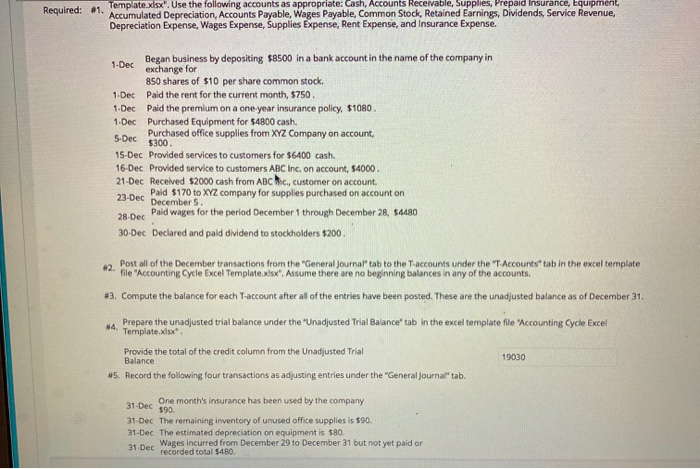

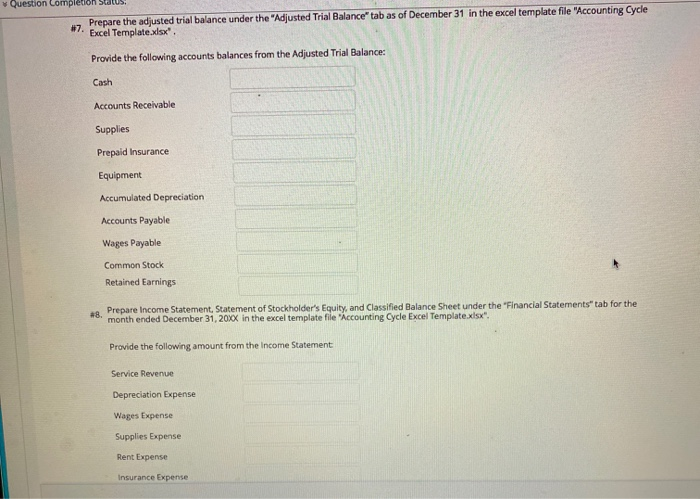

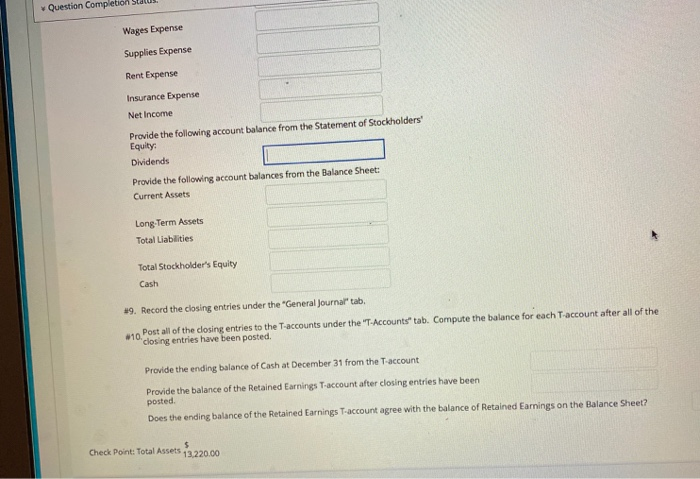

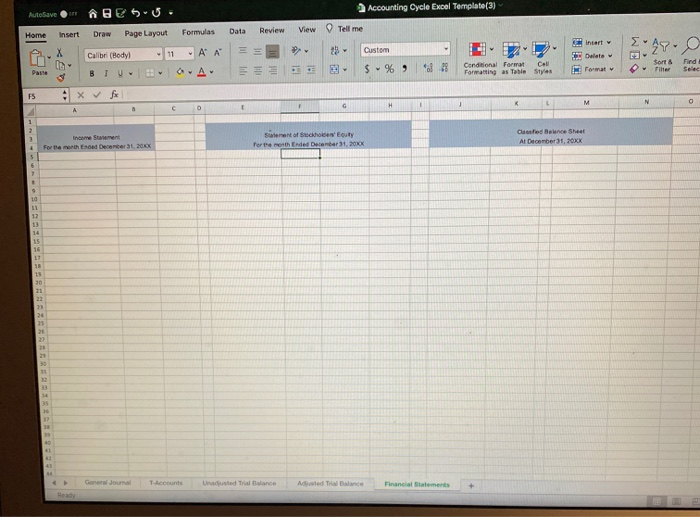

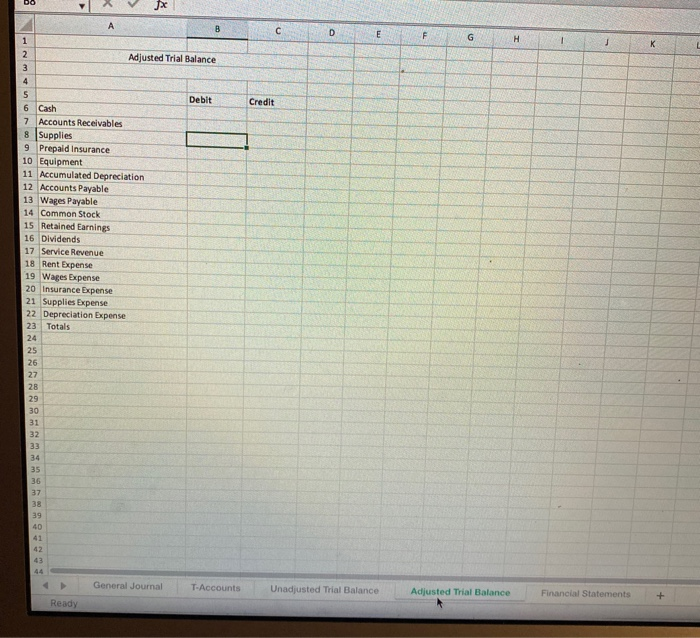

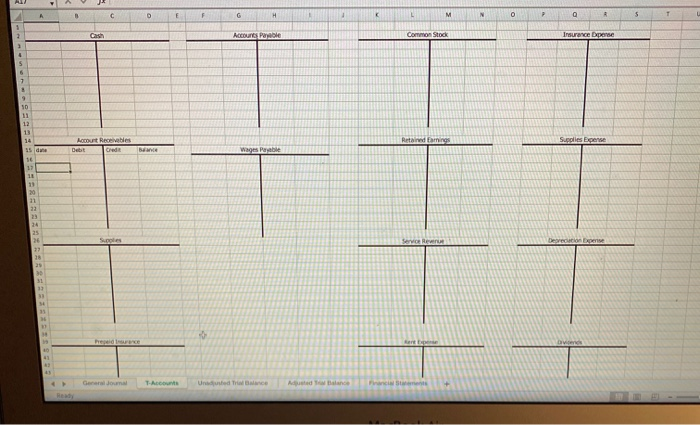

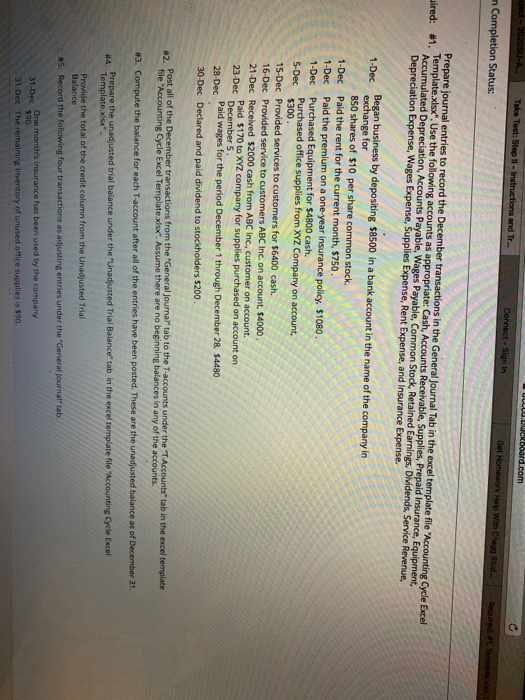

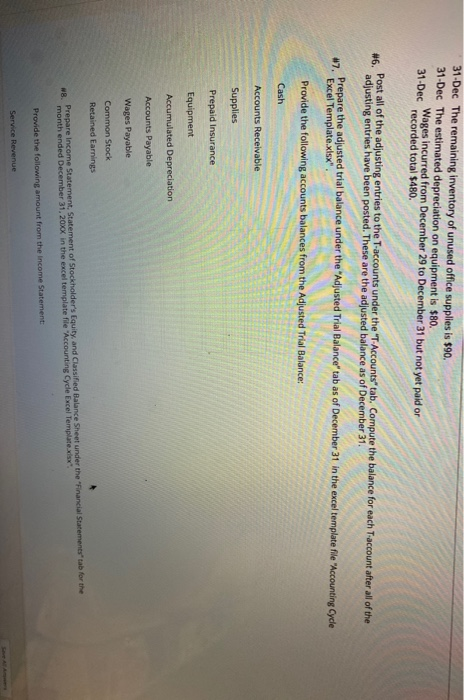

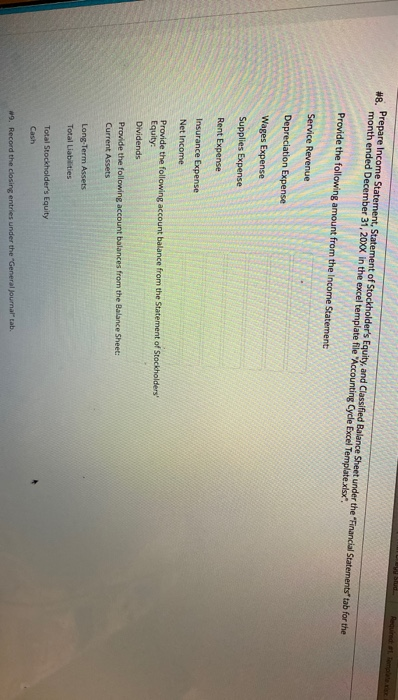

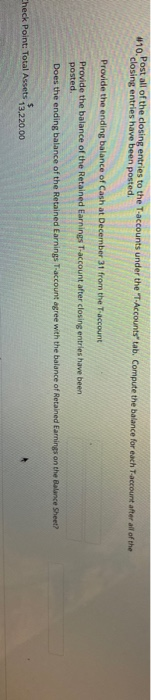

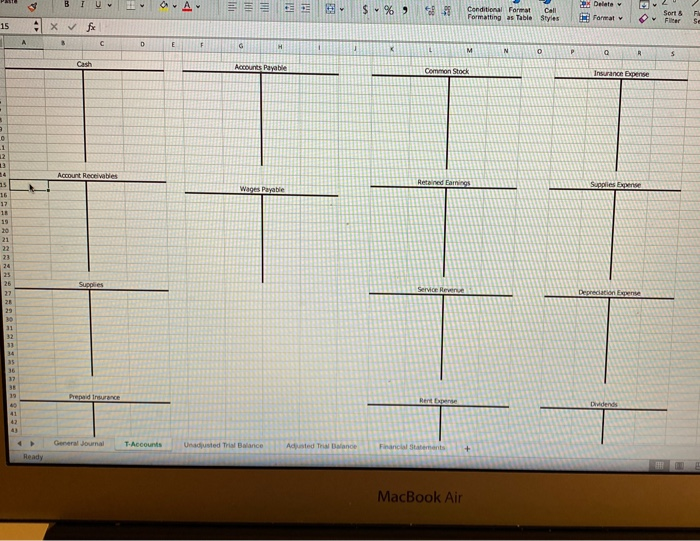

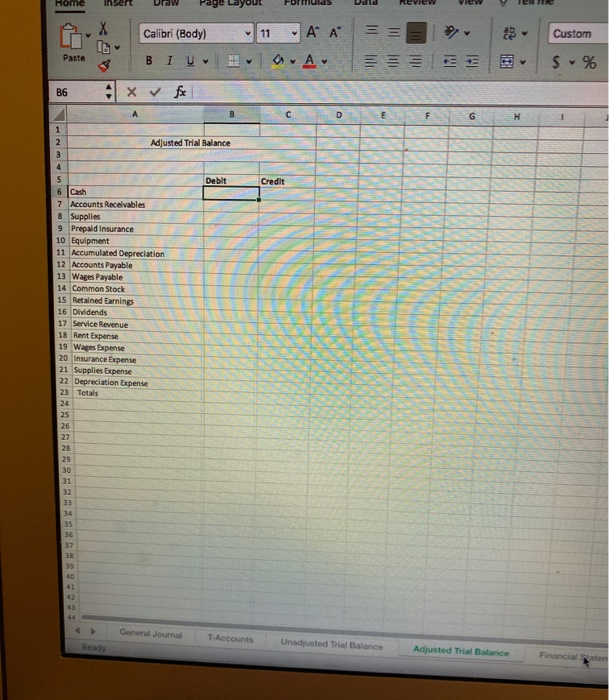

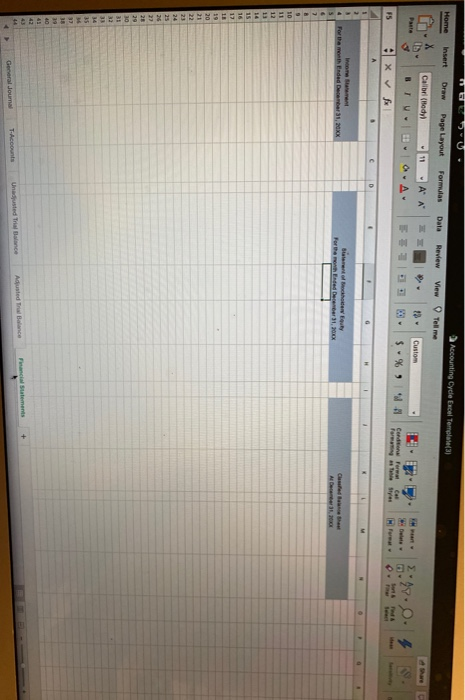

Required: 41. Template.xlsx". Use the following accounts as appropriate: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Equipment, Accumulated Depreciation Accounts Payable, Wages Payable, Common Stock, Retained Earnings, Dividends, Service Revenue, Depreciation Expense, Wages Expense, Supplies Expense, Rent Expense, and Insurance Expense. 1-Dec Began business by depositing $8500 in a bank account in the name of the company in exchange for 850 shares of $10 per share common stock. 1-Dec Paid the rent for the current month, $750. 1-Dec Paid the premium on a one-year insurance policy, $1080 1-Dec Purchased Equipment for $4800 cash. 5-Dec Purchased office supplies from XYZ Company on account, $300. 15-Dec Provided services to customers for $6400 cash. 16-Dec Provided service to customers ABC Inc. on account, 54000. 21-Dec Received $2000 cash from ABC hoc, customer on account. 23-Dec Paid $170 to XYZ company for supplies purchased on account on 28-Dec Paid wages for the period December 1 through December 28, 54480 30-Dec Declared and paid dividend to stockholders $200. 