Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required : 1. Preparing a table showing the balance in the fair value adjustments on December 31, 2019 (after making the adjustment entry for 2019).

Required :

1. Preparing a table showing the balance in the fair value adjustments on December 31, 2019 (after making the adjustment entry for 2019).

2. Preparing a table showing the total cost and fair value of Perez's portfolio shares on 31/12/2020 and determining the balance of unrealized holding gains (losses) on 31/12/2020.

3. Proof of adjustment is required based on your analysis in Clause (2) above (Change in Fair Value)

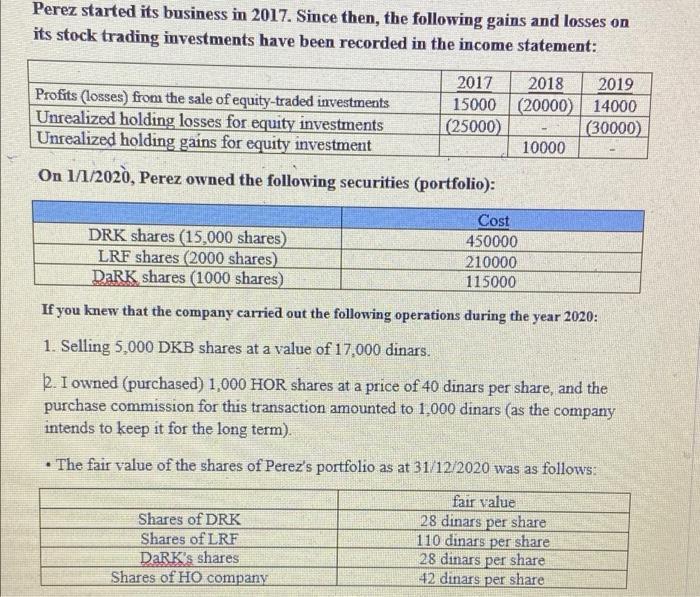

Perez started its business in 2017. Since then, the following gains and losses on its stock trading investments have been recorded in the income statement: 2017 2018 2019 15000 (20000) 14000 (25000) (30000) Profits (losses) from the sale of equity-traded investments Unrealized holding losses for equity investments Unrealized holding gains for equity investment On 1/1/2020, Perez owned the following securities (portfolio): Cost 450000 210000 115000 Shares of DRK Shares of LRF DaRK's shares Shares of HO company 10000 DRK shares (15,000 shares) LRF shares (2000 shares) DaRK shares (1000 shares) If you knew that the company carried out the following operations during the year 2020: 1. Selling 5,000 DKB shares at a value of 17,000 dinars. 2. I owned (purchased) 1,000 HOR shares at a price of 40 dinars per share, and the purchase commission for this transaction amounted to 1,000 dinars (as the company intends to keep it for the long term). The fair value of the shares of Perez's portfolio as at 31/12/2020 was as follows: fair value 28 dinars per share 110 dinars per share 28 dinars per share 42 dinars per share.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Question Answer 1 Following is the table showing the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started