Required

(a) Calculate Paul Pipes tax adjusted trading profit after capital allowances for the year ended 30 September 2019.

Your computation should commence with the net profit figure of 58,390 and should list all the items referred to in Notes (1) to (7), indicating with the use of a zero (0) any items that do not require adjustment.

(15 marks)

(b) Determine Paul Pipes trading income assessments for the tax years 2016/17 to 2019/20 inclusive, and state the amount of overlap profits generated in the opening years.

(9 marks)

(c) Compute Paul Pipes income tax liability, and his class 2 and class 4 national insurance payable for 2019/20. State the due dates for payment.

Ignore VAT in this question.

(11 marks)

very helpful if done on paper to help me understand , not allowed to use excel so not avalaible here

working out for every point will be key to me understanding for future quesitions ,

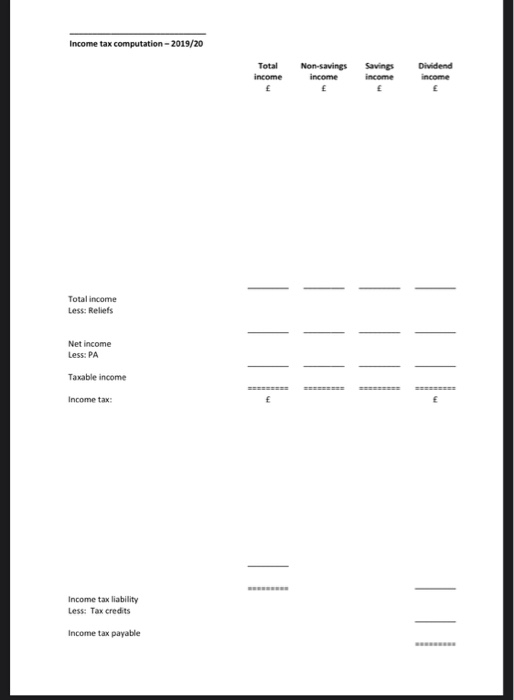

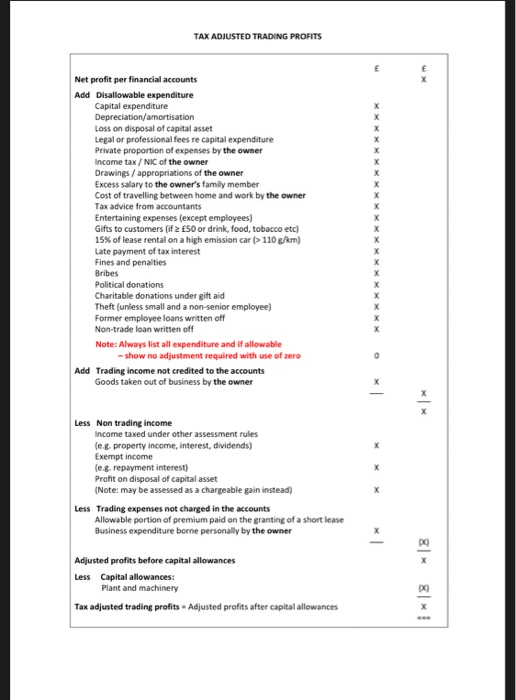

ive attached pro formas and how answers are meant to be structure so its easy for me to understand

