Question

Required: a) Calculate the cost of equity. [answer in %] (5 marks) b) Calculate the cost of preference share. [answer in %] (2 marks) c)

Required: a) Calculate the cost of equity. [answer in %] (5 marks) b) Calculate the cost of preference share. [answer in %] (2 marks) c) Determine the bond price today. [answer in 2 decimal places] (3 marks) d) Calculate the weighted average cost of capital (WACC) of the company. [answer in %] (10 marks) e) Explain the meaning of the equation of the Dividend Growth Model (DGM) in determining the current share value of a company. State any of its TWO assumptions and explain under what circumstances that these two assumptions might be violated. [within 180 words] (8 marks) f) Define WACC and discuss any issues in computing the WACC by the Hong Kong listed companies. [within 300 words] (12 marks)

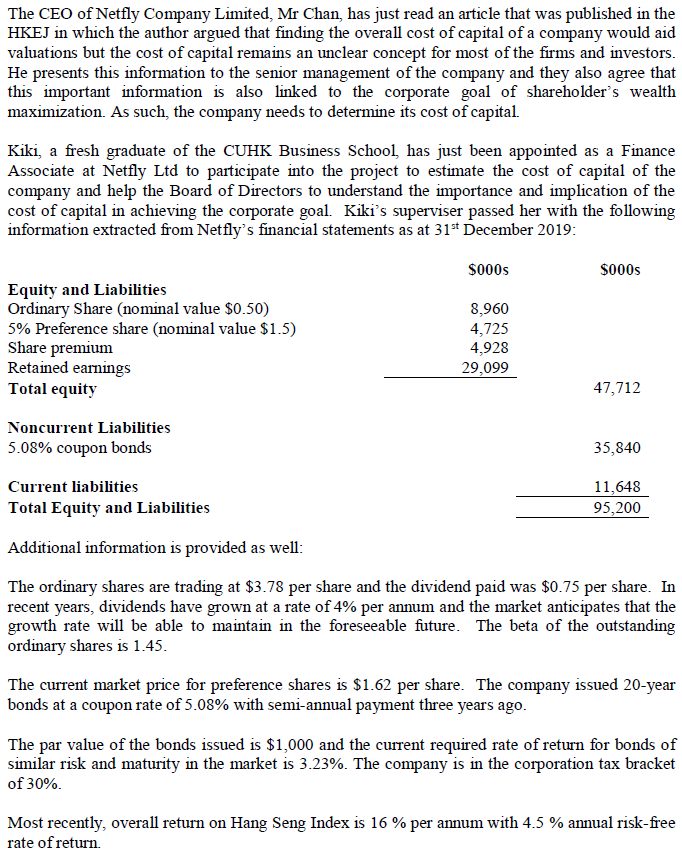

The CEO of Netfly Company Limited, Mr Chan, has just read an article that was published in the HKEJ in which the author argued that finding the overall cost of capital of a company would aid valuations but the cost of capital remains an unclear concept for most of the firms and investors. He presents this information to the senior management of the company and they also agree that this important information is also linked to the corporate goal of shareholder's wealth maximization. As such, the company needs to determine its cost of capital. Kiki, a fresh graduate of the CUHK Business School, has just been appointed as a Finance Associate at Netfly Ltd to participate into the project to estimate the cost of capital of the company and help the Board of Directors to understand the importance and implication of the cost of capital in achieving the corporate goal. Kiki's superviser passed her with the following information extracted from Netfly's financial statements as at 31st December 2019: $000s S000s Equity and Liabilities Ordinary Share (nominal value $0.50) 5% Preference share (nominal value $1.5) Share premium Retained earnings Total equity 8,960 4,725 4,928 29,099 47,712 Noncurrent Liabilities 5.08% coupon bonds 35,840 11,648 Current liabilities Total Equity and Liabilities 95,200 Additional information is provided as well: The ordinary shares are trading at $3.78 per share and the dividend paid was $0.75 per share. In recent years, dividends have grown at a rate of 4% per annum and the market anticipates that the growth rate will be able to maintain in the foreseeable future. The beta of the outstanding ordinary shares is 1.45. The current market price for preference shares is $1.62 per share. The company issued 20-year bonds at a coupon rate of 5.08% with semi-annual payment three years ago. The par value of the bonds issued is $1,000 and the current required rate of return for bonds of similar risk and maturity in the market is 3.23%. The company is in the corporation tax bracket of 30%. Most recently, overall return on Hang Seng Index is 16 % per annum with 4.5 % annual risk-free rate of returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started