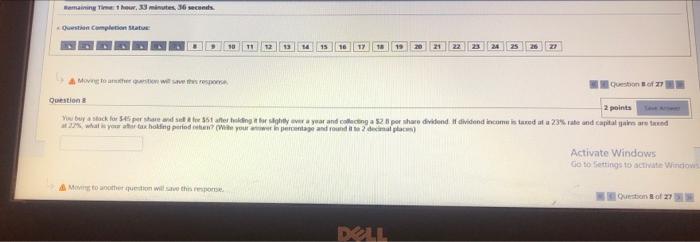

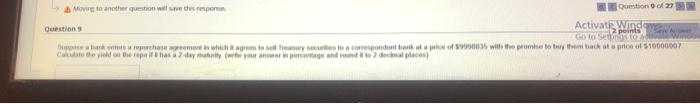

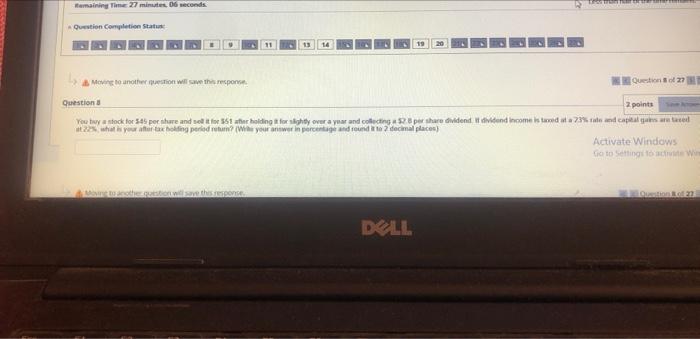

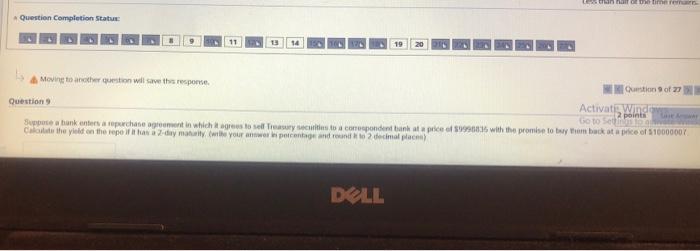

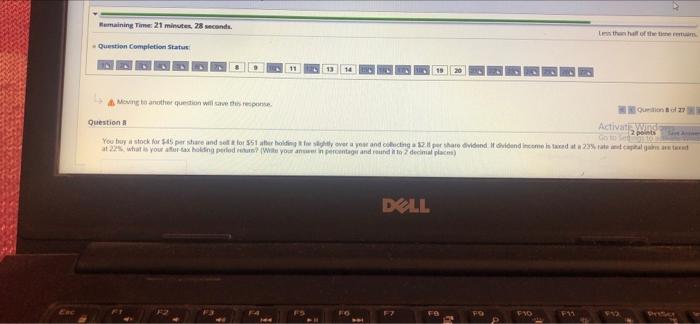

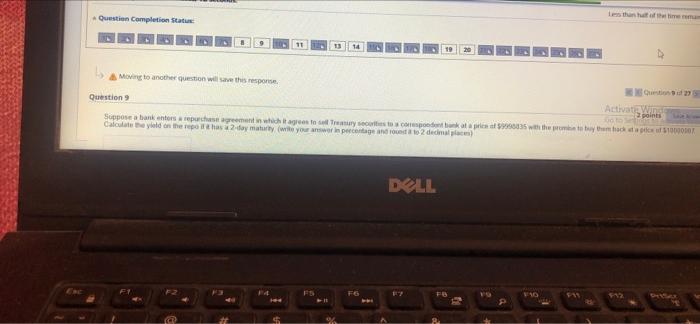

Remaining Time: 1 hour, 33 minutes, 36 seconds. Question Completion Status: 21 22 23 24 25 27 11 12 13 14 15 16 17 18 Moving to another question will save the response Question of 27 Question 2 points You buy a stack for $45 per share and sell a fer 351 after holding it for sightly over a year and collecting a $2 8 por share dividend if dividend income is taxed at a 23% rate and capital gains are taxed at 22%, what is your air tax holding period osten? (Wide your answer in percentage and round it to 2 decimal places) Activate Windows Go to Settings to activate Windows Moving to another question will save this response. Question of 27 DELL Question of 27 Moving to another question will save this response Winda Activat Go to Setongs to Niwer Question 9 uppisebark entra reprchase agreement in which it agrees to sell Treasury securities to a correspondent bank at a price of $9998835 with the promise to buy them back at a price of $10000007 Calculate the yield on the repa it 2 has a 2-day maturity (write your answer in porcentage and round it to 2 decimal places) Remaining Time 27 minutes, 06 seconds. Question Completion Status 487 13 Moving to another question will save this response. Question of 27 Question 2 points You buy a stock for $45 per share and sell it for $61 atter holding it for slightly over a year and collecting a $2.8 per share dividend. It dividend income is taxed at a 73% rate and capital gains are taxed at 22%, what is your after tax holding period return? (Wie your answer in percentage and round it to 2 decimal places) Activate Windows Go to Settings to actuite Win Moving to another question will save this response. Question of 27 DELL Less than half of the time remains 13 19 Moving to another question will save this response. Question 9 of 27 Question 9 Activatig Wind 2 points Lave Apar Go to Sets to give Suppose a bank enters a repurchase agreement in which it agrees to sell Treasury securities to a corespondent bank at a price of $9998835 with the promise to buy them back at a price of $10000007 Calculate the yield on the repo if it has a 2-day maturity (write your answer in porcentage and round it to 2 decimal places) DELL Question Completion Status 11 Remaining Time: 21 minutes, 28 seconds. Question Completion Status Less than half of the time remain 13 Moving to another question will save this response. Question of 27 Question & Activatie Winde 2 points Go to Set 10 You buy a stock for $45 per share and sell for $51 after holding for slightly over a year and collecting a $2.81 per share dividend If dividend income is taxed at a 23% rate and capital gaisa t at 22%, what is your aftur tax holding period reas? (Wite your answer in percentager and round it to 2 decimal places) DELL F10 F11 F12 Exc 11 FO FO Les than half of the time reman 13 14 Moving to another question will save this response. Question 9 Activatic Windo 2 points o to Se Suppose a bank enters a repurchase agreement in which it agrees to sell Treasury securities to a correspondent bank at a price of $9990835 with the prombie to buy them back at a price of $10000007 Calculate the yield on the repo if t has a 2-day maturity (write your