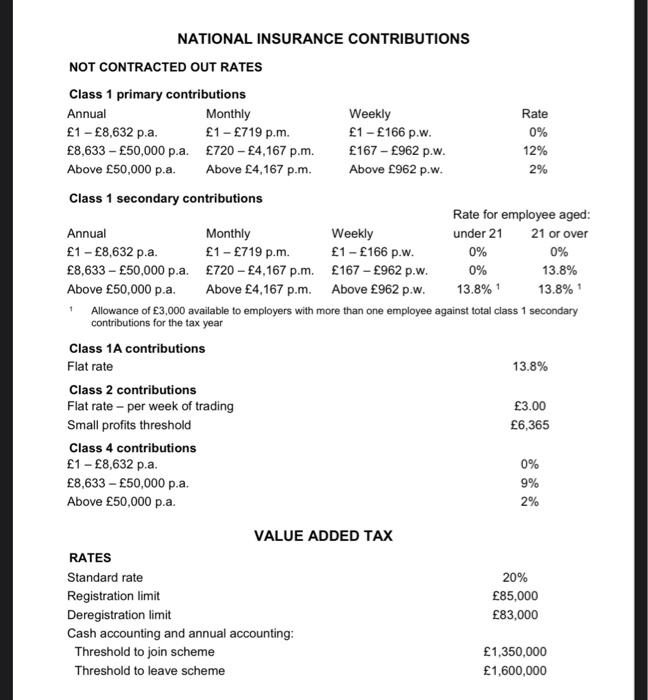

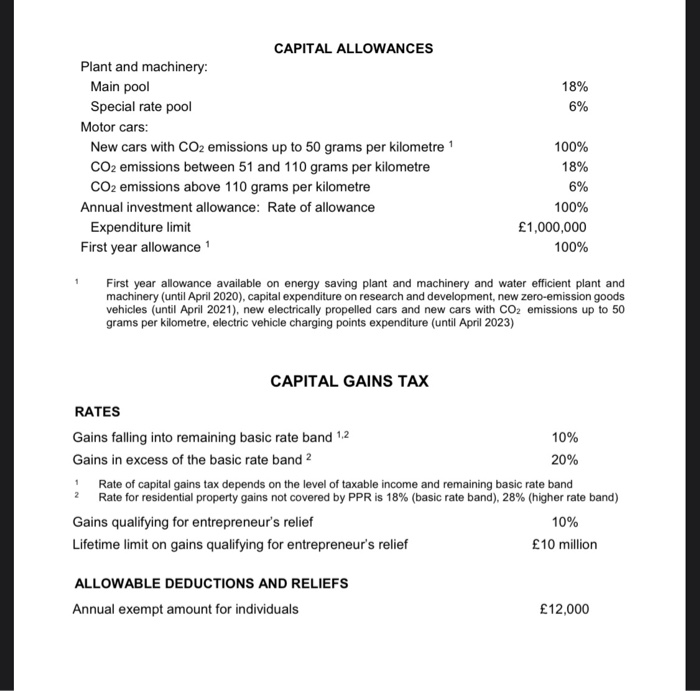

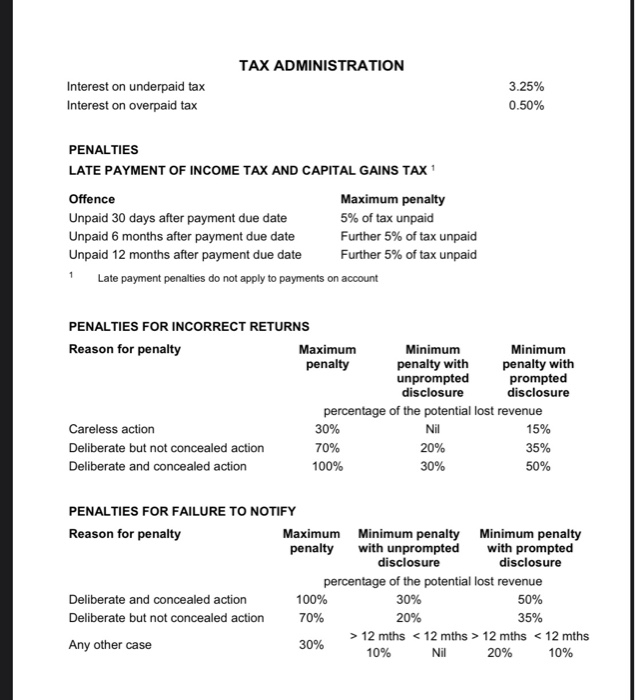

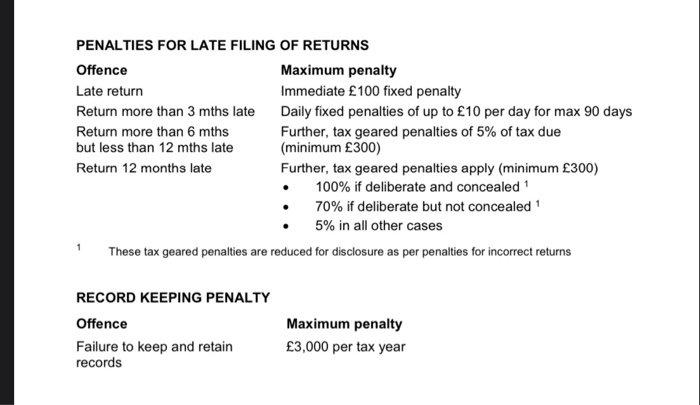

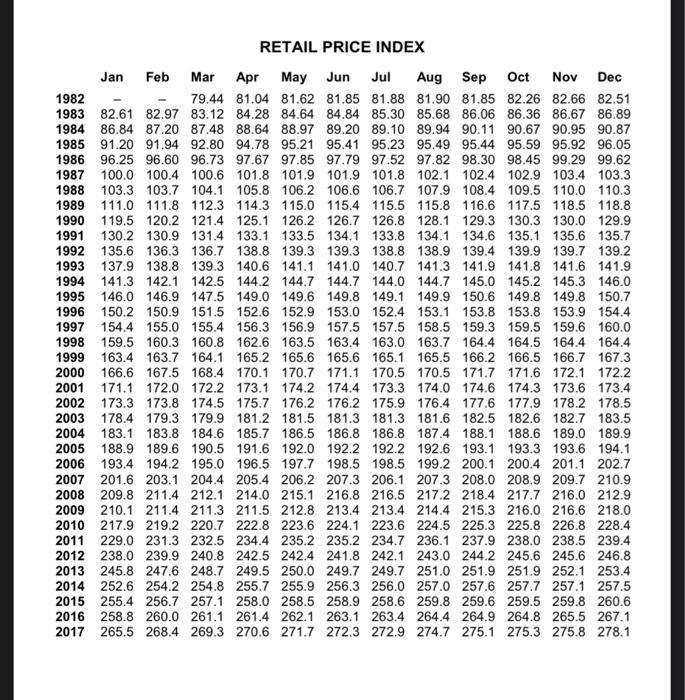

also attached the tax tables used in my module

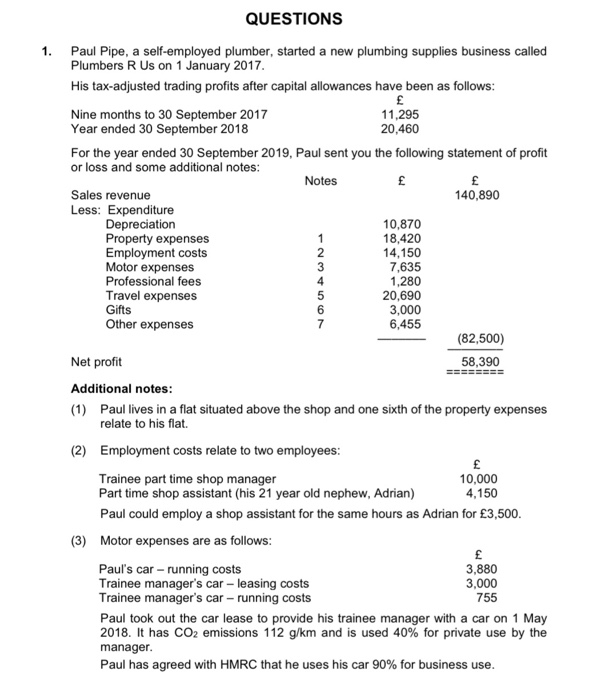

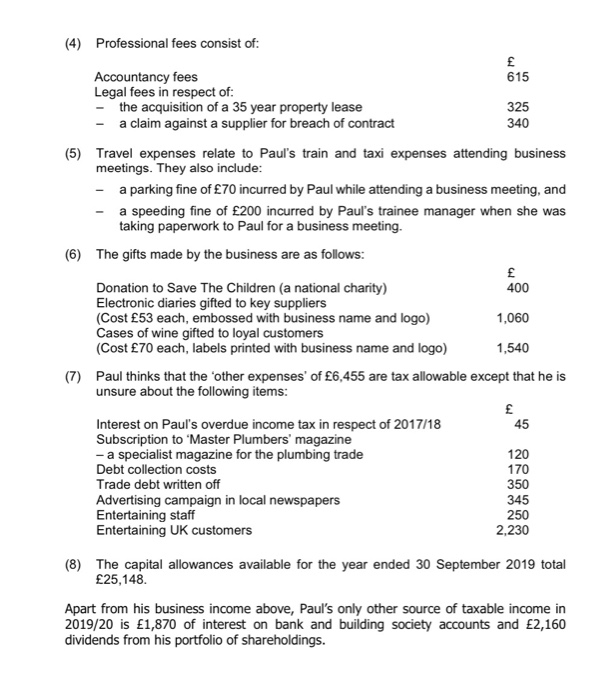

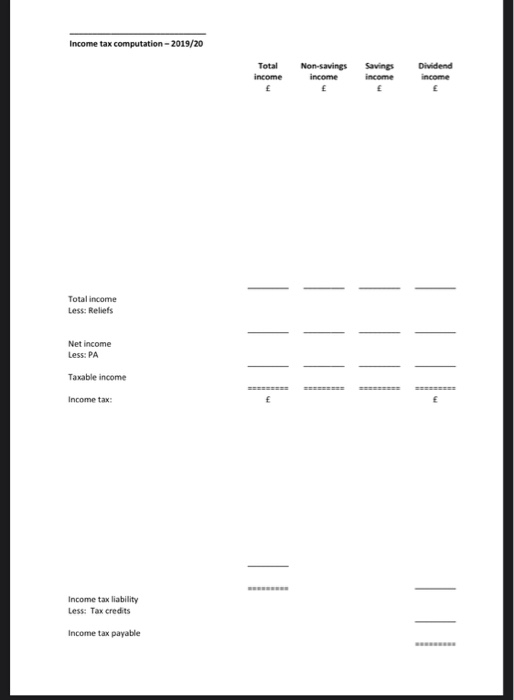

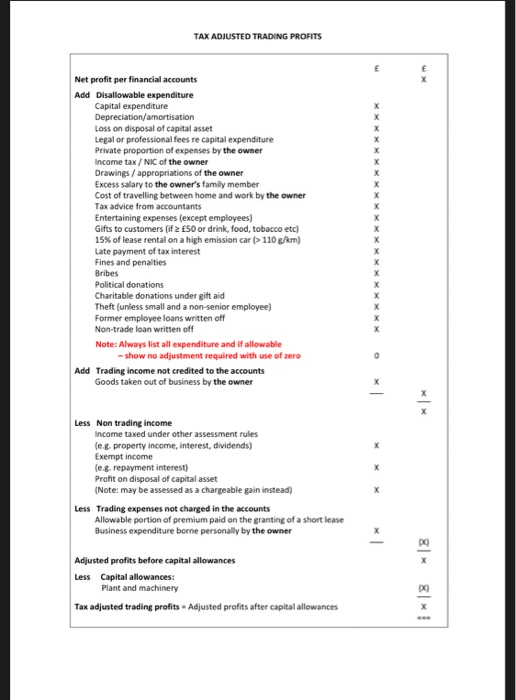

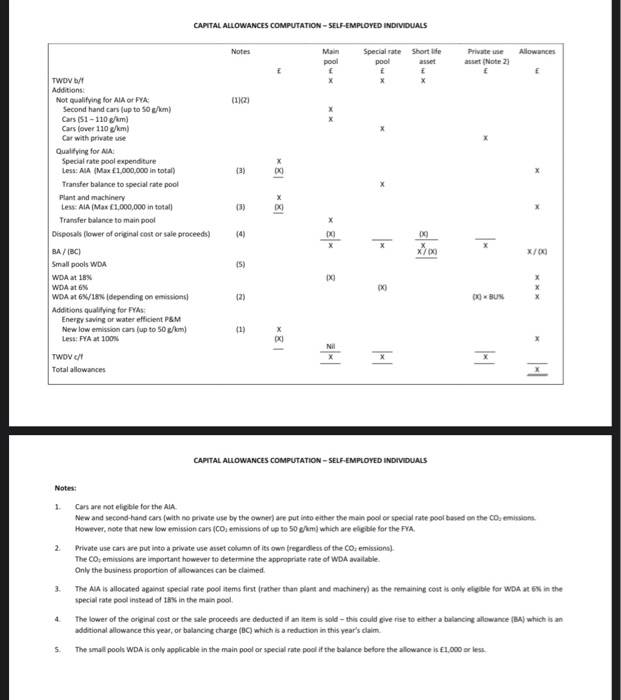

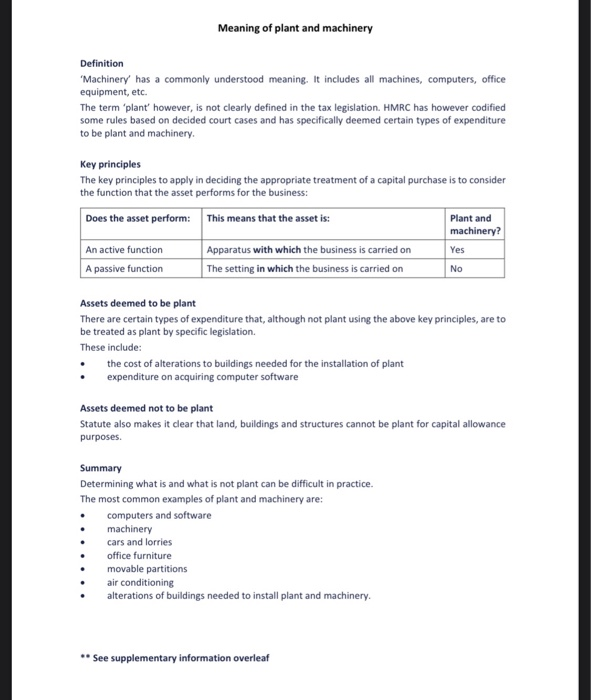

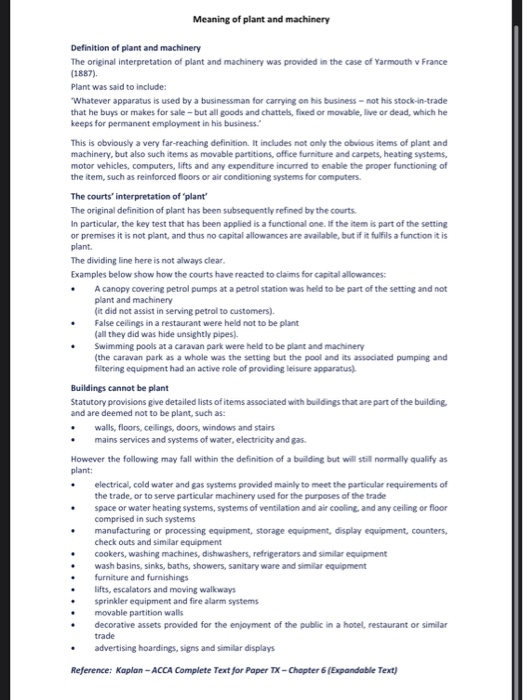

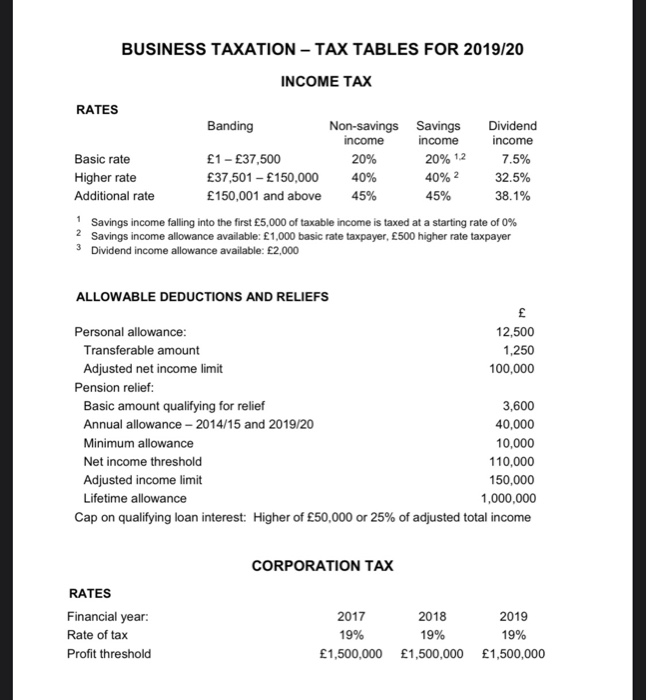

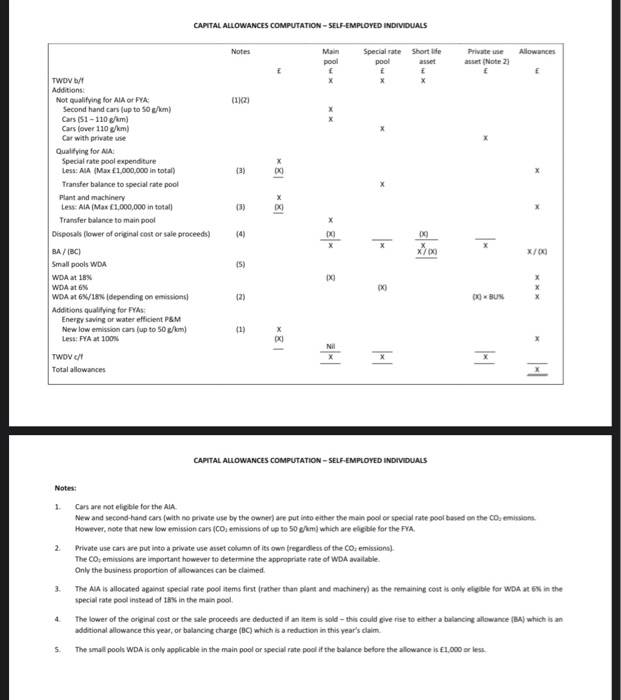

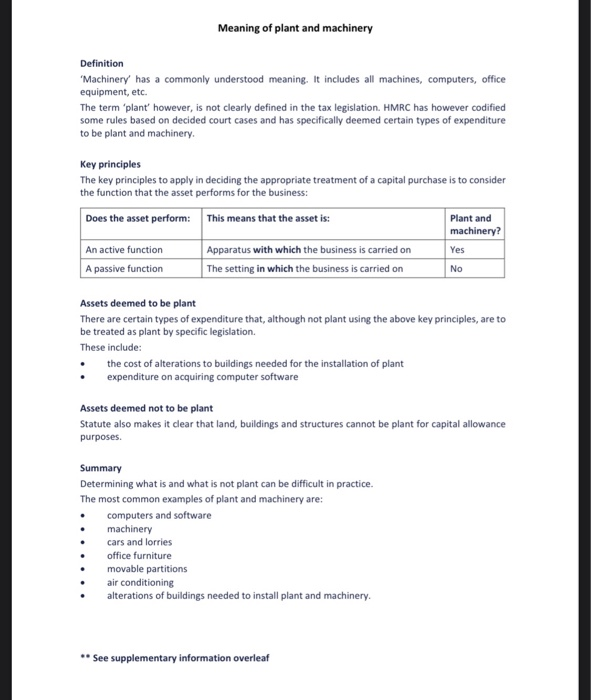

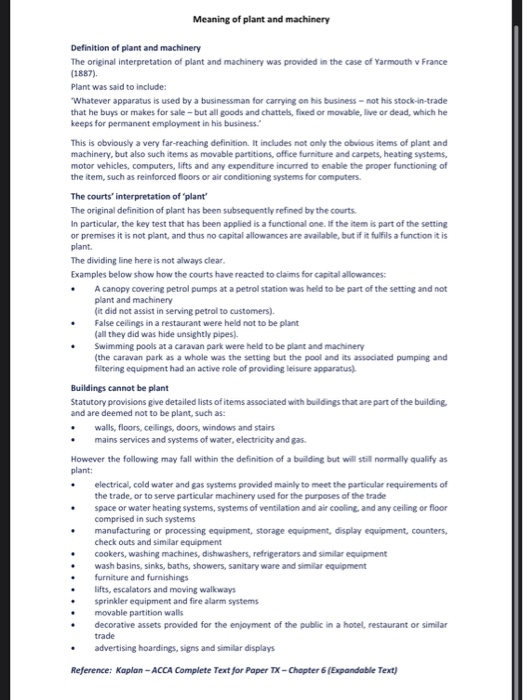

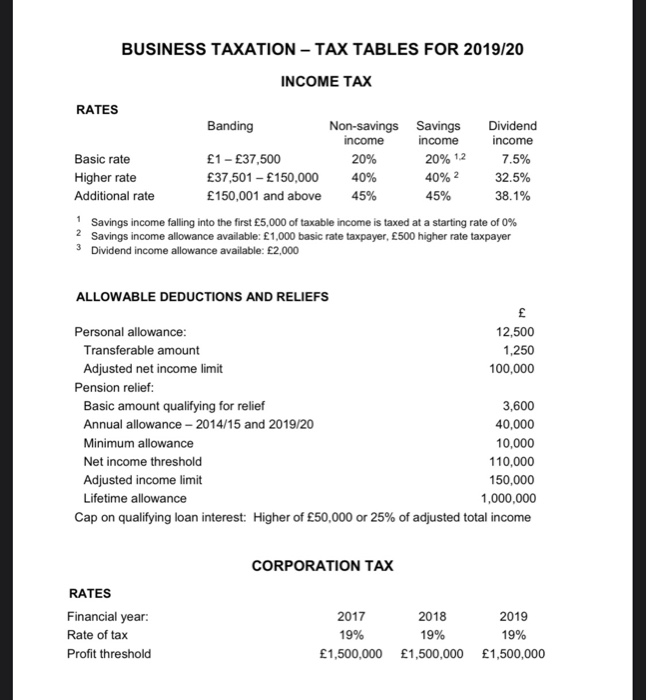

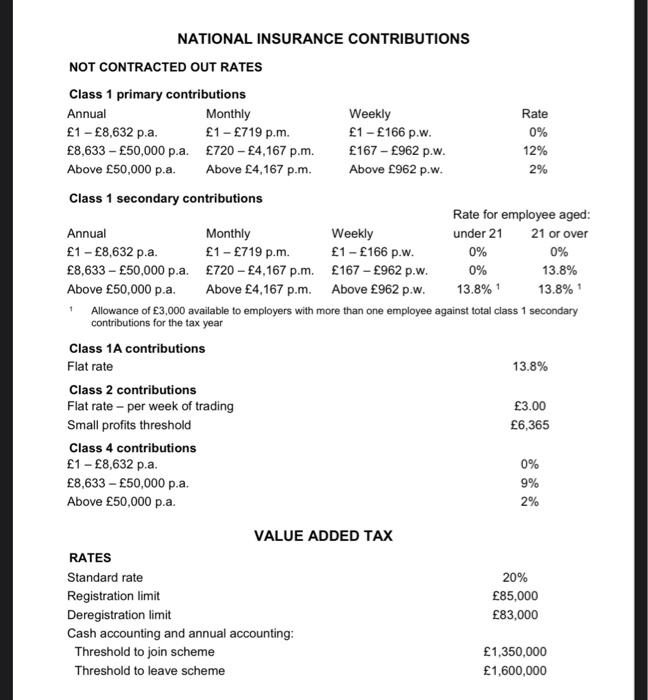

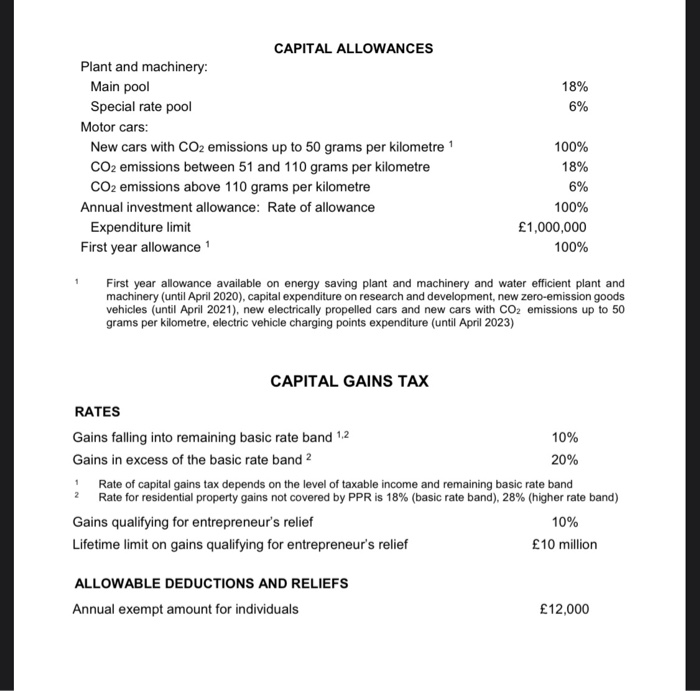

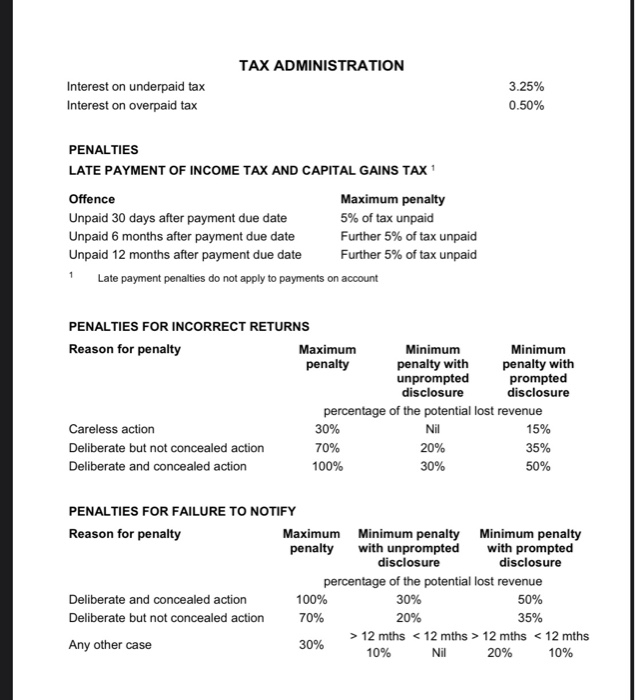

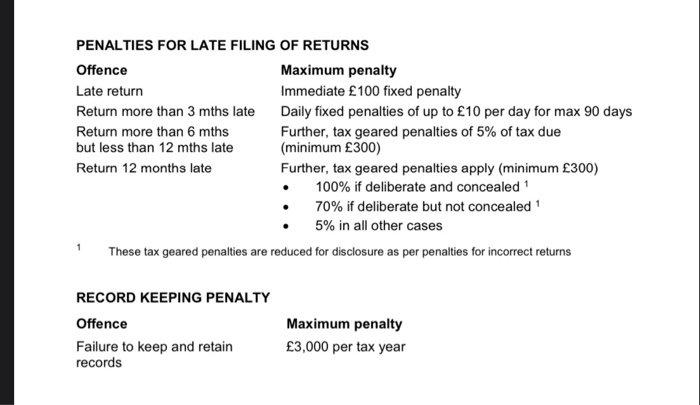

QUESTIONS 1. Paul Pipe, a self-employed plumber, started a new plumbing supplies business called Plumbers R Us on 1 January 2017. His tax-adjusted trading profits after capital allowances have been as follows: Nine months to 30 September 2017 11,295 Year ended 30 September 2018 20,460 For the year ended 30 September 2019, Paul sent you the following statement of profit or loss and some additional notes: Notes Sales revenue 140,890 Less: Expenditure Depreciation 10,870 Property expenses 18,420 Employment costs 14,150 Motor expenses 7,635 Professional fees 1,280 Travel expenses 20,690 Gifts 3,000 Other expenses 6,455 (82,500) Net profit 58,390 Additional notes: (1) Paul lives in a flat situated above the shop and one sixth of the property expenses relate to his flat. (2) Employment costs relate to two employees: Trainee part time shop manager 10,000 Part time shop assistant (his 21 year old nephew, Adrian) 4,150 Paul could employ a shop assistant for the same hours as Adrian for 3,500. (3) Motor expenses are as follows: E Paul's car - running costs 3,880 Trainee manager's car - leasing costs 3,000 Trainee manager's car - running costs 755 Paul took out the car lease to provide his trainee manager with a car on 1 May 2018. It has CO2 emissions 112 g/km and is used 40% for private use by the manager. Paul has agreed with HMRC that he uses his car 90% for business use. (4) Professional fees consist of: 615 Accountancy fees Legal fees in respect of: - the acquisition of a 35 year property lease - a claim against a supplier for breach of contract 325 340 (5) Travel expenses relate to Paul's train and taxi expenses attending business meetings. They also include: - a parking fine of 70 incurred by Paul while attending a business meeting, and - a speeding fine of 200 incurred by Paul's trainee manager when she was taking paperwork to Paul for a business meeting. (6) The gifts made by the business are as follows: 400 Donation to Save The Children (a national charity) Electronic diaries gifted to key suppliers (Cost 53 each, embossed with business name and logo) Cases of wine gifted to loyal customers (Cost 70 each, labels printed with business name and logo) 1,060 1,540 (7) Paul thinks that the other expenses of 6,455 are tax allowable except that he is unsure about the following items: Interest on Paul's overdue income tax in respect of 2017/18 Subscription to Master Plumbers' magazine - a specialist magazine for the plumbing trade Debt collection costs Trade debt written off Advertising campaign in local newspapers Entertaining staff Entertaining UK customers 120 170 350 345 250 2,230 (8) The capital allowances available for the year ended 30 September 2019 total 25,148. Apart from his business income above, Paul's only other source of taxable income in 2019/20 is 1,870 of interest on bank and building society accounts and 2,160 dividends from his portfolio of shareholdings. Income tax computation - 2019/20 Total income Non-savings income Savings income Dividend Income Total income Less: Reliefs Net Income Less: PA Taxable income Income tax: Income tax liability Less: Tax credits Income tax payable TAX ADJUSTED