Answered step by step

Verified Expert Solution

Question

1 Approved Answer

remember a bond's coupon will/might reflects the return that a bonholder would like/is obligated when the bond's coupon rate is greater be less than/equal/exceed when

| remember a bond's coupon | will/might |

| reflects the return that a bonholder | would like/is obligated |

| when the bond's coupon rate is greater | be less than/equal/exceed |

| when the bond's coupon rate is less than | par/premium/discount |

| A | Bondholder required return/ bond's market price/ bound semiannual coupon payment | 75/56.25/37.50/150.00 |

| B | bond's par value semiannual coupon payment bond's annual coupon payment

| $1000 |

| C | semi annual required return | 3.8125% 6.5000% 4.3750% 5.7525%

|

| based on this equation | unreasonable reasonable |

| if you round the bound | 1,096 639 913 1,187 |

| is | greater equal to less than |

| so that the bond is | trading at a premium trading at par trading at a discount

|

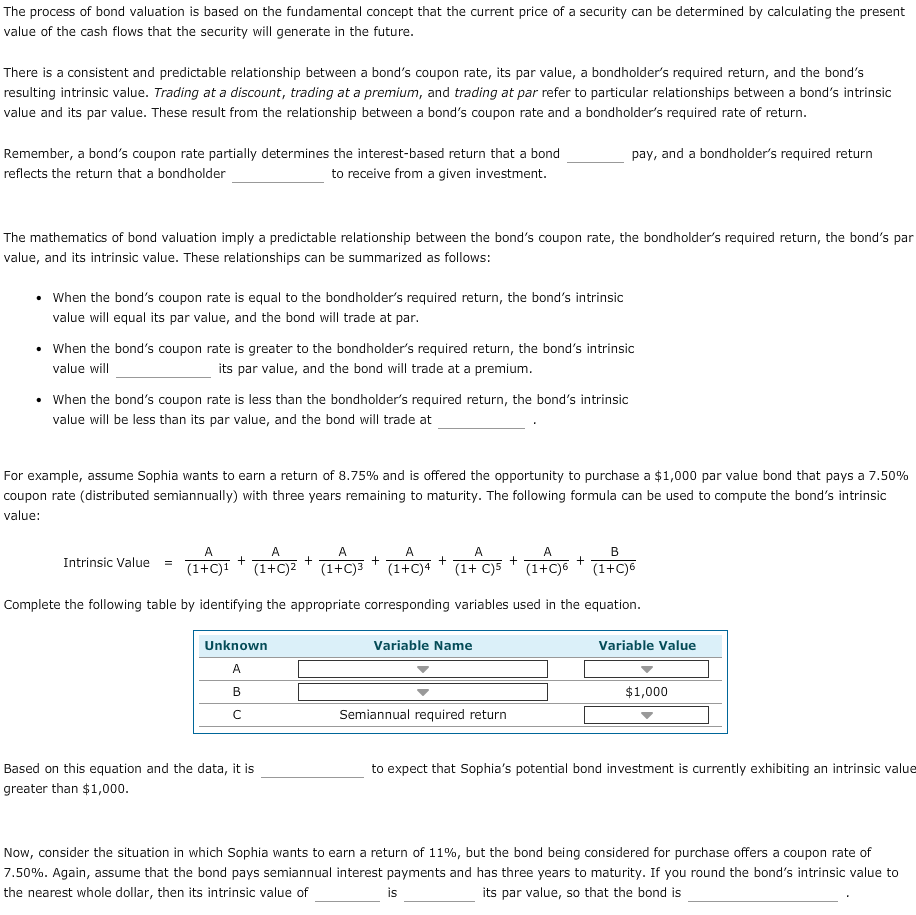

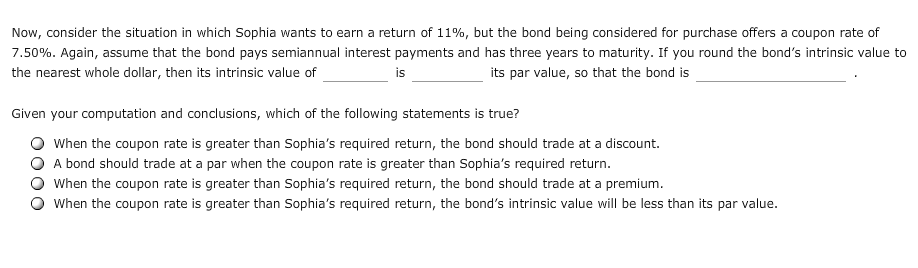

The process of bond valuation is based on the fundamental concept that the current price of a security can be determined by calculating the present value of the cash flows that the security will generate in the future There is a consistent and predictable relationship between a bond's coupon rate, its par value, a bondholder's required return, and the bond's resulting intrinsic value. Trading at a discount, trading at a premium, and trading at par refer to particular relationships between a bond's intrinsic value and its par value. These result from the relationship between a bond's coupon rate and a bondholder's required rate of return pay, and a bondholder's required return Remember, a bond's coupon rate partially determines the interest-based return that a bond reflects the return that a bondholder to receive from a given investment The mathematics of bond valuation imply a predictable relationship between the bond's coupon rate, the bondholder's required return, the bond's par value, and its intrinsic value. These relationships can be summarized as follows: . When the bond's coupon rate is equal to the bondholder's required return, the bond's intrinsic value will equal its par value, and the bond wil trade at par . When the bond's coupon rate is greater to the bondholder's required return, the bond's intrinsic value will its par value, and the bond will trade at a premium . When the bond's coupon rate is less than the bondholder's required return, the bond's intrinsic value will be less than its par value, and the bond will trade at For example, assume Sophia wants to earn a return of 8.75% and is offered the opportunity to purchase a $1,000 par value bond that pays a 7.50% coupon rate (distributed semiannually) with three years remaining to maturity. The following formula can be used to compute the bond's intrinsic value: Complete the following table by identifying the appropriate corresponding variables used in the equation Unknown Variable Name Variable Value $1,000 Semiannual required return Based on this equation and the data, it is greater than $1,000 to expect that Sophia's potential bond investment is currently exhibiting an intrinsic value Now, consider the situation in which Sophia wants to earn a return of 11%, but the bond being considered for purchase offers a coupon rate of 7.50%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to the nearest whole dollar, then its intrinsic value of IS its par value, so that the bond is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started