Replace the Fair Value amounts provided in the question with the following:

Cash $10,400

Accounts Receivable 23,100

Inventory 68,000

Trademarks 40,000

Patents 71,000

Current Liabilities 36,000

Long-Term Debt 68,000

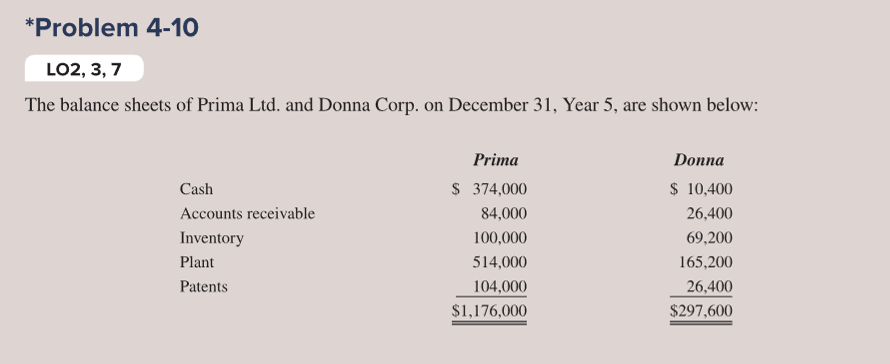

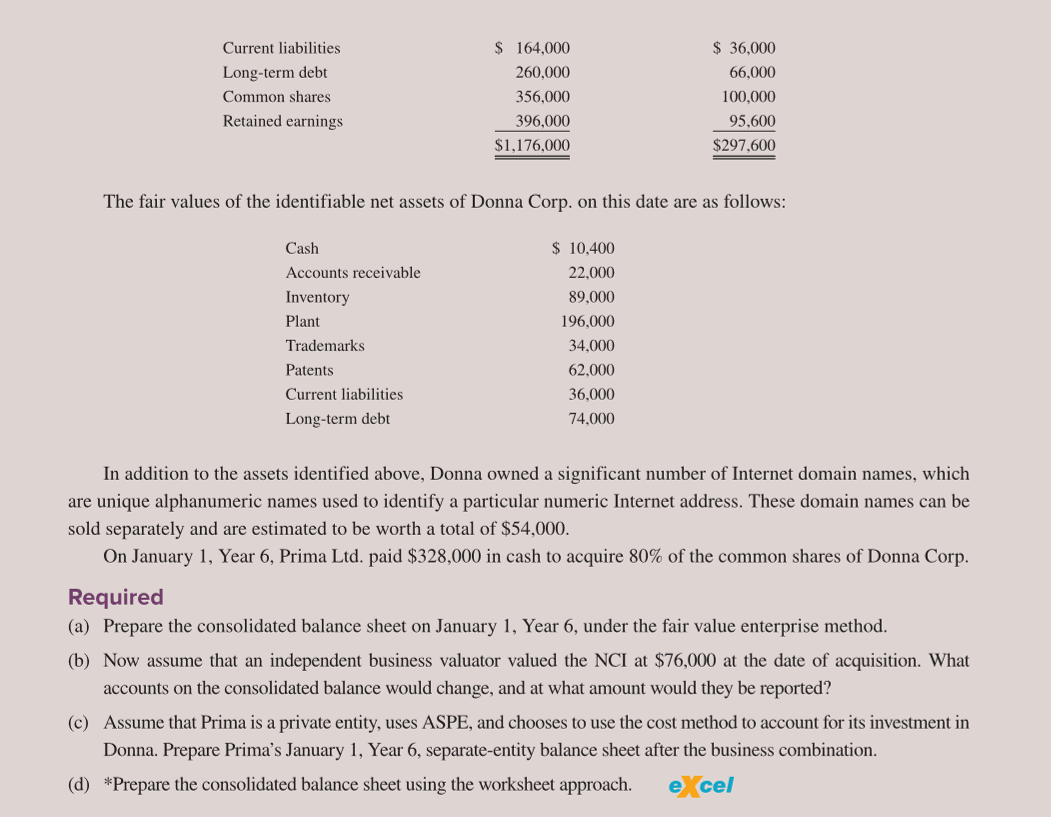

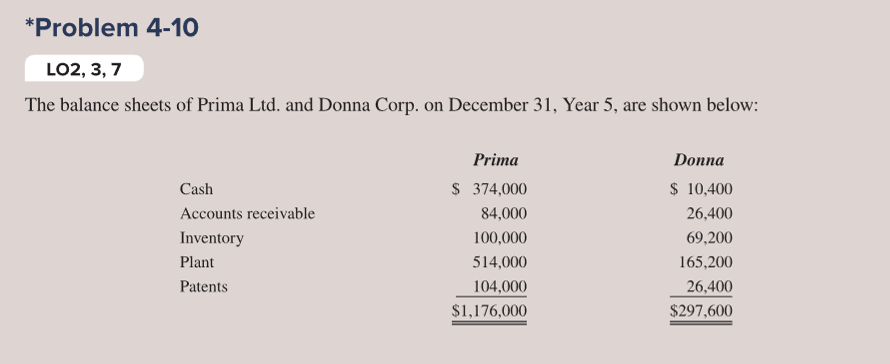

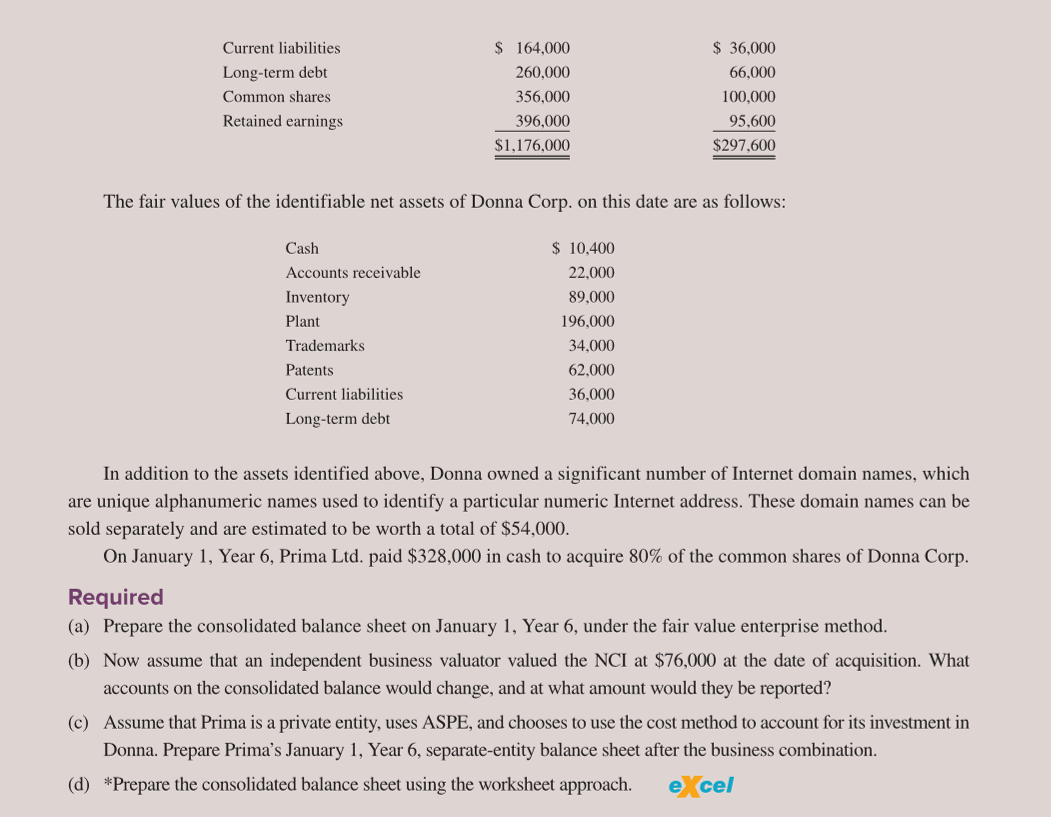

*Problem 4-10 LO2, 3, 7 The balance sheets of Prima Ltd. and Donna Corp. on December 31, Year 5, are shown below: Donna Cash Accounts receivable Inventory Plant Patents Prima $ 374,000 84,000 100,000 514,000 104,000 $1,176,000 $ 10,400 26,400 69,200 165,200 26,400 $297,600 Current liabilities Long-term debt Common shares Retained earnings $ 164,000 260,000 356,000 396,000 $1,176,000 $ 36,000 66,000 100,000 95,600 $297,600 The fair values of the identifiable net assets of Donna Corp. on this date are as follows: Cash Accounts receivable Inventory Plant Trademarks Patents Current liabilities Long-term debt $ 10,400 22,000 89,000 196,000 34,000 62,000 36,000 74,000 In addition to the assets identified above, Donna owned a significant number of Internet domain names, which are unique alphanumeric names used to identify a particular numeric Internet address. These domain names can be sold separately and are estimated to be worth a total of $54,000. On January 1, Year 6, Prima Ltd. paid $328,000 in cash to acquire 80% of the common shares of Donna Corp. Required (a) Prepare the consolidated balance sheet on January 1, Year 6, under the fair value enterprise method. (b) Now assume that an independent business valuator valued the NCI at $76,000 at the date of acquisition. What accounts on the consolidated balance would change, and at what amount would they be reported? (c) Assume that Prima is a private entity, uses ASPE, and chooses to use the cost method to account for its