TRADING PROFITS Net profit per financial accounts Add Disallowable expenditure Capital expenditure Depreciation/amortisation Loss on disposal of capital asset Legal or professional fees re capital expenditure Private proportion of expenses by the owner Income tax/NIC of the owner Drawings / appropriations of the owner Excess salary to the owner's family member Cost of travelling between home and work by the owner Tax advice from accountants Entertaining expenses (except employees) Gifts to customers (if 50 or drink, food, tobacco etc) 15% of lease rental on a high emission car > 110 g/km) Late payment of tax interest Fines and penalties Bribes Political donations Charitable donations under gift aid Theft (unless small and a non-senior employee) Former employee loans written off Non-trade loan written off Note: Always list all expenditure and if allowable - show no adjustment required with use of zero Add Trading income not credited to the accounts Goods taken out of business by the owner Less Non trading income Income taxed under other assessment rules (e.g. property income, interest, dividends) Exempt income leg.repayment interest) Profit on disposal of capital asset (Note: may be assessed as a chargeable gain instead) Less Trading expenses not charged in the accounts Allowable portion of premium paid on the granting of a short lease Business expenditure borne personally by the owner Adjusted profits before capital allowances Less Capital allowances: Plant and machinery Tax adjusted trading profits - Adjusted profits after capital allowances CAPITAL ALLOWANCES COMPUTATION - SELF-EMPLOYED INDIVIDUALS Notes Special rate Short te asset Private use Allowances (1)(2) ** TWDVb/ Additions: Not qualifying for AIA or FYA Second hand cars (up to 50 g/km) Cars (51-110/km) Cars (over 110 km) Car with private use Qualifying for AIA: Special rate pool expenditure Less: AIA (Max 1,000,000 in total) Transfer balance to special rate pool Plant and machinery Less: AIA (Max 1,000,000 in total) Transfer balance to main pool Disposals flower of original cost or sale proceeds) BA/IBC) Small pools WDA WDA at 18% WOA at 6% WDA at 6%/18% (depending on emissions] Additions qualifying for FYAS: Energy saving or water efficient P&M New low emission cars (up to 50 g/km) Less: FYA at 100% *81*81 3 ** *81 TWOV Total allowances |-* - 2 CAPITAL ALLOWANCES COMPUTATION - SELF-EMPLOYED INDIVIDUALS Cars are not eligible for the AIA New and second-hand cars (with no private use by the owners are put into either the main pool or special rate pool based on the CO2 emissions However, note that new low emission cars (CO, emissions of up to 50/km) which are eligible for the FYA Private use cars are put into a private use asset column of its own regardless of the Co. emissions) The Co, emissions are important however to determine the appropriate rate of WDA available Only the business proportion of allowances can be claimed. The AIA is allocated against special rate pool items first rather than plant and machinery) as the remaining cost is only eligible for WDA at 6% in the Special rate pool instead of 18% in the main pool The lower of the original cost or the sale proceeds are deducted if an item is sold - this could give rise to either a balancing allowance (BA) which is an additional allowance this year, or balancing charge (BC) which is a reduction in this year's claim 5. The small pools WDA is only applicable in the main pool or special rate pool if the balance before the allowance is 1,000 or less. Meaning of plant and machinery Definition 'Machinery has a commonly understood meaning. It includes all machines, computers, office equipment, etc. The term 'plant' however, is not clearly defined in the tax legislation. HMRC has however codified some rules based on decided court cases and has specifically deemed certain types of expenditure to be plant and machinery. Key principles The key principles to apply in deciding the appropriate treatment of a capital purchase is to consider the function that the asset performs for the business: Does the asset