Question

Req A, ABC Companys raw materials purchases for June, July, and August are budgeted at $54,000, $44,000, and $69,000, respectively. Based on past experience, ABC

Req A,

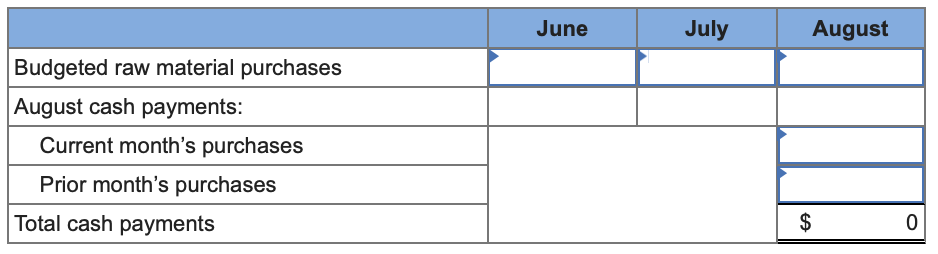

ABC Companys raw materials purchases for June, July, and August are budgeted at $54,000, $44,000, and $69,000, respectively. Based on past experience, ABC expects that 70% of a months raw material purchases will be paid in the month of purchase and 30% in the month following the purchase.

Required: Prepare an analysis of cash disbursements from raw materials purchases for ABC Company for August.

Req B,

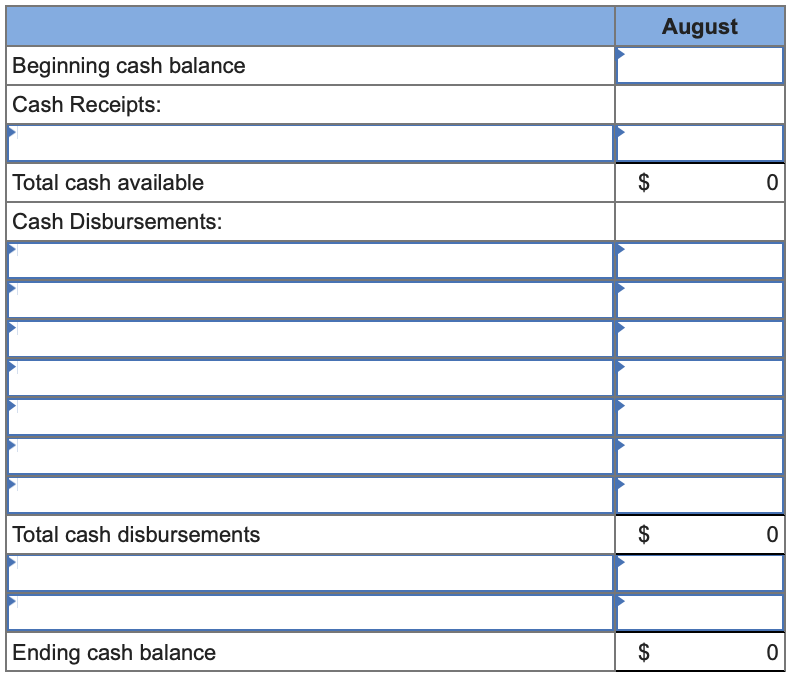

ABC Company has a cash balance of $43,000 on August 1 and requires a minimum ending cash balance of $28,344. Cash receipts from sales budgeted for August are $313,344. Cash disbursements budgeted for August include inventory purchases, $45,000; other manufacturing expenses, $122,000; operating expenses, $60,000; bond retirements, $68,000; and dividend payments, $33,000.

Required:

Prepare a cash budget for ABC Company for August.