answer in percentage and round a to 2 decimal places) DELL F4 F10 F12 Exc FS F11 Co Question Completion Status: 14 11 F6 FB B P Remaining Time: 1 hour, 33 minutes, 36 seconds. Question Completion Status: 21 22 23 24 25 27 11 12 13 14 15 16 17 18 Moving to another question will save the response Question of 27 Question 2 points You buy a stack for $45 per share and sell a fer 351 after holding it for sightly over a year and collecting a $2 8 por share dividend if dividend income is taxed at a 23% rate and capital gains are taxed at 22%, what is your air tax holding period osten? (Wide your answer in percentage and round it to 2 decimal places) Activate Windows Go to Settings to activate Windows Moving to another question will save this response. Question of 27 DELL Question of 27 Moving to another question will save this response Winda Activat Go to Setongs to Niwer Question 9 uppisebark entra reprchase agreement in which it agrees to sell Treasury securities to a correspondent bank at a price of $9998835 with the promise to buy them back at a price of $10000007 Calculate the yield on the repa it 2 has a 2-day maturity (write your answer in porcentage and round it to 2 decimal places) Remaining Time 27 minutes, 06 seconds. Question Completion Status 487 13 Moving to another question will save this response. Question of 27 Question 2 points You buy a stock for $45 per share and sell it for $61 atter holding it for slightly over a year and collecting a $2.8 per share dividend. It dividend income is taxed at a 73% rate and capital gains are taxed at 22%, what is your after tax holding period return? (Wie your answer in percentage and round it to 2 decimal places) Activate Windows Go to Settings to actuite Win Moving to another question will save this response. Question of 27 DELL Less than half of the time remains 13 19 Moving to another question will save this response. Question 9 of 27 Question 9 Activatig Wind 2 points Lave Apar Go to Sets to give Suppose a bank enters a repurchase agreement in which it agrees to sell Treasury securities to a corespondent bank at a price of $9998835 with the promise to buy them back at a price of $10000007 Calculate the yield on the repo if it has a 2-day maturity (write your answer in porcentage and round it to 2 decimal places) DELL Question Completion Status 11 Remaining Time: 21 minutes, 28 seconds. Question Completion Status Less than half of the time remain 13 Moving to another question will save this response. Question of 27 Question & Activatie Winde 2 points Go to Set 10 You buy a stock for $45 per share and sell for $51 after holding for slightly over a year and collecting a $2.81 per share dividend If dividend income is taxed at a 23% rate and capital gaisa t at 22%, what is your aftur tax holding period reas? (Wite your answer in percentager and round it to 2 decimal places) DELL F10 F11 F12 Exc 11 FO FO Les than half of the time reman 13 14 Moving to another question will save this response. Question 9 Activatic Windo 2 points o to Se Suppose a bank enters a repurchase agreement in which it agrees to sell Treasury securities to a correspondent bank at a price of $9990835 with the prombie to buy them back at a price of $10000007 Calculate the yield on the repo if t has a 2-day maturity (write your answer in percentage and round a to 2 decimal places) DELL F4 F10 F12 Exc FS F11 Co Question Completion Status: 14 11 F6 FB B P