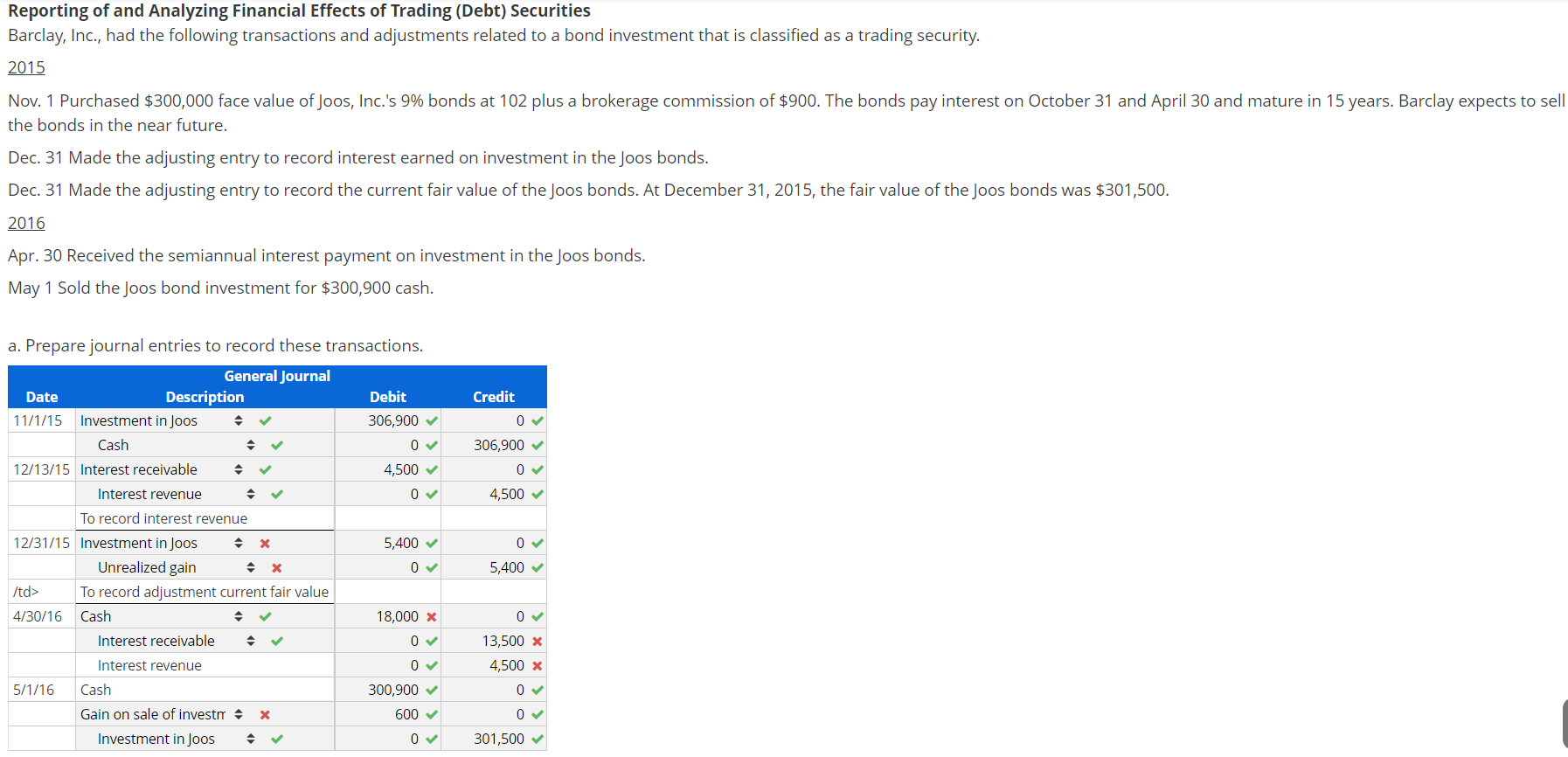

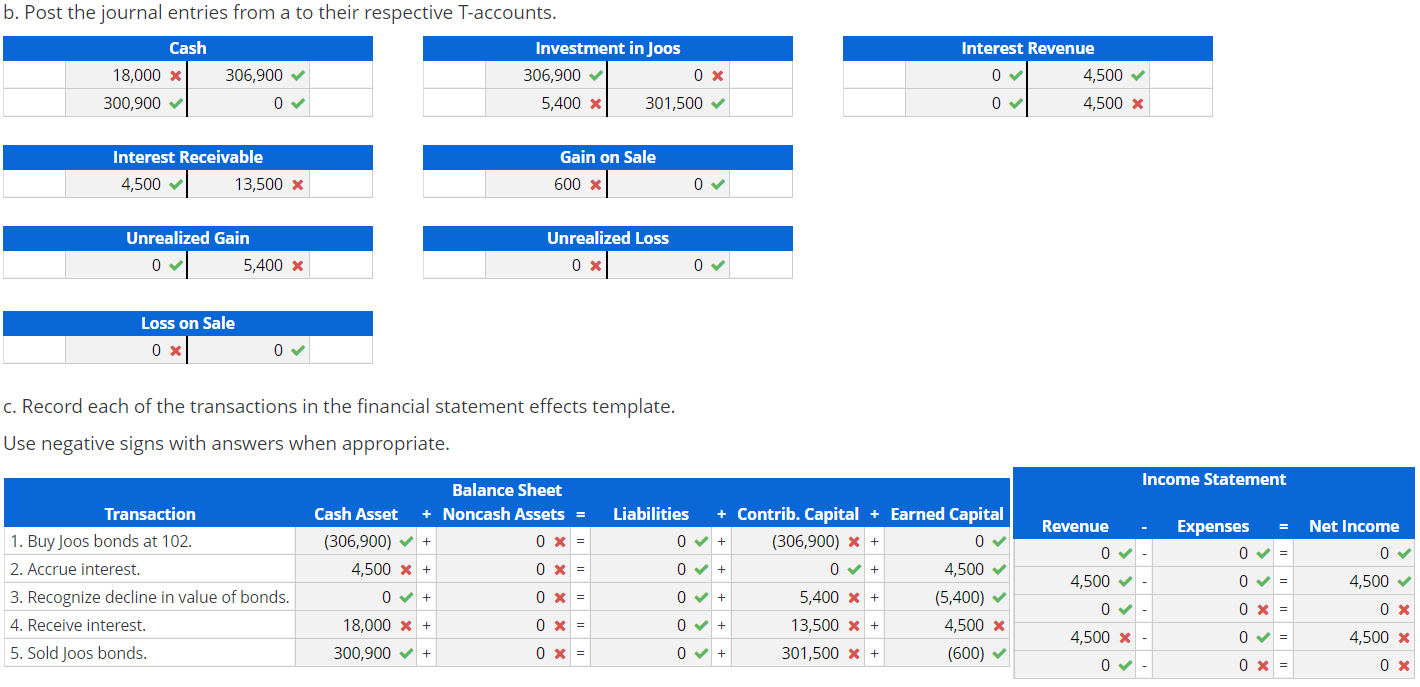

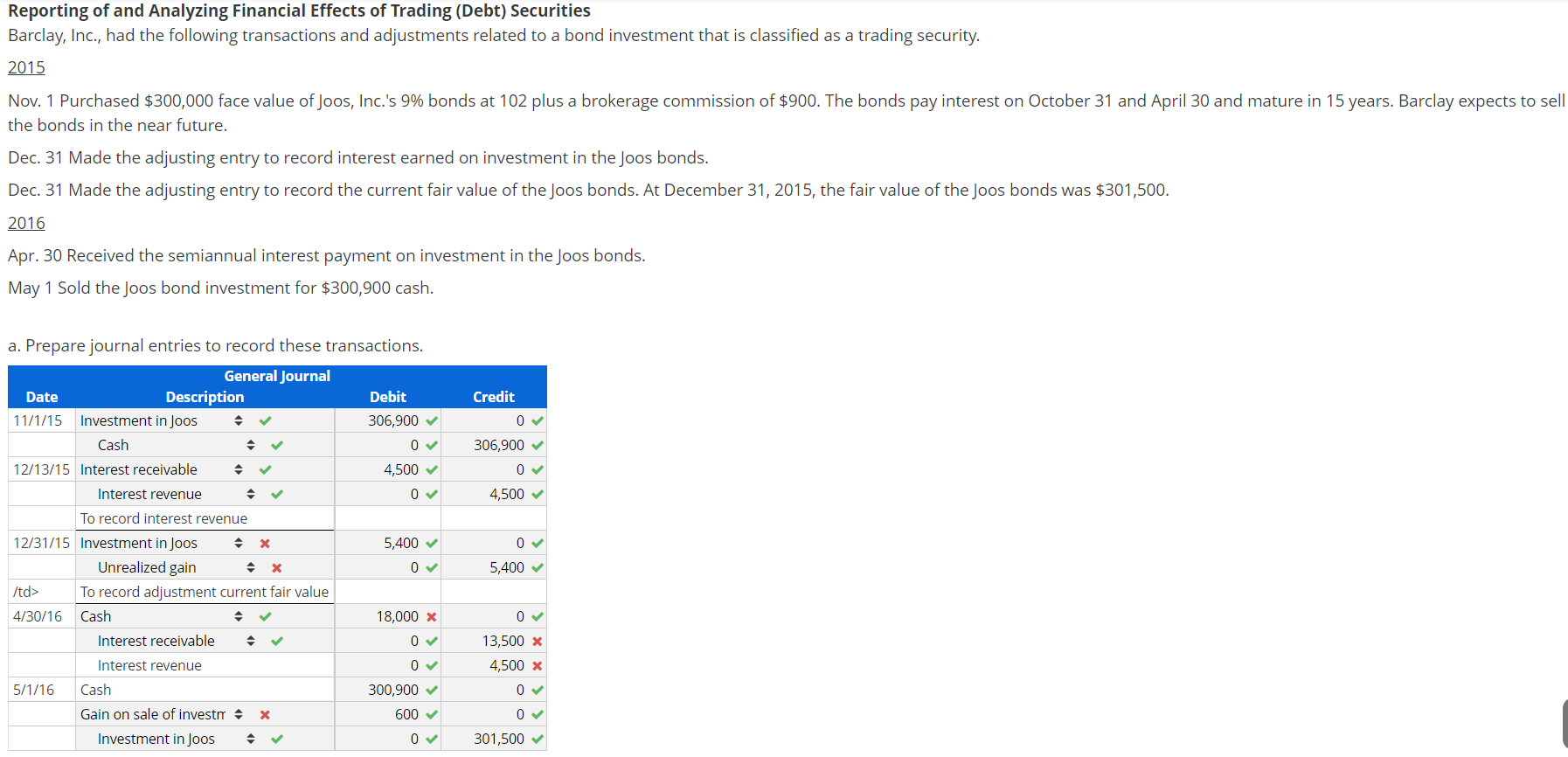

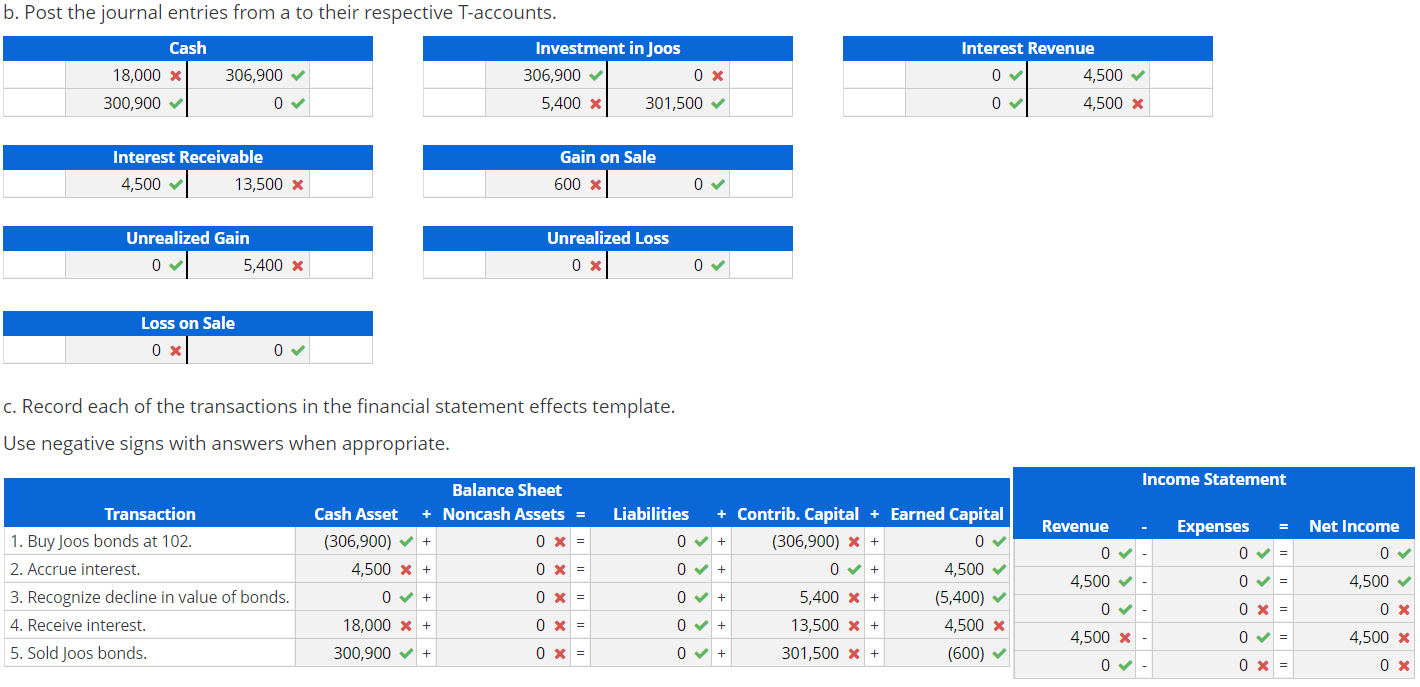

Reporting of and Analyzing Financial Effects of Trading (Debt) Securities Barclay, Inc., had the following transactions and adjustments related to a bond investment that is classified as a trading security. 2015 Nov. 1 Purchased $300,000 face value of Joos, Inc.'s 9% bonds at 102 plus a brokerage commission of $900. The bonds pay interest on October 31 and April 30 and mature in 15 years. Barclay expects to sell the bonds in the near future. Dec. 31 Made the adjusting entry to record interest earned on investment in the Joos bonds. Dec. 31 Made the adjusting entry to record the current fair value of the Joos bonds. At December 31, 2015, the fair value of the Joos bonds was $301,500. 