Req C,

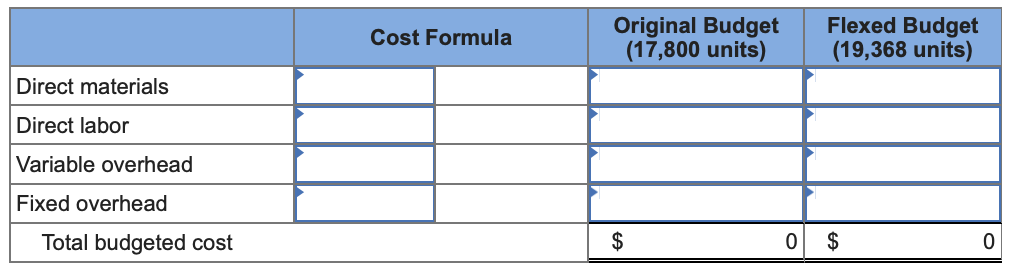

Acme Companys production budget for August is 17,800 units and includes the following component unit costs: direct materials, $6.00; direct labor, $10.00; variable overhead, $6.00. Budgeted fixed overhead is $35,000. Actual production in August was 19,368 units. Required: Prepare a flexible budget that would be used to compare against actual production costs for August.

Note: Round "Cost per unit" to 2 decimal places.

Req D,

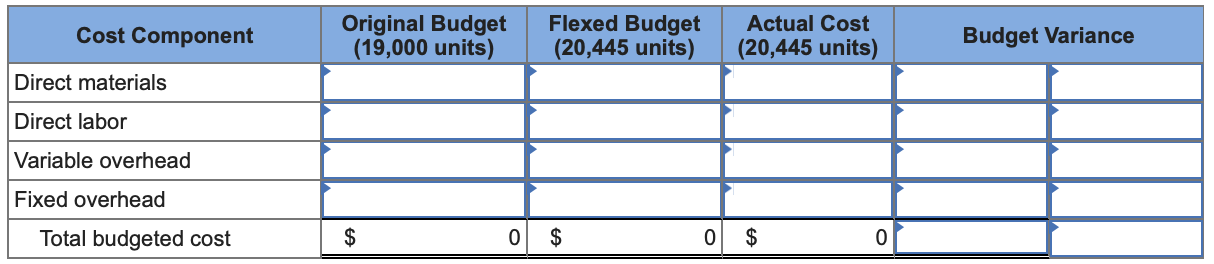

Acme Companys production budget for August is 19,000 units and includes the following component unit costs: direct materials, $8.00; direct labor, $11.60; variable overhead, $5.60. Budgeted fixed overhead is $47,000. Actual production in August was 20,445 units. Actual unit component costs incurred during August include direct materials, $9.80; direct labor, $10.00; variable overhead, $6.40. Actual fixed overhead was $50,000. Required: Prepare a performance report, including each cost component.

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).

Req E,

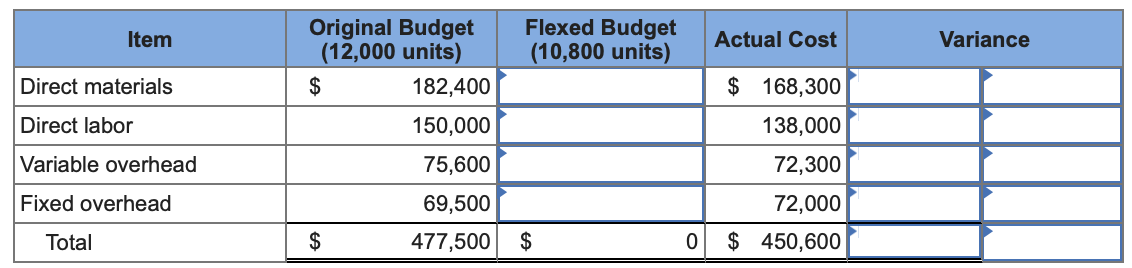

Western Manufacturing produces a single product. The original budget for April was based on expected production of 12,000 units; actual production for April was 10,800 units. The original budget and actual costs incurred for the manufacturing department follow:

| Original Budget | Actual Costs | |

|---|---|---|

| Direct materials | $ 182,400 | $ 168,300 |

| Direct labor | 150,000 | 138,000 |

| Variable overhead | 75,600 | 72,300 |

| Fixed overhead | 69,500 | 72,000 |

| Total | $ 477,500 | $ 450,600 |

Required:

Prepare an appropriate performance report for the manufacturing department.

Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started