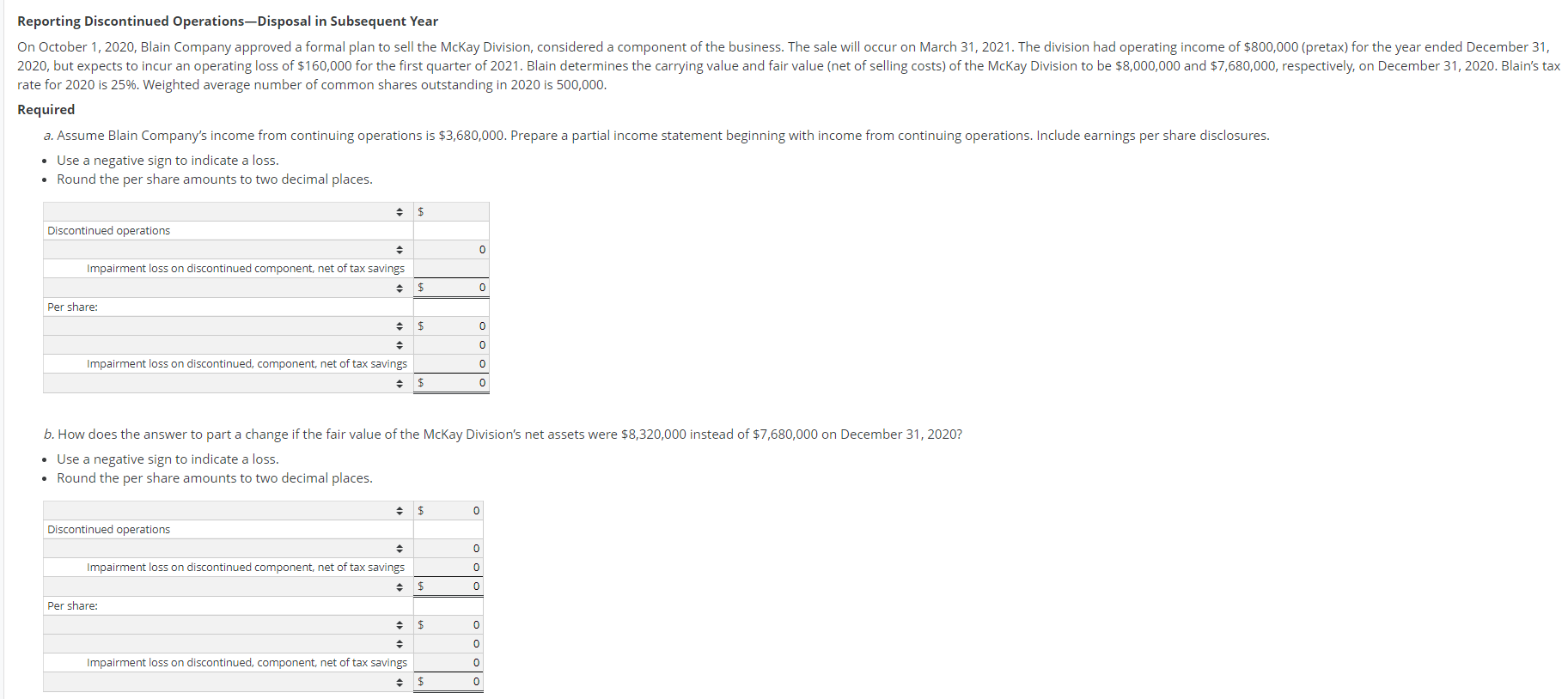

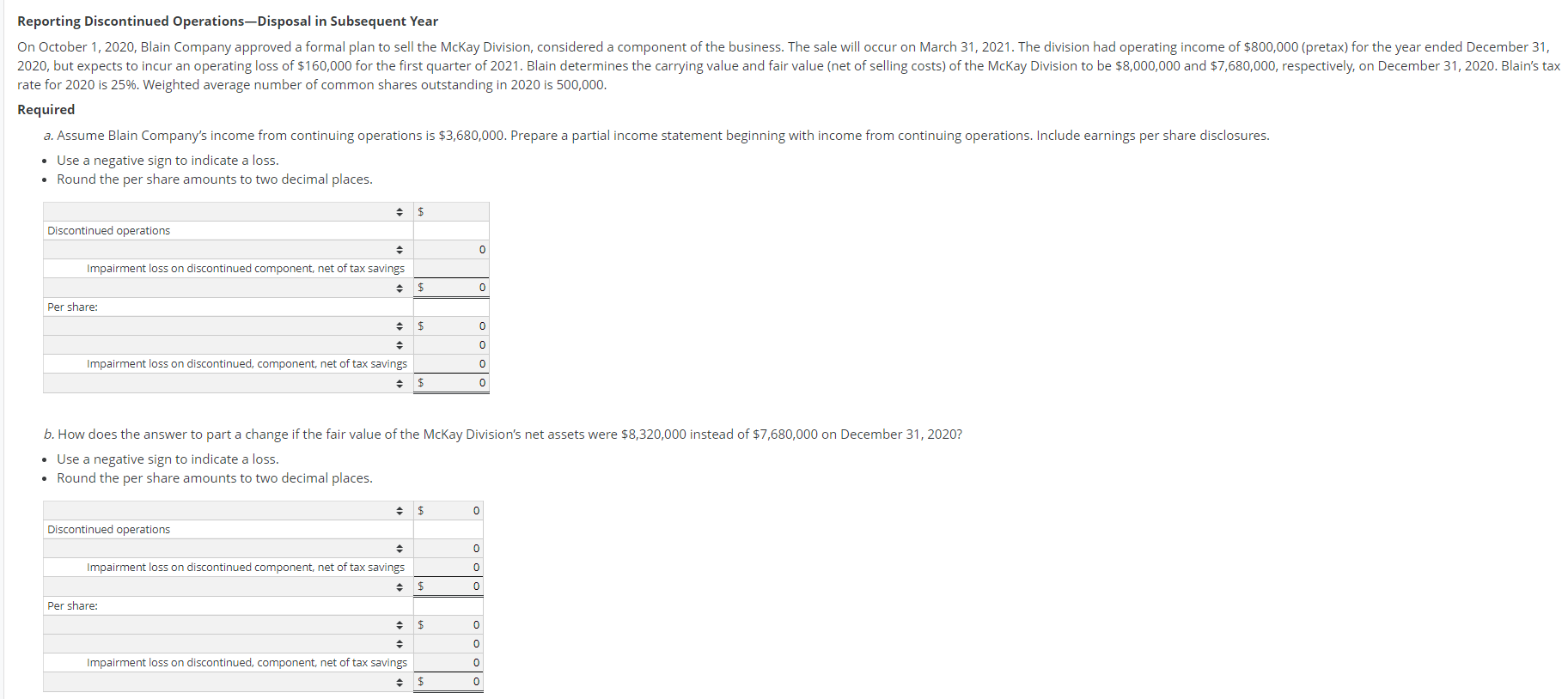

Reporting Discontinued Operations-Disposal in Subsequent Year On October 1, 2020, Blain Company approved a formal plan to sell the McKay Division, considered a component of the business. The sale will occur on March 31, 2021. The division had operating income of $800,000 (pretax) for the year ended December 31, 2020, but expects to incur an operating loss of $160,000 for the first quarter of 2021. Blain determines the carrying value and fair value (net of selling costs) of the McKay Division to be $8,000,000 and $7,680,000, respectively, on December 31, 2020. Blain's tax rate for 2020 is 25%. Weighted average number of common shares outstanding in 2020 is 500,000. Required a. Assume Blain Company's income from continuing operations is $3,680,000. Prepare a partial income statement beginning with income from continuing operations. Include earnings per share disclosures. Use a negative sign to indicate a loss. Round the per share amounts to two decimal places. Discontinued operations Impairment loss on discontinued component, net of tax savings Per share: Impairment loss on discontinued, component, net of tax savings b. How does the answer to part a change if the fair value of the Mckay Division's net assets were $8,320,000 instead of $7,680,000 on December 31, 2020? Use a negative sign to indicate a loss. Round the per share amounts to two decimal places. Discontinued operations Impairment loss on discontinued component, net of tax savings Per share: Impairment loss on