Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1) Given the above information, and assuming the capital asset pricing model is valid, Calculate the current weighted average cost of capital for the

Required:

1) Given the above information, and assuming the capital asset pricing model is valid, Calculate the current weighted average cost of capital for the Dr. Phil Media Corporation? (Round your final answer to the nearest 0.01 per cent)?

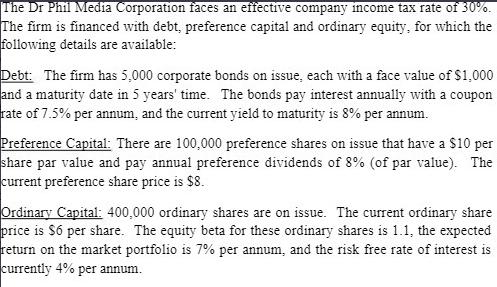

The Dr Phil Media Corporation faces an effective company income tax rate of 30%. The firm is financed with debt, preference capital and ordinary equity, for which the following details are available: Debt: The firm has 5,000 corporate bonds on issue, each with a face value of $1,000 and a maturity date in 5 years' time. The bonds pay interest annually with a coupon rate of 7.5% per annum, and the current yield to maturity is 8% per annum. Preference Capital: There are 100,000 preference shares on issue that have a $10 per share par value and pay annual preference dividends of 8% (of par value). The current preference share price is $8. Ordinary Capital: 400,000 ordinary shares are on issue. The current ordinary share price is $6 per share. The equity beta for these ordinary shares is 1.1, the expected return on the market portfolio is 7% per annum, and the risk free rate of interest is currently 4% per annum.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Weighted Average Cost of Capital WACC Debt Cost of Debt 8 1 30 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started