Answered step by step

Verified Expert Solution

Question

1 Approved Answer

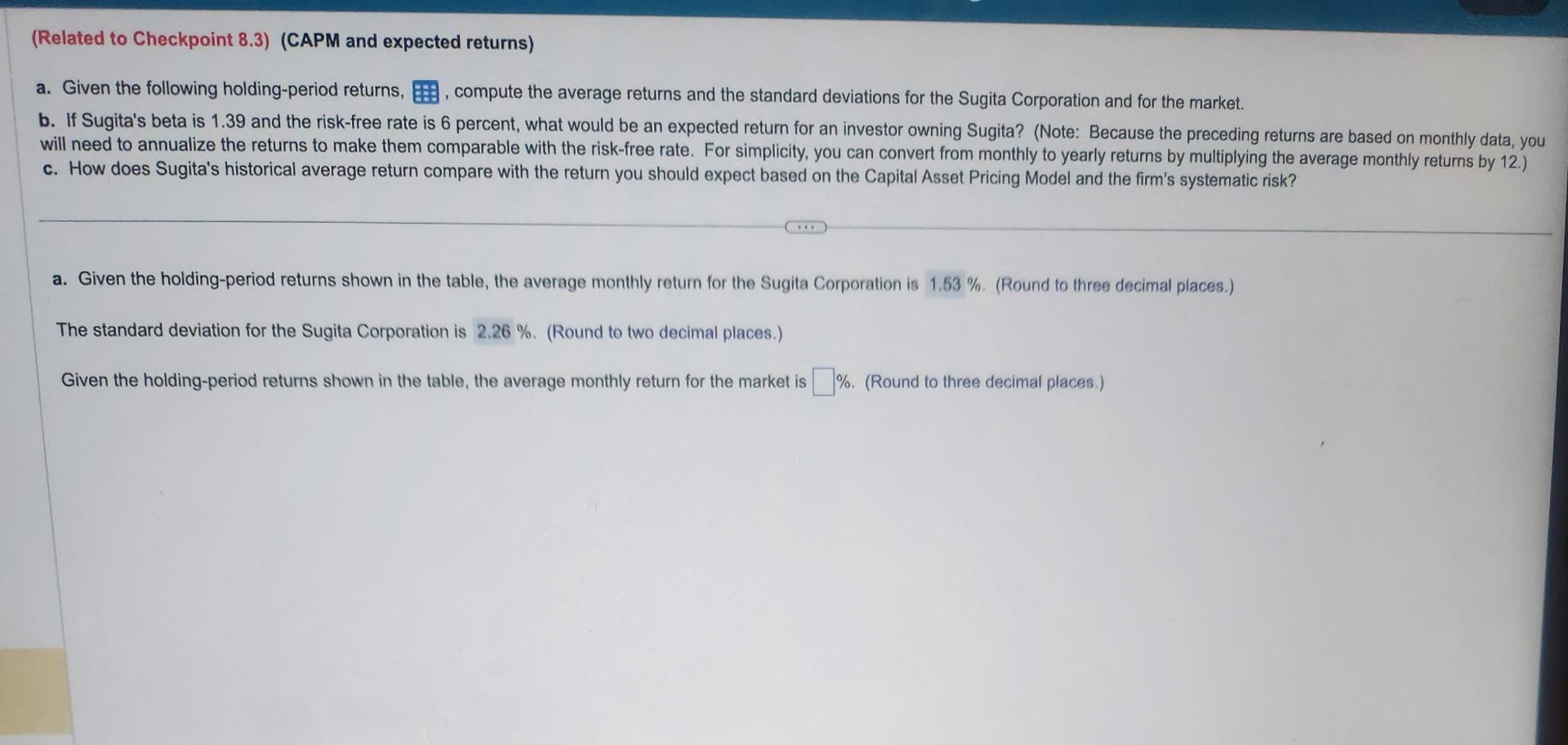

(Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, , compute the average returns and the standard deviations for the

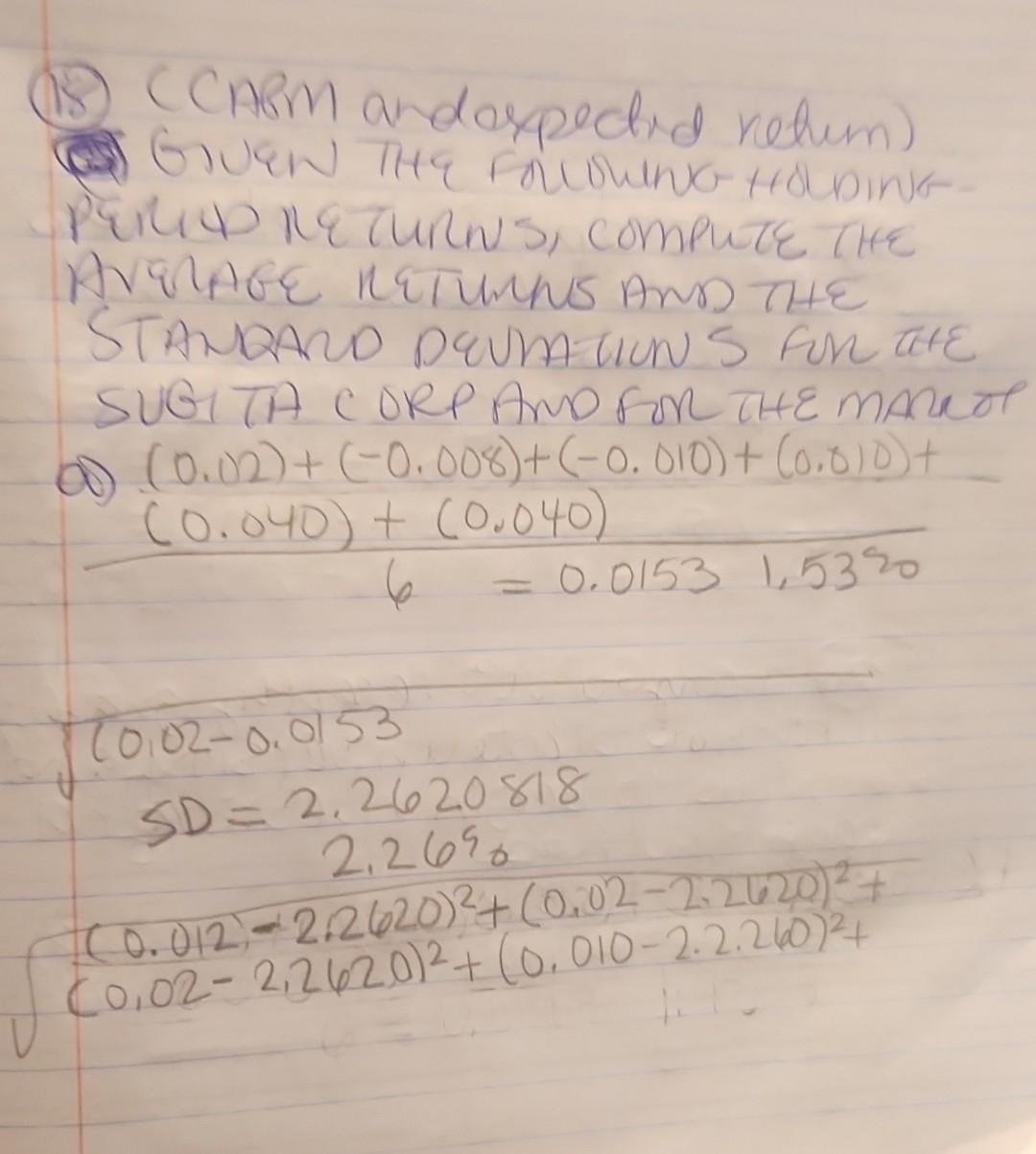

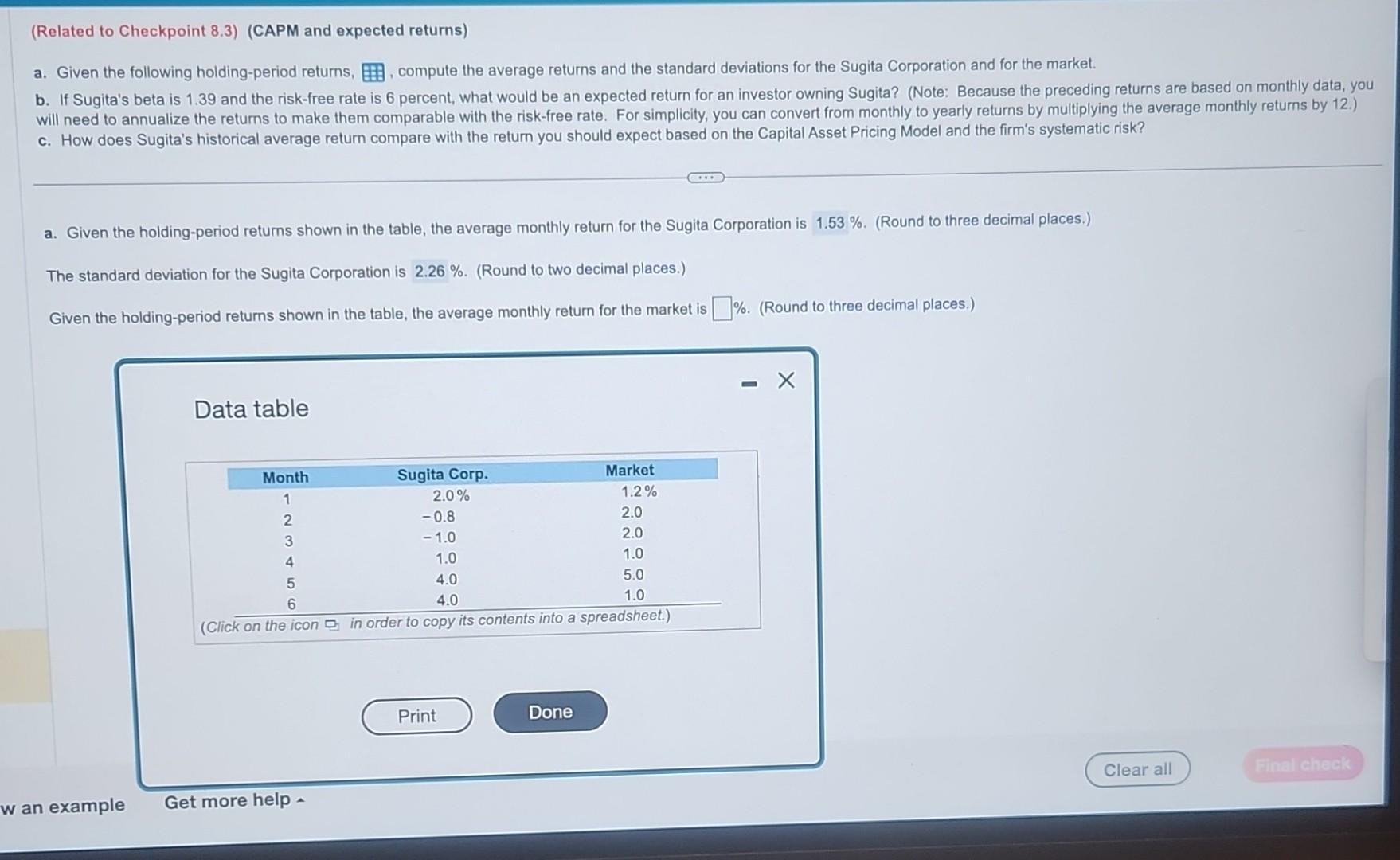

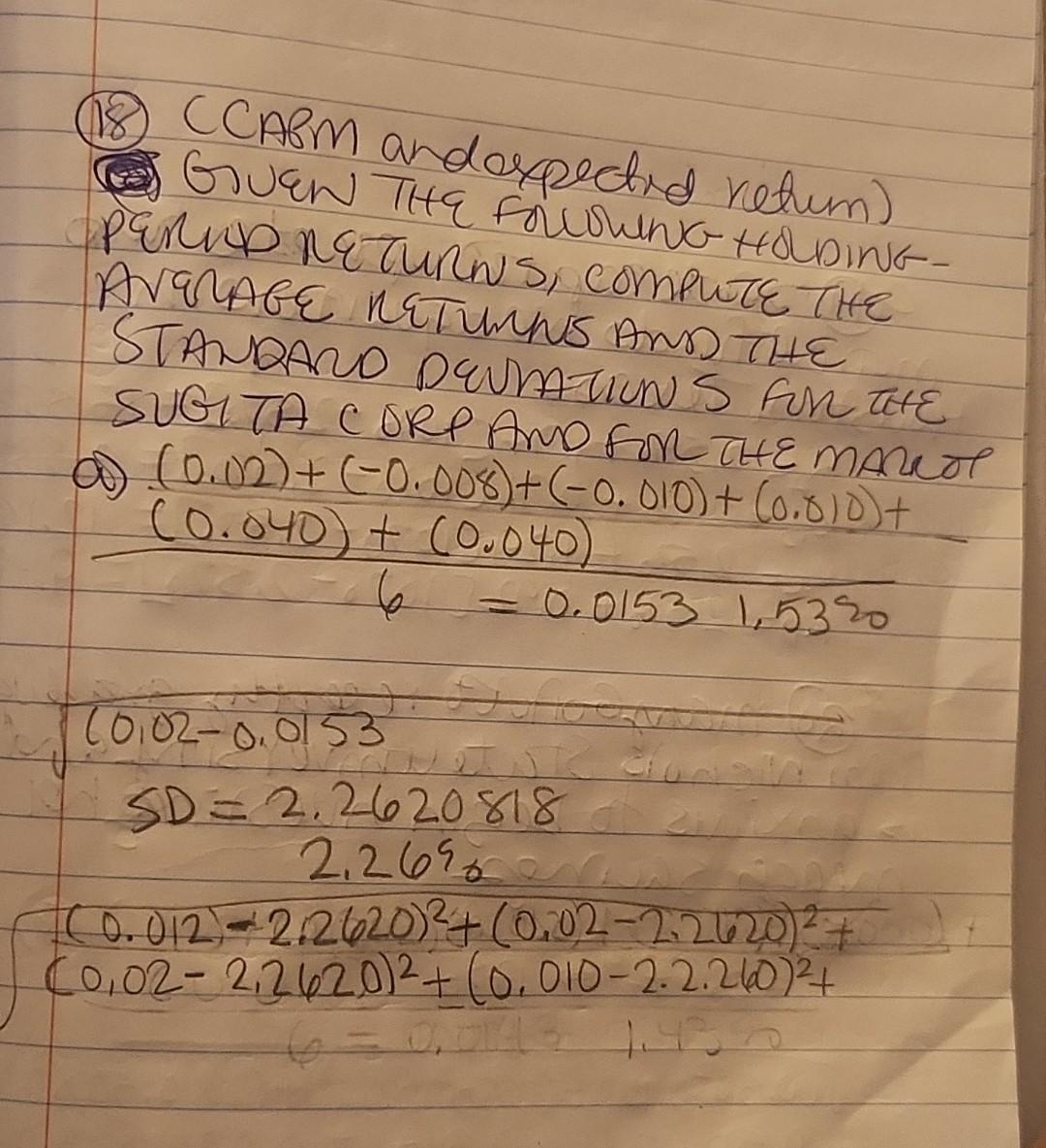

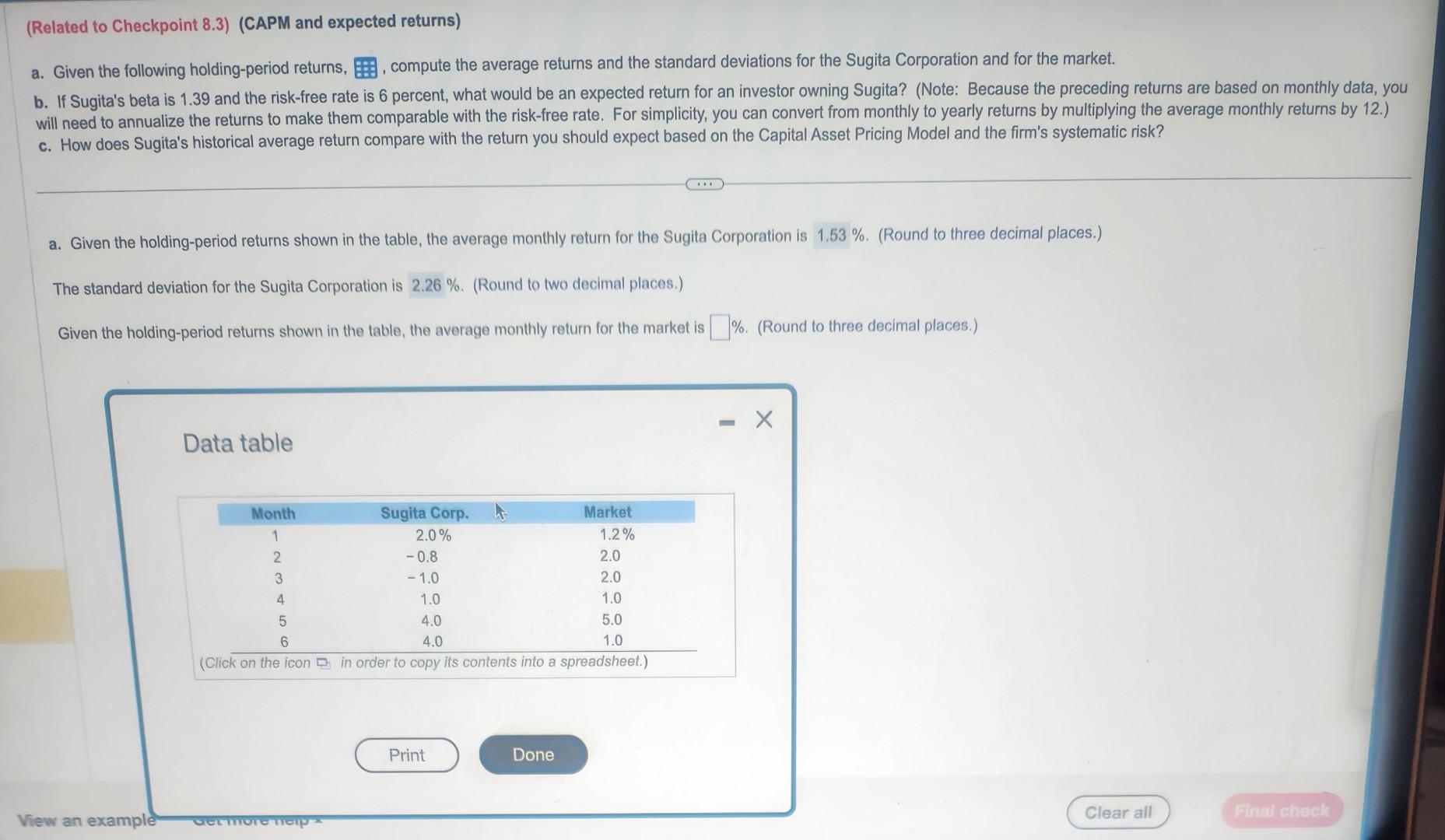

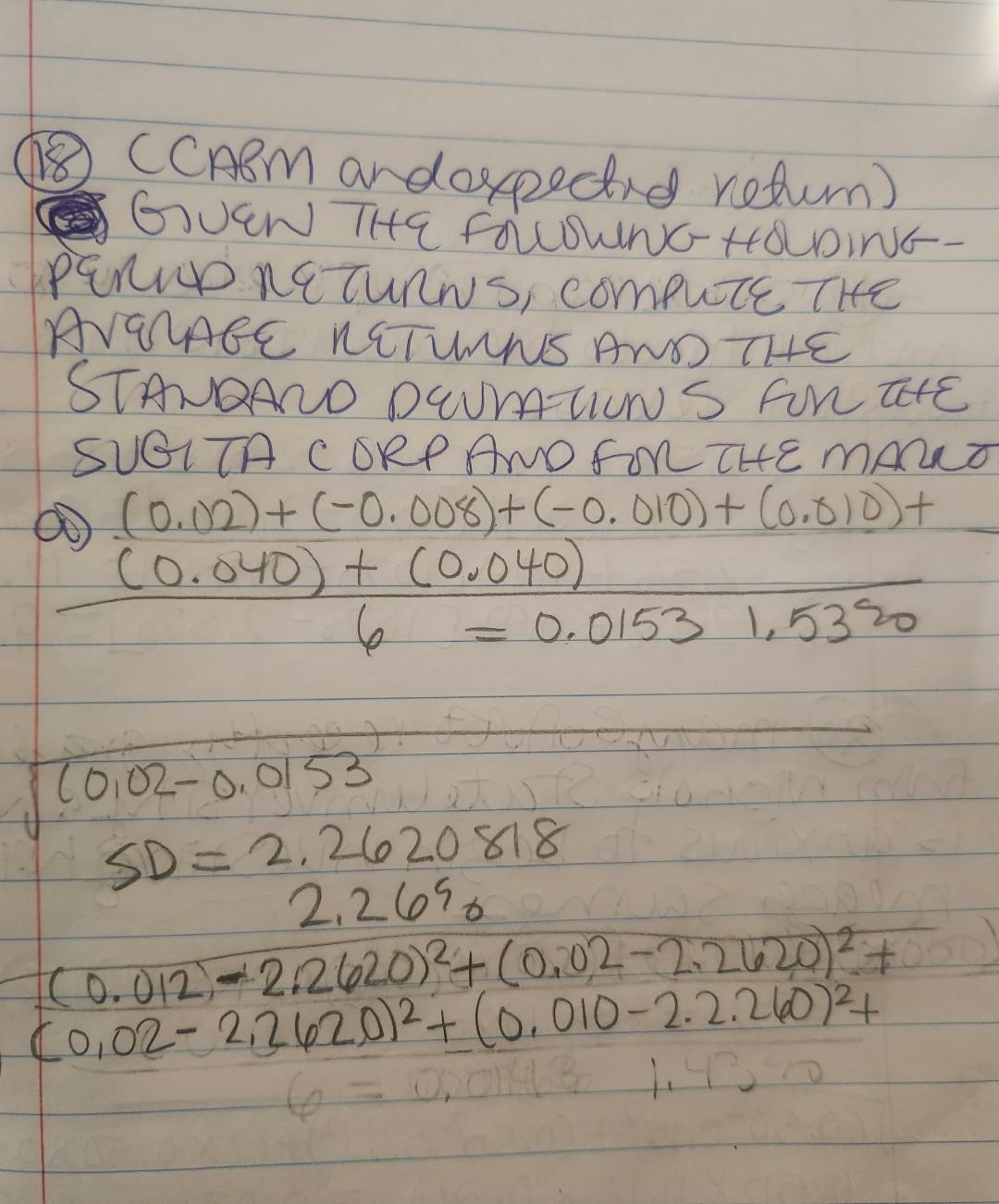

(Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, , compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.39 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12 .) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is \%. (Round to three decimal places.) The standard deviation