2 Post all of the December transactions from the "General Journal" tab to the T-accounts under the 'T Accounts tab in the excel template file "Accounting Cycle Excel Template.xlsx". Assume there are no beginning balances in any of the accounts. #3. Compute the balance for each T-account after all of the entries have been posted. These are the unadjusted balance as of December 31. Prepare the unadjusted trial balance under the "Unadjusted Trial Balance" tab in the excel template file "Accounting Cycle Excel Template.xlsx'. Provide the total of the credit column from the Unadjusted Trial 45. Record the following four transactions as adjusting entries under the "General Journal" tab. 14. 19030 Balance 31-Dec One month's Insurance has been used by the company $90 31-Dec The remaining inventory of unused office supplies is $90. 31-Dec The estimated depreciation on equipment is 580 31 Dec Wages incurred from December 29 to December 31 but not yet paid or recorded total $480 Question Completion Status #7. Excel Template.xlsx". Prepare the adjusted trial balance under the "Adjusted Trial Balance" tab as of December 31 in the excel template file "Accounting Cycle Provide the following accounts balances from the Adjusted Trial Balance: Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Earnings *8 Prepare Income Statement, Statement of Stockholder's Equity, and Classified Balance Sheet under the Financial Statements" tab for the month ended December 31, 20xx in the excel template file "Accounting Cycle Excel Template.xlsx". Provide the following amount from the income Statement Service Revenue Depreciation Expense Wages Expense Supplies Expense Rent Expense Insurance Expense Question Completion Wages Expense Supplies Expense Rent Expense Insurance Expense Net Income Provide the following account balance from the Statement of Stockholders' Equity: Dividends Provide the following account balances from the Balance Sheet: Current Assets Long-Term Assets Total Liabilities Total Stockholder's Equity Cash #9. Record the closing entries under the "General Journal' tab, #10 Post all of the closing entries to the T-accounts under the "T-Accounts" tab. Compute the balance