Answered step by step

Verified Expert Solution

Question

1 Approved Answer

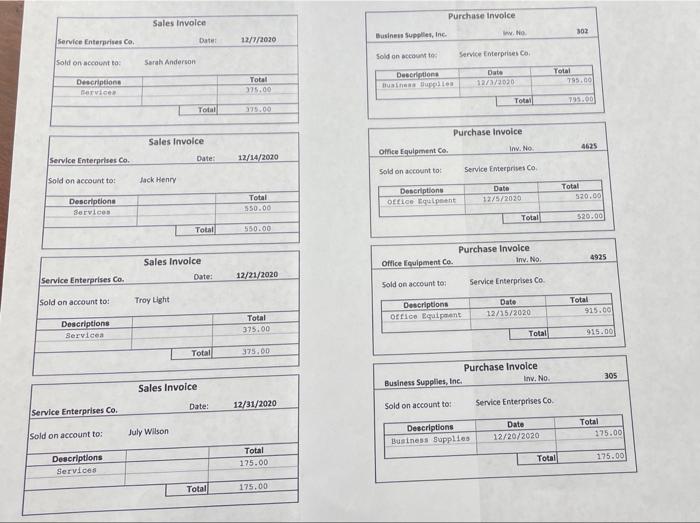

1. Journalize the transactions for December (in date order) in the general journal. (See attached source documents) 2. Post the entries to the general

