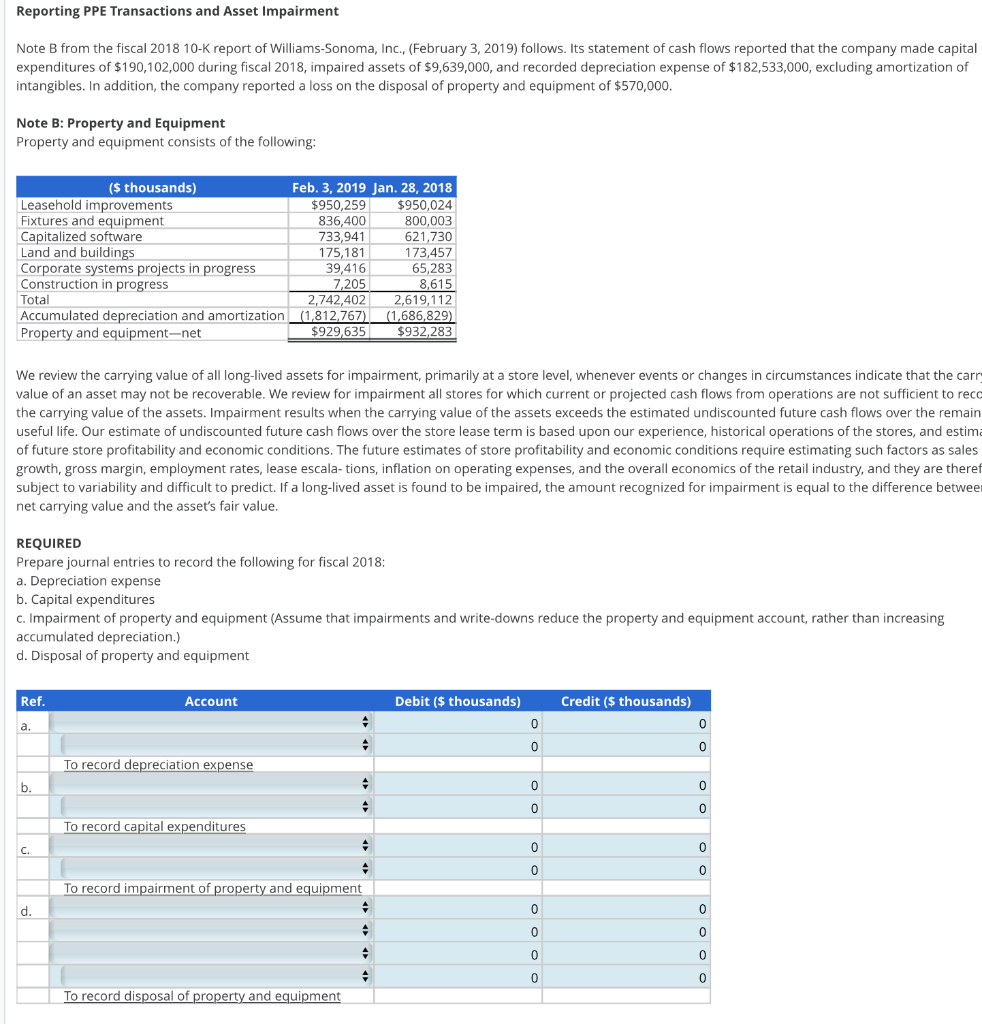

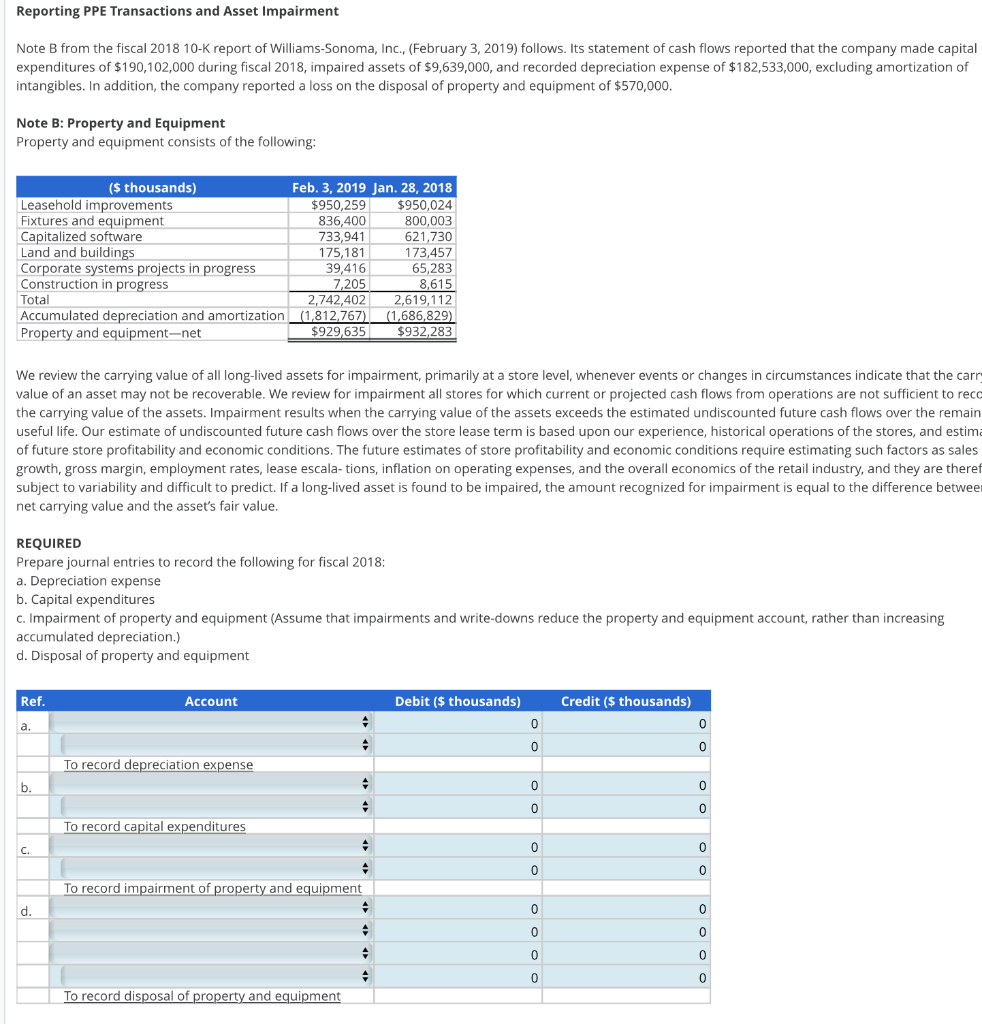

Reporting PPE Transactions and Asset Impairment Note B from the fiscal 2018 10-K report of Williams-Sonoma, Inc., (February 3, 2019) follows. Its statement of cash flows reported that the company made capital expenditures of $190,102,000 during fiscal 2018, impaired assets of $9,639,000, and recorded depreciation expense of $182,533,000, excluding amortization of intangibles. In addition, the company reported a loss on the disposal of property and equipment of $570,000. Note B: Property and Equipment Property and equipment consists of the following: We review the carrying value of all long-lived assets for impairment, primarily at a store level, whenever events or changes in circumstances indicate that the carr value of an asset may not be recoverable. We review for impairment all stores for which current or projected cash flows from operations are not sufficient to reco the carrying value of the assets. Impairment results when the carrying value of the assets exceeds the estimated undiscounted future cash flows over the remain useful life. Our estimate of undiscounted future cash flows over the store lease term is based upon our experience, historical operations of the stores, and estima of future store profitability and economic conditions. The future estimates of store profitability and economic conditions require estimating such factors as sales growth, gross margin, employment rates, lease escala- tions, inflation on operating expenses, and the overall economics of the retail industry, and they are theref subject to variability and difficult to predict. If a long-lived asset is found to be impaired, the amount recognized for impairment is equal to the difference betweenet carrying value and the asset's fair value. REQUIRED Prepare journal entries to record the following for fiscal 2018: a. Depreciation expense b. Capital expenditures c. Impairment of property and equipment (Assume that impairments and write-downs reduce the property and