for each T-account after all of the "closing entries have been posted Provide the ending balance of Cash at December 31 from the Taccount Provide the balance of the Retained Earnings Taccount after closing entries have been posted Does the ending balance of the Retained Earnings T-account agree with the balance of Retained Earnings on the Balance Sheet? $ Check Point: Total Assets 13.220.00 AutoSave ABE. Accounting Cycle Excel Template (3) Review View Home Insert Formulas Data Tell me Draw Page Layout Intert ' 47-9 X Calibri (Body! -AA Custom = 25 11 Dr Dalata $ % ) al 28 Conditional Format Call Forwanting as Table Styles Format Sort Filter Find - a. Av PA B TV 3 FS Xf M N G D 3 4 5 Income tamen Fonament End Decret 2X Class Bancsheet Al December 31, 2000 Sent of Schoes' Equity for the month Ende Detencer 31, 2010 7 9 10 11 12 13 14 15 16 13 19 20 11 Goneral Journal Tents United Trial Balance Add Dalance Financial Statements DO fx D E G H J 2 3 Adjusted Trial Balance Debit Credit 4 5 6 Cash 7 Accounts Receivables 8 Supplies 9 Prepaid Insurance 10 Equipment 11 Accumulated Depreciation 12 Accounts Payable 13 Wages Payable 14 Common Stock 15 Retained Earnings 16 Dividends 17 Service Revenue 18 Rent Expense 19 Wages Expense 20 Insurance Expense 21 Supplies Expense 22 Depreciation Expense 23 Totals 24 25 26 27 28 29 30 31 32 34 35 36 37 38 39 40 41 42 43 General Journal T-Accounts Unadjusted Trial Balance Adjusted Trial Balance Financial Statements Ready 0 E F L M N 0 P Q S T Casa Account Pie Common Stock Insurance Opere 9 2 3 4 5 6 1 8 9 10 12 13 14 15 dan Read Earnings Supplies Expense Account Receivables Det Credit Wages Payable 11 1 13 11 23 Server Devotion Expense 25 26 12 28 13 43 General jou T-Account Uradne Francis 2020SU-A ULUDURDoard.com Take Test: Step il - Instructions and Tr Cornect Sign In n Completion Status: Get Homework Help With Chege Stud Required lamela Prepare journal