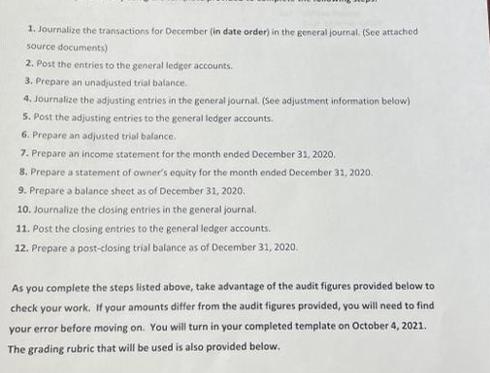

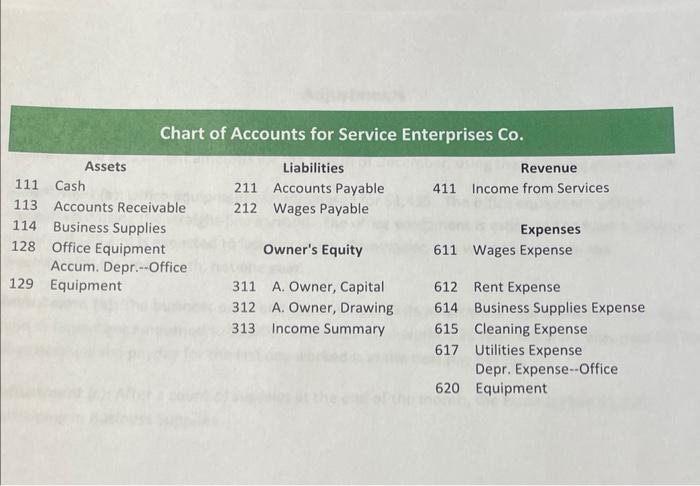

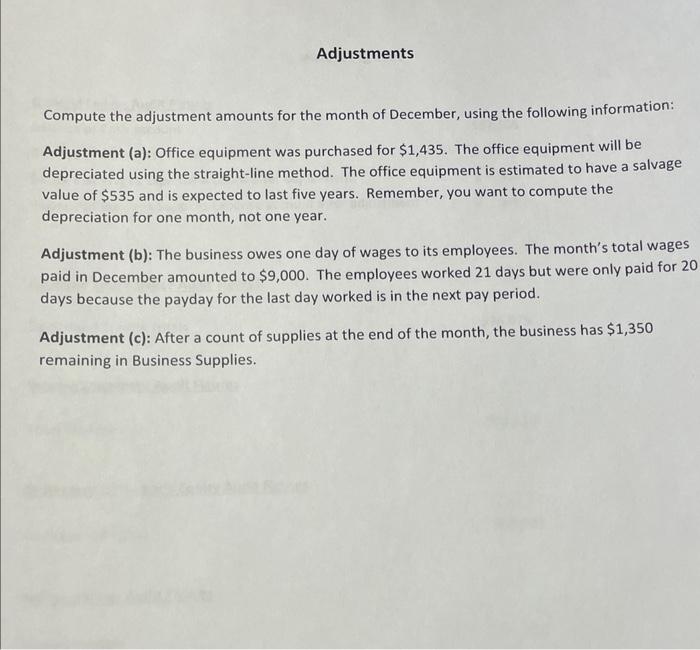

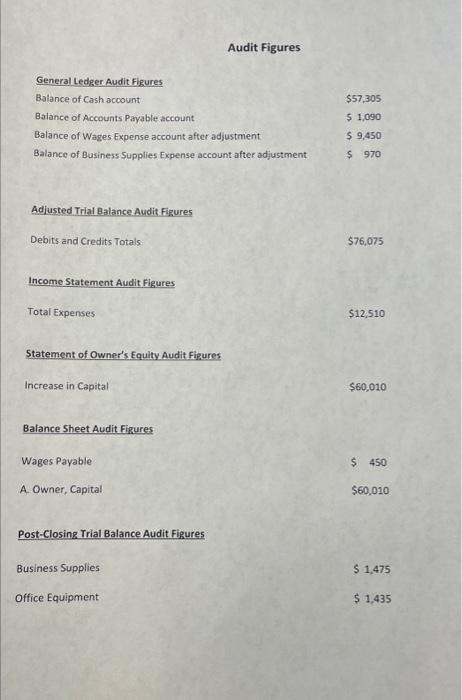

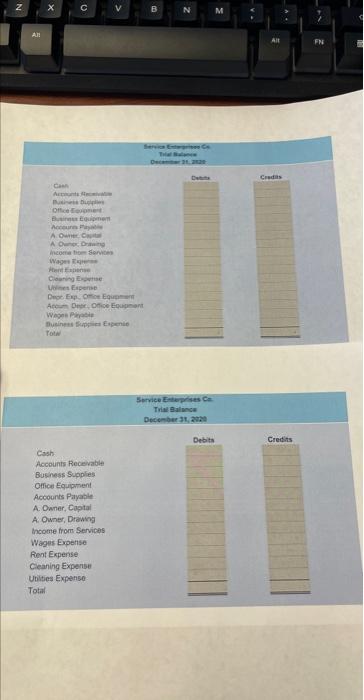

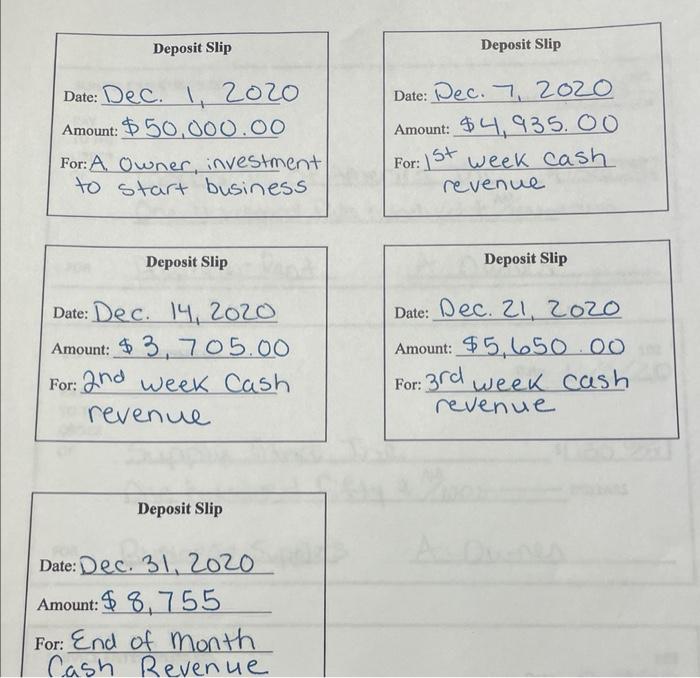

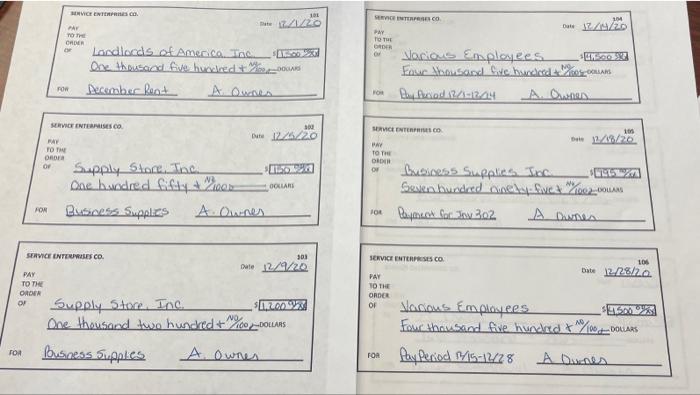

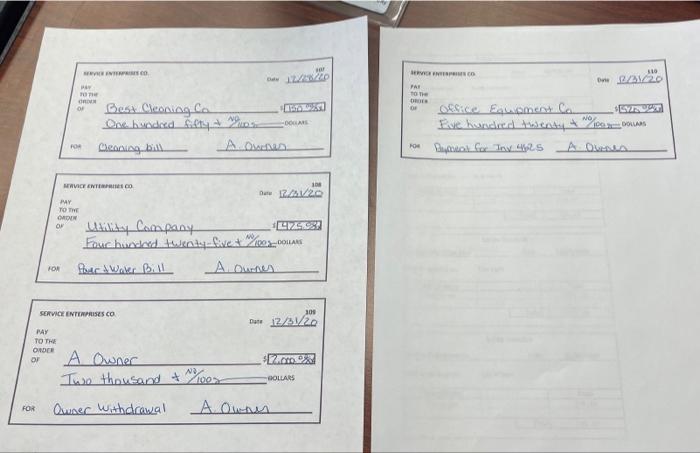

1. Journalize the transactions for December (in date order) in the general journal. (See attached source documents) 2. Post the entries to the general ledger accounts. 3. Prepare an unadjusted trial balance. 4. Journalize the adjusting entries in the general journal. (See adjustment information below) 5. Post the adjusting entries to the general ledger accounts. 6. Prepare an adjusted trial balance. 7. Prepare an income statement for the month ended December 31, 2020. 8. Prepare a statement of owner's equity for the month ended December 31, 2020. 9. Prepare a balance sheet as of December 31, 2020. 10. Journalize the closing entries in the general journal, 11. Post the closing entries to the general ledger accounts. 12. Prepare a post-closing trial balance as of December 31, 2020. As you complete the steps listed above, take advantage of the audit figures provided below to check your work. If your amounts differ from the audit figures provided, you will need to find your error before moving on. You will turn in your completed template on October 4, 2021. The grading rubric that will be used is also provided below. Assets Chart of Accounts for Service Enterprises Co. Liabilities 211 Accounts Payable 212 Wages Payable 111 Cash 113 Accounts Receivable 114 Business Supplies 128 Office Equipment Accum. Depr.--Office 129 Equipment Owner's Equity 311 A. Owner, Capital 312 A. Owner, Drawing 313 Income Summary Revenue 411 Income from Services Expenses 611 Wages Expense 612 Rent Expense 614 Business Supplies Expense 615 Cleaning Expense 617 Utilities Expense Depr. Expense--Office 620 Equipment Adjustments Compute the adjustment amounts for the month of December, using the following information: Adjustment (a): Office equipment was purchased for $1,435. The office equipment will be depreciated using the straight-line method. The office equipment is estimated to have a salvage value of $535 and is expected to last five years. Remember, you want to compute the depreciation for one month, not one year. Adjustment (b): The business owes one day of wages to its employees. The month's total wages paid in