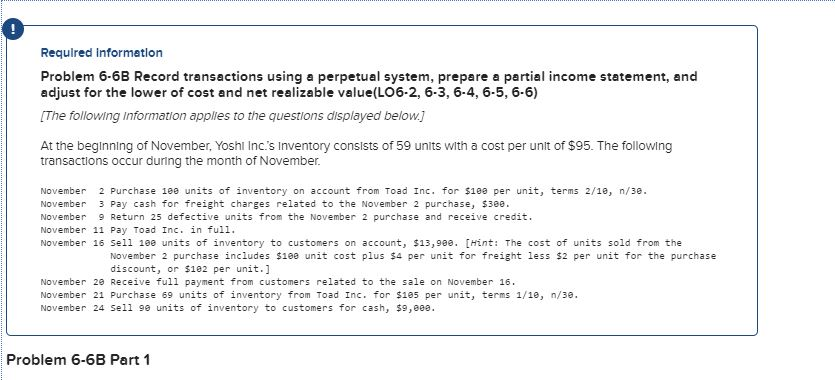

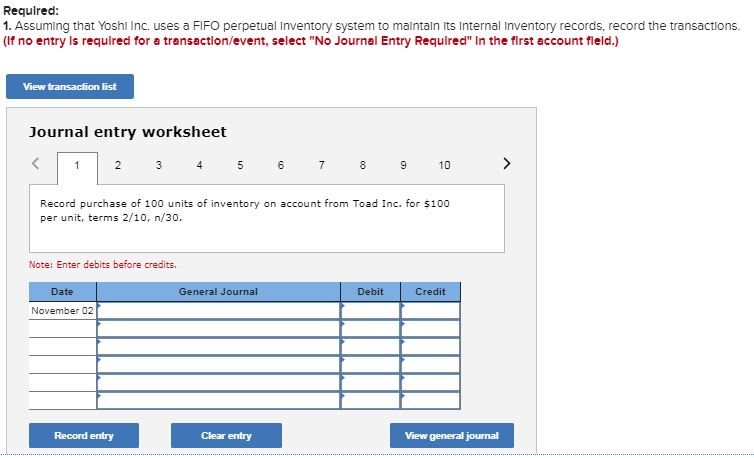

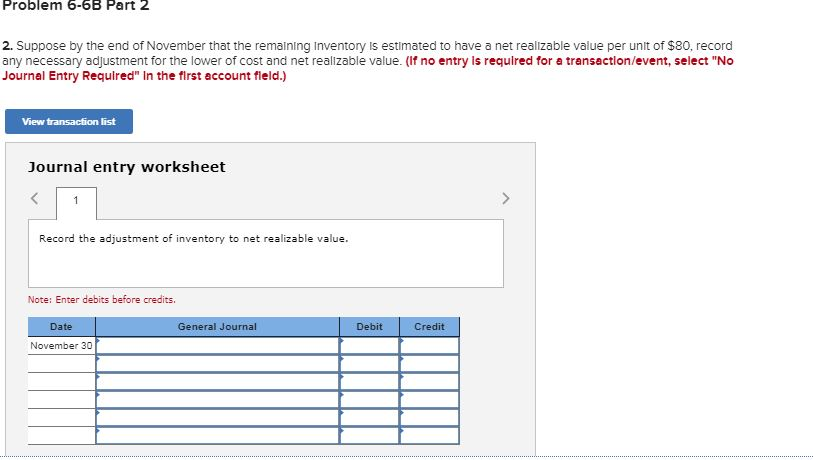

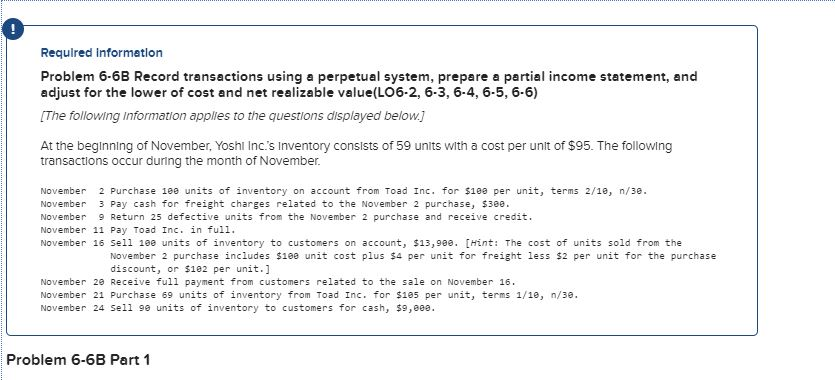

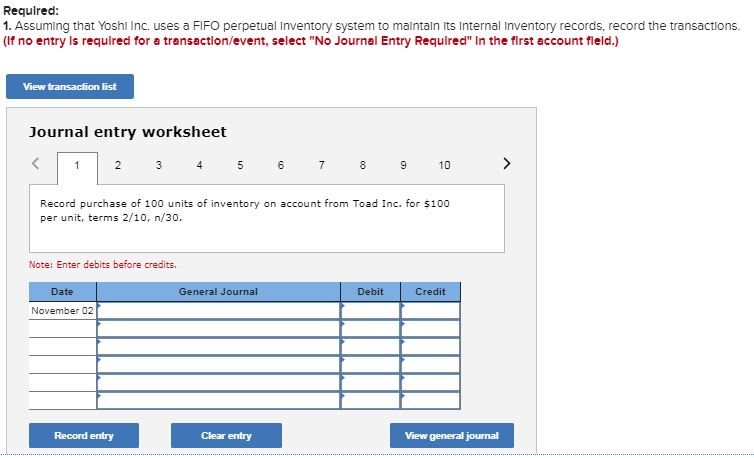

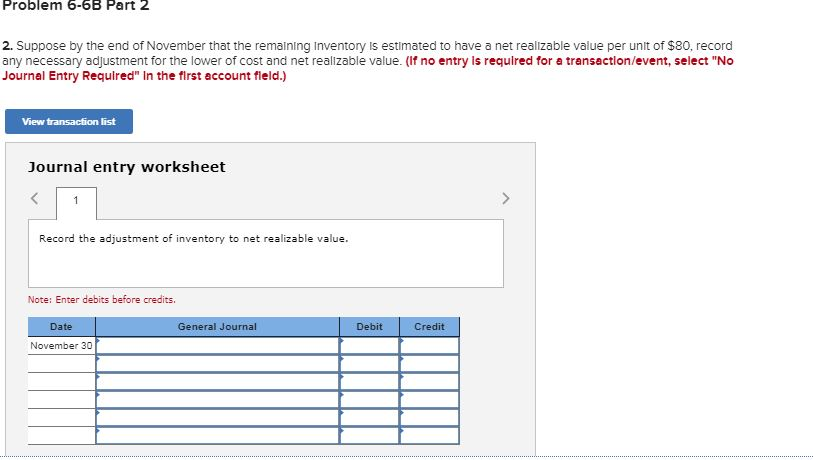

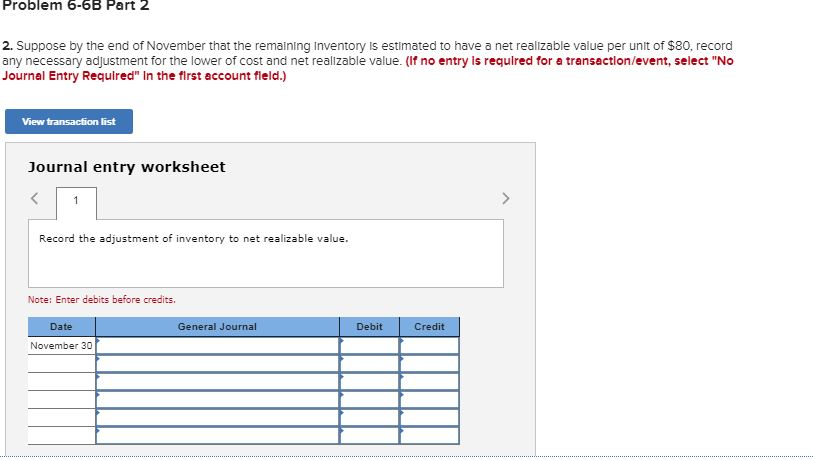

Required: 1. Assuming that Yoshi Inc. uses a FIFO perpetual Inventory system to maintain Its Internal Inventory records, record the transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet 2 3 4 5 6 7 8 9 10 > Record purchase of 100 units of inventory on account from Toad Inc. for $100 per unit, terms 2/10, n/30. Note: Enter debits before credits. Date General Journal Debit Credit November 02 Record entry Clear entry View general journal Problem 6-68 Part 2 2. Suppose by the end of November that the remaining Inventory is estimated to have a net realizable value per unit of $80, record any necessary adjustment for the lower of cost and net realizable value. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet Record the adjustment of inventory to net realizable value. Note: Enter debits before credits. General Journal Debit Credit Date November 30 Problem 6-68 Part 2 2. Suppose by the end of November that the remaining Inventory is estimated to have a net realizable value per unit of $80, record any necessary adjustment for the lower of cost and net realizable value. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet Record the adjustment of inventory to net realizable value. Note: Enter debits before credits. General Journal Debit Credit Date November 30 Required: 1. Assuming that Yoshi Inc. uses a FIFO perpetual Inventory system to maintain Its Internal Inventory records, record the transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet 2 3 4 5 6 7 8 9 10 > Record purchase of 100 units of inventory on account from Toad Inc. for $100 per unit, terms 2/10, n/30. Note: Enter debits before credits. Date General Journal Debit Credit November 02 Record entry Clear entry View general journal Problem 6-68 Part 2 2. Suppose by the end of November that the remaining Inventory is estimated to have a net realizable value per unit of $80, record any necessary adjustment for the lower of cost and net realizable value. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet Record the adjustment of inventory to net realizable value. Note: Enter debits before credits. General Journal Debit Credit Date November 30 Problem 6-68 Part 2 2. Suppose by the end of November that the remaining Inventory is estimated to have a net realizable value per unit of $80, record any necessary adjustment for the lower of cost and net realizable value. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet Record the adjustment of inventory to net realizable value. Note: Enter debits before credits. General Journal Debit Credit Date November 30