entries to record the December transactions in the General Journal Tab in the excel template file "Accounting Cycle Excel Lired: #1. Template.xlsx". Use the following accounts as appropriate: Cash, Accounts Receivable Supplies, Prepaid Insurance, Equipment Accumulated Depreciation, Accounts Payable, Wages Payable, Common Stock, Retained Earnings, Dividends, Service Revenue, Depreciation Expense, Wages Expense, Supplies Expense, Rent Expense, and Insurance Expense. 1-Dec Began business by depositing $8500 in a bank account in the name of the company in exchange for 850 shares of $10 per share common stock. 1-Dec Pald the rent for the current month, $750. 1-Dec Paid the premium on a one-year insurance policy, $1080 1-Dec Purchased Equipment for $4800 cash. Purchased office supplies from XYZ Company on account, 5-Dec $300 15-Dec Provided services to customers for $6400 cash. 16-Dec Provided service to customers ABC Inc. on account, $4000 21-Dec Received $2000 cash from ABC Inc., customer on account 23-Dec Paid $170 to XYZ company for supplies purchased on account on December 5 28-Dec Paid wages for the period December 1 through December 28, $4480 30-Dec Declared and paid dividend to stockholders $200 #2 Post all of the December transactions from the "General Journal tab to the T-accounts under the "T.Accounts tab in the excel template file "Accounting Cycle Excel Template.xlsx". Assume there are no beginning balances in any of the accounts. #3. Compute the balance for each T-account after all of the entries have been posted. These are the unadjusted balance as of December 31. #4. Prepare the unadjusted trial balance under the "Unadjusted Trial Balance" tab in the excel template file "Accounting Cycle Excel Template.xlsx Provide the total of the credit column from the Unadjusted Trial Balance #5. Record the following four transactions as adjusting entries under the General Journal tab. 31-Dec One month's insurance has been used by the company $90 31-Dec The remaining inventory of unused office supplies is 590 31-Dec The remaining inventory of unused office supplies is $90, 31-Dec The estimated depreciation on equipment is $80. 