December amounted to $9,000. The employees worked 21 days but were only paid for 20 days because the payday for the last day worked is in the next pay period. Adjustment (c): After a count of supplies at the end of the month, the business has $1,350 remaining in Business Supplies. General Ledger Audit Figures Balance of Cash account Balance of Accounts Payable account Balance of Wages Expense account after adjustment Balance of Business Supplies Expense account after adjustment Adjusted Trial Balance Audit Figures Debits and Credits Totals Income Statement Audit Figures Total Expenses Statement of Owner's Equity Audit Figures Increase in Capital Balance Sheet Audit Figures Wages Payable A. Owner, Capital Post-Closing Trial Balance Audit Figures Business Supplies Audit Figures Office Equipment $57,305 $ 1,090 $ 9,450 $ 970 $76,075 $12,510 $60,010 $ 450 $60,010 $ 1,475 $ 1,435 Z All X C Accounts Rec Bu Du Office Expert Business Equipmen Accounts Payab A Owner Capital A Owner Drawing income trom Services Wages Ex Het Expense Cleaning Expense Udines Expense Der Exp. Office Equipment Acoum Depr, Office Equipment Wages Payable Business Supplies Expense Tot Cash Accounts Receivable Business Supplies V Office Equipment Accounts Payable A. Owner, Capital A. Owner, Drawing Income from Services Wages Expense Rent Expense Cleaning Expense Utilities Expense Total B N Trial Balanc December 21.2129 Detai Service Enterprises Co Trial Balance December 31, 2020 Debits M Credits Credits FN Deposit Slip Date: Dec. 1, 2020 Amount: $50,000.00 For: A Owner, investment to start business. Deposit Slip Date: Dec. 14, 2020 Amount: $3, 705.00 For: 2nd week Cash revenue Deposit Slip Date: Dec. 31, 2020 Amount: $8,755 For: End of month Cash Revenue Deposit Slip Date: Dec. 7, 2020 Amount: $4, 935.00 For: 1st week cash St revenue. Deposit Slip Date: Dec. 21, 2020 Amount: $5,650.000 For: 3rd week cash. revenue FOR FOR PAY TO THE ORDER OF PAY TO THE ORDER SERVICE ENTERPRISES CO OF FOR PAY TO THE ORDER OF SERVICE ENTERPRISES CO ABOO Loodlords of America. Inc One thousand five hundred + MAS December Rent A Qunes SERVICE ENTERPRISES CO. Tate 17/1/20 Supply Store. The One hundred fifty + 21005 DOLLARS Business Supplies A Ownes Date 12/6/20 300 Supply Store. Inc. One thousand two hundred +100-DOLLARS Business Supplies A. Owner 101 303 Date 12/9/20 1.2.0098 SERVICE INTERPRES CO PAY TO THE ORDER Of FOR SERVICE ENTERPRISES CO PAY TO THE ORDER OF FOR Various