Answered step by step

Verified Expert Solution

Question

1 Approved Answer

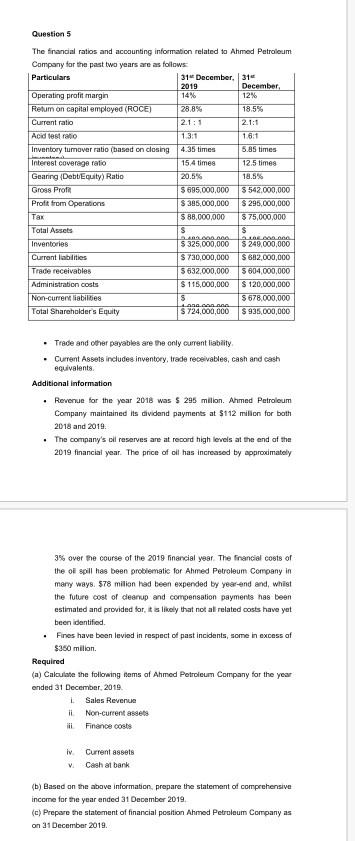

Required (a) Calculate the following items of Ahmed Petroleum Company for the year ended 31 December, 2019. i Sales Revenue ii. Non - current assets

Required (a) Calculate the following items of Ahmed Petroleum Company for the year ended 31 December, 2019. i Sales Revenue ii. Non - current assets iii. Finance costs iv. Current assets V. Cash at bank (b) Based on the above information, prepare the statement of comprehensive income for the year ended 31 December 2019. (c) Prepare the statement of financial position Ahmed Petroleum Company as on 31 December 2019.

Question 5 The financial ratios and accounting information related to Ahmed Petroleum Company for the past two years are as follows Particulars 31 December 31 2019 December Operating profit margin 14% 12% Retur on capital employed (ROCE) 28.8% 18.5% Current ratio 2.1 : 1 2.1:1 Acid est 1.3:1 16:1 Inventory turnover ratio (based on closing 4.35 times 5.85 times - Interest coverage ratio 15.4 times 12.5 times Gearing (Debt Equity) Ratio 20.5% 18.5% Gross Prof $ 695.000.000 S 542,000,000 Profit from Operations $ 395,000,000 $295,000,000 Tax $ 88,000,000 $75,000,000 Total Assets $ $ DAM 2000 Inventories $ 325,000,000 $ 249,000,000 Current abilities $ 730,000,000 $ 602,000,000 Trade receivables 5 632.000.000 5 604,000,000 Administration costs $ 115,000,000 $ 120,000,000 Non-current liabilities s S 678,000,000 Total Shareholders Equity $724,000,000 $935,000,000 . Trade and other payables are the only current liability . Current Assets includes inventory, trade receivables, cash and cash equivalents Additional information Revenue for the year 2018 was S 295 milion. Ahmed Petroleum Company maintained its dividend payments at $112 million for both 2018 and 2019 The company's bil reserves are at record high levels at the end of the 2019 financial year. The price of oil has increased by approximately 3% over the course of the 2019 financial year. The financial costs of the ol spill has been problematic for Ahmed Petroleum Company in many ways. $78 milion had been expended by year-end and, whist the future cost of cleanup and compensation payments has been estimated and provided for its likely that not all related costs have yet been identified Fines have been levied in respect of past incidents, some in excess of $350 milion. Required (a) Calculate the following items of Ahmed Petroleum Company for the year ended 31 December, 2019 Sales Revenue ii Non-current i Finance costs iv Current 88sets Cash al bank (b) Based on the above information, prepare the statement of comprehensive income for the year anded 31 December 2019 (c) Prepare the statement of financial position Ahmed Petroleum Company as on 21 December 2019, Question 5 The financial ratios and accounting information related to Ahmed Petroleum Company for the past two years are as follows Particulars 31 December 31 2019 December Operating profit margin 14% 12% Retur on capital employed (ROCE) 28.8% 18.5% Current ratio 2.1 : 1 2.1:1 Acid est 1.3:1 16:1 Inventory turnover ratio (based on closing 4.35 times 5.85 times - Interest coverage ratio 15.4 times 12.5 times Gearing (Debt Equity) Ratio 20.5% 18.5% Gross Prof $ 695.000.000 S 542,000,000 Profit from Operations $ 395,000,000 $295,000,000 Tax $ 88,000,000 $75,000,000 Total Assets $ $ DAM 2000 Inventories $ 325,000,000 $ 249,000,000 Current abilities $ 730,000,000 $ 602,000,000 Trade receivables 5 632.000.000 5 604,000,000 Administration costs $ 115,000,000 $ 120,000,000 Non-current liabilities s S 678,000,000 Total Shareholders Equity $724,000,000 $935,000,000 . Trade and other payables are the only current liability . Current Assets includes inventory, trade receivables, cash and cash equivalents Additional information Revenue for the year 2018 was S 295 milion. Ahmed Petroleum Company maintained its dividend payments at $112 million for both 2018 and 2019 The company's bil reserves are at record high levels at the end of the 2019 financial year. The price of oil has increased by approximately 3% over the course of the 2019 financial year. The financial costs of the ol spill has been problematic for Ahmed Petroleum Company in many ways. $78 milion had been expended by year-end and, whist the future cost of cleanup and compensation payments has been estimated and provided for its likely that not all related costs have yet been identified Fines have been levied in respect of past incidents, some in excess of $350 milion. Required (a) Calculate the following items of Ahmed Petroleum Company for the year ended 31 December, 2019 Sales Revenue ii Non-current i Finance costs iv Current 88sets Cash al bank (b) Based on the above information, prepare the statement of comprehensive income for the year anded 31 December 2019 (c) Prepare the statement of financial position Ahmed Petroleum Company as on 21 December 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started