31-Dec Wages incurred from December 29 to December 31 but not yet paid or recorded total $480. #6. Post all of the adjusting entries to the T-accounts under the "Accounts" tab, Compute the balance for each T-account after all of the adjusting entries have been posted. These are the adjusted balance as of December 31. Prepare the adjusted trial balance under the "Adjusted Trial Balance" tab as of December 31 in the excel template file "Accounting Cycle Excel Template.xlsx" Provide the following accounts balances from the Adjusted Trial Balance: #7 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Earnings WB Prepare Income Statement, Statement of Stockholder's Equity, and Classified Balance Sheet under the Financial Statements tab for the month ended December 31, 20xx in the excel template file "Accounting Cycle Excel Template.xlsx Provide the following amount from the income Statement: Service Revenue - Sud #8. Prepare Income Statement, Statement of Stockholder's Equity, and Classified Balance Sheet under the Financial Statements" tab for the month ended December 31, 20% in the excel template file "Accounting Cycle Excel Template.xlsx Provide the following amount from the Income Statement Service Revenue Depreciation Expense Wages Expense Supplies Expense Rent Expense Insurance Expense Net Income Provide the following account balance from the Statement of Stockholders' Equity: Dividends Provide the following account balances from the Balance Sheet: Current Assets Long-Term Assets Total Liabilities Total Stockholder's Equity Cash w9. Record the closing entries under the "General Journal" tab. #10. Post all of the closing entries to