Employees. Four thousand five hundlord + MS-DOLLARS Bay Period 12/1-12/24 A. Ownen SERVICE ENTERPRISES CO FOR 104 PAY 10 THE ORDER OF Various Employees Date 17/4/20 105 Business Supplies Inc. 1952 Seven hundred ninety-five + 1002-0 -DOLLARS Payment for Jov 302 A Dunes Date 12/18/20 106 Date 12/28/20 $4.500 Four thousand five hundred + 10/100 DOLLARS Pay Period 1/15-12/28 A Dunes FOR OF FOR PAY TO THE ORDER OF PAY TO THE ORDER SERVICE INTERPRISE CO of FOR PAY TO THE ORDER SERVICE ENTERPRISE CO Best Cleaning Co One hundred fifty + 10% 4 Cleaning bill SERVICE ENTERPRISES CO sor De 12/28/20 A Owner Two thousand + 10/100s Owner Withdrawal -DOLLARS A OD Utility Company Four hundred twenty-five + 1002-0 Pour & Water Bill A Owner De 12/31/20 108 A Owner 1425.98 $2.000. BOLLARS Date 12/31/20 309 SERVICE NEPRISE CO PAR to the ORDER OF 110 Dne 12/31/20 office Equipment Co. Five hundred twenty +1000 Ad Deal for Inv 4625 A. Owner SENZE OUT Service Enterprises Co. Sold on account to: Descriptione Services Service Enterprises Co. Sold on account to: Descriptions Services Service Enterprises Co. Sold on account to: Descriptions Services Service Enterprises Co. Sold on account to: Descriptions Services Sales Invoice Sarah Anderson Jack Henry Sales Invoice Troy Light Date: Total July Wilson Date: Sales Invoice Total Sales Invoice Date: Total Date: Total 12/7/2020 Total 375.00 375.00 12/14/2020 Total 550.00 550.00 12/21/2020 Total 375.00 375.00 12/31/2020 Total 175.00 175.00 Business Supplies, Inc. Sold on account to: Purchase Invoice Descriptions Business Supplies Office Equipment Co. Sold on account to: Descriptions Office Equipment Office Equipment Co. Sold on account to: Service Enterprises Co. Descriptions Descriptions office Equipment w. No. Purchase Invoice Business Supplies, Inc. Sold on account to: Date 12/3/2020 Total Inv. No. Service Enterprises Co. Purchase Invoice Business Supplies Date 12/5/2020 Total Inv. No. Service Enterprises Co. Date 12/15/2020 Total Purchase Invoice Inv. No. Total Service Enterprises Co. Date 12/20/2020 Total 302 795.00 795.00 Total 4625 520.00 520.00 Total 4925 915.00 915.00 Total 305 175.00 175.00

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Journalize the transactions for December in the general journal Date Account Debit Credit Dec 1 Cash 50000 Dec 1 A Owner Capital 50000 Dec 7 Cash 4935 Dec 7 Income from Services 4935 Dec 14 Cash 370...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started