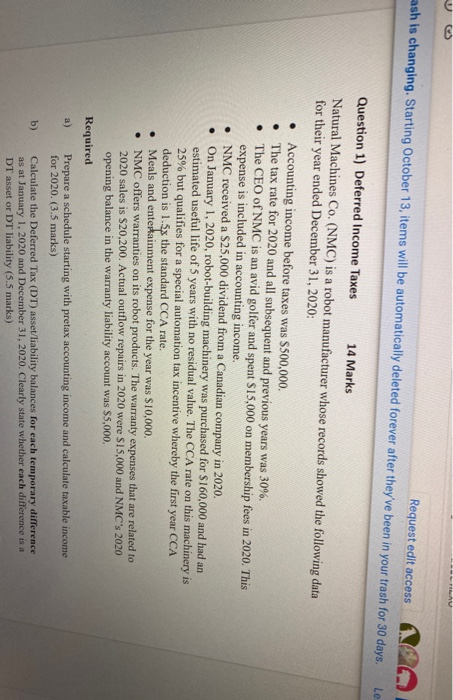

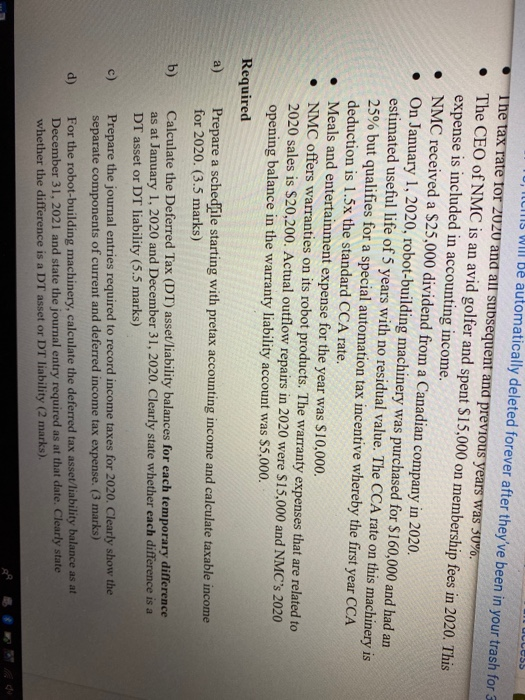

Request edit access sash is changing. Starting October 13, items will be automatically deleted forever after they've been in your trash for 30 days. Le Question 1) Deferred Income Taxes 14 Marks Natural Machines Co. (NMC) is a robot manufacturer whose records showed the following data for their year ended December 31, 2020: Accounting income before taxes was $500,000. The tax rate for 2020 and all subsequent and previous years was 30%. The CEO of NMC is an avid golfer and spent $15,000 on membership fees in 2020. This expense is included in accounting income. NMC received a $25,000 dividend from a Canadian company in 2020. On January 1, 2020, robot-building machinery was purchased for $160,000 and had an estimated useful life of 5 years with no residual value. The CCA rate on this machinery is 25% but qualifies for a special automation tax incentive whereby the first year CCA deduction is 1.5x the standard CCA rate. Meals and entertainment expense for the year was $10,000. NMC offers warranties on its robot products. The warranty expenses that are related to 2020 sales is $20,200. Actual outflow repairs in 2020 were $15,000 and NMC's 2020 opening balance in the warranty liability account was $5,000. Required Prepare a schedule starting with pretax accounting income and calculate taxable income for 2020. (3.5 marks) b) Calculate the Deferred Tax (DT) asset/liability balances for each temporary difference as at January 1, 2020 and December 31, 2020. Clearly state whether each difference is a DT asset or DT liability (5.5 marks) . CLOSS U, ILLIS Will be automatically deleted forever after they've been in your trash for 3 The tax rate for 2020 and all subsequent and previous years was 30%. The CEO of NMC is an avid golfer and spent $15,000 on membership fees in 2020. This expense is included in accounting income. NMC received a $25,000 dividend from a Canadian company in 2020. On January 1, 2020, robot-building machinery was purchased for $160,000 and had an estimated useful life of 5 years with no residual value. The CCA rate on this machinery is 25% but qualifies for a special automation tax incentive whereby the first year CCA deduction is 1.5x the standard CCA rate. Meals and entertainment expense for the year was $10,000. NMC offers warranties on its robot products. The warranty expenses that are related to 2020 sales is $20,200. Actual outflow repairs in 2020 were $15,000 and NMC's 2020 opening balance in the warranty liability account was $5,000. Required a) Prepare a schedfile starting with pretax accounting income and calculate taxable income for 2020. (3.5 marks) b) Calculate the Deferred Tax (DT) asset/liability balances for each temporary difference as at January 1, 2020 and December 31, 2020. Clearly state whether each difference is a DT asset or DT liability (5.5 marks) Prepare the journal entries required to record income taxes for 2020. Clearly show the separate components of current and deferred income tax expense. (3 marks) d) For the robot-building machinery, calculate the deferred tax asset/liability balance as at December 31, 2021 and state the journal entry required as at that date. Clearly state whether the difference