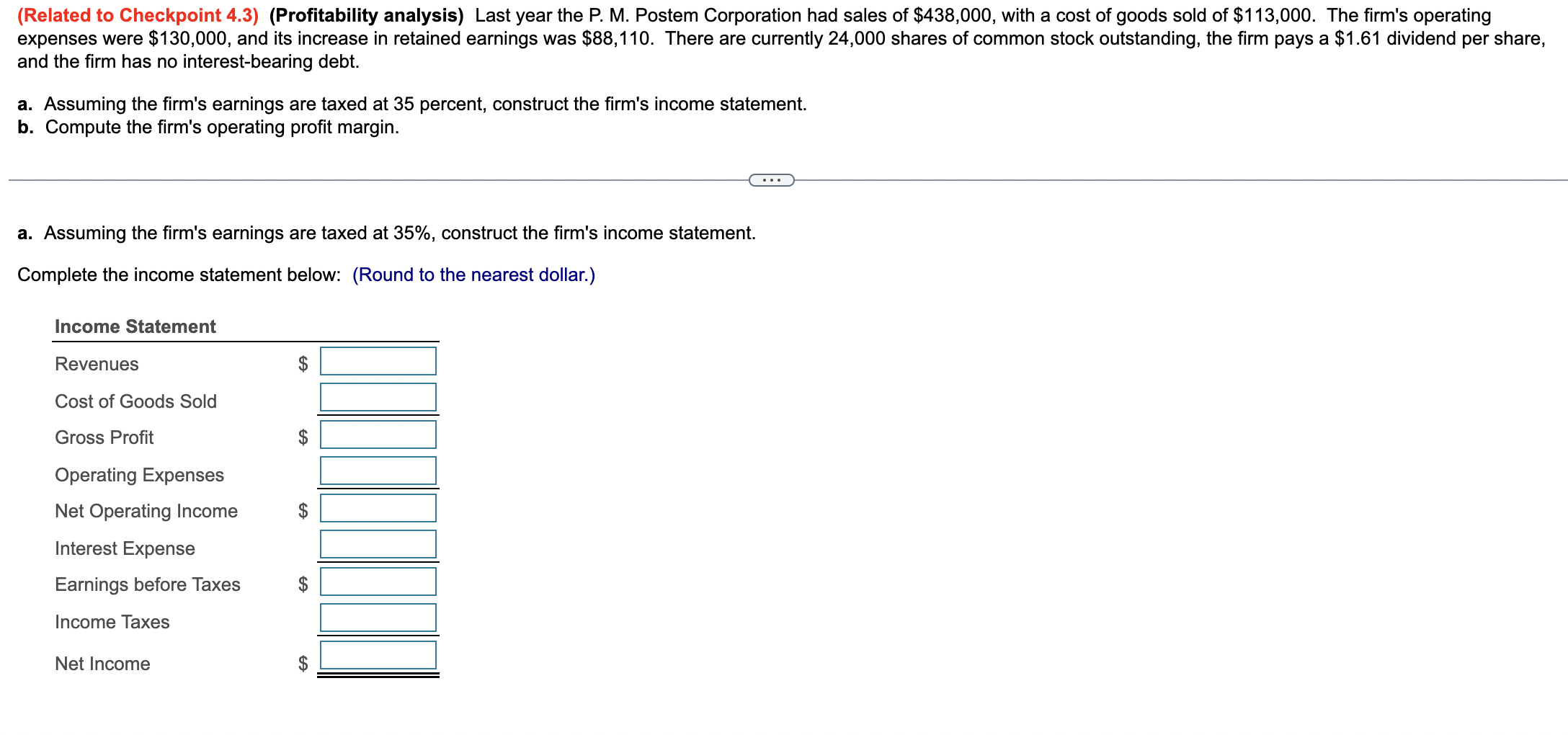

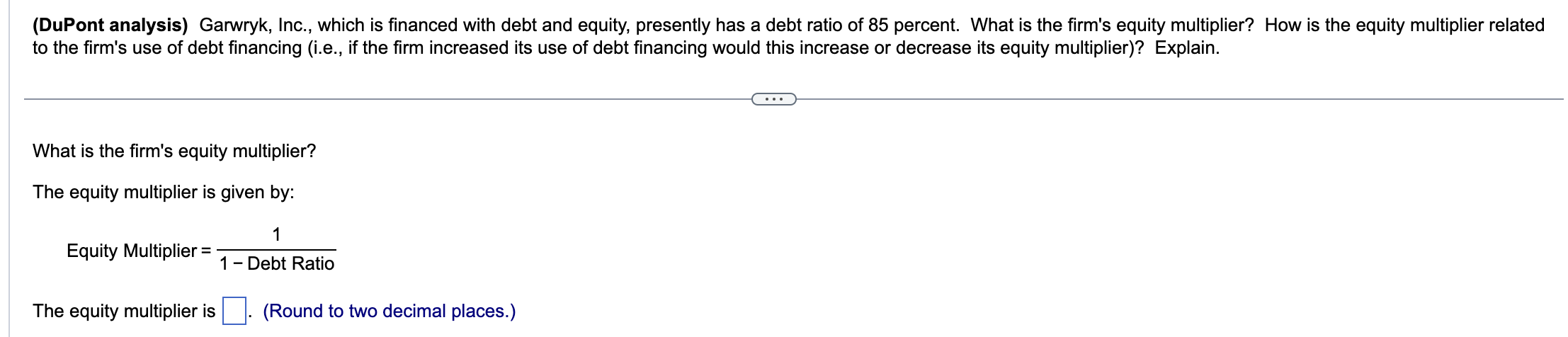

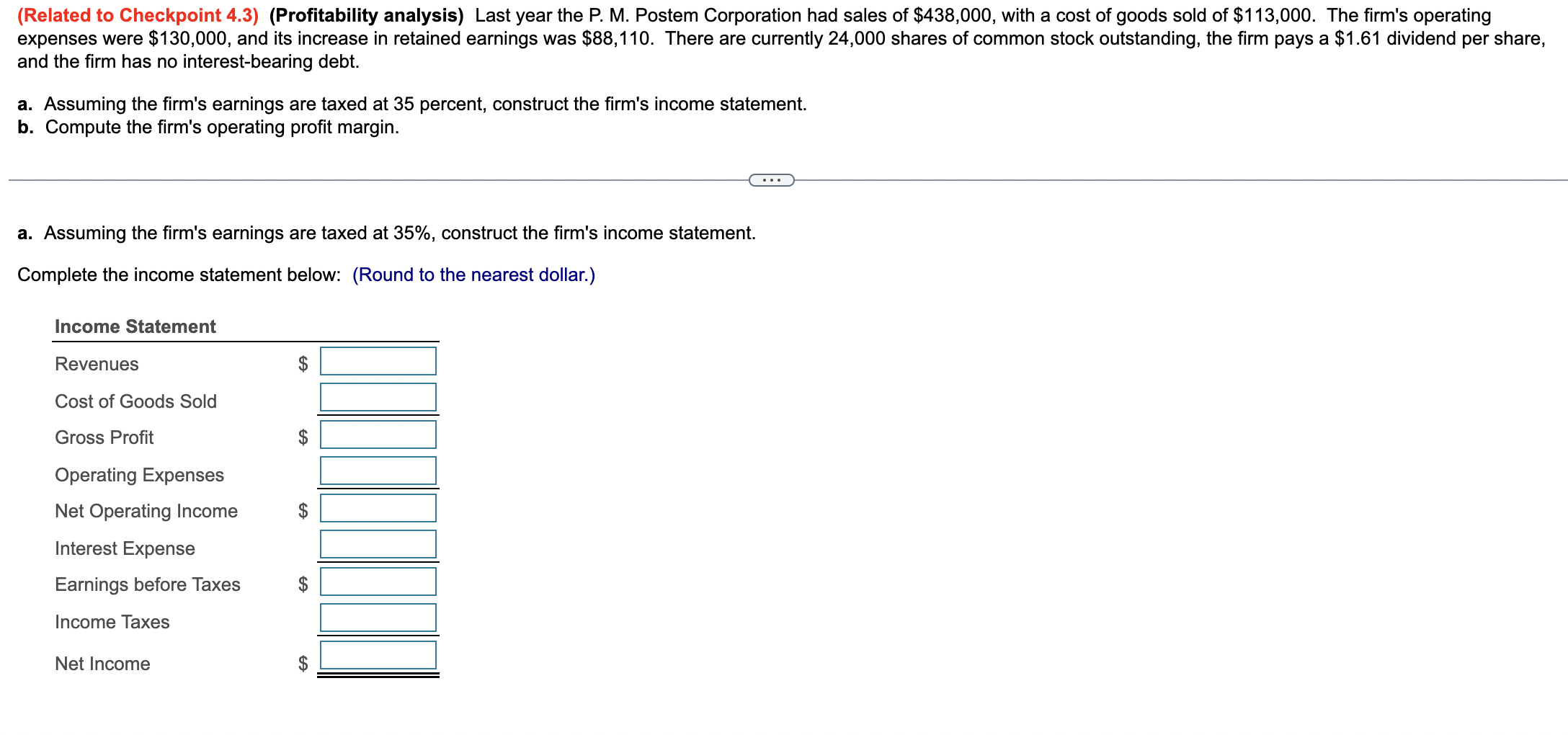

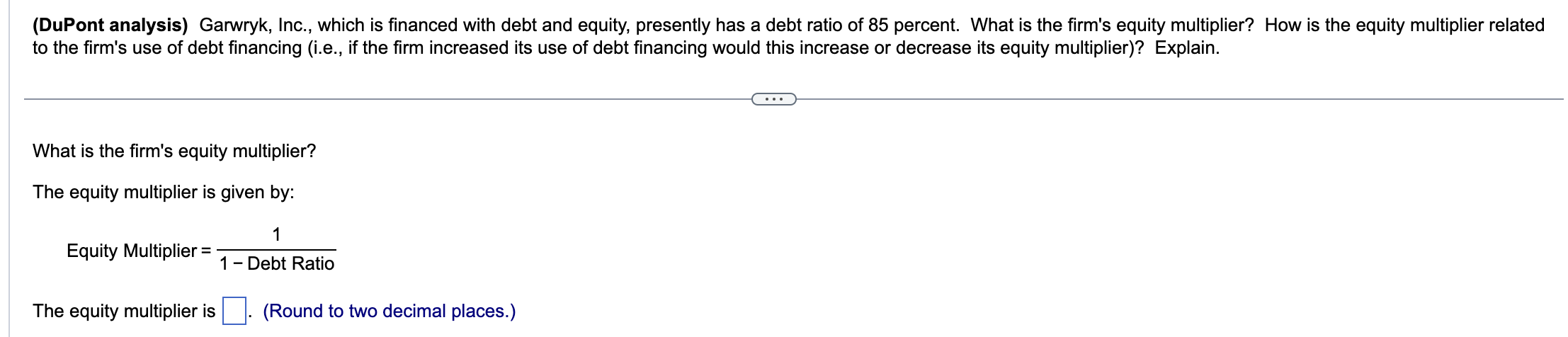

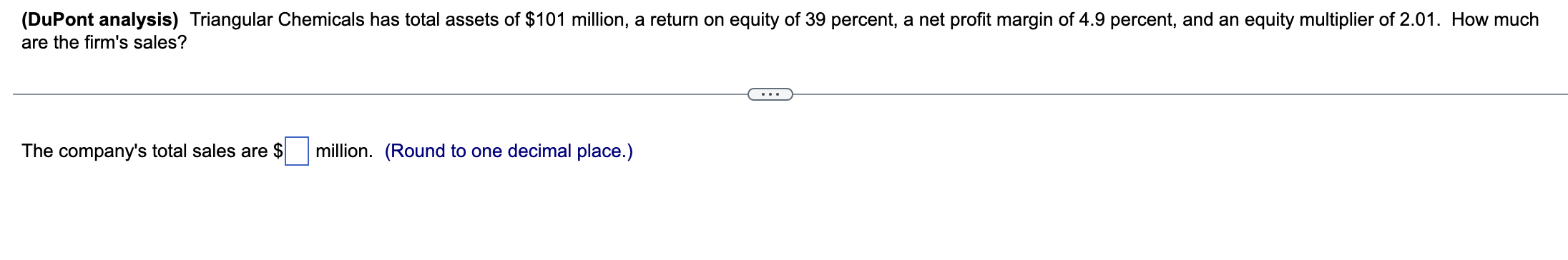

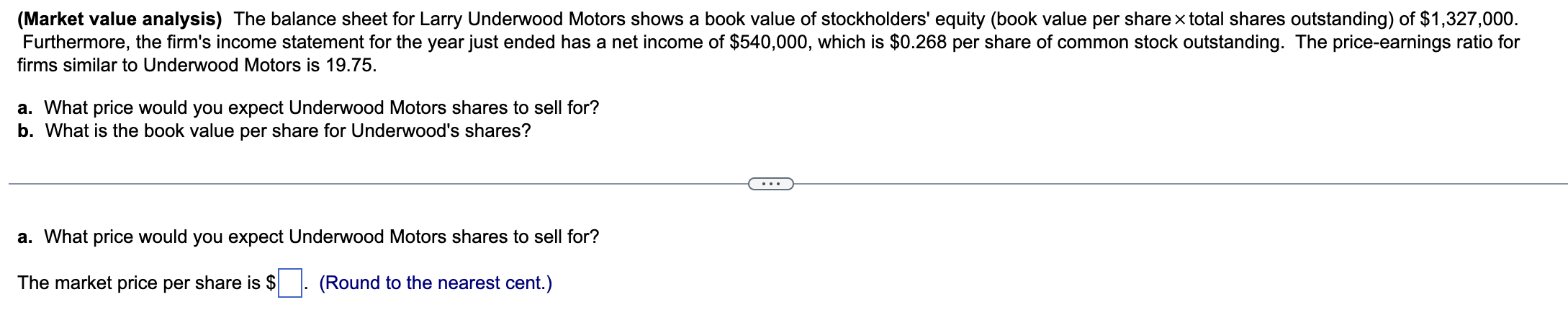

(Related to Checkpoint 4.3) (Profitability analysis) Last year the P. M. Postem Corporation had sales of $438,000, with a cost of goods sold of $113,000. The firm's operating expenses were $130,000, and its increase in retained earnings was $88,110. There are currently 24,000 shares of common