Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Complete an amortization table for this installment note. 2. Prepare the journal entries in which Norwood records the following: (a) Accrued interest as

Required: 1. Complete an amortization table for this installment note. 2. Prepare the journal entries in which Norwood records the following: (a) Accrued interest as of December 31, 2019 (the end of its annual reporting period). (b) The first annual payment on the note.

Req 2A and 2B

General Journal:

- Accounts payable

- Accounts receivable

- Accumulated depreciation

- Bond interest payable

- Bonds payable

- Cash

- Common stock

- Contributed capital in excess of par value

- Depreciation expense

- Discount on bonds payable

- Gain on retirement of bonds payable

- Interest expense

- Interest payable

- Lease liability

- Leased asset

- Loss on retirement of bonds payable

- Notes payable

- Premium on bonds payable

- Rental expense

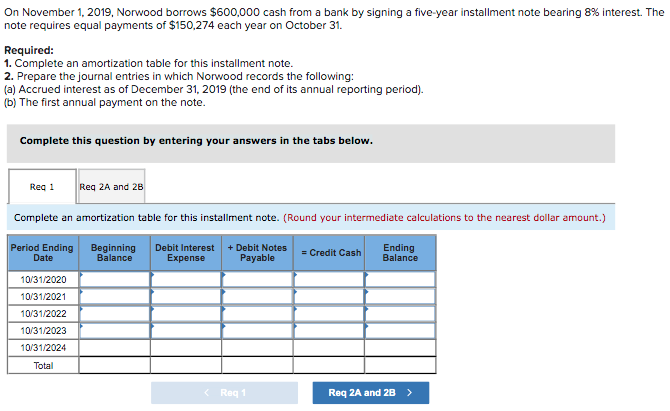

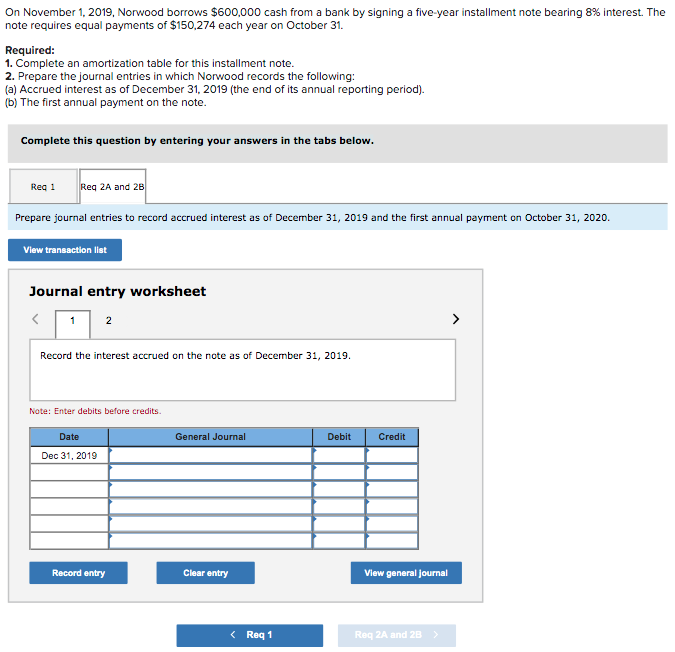

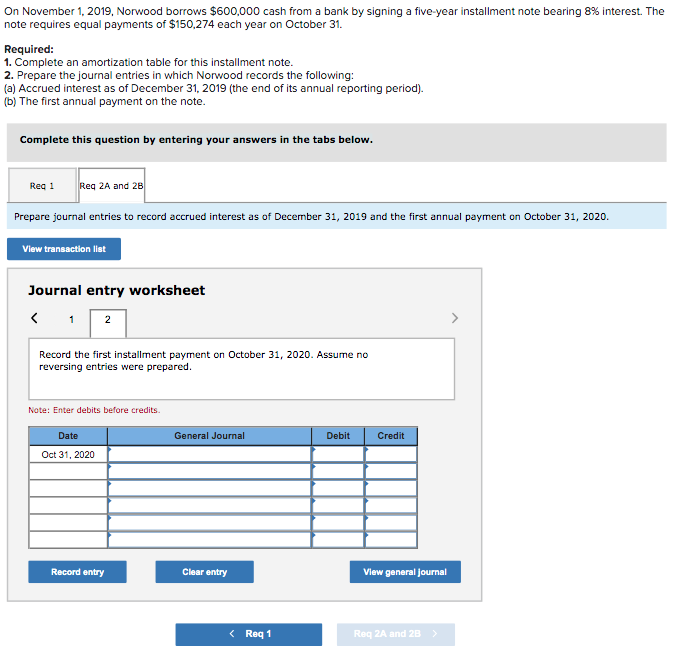

On November 1, 2019, Norwood borrows $600,000 cash from a bank by signing a five-year installment note bearing 8% interest. The note requires equal payments of $150,274 each year on October 31. Required: 1. Complete an amortization table for this installment note. 2. Prepare the journal entries in which Norwood records the following: (a) Accrued interest as of December 31, 2019 (the end of its annual reporting period). (b) The first annual payment on the note. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A and 2B Complete an amortization table for this installment note. (Round your intermediate calculations to the nearest dollar amount.) Period Ending Date Beginning Balance Debit Interest Expense + Debit Notes Payable = Credit Cash Ending Balance 10/31/2020 10/31/2021 10/31/2022 10/31/2023 10/31/2024 Total On November 1, 2019, Norwood borrows $600,000 cash from a bank by signing a five-year installment note bearing 8% interest. The note requires equal payments of $150,274 each year on October 31. Required: 1. Complete an amortization table for this installment note. 2. Prepare the journal entries in which Norwood records the following: (a) Accrued interest as of December 31, 2019 (the end of its annual reporting period). (b) The first annual payment on the note. Complete this question by entering your answers in the tabs below. Reg 1 Req 2A and 28 Prepare journal entries to record accrued interest as of December 31, 2019 and the first annual payment on October 31, 2020. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started