equipment account, rather than increasing Reporting PPE Transactions and Asset Impairment Note B from the fiscal 2018 10-K report of Williams-Sonoma, Inc., (February 3, 2019) follows. Its statement of cash flows reported that the company made capital expenditures of $190,102,000 during fiscal 2018, impaired assets of $9,639,000, and recorded depreciation expense of $182,533,000, excluding amortization of intangibles. In addition, the company reported a loss on the disposal of property and equipment of $570,000. Note B: Property and Equipment Property and equipment consists of the following: We review the carrying value of all long-lived assets for impairment, primarily at a store level, whenever events or changes in circumstances indicate that the carr value of an asset may not be recoverable. We review for impairment all stores for which current or projected cash flows from operations are not sufficient to reco the carrying value of the assets. Impairment results when the carrying value of the assets exceeds the estimated undiscounted future cash flows over the remain useful life. Our estimate of undiscounted future cash flows over the store lease term is based upon our experience, historical operations of the stores, and estima of future store profitability and economic conditions. The future estimates of store profitability and economic conditions require estimating such factors as sales growth, gross margin, employment rates, lease escala- tions, inflation on operating expenses, and the overall economics of the retail industry, and they are theref subject to variability and difficult to predict. If a long-lived asset is found to be impaired, the amount recognized for impairment is equal to the difference betweenet carrying value and the asset's fair value. REQUIRED Prepare journal entries to record the following for fiscal 2018: a. Depreciation expense b. Capital expenditures c. Impairment of property and equipment (Assume that impairments and write-downs reduce the property and equipment account, rather than increasing