for the Sugita Corporation is 2.26%. (Round to two decimal places.) Given the holding-period returns shown in the table, the average monthly return for the market is \%. (Round to three decimal places.) (18) (CABm andospectid retum) Glugw tha foloweno todoint PEllu neTuRns, comphte the AVqAGE KaTUnNo Ans THE STANDARD DQUMATIUNS FOn IE SUGTTA CORP And FON THE MAReT a)(0.02)+(0.008)+(0.010)+(0.810)+(0.040)+(0.040)6=0.01531.5320 (0.020.0153SD=2.26208182.2698(0.0122.2620)2+(0.022.2620)2+(0.022.2620)2+(0.0102.2.260)2+ (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.39 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12 .) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is 1.53%. (Round to three decimal places.) The standard deviation for the Sugita Corporation is 2.26%. (Round to two decimal places.) Given the holding-period returns shown in the table, the average monthly return for the market is \%. (Round to three decimal places.) Data table Get more help - (18) CCABM andoxpectid retum) GuEn THa folcoluna- toldingPERnD neturns, compute THE Avarabe neturno ans tie SUGT TA C ORP AnD FOR THE mARe of a) 6=0.01531.5320(0.040)+(0.040)(0.02)+(0.008)+(0.010)+(0.810)+ (0,020,0153SD=2.26208182.2698(0.0122.2620)2+(0.022.2620)2+(0.022.2620)2+(0.0102.2.260)2+ (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.39 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12 .) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is 1.53%. (Round to three decimal places.) The standard deviation for the Sugita Corporation is 2.26%. (Round to two decimal places.) Given the holding-period returns shown in the table, the average monthly return for the market is \%. (Round to three decimal places.) Data table (18) (CABm andoxpectind retum) Guan Tita fololinu- toldingpennD neturns, compute THe Avarabe netunno and tite Standard DuUhaun's fon tete SUGITA C ORP AnD FOR THE MARat a) (0.02)+(0.008)+(0.010)+(0.010)+(0.040)+(0.040)6=0.01531.5320 (0.020.0153SD=2.26208182.269%(0.0122.2620)2+(0.022.2620)2+(0.022.2620)2+(0.0102.2.260)2+ (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, , compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.39 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12 .) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is \%. (Round to three decimal places.) The standard deviation for the Sugita Corporation is 2.26%. (Round to two decimal places.) Given the holding-period returns shown in the table, the average monthly return for the market is \%. (Round to three decimal places.) (18) (CABm andospectid retum) Glugw tha foloweno todoint PEllu neTuRns, comphte the AVqAGE KaTUnNo Ans THE STANDARD DQUMATIUNS FOn IE SUGTTA CORP And FON THE MAReT a)(0.02)+(0.008)+(0.010)+(0.810)+(0.040)+(0.040)6=0.01531.5320 (0.020.0153SD=2.26208182.2698(0.0122.2620)2+(0.022.2620)2+(0.022.2620)2+(0.0102.2.260)2+ (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.39 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12 .) