Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ren and Jun are partners with capital accounts that had the following transactions during 2020: Balance, Jan 1 Feb 28 Mar 31 Apr 30

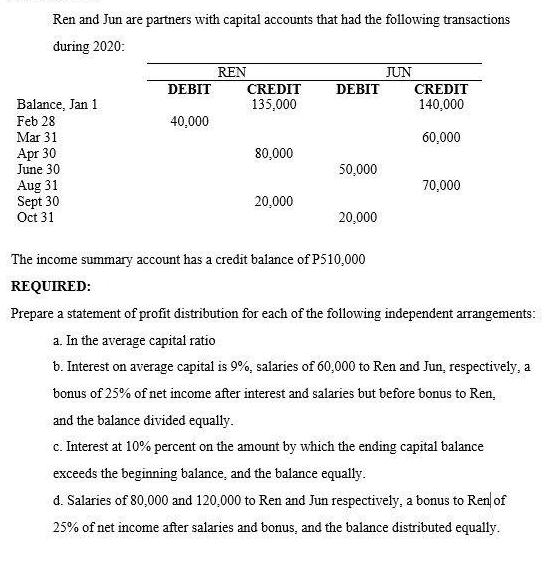

Ren and Jun are partners with capital accounts that had the following transactions during 2020: Balance, Jan 1 Feb 28 Mar 31 Apr 30 June 30 Aug 31 Sept 30 Oct 31 DEBIT 40,000 REN CREDIT 135,000 80,000 20,000 DEBIT 50,000 20,000 JUN CREDIT 140,000 60,000 70,000 The income summary account has a credit balance of P510,000 REQUIRED: Prepare a statement of profit distribution for each of the following independent arrangements: a. In the average capital ratio b. Interest on average capital is 9%, salaries of 60,000 to Ren and Jun, respectively, a bonus of 25% of net income after interest and salaries but before bonus to Ren, and the balance divided equally. c. Interest at 10% percent on the amount by which the ending capital balance exceeds the beginning balance, and the balance equally. d. Salaries of 80,000 and 120,000 to Ren and Jun respectively, a bonus to Ren of 25% of net income after salaries and bonus, and the balance distributed equally.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Profit Loss Appropriation Account Particulars Amount Particulars Amount ToNetIncome ByNetIn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started