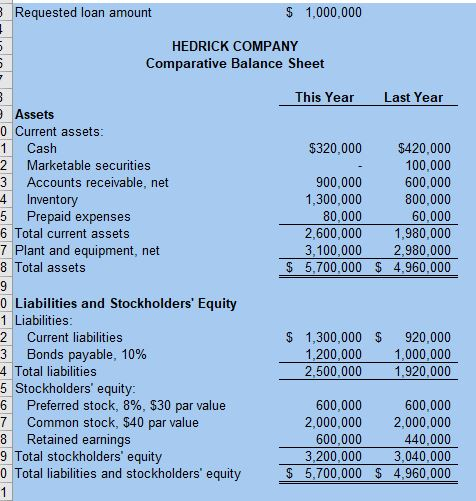

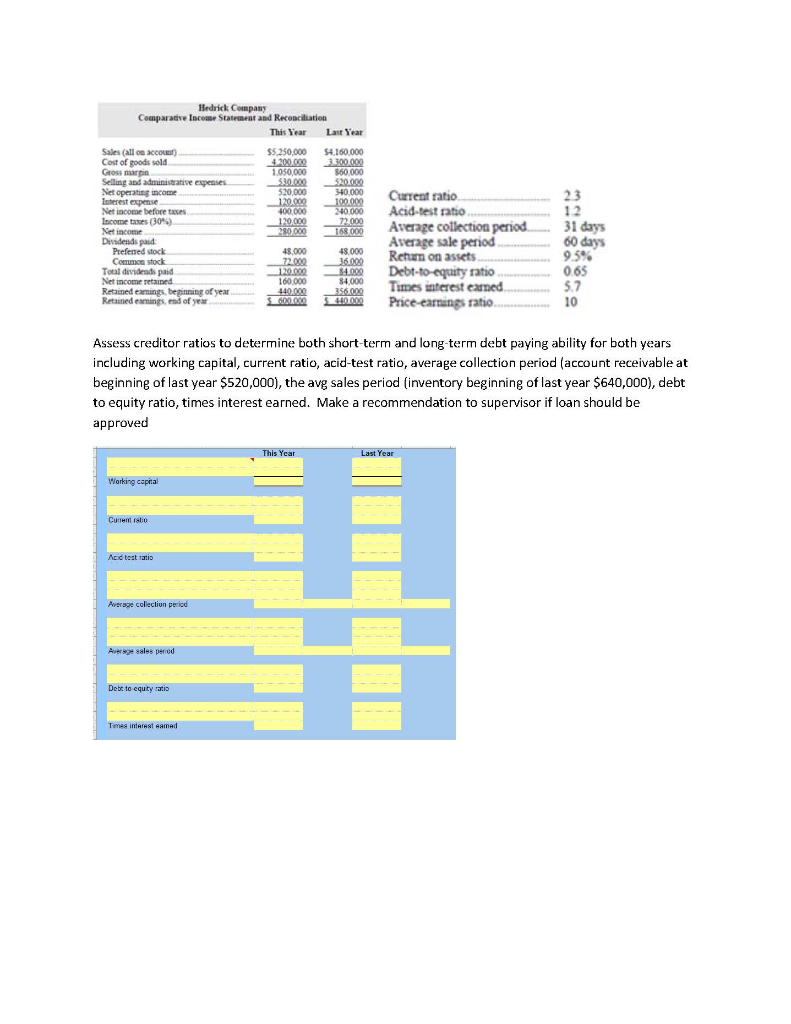

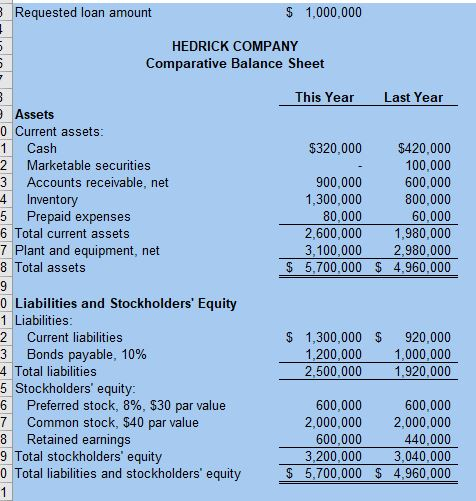

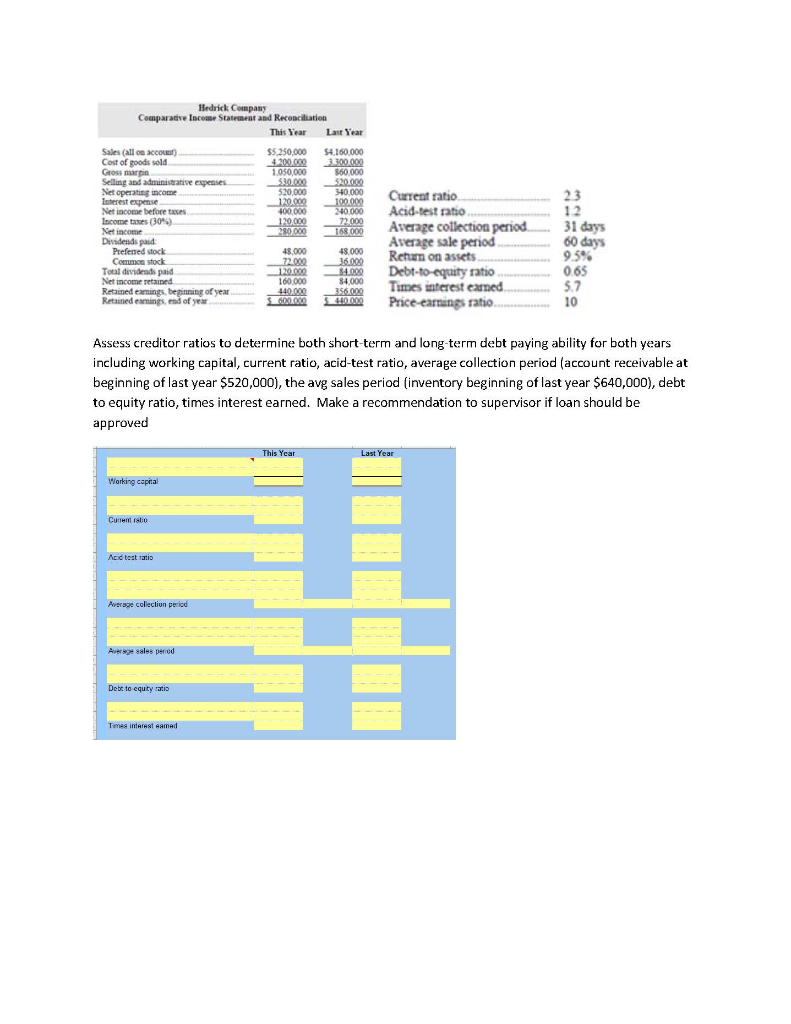

Requested loan amount $ 1,000,000 HEDRICK COMPANY Comparative Balance Sheet This Year Last Year Assets 0 Current assets: 1 Cash 2 Marketable securities 3 Accounts receivable, net 4 Inventory 5 Prepaid expenses 6 Total current assets 7 Plant and equipment, net 8 Total assets $320,000 $420,000 100,000 900,000 600,000 1,300,000 800,000 80,000 60,000 2,600,000 1,980,000 3,100,000 2,980,000 $ 5,700,000 $ 4.960,000 $ $ 1,300,000 1,200,000 2.500.000 920,000 1,000,000 1.920,000 0 Liabilities and Stockholders' Equity 1 Liabilities: 2 Current liabilities 3 Bonds payable, 10% 4 Total liabilities 5 Stockholders' equity: 6 Preferred stock, 8%, $30 par value 7 Common stock, $40 par value 8 Retained earnings 9 Total stockholders' equity 0 Total liabilities and stockholders' equity 600,000 600,000 2,000,000 2,000,000 600,000 440,000 3,200,000 3,040,000 $ 5.700,000 $ 4.960,000 Hedrick Corpany Comparative Income Statement and Reconciliation This Year Last Year $5.250,000 4.200.000 1050 000 530.00 520.000 120.000 400 000 120.000 Sales (all count) Cost of roods sold Grossman Selling and administrative expenses Net operating income Interest expense Net income before te Income taxes (304) Net income Dividends pasid Preferred stock Come stock Total dividend paid Net income retained Retained earnings beinning of year Retained emings, end of year $4,160.000 3.300.000 360 000 $20.000 340.000 100.000 240000 000 168000 23 12 31 days 60 days 9.5% 48.000 72.000 Current ratio Acid-test ratio Average collection period Average sale period... Return on assets. Debt-to-equity ratio. Times interest canned Price earnings ratio.. 48.000 36.000 84.000 84000 356.000 S440.000 0.65 160,000 440.000 SARDERO 5.7 . 10 Assess creditor ratios to determine both short-term and long-term debt paying ability for both years including working capital, current ratio, acid-test ratio, average collection period (account receivable at beginning of last year $520,000), the avg sales period (inventory beginning of last year $640,000), debt to equity ratio, times interest earned. Make a recommendation to supervisor if loan should be approved Last Year Working capital Current ratio Acid test ratio Average collection period Avere sales period Debt to equity ratio Times interest Aamad