the T-accounts under the "T. Accounts" tab. Compute the balance for each account after all of the closing entries have been posted. Provide the ending balance of Cash at December 31 from the Taccount Provide the balance of the Retained Earnings T-account after closing entries have been posted Does the ending balance of the Retained Earnings T-account agree with the balance of Retained Earnings on the Balance Sheet? Check Point: Total Assets 3,220.00 BIU AA 22x Delete IM $ % ) 823 Conditional Format Call Formatting as Table Styles Format Sort & Filter F Se 15 Ax fe A 3 C D E F G H M N O P 5 Cash Accounts Payable Common Stock Insurance pense 3 1 12 13 Account Receivables Retained famings Supplies Expense Wages Payable 15 16 17 18 20 21 22 23 25 Supplies Service Re Depreciation Experte 30 11 11 34 36 17 38 19 Prepaid runde Renta Didends 41 42 General Journal T-Accounts Unadjusted Trance Adjusted Trial Balance Financial Statements Ready MacBook Air Home Insert REVIEW 06 Calibri (Body) 11 - A A Custom Paste B U av A 00 + V $ % B6 Ax & fi D E G H 1 2 3 Adjusted Trial Balance Debit Credit 4 5 6 Cash 7 Accounts Receivables & Supplies 9 Prepaid insurance 10 Equipment 11 Accumulated Depreciation 12 Accounts Payable 13 Wages Payable 14 Common Stock 15 Retained Earnings 16 Dividends 17 Service Revenue 18 Rent Expense 19 Wages Expense 20 Insurance Expense 21 Supplies Expense 22 Depreciation Expense 23 Totals 24 25 26 27 28 29 30 32 33 34 35 36 38 40 42 General Journal T-Accounts Ready Unadjusted Trial Balance Adjusted Trial Balance Financial State Home Insert Draw Page Layout Accounting Cycle Excel Template(3 View Tell me Formulas Data Review X Calibriedy 11 A A 12 Custom a. Au 2099.0.4 $ %) WA Condos For Cal F5 Xfx For the month Ended December 31, 20XX 6 2 10 11 12 14 15 16 17 20 21 10 32 34 35 38 29 40 43 44 Financial Statements T-Accounts Adjusted Balance Undsted Trial Balance General Journal