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is 1.53%. (Round to three decimal places.) The standard deviation for the Sugita Corporation is 2.26%. (Round to two decimal places.) Given the holding-period returns shown in the table, the average monthly return for the market is \%. (Round to three decimal places.) Data table Get more help - (18) CCABM andoxpectid retum) GuEn THa folcoluna- toldingPERnD neturns, compute THE Avarabe neturno ans tie SUGT TA C ORP AnD FOR THE mARe of a) 6=0.01531.5320(0.040)+(0.040)(0.02)+(0.008)+(0.010)+(0.810)+ (0,020,0153SD=2.26208182.2698(0.0122.2620)2+(0.022.2620)2+(0.022.2620)2+(0.0102.2.260)2+ (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.39 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12 .) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is 1.53%. (Round to three decimal places.) The standard deviation for the Sugita Corporation is 2.26%. (Round to two decimal places.) Given the holding-period returns shown in the table, the average monthly return for the market is \%. (Round to three decimal places.) Data table (18) (CABm andoxpectind retum) Guan Tita fololinu- toldingpennD neturns, compute THe Avarabe netunno and tite Standard DuUhaun's fon tete SUGITA C ORP AnD FOR THE MARat a) (0.02)+(0.008)+(0.010)+(0.010)+(0.040)+(0.040)6=0.01531.5320 (0.020.0153SD=2.26208182.269%(0.0122.2620)2+(0.022.2620)2+(0.022.2620)2+(0.0102.2.260)2+

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started