perform: This means that the asset is: Plant and machinery? Yes An active function A passive function Apparatus with which the business is carried on The setting in which the business is carried on No Assets deemed to be plant There are certain types of expenditure that, although not plant using the above key principles, are to be treated as plant by specific legislation. These include: the cost of alterations to buildings needed for the installation of plant expenditure on acquiring computer software Assets deemed not to be plant Statute also makes it clear that land, buildings and structures cannot be plant for capital allowance purposes. Summary Determining what is and what is not plant can be difficult in practice. The most common examples of plant and machinery are: computers and software machinery cars and lorries office furniture movable partitions air conditioning alterations of buildings needed to install plant and machinery ** See supplementary information overleaf Meaning of plant and machinery Definition of plant and machinery The original interpretation of plant and machinery was provided in the case of Yarmouth v France (1887). Plant was said to include: Whatever apparatus is used by a businessman for carrying on his business - not his stock-in-trade that he buys or makes for sale - but all goods and chattels, fixed or movable, live or dead, which he keeps for permanent employment in his business." This is obviously a very far-reaching definition. It includes not only the obvious items of plant and machinery, but also such items as movable partitions, office furniture and carpets, heating systems, motor vehicles, computers, lifts and any expenditure incurred to enable the proper functioning of the item, such as reinforced floors or air conditioning systems for computers. The courts' interpretation of plant The original definition of plant has been subsequently refined by the courts. In particular, the key test that has been applied is a functional one. If the item is part of the setting or premises it is not plant, and thus no capital allowances are available, but if it fulfils a function it is plant. The dividing line here is not always clear. Examples below show how the courts have reacted to claims for capital allowances: A canopy covering petrol pumps at a petrol station was held to be part of the setting and not plant and machinery (it did not assist in serving petrol to customers). False ceilings in a restaurant were held not to be plant (all they did was hide unsightly pipes). Swimming pools at a caravan park were held to be plant and machinery (the caravan park as a whole was the setting but the pool and its associated pumping and filtering equipment had an active role of providing leisure apparatus) Buildings cannot be plant Statutory provisions give detailed lists of items associated with buildings that are part of the building and are deemed not to be plant, such as: walls, floors, ceilings, doors, windows and stairs mains services and systems of water, electricity and gas However the following may fall within the definition of a building but will still normally qualify as plant: electrical, cold water and gas systems provided mainly to meet the particular requirements of the trade, or to serve particular machinery used for the purposes of the trade space or water heating systems, systems of ventilation and air cooling and any ceiling or floor comprised in such systems manufacturing or processing equipment, storage equipment, display equipment, counters, check outs and similar equipment cookers, washing machines, dishwashers, refrigerators and similar equipment wash basins, sinks, baths, showers, sanitary ware and similar equipment furniture and furnishings lifts, escalators and moving walkways sprinkler equipment and fire alarm systems movable partition walls decorative assets provided for the enjoyment of the public in a hotel, restaurant or similar trade advertising hoardings, signs and similar displays Reference: Kaplan- ACCA Complete Text for Paper TX - Chapter 6 (Expandable Text) BUSINESS