Question

Required: #1. Record the March transactions in the General Journal. #2. Post the March transactions to the General Ledger. Don't forget to enter the beginning

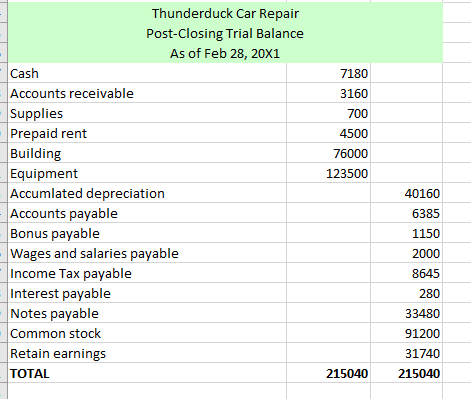

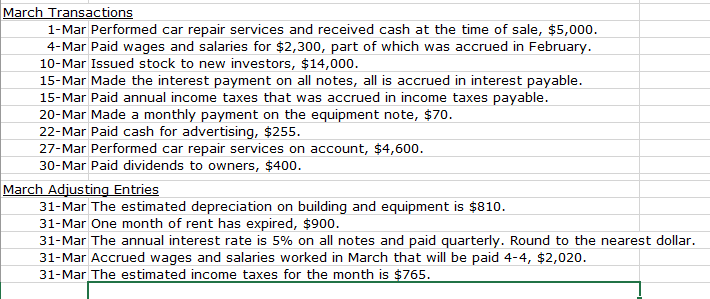

Required: #1. Record the March transactions in the General Journal. #2. Post the March transactions to the General Ledger. Don't forget to enter the beginning balances as of Feb. #3. Record the adjusting entries for March in the General Journal. #4. Post the adjusting entries for March to the General Ledger. #5. Prepare the adjusted trial balance as of March 31. #6. Prepare the following March financial statements: Income Statement, Statement of Stockholders' Equity, Balance Sheet and Statement of Cash Flows. #7. Record March closing entries in the General Journal and post to the General Ledger. #8. Prepare a post-closing trial balance as of March 31.

7180 3160 700 4500 76000 123500 Thunderduck Car Repair Post-Closing Trial Balance As of Feb 28, 20X1 Cash Accounts receivable Supplies Prepaid rent Building Equipment Accumlated depreciation Accounts payable Bonus payable Wages and salaries payable Income Tax payable Interest payable Notes payable Common stock Retain earnings TOTAL 40160 6385 1150 2000 8645 280 33480 91200 31740 215040 215040 March Transactions 1-Mar Performed car repair services and received cash at the time of sale, $5,000. 4-Mar Paid wages and salaries for $2,300, part of which was accrued in February. 10-Mar Issued stock to new investors, $14,000. 15-Mar Made the interest payment on all notes, all is accrued in interest payable. 15-Mar Paid annual income taxes that was accrued in income taxes payable. 20-Mar Made a monthly payment on the equipment note, $70. 22-Mar Paid cash for advertising, $255. 27-Mar Performed car repair services on account, $4,600. 30-Mar Paid dividends to owners, $400. March Adjusting Entries 31-Mar The estimated depreciation on building and equipment is $810. 31-Mar One month of rent has expired, $900. 31-Mar The annual interest rate is 5% on all notes and paid quarterly. Round to the nearest dollar. 31-Mar Accrued wages and salaries worked in March that will be paid 4-4, $2,020. 31-Mar The estimated income taxes for the month is $765

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started