Answered step by step

Verified Expert Solution

Question

1 Approved Answer

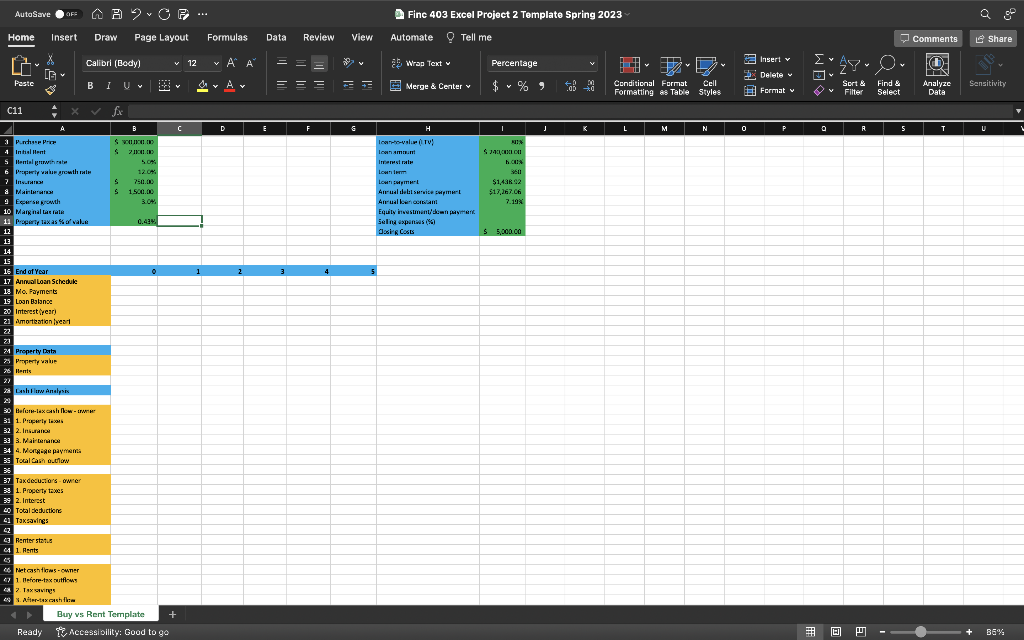

Rent vs Own and excel calculations Property Information Loan information Purchase Price $ 300,000.00 Loan-to-value (LTV) 80% Initial Rent $ 2,000.00 Loan amount $ 240,000.00

Rent vs Own and excel calculations

| Property Information | Loan information | |||||||

| Purchase Price | $ 300,000.00 | Loan-to-value (LTV) | 80% | |||||

| Initial Rent | $ 2,000.00 | Loan amount | $ 240,000.00 | |||||

| Rental growth rate | 5.0% | Interest rate | 6.00% | |||||

| Property value growth rate | 12.0% | Loan term | 360 | |||||

| Insurance | $ 750.00 | Loan payment | $1,438.92 | |||||

| Maintenance | $ 1,500.00 | Annual debt service payment | $17,267.06 | |||||

| Expense growth | 3.0% | Annual loan constant | 7.19% | |||||

| Marginal tax rate | Equity investment/down payment | |||||||

| Property tax as % of value | 0.43% | Selling expenses (%) | ||||||

| Closing Costs | $ 5,000.00 | |||||||

| End of Year | 0 | 1 | 2 | 3 | 4 | 5 | ||

| Annual Loan Schedule | ||||||||

| Mo. Payments | ||||||||

| Loan Balance | ||||||||

| Interest (year) | ||||||||

| Amortization (year) | ||||||||

| Property Data | ||||||||

| Property value | ||||||||

| Rents | ||||||||

| Cash Flow Analysis | ||||||||

| Before-tax cash flow - owner | ||||||||

| 1. Property taxes | ||||||||

| 2. Insurance | ||||||||

| 3. Maintenance | ||||||||

| 4. Mortgage payments | ||||||||

| Total Cash outflow | ||||||||

| Tax deductions - owner | ||||||||

| 1. Property taxes | ||||||||

| 2. Interest | ||||||||

| Total deductions | ||||||||

| Tax savings | ||||||||

| Renter status | ||||||||

| 1. Rents | ||||||||

| Net cash flows - owner | ||||||||

| 1. Before-tax outflows | ||||||||

| 2. Tax savings | ||||||||

| 3. After-tax cash flow | ||||||||

| 4. Rent saved | ||||||||

| 5. After-tax CF - owning | ||||||||

| Before-tax CF for sales | ||||||||

| 1. Property value | ||||||||

| 2. Less: Selling expenses | ||||||||

| 3. Less: Mortgage payoff | ||||||||

| 4. Before-tax CF sale | ||||||||

| After-tax CF for sales | ||||||||

| 1. Property value | ||||||||

| 2. Less: Selling expenses | ||||||||

| 3. Less: Basis | ||||||||

| 4. Gain on sale | ||||||||

| 5: Less: Exclusion | ||||||||

| 6. Tax | ||||||||

| 7. After-tax CF | ||||||||

| After-tax IRR on equity of sold |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started