TAXATION - TAX TABLES FOR 2019/20 INCOME TAX RATES Basic rate Higher rate Additional rate Banding Non-savings income 1- 37,500 20% 37,501 - 150,000 150,001 and above 45% Savings income 20% 12 40% 2 45% Dividend income 7.5% 32.5% 38.1% 1 Savings income falling into the first 5,000 of taxable income is taxed at a starting rate of 0% 2 Savings income allowance available: 1,000 basic rate taxpayer, 500 higher rate taxpayer 3 Dividend income allowance available: 2,000 ALLOWABLE DEDUCTIONS AND RELIEFS Personal allowance: 12,500 Transferable amount 1,250 Adjusted net income limit 100,000 Pension relief: Basic amount qualifying for relief 3,600 Annual allowance - 2014/15 and 2019/20 40,000 Minimum allowance 10,000 Net income threshold 110,000 Adjusted income limit 150,000 Lifetime allowance 1,000,000 Cap on qualifying loan interest: Higher of 50,000 or 25% of adjusted total income CORPORATION TAX RATES Financial year: Rate of tax Profit threshold 2017 19% 1,500,000 2018 2019 19% 19% 1,500,000 1,500,000 NATIONAL INSURANCE CONTRIBUTIONS NOT CONTRACTED OUT RATES Class 1 primary contributions Annual Monthly 1 - 8,632 p.a. 1 - 719 p.m. 8,633 - 50,000 p.a. 720 - 4,167 p.m. Above 50,000 p.a. Above 4,167 p.m. Weekly 1 - 166 p.w. 167 - 962 p.w. Above 962 p.w. Rate 0% 12% 2% Class 1 secondary contributions Rate for employee aged: Annual Monthly Weekly under 21 21 or over 1 - 8,632 p.a. 1 - 719 p.m. 1 - 166 p.w. 0% 8,633 - 50,000 p.a. 720 - 4,167 p.m. 167 - 962 p.w. 0% 13.8% Above 50,000 p.a. Above 4,167 p.m. Above 962 p.w. 13.8% 1 13.8% 1 Allowance of 3,000 available to employers with more than one employee against total class 1 secondary contributions for the tax year Class 1A contributions Flat rate 13.8% 3.00 6,365 Class 2 contributions Flat rate - per week of trading Small profits threshold Class 4 contributions 1 - 8,632 p.a. 8,633 - 50,000 p.a. Above 50,000 p.a. 0% VALUE ADDED TAX RATES Standard rate Registration limit Deregistration limit Cash accounting and annual accounting: Threshold to join scheme Threshold to leave scheme 20% 85,000 83,000 1,350,000 1,600,000 18% 6% CAPITAL ALLOWANCES Plant and machinery: Main pool Special rate pool Motor cars: New cars with CO2 emissions up to 50 grams per kilometre 1 CO2 emissions between 51 and 110 grams per kilometre CO2 emissions above 110 grams per kilometre Annual investment allowance: Rate of allowance Expenditure limit First year allowance 1 100% 18% 6% 100% 1,000,000 100% First year allowance available on energy saving plant and machinery and water efficient plant and machinery (until April 2020), capital expenditure on research and development, new zero-emission goods vehicles (until April 2021), new electrically propelled cars and new cars with CO2 emissions up to 50 grams per kilometre, electric vehicle charging points expenditure (until April 2023) CAPITAL GAINS TAX RATES Gains falling into remaining basic rate band 1.2 10% Gains in excess of the basic rate band 2 20% 1 Rate of capital gains tax depends on the level of taxable income and remaining basic rate band 2 Rate for residential property gains not covered by PPR is 18% (basic rate band), 28% (higher rate band) Gains qualifying for entrepreneur's relief 10% Lifetime limit on gains qualifying for entrepreneur's relief 10 million ALLOWABLE DEDUCTIONS AND RELIEFS Annual exempt amount for individuals 12,000 TAX ADMINISTRATION Interest on underpaid tax Interest on overpaid tax 3.25% 0.50% PENALTIES LATE PAYMENT OF INCOME TAX AND CAPITAL GAINS TAX Offence Maximum penalty Unpaid 30 days after payment due date 5% of tax unpaid Unpaid 6 months after payment due date Further 5% of tax unpaid Unpaid 12 months after payment due date Further 5% of tax unpaid 1 Late payment penalties do not apply to payments on account PENALTIES FOR INCORRECT RETURNS Reason for penalty Maximum Minimum Minimum penalty penalty with penalty with unprompted prompted disclosure disclosure percentage of the potential lost revenue Careless action 30% Nil 15% Deliberate but not concealed action 70% 20% 35% Deliberate and concealed action 100% 30% 