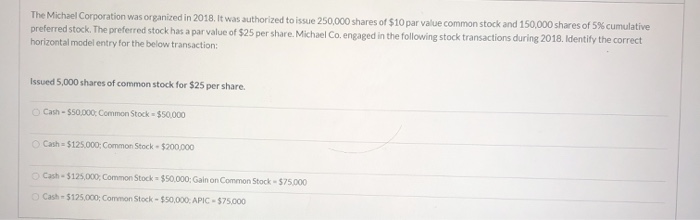

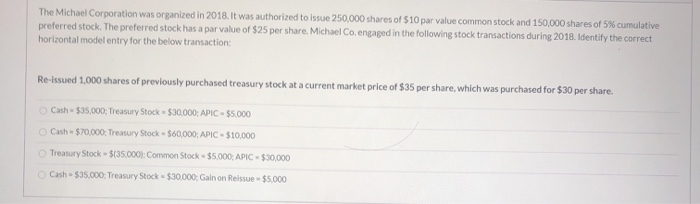

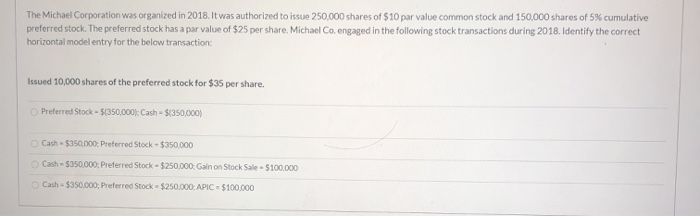

The Michael Corporation was organized in 2018. It was authorized to issue 250,000 shares of $10 par value common stock and 150,000 shares of 5% cumulative preferred stock. The preferred stock has a par value of $25 per share, Michael Co. engaged in the following stock transactions during 2018. Identify the correct horizontal model entry for the below transaction: Declared the annual dividend to preferred stockholders, there were 10,000 outstanding preferred shares at the time. No entry is necessary Preferred Stock - $(12,500): Cash - $112.500) Retained Earnings = 5(37,5001: Dividends Payable - $37.500 Retained Earnings = 51125001: Dividends Payable = $12.500 The Michael Corporation was organized in 2018. It was authorized to issue 250,000 shares of $10 par value common stock and 150,000 shares of 5% cumulative preferred stock. The preferred stock has a par value of $25 per share. Michael Co. engaged in the following stock transactions during 2018. Identify the correct horizontal model entry for the below transaction Issued a 10% stock dividend on the common stock at a time when the market price was $20 per share and 40,000 shares were outstanding Retained Earnines - 58000: Common Stock - $40.000; APIC - $40.000 Retained Earnines = $180.000): Common Stock = $80,000 Dividends Payable 56100.000: Common Stock - $40.000 APIC - $20.000 No entry is required The Michael Corporation was organized in 2018. It was authorized to issue 250,000 shares of $10 par value common stock and 150,000 shares of 5% cumulative preferred stock. The preferred stock has a par value of $25 per share. Michael Co. engaged in the following stock transactions during 2018. Identify the correct horizontal model entry for the below transaction: Repurchased 2,000 shares of its own common stock for $30 per share. Treasury Stock $40.000 APIC$120.000 Cash $160.0001 Treasury Stock - 3.60.000 Cash 60.0001 Common Stock - $40.000): APIC - $ 20,000: Cash - 560,000) Treasury Stock $160,000: Common Stock = 5(60,000 The Michael Corporation was organized in 2018. It was authorized to issue 250,000 shares of $10 par value common stock and 150,000 shares of 5% cumulative preferred stock. The preferred stock has a par value of $25 per share. Michael Co. engaged in the following stock transactions during 2018. Identify the correct horizontal model entry for the below transaction: Issued 5,000 shares of common stock for $25 per share. Cash - $50,000: Common Stock - $50,000 Cash = $125.000: Common Stock - $200.000 Cash - $125,000. Common Stock = $50.000: Gain on Common Stock - $75.000 Cash - 5125.000: Common Stock - $50,000: APIC - $75,000 The Michael Corporation was organized in 2018. It was authorized to issue 250,000 shares of $10 par value common stock and 150,000 shares of 5% cumulative preferred stock. The preferred stock has a par value of $25 per share. Michael Co. engaged in the following stock transactions during 2018. Identify the correct horizontal model entry for the below transaction: Re-issued 1,000 shares of previously purchased treasury stock at a current market price of $35 per share, which was purchased for $30 per share. Cash - $35,000; Treasury Stock $30,000, APIC - $5.000 Cash $70.000: Treasury Stock - $60.000; APIC - $10,000 Treasury Stock - $(35,000): Common Stock - $5,000: APIC - $30,000 Cash$35,000: Treasury Stock $30,000: Gain on Reissue - $5.000 The Michael Corporation was organized in 2018. It was authorized to issue 250,000 shares of $10 par value common stock and 150,000 shares of 5% cumulative preferred stock. The preferred stock has a par value of $25 per share. Michael Co, engaged in the following stock transactions during 2018. Identify the correct horizontal model entry for the below transaction: Issued 10,000 shares of the preferred stock for $35 per share. Preferred Stock - $(350,000: Cash - $(350,000) Cash - $350.000: Preferred Stock - $350.000 Cash - $350,000: Preferred Stock - $250,000: Gain on Stock Sale - $100.000 Cash - $350,000; Preferred Stock-$250,000, APIC - $100.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started