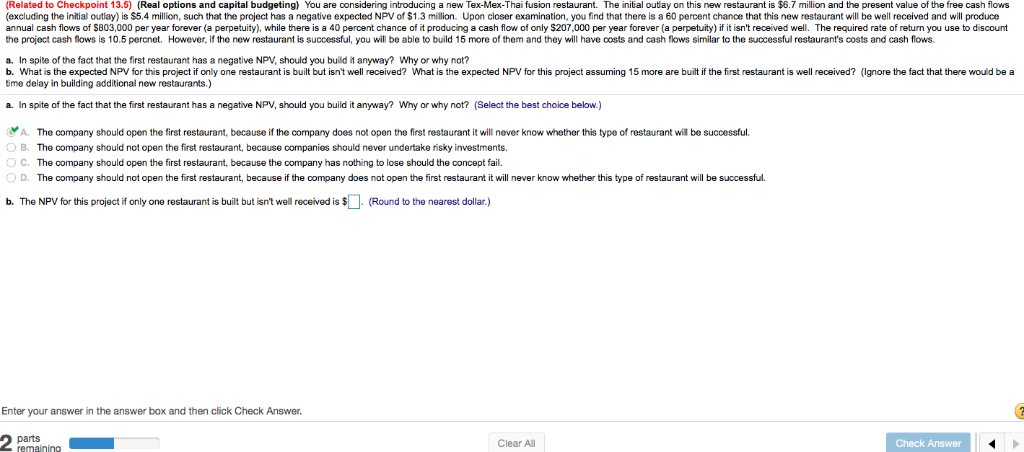

Related to Checkpoint 13.5) (Real options and capital budgeting) You are considering introducing a new Tex-Mex-Thai fusion restaurant. The initial outay on this new restaurant is $6.7 million and the present value of the free cash flows excluding the initial outlay is $5.4 million, such that the project has a negative expected NPVS1.3 million. Upon closer examination, you find that there is a 60 percent chance that this e restaurant will be well received and will produce annual cash flows of $803,000 per year forever (a perpetuity), while there is a 40 percent chance of it producing a cash flow of only $207,000 per year forever (a perpetuity) if it isn't received well. The required rate of return you use to discount the project cash flows is 10.5 percnet. However, if the new restaurant is successful, you will be able to build 15 more of them and they will have costs and cash flows similar to the successful restaurant's costs and cash flows. a. In spite of the fact that the first restaurant has a negative NPV, should you build it anyway? Why or why not? b. What is the expected NPV for this project if only one restaurant is built but isn't well received? What is the expected NPV for this project assuming 15 more are built if the first restaurant is well received? (Ignore the fact that there would be a time delay in building additional new restaurants.) a. In spite of the fact that the first restaurant has a negative NPV, should you build it anyway? Why or why not? (Select the best choice below.) A. The company should open the first restaurant, because if the company does not open the first restaurant it will never know whether this type of restaurant will be successful B. The company should not open the first restaurant, because companies should never undertake risky investments. C. The company should open the first restaurant, because the company has nothing to lose should the concept fail. 0 D. The company should not open the first restaurant, because if the company does not open the first restaurant it will never know whether this type of restaurant will be successful. b. The NPV for this project if only one restaurant is built but isn't well received is (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer Clear All Check Answer Related to Checkpoint 13.5) (Real options and capital budgeting) You are considering introducing a new Tex-Mex-Thai fusion restaurant. The initial outay on this new restaurant is $6.7 million and the present value of the free cash flows excluding the initial outlay is $5.4 million, such that the project has a negative expected NPVS1.3 million. Upon closer examination, you find that there is a 60 percent chance that this e restaurant will be well received and will produce annual cash flows of $803,000 per year forever (a perpetuity), while there is a 40 percent chance of it producing a cash flow of only $207,000 per year forever (a perpetuity) if it isn't received well. The required rate of return you use to discount the project cash flows is 10.5 percnet. However, if the new restaurant is successful, you will be able to build 15 more of them and they will have costs and cash flows similar to the successful restaurant's costs and cash flows. a. In spite of the fact that the first restaurant has a negative NPV, should you build it anyway? Why or why not? b. What is the expected NPV for this project if only one restaurant is built but isn't well received? What is the expected NPV for this project assuming 15 more are built if the first restaurant is well received? (Ignore the fact that there would be a time delay in building additional new restaurants.) a. In spite of the fact that the first restaurant has a negative NPV, should you build it anyway? Why or why not? (Select the best choice below.) A. The company should open the first restaurant, because if the company does not open the first restaurant it will never know whether this type of restaurant will be successful B. The company should not open the first restaurant, because companies should never undertake risky investments. C. The company should open the first restaurant, because the company has nothing to lose should the concept fail. 0 D. The company should not open the first restaurant, because if the company does not open the first restaurant it will never know whether this type of restaurant will be successful. b. The NPV for this project if only one restaurant is built but isn't well received is (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer Clear All Check