50% PENALTIES FOR FAILURE TO NOTIFY Reason for penalty Maximum Minimum penalty Minimum penalty penalty with unprompted with prompted disclosure percentage of the potential lost revenue Deliberate and concealed action 100% 30% 50% Deliberate but not concealed action 70% 20% 35% > 12 mths 12 mths 110 g/km) Late payment of tax interest Fines and penalties Bribes Political donations Charitable donations under gift aid Theft (unless small and a non-senior employee) Former employee loans written off Non-trade loan written off Note: Always list all expenditure and if allowable - show no adjustment required with use of zero Add Trading income not credited to the accounts Goods taken out of business by the owner Less Non trading income Income taxed under other assessment rules (e.g. property income, interest, dividends) Exempt income leg.repayment interest) Profit on disposal of capital asset (Note: may be assessed as a chargeable gain instead) Less Trading expenses not charged in the accounts Allowable portion of premium paid on the granting of a short lease Business expenditure borne personally by the owner Adjusted profits before capital allowances Less Capital allowances: Plant and machinery Tax adjusted trading profits - Adjusted profits after capital allowances CAPITAL ALLOWANCES COMPUTATION - SELF-EMPLOYED INDIVIDUALS Notes Special rate Short te asset Private use Allowances (1)(2) ** TWDVb/ Additions: Not qualifying for AIA or FYA Second hand cars (up to 50 g/km) Cars (51-110/km) Cars (over 110 km) Car with private use Qualifying for AIA: Special rate pool expenditure Less: AIA (Max 1,000,000 in total) Transfer balance to special rate pool Plant and machinery Less: AIA (Max 1,000,000 in total) Transfer balance to main pool Disposals flower of original cost or sale proceeds) BA/IBC) Small pools WDA WDA at 18% WOA at 6% WDA at 6%/18% (depending on emissions] Additions qualifying for FYAS: Energy saving or water efficient P&M New low emission cars (up to 50 g/km) Less: FYA at 100% *81*81 3 ** *81 TWOV Total allowances |-* - 2 CAPITAL ALLOWANCES COMPUTATION - SELF-EMPLOYED INDIVIDUALS Cars are not eligible for the AIA New and second-hand cars (with no private use by the owners are put into either the main pool or special rate pool based on the CO2 emissions However, note that new low emission cars (CO, emissions of up to 50/km) which are eligible for the FYA Private use cars are put into a private use asset column of its own regardless of the Co. emissions) The Co, emissions are important however to determine the appropriate rate of WDA available Only the business proportion of allowances can be claimed. The AIA is allocated against special rate pool items first rather than plant and machinery) as the remaining cost is only eligible for WDA at 6% in the Special rate pool instead of 18% in the main pool The lower of the original cost or the sale proceeds are deducted if an item is sold - this could give rise to either a balancing allowance (BA) which is an additional allowance this year, or balancing charge (BC) which is a reduction in this year's claim 5. The small pools WDA is only applicable in the main pool or special rate pool if the balance before the allowance is 1,000 or less. Meaning of plant and machinery Definition 'Machinery has a commonly understood meaning. It includes all machines, computers, office equipment, etc. The term 'plant' however, is not clearly defined in the tax legislation. HMRC has however codified some rules based on decided court cases and has specifically deemed certain types of expenditure to be plant and machinery. Key principles The key principles to apply in deciding the appropriate treatment of a capital purchase is to consider the function that the asset performs for the business: Does the asset perform: This means that the asset is: Plant and machinery? Yes An active function A passive function Apparatus with which the business is carried on The setting in which the business is carried on No Assets deemed to be plant There are certain types of expenditure that, although not plant using