2016 Apr. 30 Received the semiannual interest payment on investment in the Joos bonds. May 1 Sold the Joos bond investment for $300,900 cash. a. Prepare journal entries to record these transactions. General Journal Description Debit Date Credit Investment in Joos 306,900 0 11/1/15 Cash 0 306,900 12/13/15 Interest receivable 4,500 0v 4,500 Interest revenue 0 To record interest revenue Investment in Joos 12/31/15 5,400 0 Unrealized gain 0 5,400 /td> To record adjustment current fair value Cash 0 4/30/16 18,000 Interest receivable 0 13,500 0 4,500 Interest revenue Cash 300,900 0 5/1/16 Gain on sale of investm 0 600 Investment in Joos 0 301,500 b. Post the journal entries from a to their respective T-accounts. Investment in Joos Cash Interest Revenue 0 x 0 18,000 306,900 306,900 4,500 0 0 5,400 4,500 300,900 301,500 Gain on Sale Interest Receivable 4,500 600 13,500 0 Unrealized Gain Unrealized Loss 0 0 x 5,400 0 Loss on Sale 0 x 0 c. Record each of the transactions in the financial statement effects template. Use negative signs with answers when appropriate. Income Statement Balance Sheet +Contrib. Capital+ Earned Capital +Noncash Assets = Transaction Cash Asset Liabilities Revenue Expenses Net Income 1. Buy Joos bonds at 102. 0 (306,900) 0 (306,900) = 0 2. Accrue interest 0 4,500 0 x= 0 + 4,500 0 = 4,500 4,500 3. Recognize decline in value of bonds. 0 x = 0 5,400 (5,400) 0 + 0 0 x 0 4. Receive interest 0 18,000 0 13,500 4,500 4,500 4,500 0 5. Sold Joos bonds. 301,500 300,900 0 0 + (600) 0 0 x 0 O O O c Reporting of and Analyzing Financial Effects of Trading (Debt) Securities Barclay, Inc., had the following transactions and adjustments related to a bond investment that is classified as a trading security. 2015 Nov. 1 Purchased $300,000 face value of Joos, Inc.'s 9% bonds at 102 plus a brokerage commission of $900. The bonds pay interest on October 31 and April 30 and mature