Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required 2) Journal entry worksheet: 1. Record the purchase of new refrigerators. 2. Record the sale of old refrigerators. Highsmith Rental Company purchased an apartment

Required 2)

Required 2)

Journal entry worksheet:

1. Record the purchase of new refrigerators.

2. Record the sale of old refrigerators.

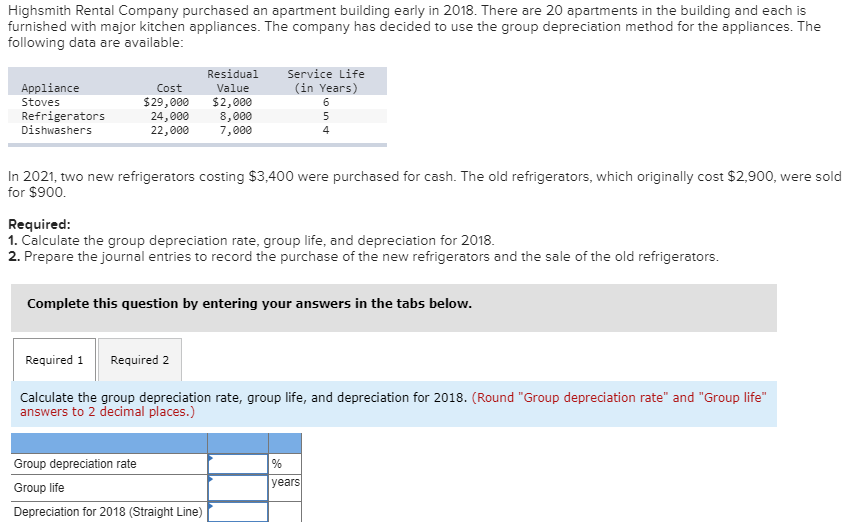

Highsmith Rental Company purchased an apartment building early in 2018. There are 20 apartments in the building and each is furnished with major kitchen appliances. The company has decided to use the group depreciation method for the appliances. The following data are available: Service Life (in Years) Appliance Stoves Refrigerators Dishwashers Cost $29,000 24,000 22,000 Residual Value $2,000 8,000 7,000 out In 2021, two new refrigerators costing $3,400 were purchased for cash. The old refrigerators, which originally cost $2,900, were sold for $900. Required: 1. Calculate the group depreciation rate, group life, and depreciation for 2018. 2. Prepare the journal entries to record the purchase of the new refrigerators and the sale of the old refrigerators. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the group depreciation rate, group life, and depreciation for 2018. (Round "Group depreciation rate" and "Group life" answers to 2 decimal places.) Group depreciation rate years Group life Depreciation for 2018 (Straight Line)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started