the above key principles, are to be treated as plant by specific legislation. These include: the cost of alterations to buildings needed for the installation of plant expenditure on acquiring computer software Assets deemed not to be plant Statute also makes it clear that land, buildings and structures cannot be plant for capital allowance purposes. Summary Determining what is and what is not plant can be difficult in practice. The most common examples of plant and machinery are: computers and software machinery cars and lorries office furniture movable partitions air conditioning alterations of buildings needed to install plant and machinery ** See supplementary information overleaf Meaning of plant and machinery Definition of plant and machinery The original interpretation of plant and machinery was provided in the case of Yarmouth v France (1887). Plant was said to include: Whatever apparatus is used by a businessman for carrying on his business - not his stock-in-trade that he buys or makes for sale - but all goods and chattels, fixed or movable, live or dead, which he keeps for permanent employment in his business." This is obviously a very far-reaching definition. It includes not only the obvious items of plant and machinery, but also such items as movable partitions, office furniture and carpets, heating systems, motor vehicles, computers, lifts and any expenditure incurred to enable the proper functioning of the item, such as reinforced floors or air conditioning systems for computers. The courts' interpretation of plant The original definition of plant has been subsequently refined by the courts. In particular, the key test that has been applied is a functional one. If the item is part of the setting or premises it is not plant, and thus no capital allowances are available, but if it fulfils a function it is plant. The dividing line here is not always clear. Examples below show how the courts have reacted to claims for capital allowances: A canopy covering petrol pumps at a petrol station was held to be part of the setting and not plant and machinery (it did not assist in serving petrol to customers). False ceilings in a restaurant were held not to be plant (all they did was hide unsightly pipes). Swimming pools at a caravan park were held to be plant and machinery (the caravan park as a whole was the setting but the pool and its associated pumping and filtering equipment had an active role of providing leisure apparatus) Buildings cannot be plant Statutory provisions give detailed lists of items associated with buildings that are part of the building and are deemed not to be plant, such as: walls, floors, ceilings, doors, windows and stairs mains services and systems of water, electricity and gas However the following may fall within the definition of a building but will still normally qualify as plant: electrical, cold water and gas systems provided mainly to meet the particular requirements of the trade, or to serve particular machinery used for the purposes of the trade space or water heating systems, systems of ventilation and air cooling and any ceiling or floor comprised in such systems manufacturing or processing equipment, storage equipment, display equipment, counters, check outs and similar equipment cookers, washing machines, dishwashers, refrigerators and similar equipment wash basins, sinks, baths, showers, sanitary ware and similar equipment furniture and furnishings lifts, escalators and moving walkways sprinkler equipment and fire alarm systems movable partition walls decorative assets provided for the enjoyment of the public in a hotel, restaurant or similar trade advertising hoardings, signs and similar displays Reference: Kaplan- ACCA Complete Text for Paper TX - Chapter 6 (Expandable Text) BUSINESS TAXATION - TAX TABLES FOR 2019/20 INCOME TAX RATES Basic rate Higher rate Additional rate Banding Non-savings income 1- 37,500 20% 37,501 - 150,000 150,001 and above 45% Savings income 20% 12 40% 2 45% Dividend income 7.5% 32.5% 38.1% 1 Savings income falling into the first 5,000 of