is a DT asset or DT liability (2 marks). Request edit access sash is changing. Starting October 13, items will be automatically deleted forever after they've been in your trash for 30 days. Le Question 1) Deferred Income Taxes 14 Marks Natural Machines Co. (NMC) is a robot manufacturer whose records showed the following data for their year ended December 31, 2020: Accounting income before taxes was $500,000. The tax rate for 2020 and all subsequent and previous years was 30%. The CEO of NMC is an avid golfer and spent $15,000 on membership fees in 2020. This expense is included in accounting income. NMC received a $25,000 dividend from a Canadian company in 2020. On January 1, 2020, robot-building machinery was purchased for $160,000 and had an estimated useful life of 5 years with no residual value. The CCA rate on this machinery is 25% but qualifies for a special automation tax incentive whereby the first year CCA deduction is 1.5x the standard CCA rate. Meals and entertainment expense for the year was $10,000. NMC offers warranties on its robot products. The warranty expenses that are related to 2020 sales is $20,200. Actual outflow repairs in 2020 were $15,000 and NMC's 2020 opening balance in the warranty liability account was $5,000. Required Prepare a schedule starting with pretax accounting income and calculate taxable income for 2020. (3.5 marks) b) Calculate the Deferred Tax (DT) asset/liability balances for each temporary difference as at January 1, 2020 and December 31, 2020. Clearly state whether each difference is a DT asset or DT liability (5.5 marks) . CLOSS U, ILLIS Will be automatically deleted forever after they've been in your trash for 3 The tax rate for 2020 and all subsequent and previous years was 30%. The CEO of NMC is an avid golfer and spent $15,000 on membership fees in 2020. This expense is included in accounting income. NMC received a $25,000 dividend from a Canadian company in 2020. On January 1, 2020, robot-building machinery was purchased for $160,000 and had an estimated useful life of 5 years with no residual value. The CCA rate on this machinery is 25% but qualifies for a special automation tax incentive whereby the first year CCA deduction is 1.5x the standard CCA rate. Meals and entertainment expense for the year was $10,000. NMC offers warranties on its robot products. The warranty expenses that are related to 2020 sales is $20,200. Actual outflow repairs in 2020 were $15,000 and NMC's 2020 opening balance in the warranty liability account was $5,000. Required a) Prepare a schedfile starting with pretax accounting income and calculate taxable income for 2020. (3.5 marks) b) Calculate the Deferred Tax (DT) asset/liability balances for each temporary difference as at January 1, 2020 and December 31, 2020. Clearly state whether each difference is a DT asset or DT liability (5.5 marks) Prepare the journal entries required to record income taxes for 2020. Clearly show the separate components of current and deferred income tax expense. (3 marks) d) For the robot-building machinery, calculate the deferred tax asset/liability balance as at December 31, 2021 and state the journal entry required as at that date. Clearly state whether the difference is a DT asset or DT liability (2 marks)