in 15 years. Barclay expects to sell the bonds in the near future. Dec. 31 Made the adjusting entry to record interest earned on investment in the Joos bonds. Dec. 31 Made the adjusting entry to record the current fair value of the Joos bonds. At December 31, 2015, the fair value of the Joos bonds was $301,500. 2016 Apr. 30 Received the semiannual interest payment on investment in the Joos bonds. May 1 Sold the Joos bond investment for $300,900 cash. a. Prepare journal entries to record these transactions. General Journal Description Debit Date Credit Investment in Joos 306,900 0 11/1/15 Cash 0 306,900 12/13/15 Interest receivable 4,500 0v 4,500 Interest revenue 0 To record interest revenue Investment in Joos 12/31/15 5,400 0 Unrealized gain 0 5,400 /td> To record adjustment current fair value Cash 0 4/30/16 18,000 Interest receivable 0 13,500 0 4,500 Interest revenue Cash 300,900 0 5/1/16 Gain on sale of investm 0 600 Investment in Joos 0 301,500 b. Post the journal entries from a to their respective T-accounts. Investment in Joos Cash Interest Revenue 0 x 0 18,000 306,900 306,900 4,500 0 0 5,400 4,500 300,900 301,500 Gain on Sale Interest Receivable 4,500 600 13,500 0 Unrealized Gain Unrealized Loss 0 0 x 5,400 0 Loss on Sale 0 x 0 c. Record each of the transactions in the financial statement effects template. Use negative signs with answers when appropriate. Income Statement Balance Sheet +Contrib. Capital+ Earned Capital +Noncash Assets = Transaction Cash Asset Liabilities Revenue Expenses Net Income 1. Buy Joos bonds at 102. 0 (306,900) 0 (306,900) = 0 2. Accrue interest 0 4,500 0 x= 0 + 4,500 0 = 4,500 4,500 3. Recognize decline in value of bonds. 0 x = 0 5,400 (5,400) 0 + 0 0 x 0 4. Receive interest 0 18,000 0 13,500 4,500 4,500 4,500 0 5. Sold Joos bonds. 301,500 300,900 0 0 + (600) 0 0 x 0 O O O c