taxable income is taxed at a starting rate of 0% 2 Savings income allowance available: 1,000 basic rate taxpayer, 500 higher rate taxpayer 3 Dividend income allowance available: 2,000 ALLOWABLE DEDUCTIONS AND RELIEFS Personal allowance: 12,500 Transferable amount 1,250 Adjusted net income limit 100,000 Pension relief: Basic amount qualifying for relief 3,600 Annual allowance - 2014/15 and 2019/20 40,000 Minimum allowance 10,000 Net income threshold 110,000 Adjusted income limit 150,000 Lifetime allowance 1,000,000 Cap on qualifying loan interest: Higher of 50,000 or 25% of adjusted total income CORPORATION TAX RATES Financial year: Rate of tax Profit threshold 2017 19% 1,500,000 2018 2019 19% 19% 1,500,000 1,500,000 NATIONAL INSURANCE CONTRIBUTIONS NOT CONTRACTED OUT RATES Class 1 primary contributions Annual Monthly 1 - 8,632 p.a. 1 - 719 p.m. 8,633 - 50,000 p.a. 720 - 4,167 p.m. Above 50,000 p.a. Above 4,167 p.m. Weekly 1 - 166 p.w. 167 - 962 p.w. Above 962 p.w. Rate 0% 12% 2% Class 1 secondary contributions Rate for employee aged: Annual Monthly Weekly under 21 21 or over 1 - 8,632 p.a. 1 - 719 p.m. 1 - 166 p.w. 0% 8,633 - 50,000 p.a. 720 - 4,167 p.m. 167 - 962 p.w. 0% 13.8% Above 50,000 p.a. Above 4,167 p.m. Above 962 p.w. 13.8% 1 13.8% 1 Allowance of 3,000 available to employers with more than one employee against total class 1 secondary contributions for the tax year Class 1A contributions Flat rate 13.8% 3.00 6,365 Class 2 contributions Flat rate - per week of trading Small profits threshold Class 4 contributions 1 - 8,632 p.a. 8,633 - 50,000 p.a. Above 50,000 p.a. 0% VALUE ADDED TAX RATES Standard rate Registration limit Deregistration limit Cash accounting and annual accounting: Threshold to join scheme Threshold to leave scheme 20% 85,000 83,000 1,350,000 1,600,000 18% 6% CAPITAL ALLOWANCES Plant and machinery: Main pool Special rate pool Motor cars: New cars with CO2 emissions up to 50 grams per kilometre 1 CO2 emissions between 51 and 110 grams per kilometre CO2 emissions above 110 grams per kilometre Annual investment allowance: Rate of allowance Expenditure limit First year allowance 1 100% 18% 6% 100% 1,000,000 100% First year allowance available on energy saving plant and machinery and water efficient plant and machinery (until April 2020), capital expenditure on research and development, new zero-emission goods vehicles (until April 2021), new electrically propelled cars and new cars with CO2 emissions up to 50 grams per kilometre, electric vehicle charging points expenditure (until April 2023) CAPITAL GAINS TAX RATES Gains falling into remaining basic rate band 1.2 10% Gains in excess of the basic rate band 2 20% 1 Rate of capital gains tax depends on the level of taxable income and remaining basic rate band 2 Rate for residential property gains not covered by PPR is 18% (basic rate band), 28% (higher rate band) Gains qualifying for entrepreneur's relief 10% Lifetime limit on gains qualifying for entrepreneur's relief 10 million ALLOWABLE DEDUCTIONS AND RELIEFS Annual exempt amount for individuals 12,000 TAX ADMINISTRATION Interest on underpaid tax Interest on overpaid tax 3.25% 0.50% PENALTIES LATE PAYMENT OF INCOME TAX AND CAPITAL GAINS TAX Offence Maximum penalty Unpaid 30 days after payment due date 5% of tax unpaid Unpaid 6 months after payment due date Further 5% of tax unpaid Unpaid 12 months after payment due date Further 5% of tax unpaid 1 Late payment penalties do not apply to payments on account PENALTIES FOR INCORRECT RETURNS Reason for penalty Maximum Minimum Minimum penalty penalty with penalty with unprompted prompted disclosure disclosure percentage of the potential lost revenue Careless action 30% Nil 15% Deliberate but not concealed action 70% 20% 35% Deliberate and concealed action 100% 30% 50% PENALTIES FOR FAILURE TO NOTIFY Reason for penalty Maximum Minimum penalty Minimum penalty penalty with unprompted with prompted disclosure percentage of the potential lost revenue Deliberate and concealed action 100% 30% 50% Deliberate but not concealed action 70% 20% 35% > 12 mths 12 mths