investment in Donna. Prepare Prima's January 1, Year 6, separate-entity balance sheet after the business combination. (d) *Prepare the consolidated balance sheet using the worksheet approach. cel *Problem 4-10 LO2, 3, 7 The balance sheets of Prima Ltd. and Donna Corp. on December 31, Year 5, are shown below: Donna Cash Accounts receivable Inventory Plant Patents Prima $ 374,000 84,000 100,000 514,000 104,000 $1,176,000 $ 10,400 26,400 69,200 165,200 26,400 $297,600 Current liabilities Long-term debt Common shares Retained earnings $ 164,000 260,000 356,000 396,000 $1,176,000 $ 36,000 66,000 100,000 95,600 $297,600 The fair values of the identifiable net assets of Donna Corp. on this date are as follows: Cash Accounts receivable Inventory Plant Trademarks Patents Current liabilities Long-term debt $ 10,400 22,000 89,000 196,000 34,000 62,000 36,000 74,000 In addition to the assets identified above, Donna owned a significant number of Internet domain names, which are unique alphanumeric names used to identify a particular numeric Internet address. These domain names can be sold separately and are estimated to be worth a total of $54,000. On January 1, Year 6, Prima Ltd. paid $328,000 in cash to acquire 80% of the common shares of Donna Corp. Required (a) Prepare the consolidated balance sheet on January 1, Year 6, under the fair value enterprise method. (b) Now assume that an independent business valuator valued the NCI at $76,000 at the date of acquisition. What accounts on the consolidated balance would change, and at what amount would they be reported? (c) Assume that Prima is a private entity, uses ASPE, and chooses to use the cost method to account for its investment in Donna. Prepare Prima's January 1, Year 6, separate-entity balance sheet after the business combination. (d) *Prepare the consolidated balance sheet using the worksheet approach. cel