Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1) Assuming that the rate of inflation is 3 percent at both pre and post-retirement, find out Jay works as a financial consultant with

Required:

1) Assuming that the rate of inflation is 3 percent at both pre and post-retirement, find out

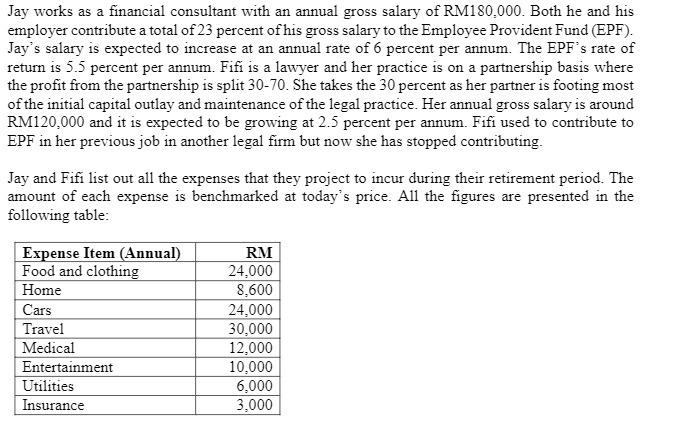

Jay works as a financial consultant with an annual gross salary of RM180,000. Both he and his employer contribute a total of 23 percent of his gross salary to the Employee Provident Fund (EPF). Jay's salary is expected to increase at an annual rate of 6 percent per annum. The EPF's rate of return is 5.5 percent per annum. Fifi is a lawyer and her practice is on a partnership basis where the profit from the partnership is split 30-70. She takes the 30 percent as her partner is footing most of the initial capital outlay and maintenance of the legal practice. Her annual gross salary is around RM120,000 and it is expected to be growing at 2.5 percent per annum. Fifi used to contribute to EPF in her previous job in another legal firm but now she has stopped contributing. Jay and Fifi list out all the expenses that they project to incur during their retirement period. The amount of each expense is benchmarked at today's price. All the figures are presented in the following table: Expense Item (Annual) Food and clothing Home Cars Travel Medical Entertainment Utilities Insurance RM 24,000 8,600 24,000 30,000 12,000 10,000 6,000 3,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find out the required values we need to perform the following calculations Jays retirement savings a Total annual contribution to EPF 23 of Jays gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started