Answered step by step

Verified Expert Solution

Question

1 Approved Answer

required - A B C and D, pls provide full workings and explanation. need the excel sheet to be attached if possible or clippings. thank

required - A B C and D, pls provide full workings and explanation. need the excel sheet to be attached if possible or clippings. thank you

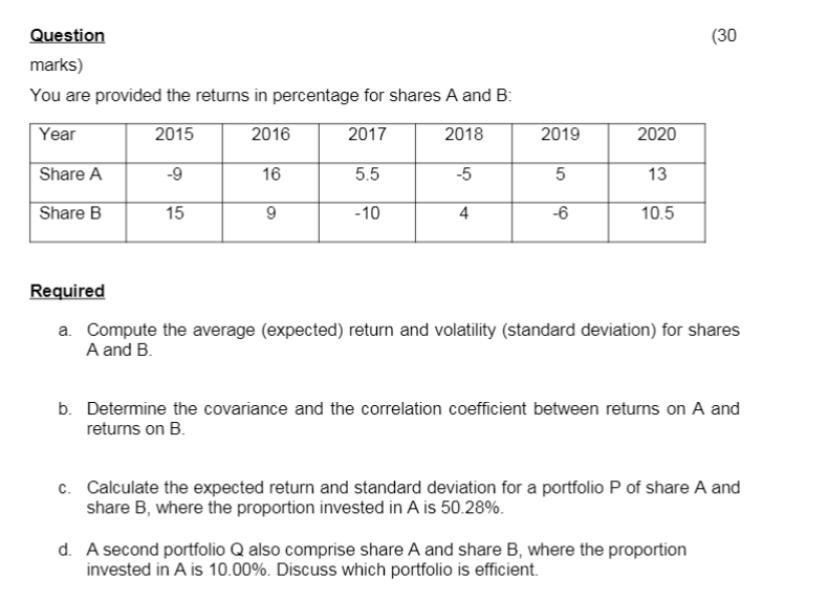

(30 Question marks) You are provided the returns in percentage for shares A and B. Year 2015 2016 2017 2018 2019 2020 Share A 16 5.5 -5 5 13 Share B 15 9 - 10 4 -6 10.5 Required a Compute the average (expected) return and volatility (standard deviation) for shares A and B b. Determine the covariance and the correlation coefficient between returns on A and returns on B. C. Calculate the expected return and standard deviation for a portfolio P of share A and share B, where the proportion invested in A is 50.28%. d. A second portfolio Q also comprise share A and share B, where the proportion invested in A is 10.00%. Discuss which portfolio is efficientStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started