stock outstanding, the firm pays a $1.61 dividend per share, and the firm has no interest-bearing debt. a. Assuming the firm's earnings are taxed at 35 percent, construct the firm's income statement. b. Compute the firm's operating profit margin. a. Assuming the firm's earnings are taxed at 35%, construct the firm's income statement. Complete the income statement below: (Round to the nearest dollar.) (DuPont analysis) Garwryk, Inc., which is financed with debt and equity, presently has a debt ratio of 85 percent. What is the firm's equity multiplier? How is the equity multiplier related to the firm's use of debt financing (i.e., if the firm increased its use of debt financing would this increase or decrease its equity multiplier)? Explain. What is the firm's equity multiplier? The equity multiplier is given by: EquityMultiplier=1DebtRatio1 The equity multiplier is (Round to two decimal places.) (DuPont analysis) Triangular Chemicals has total assets of $101 million, a return on equity of 39 percent, a net profit margin of 4.9 percent, and an equity multiplier of 2.01 . How much are the firm's sales? The company's total sales are $ million. (Round to one decimal place.) (Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share total shares outstanding) of $1,327,000. Furthermore, the firm's income statement for the year just ended has a net income of $540,000, which is $0.268 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 19.75 . a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? a. What price would you expect Underwood Motors shares to sell for? The market price per share is $ (Round to the nearest cent.)