discontinued, component, net of tax savings Reporting Discontinued Operations-Disposal in Subsequent Year On October 1, 2020, Blain Company approved a formal plan to sell the McKay Division, considered a component of the business. The sale will occur on March 31, 2021. The division had operating income of $800,000 (pretax) for the year ended December 31, 2020, but expects to incur an operating loss of $160,000 for the first quarter of 2021. Blain determines the carrying value and fair value (net of selling costs) of the McKay Division to be $8,000,000 and $7,680,000, respectively, on December 31, 2020. Blain's tax rate for 2020 is 25%. Weighted average number of common shares outstanding in 2020 is 500,000. Required a. Assume Blain Company's income from continuing operations is $3,680,000. Prepare a partial income statement beginning with income from continuing operations. Include earnings per share disclosures. Use a negative sign to indicate a loss. Round the per share amounts to two decimal places. Discontinued operations Impairment loss on discontinued component, net of tax savings Per share: Impairment loss on discontinued, component, net of tax savings b. How does the answer to part a change if the fair value of the Mckay Division's net assets were $8,320,000 instead of $7,680,000 on December 31, 2020? Use a negative sign to indicate a loss. Round the per share amounts to two decimal places. Discontinued operations Impairment loss on discontinued component, net of tax savings Per share: Impairment loss on discontinued, component, net of tax savings