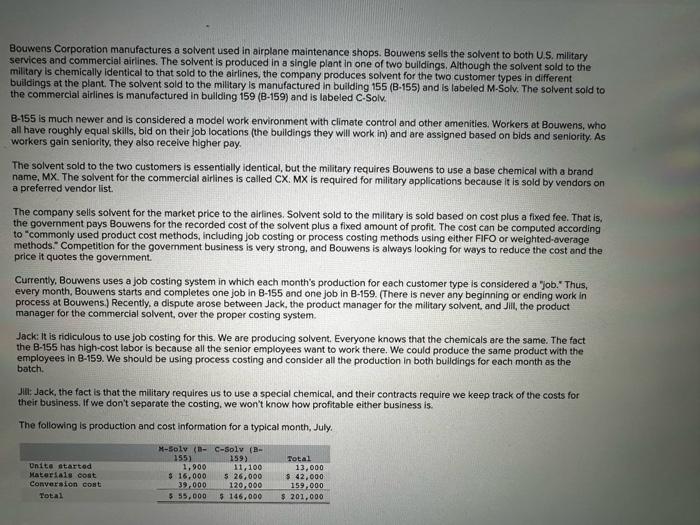

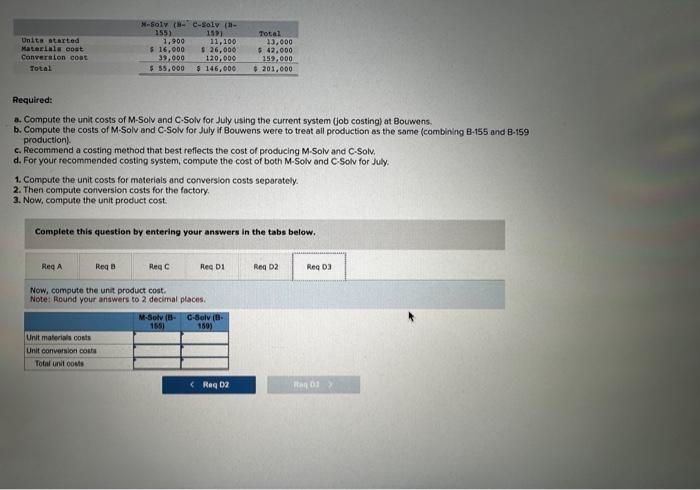

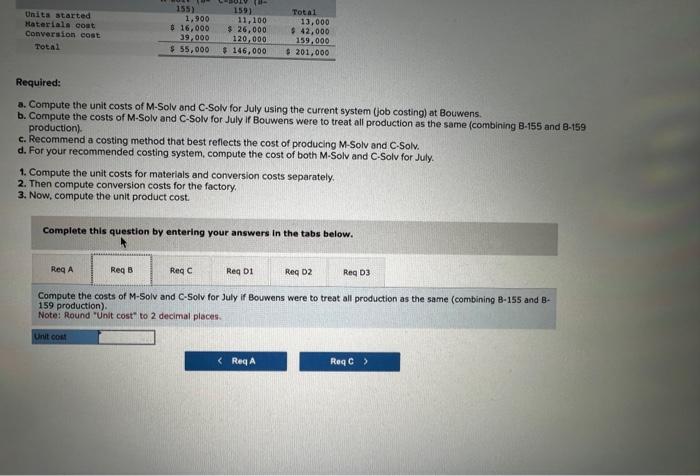

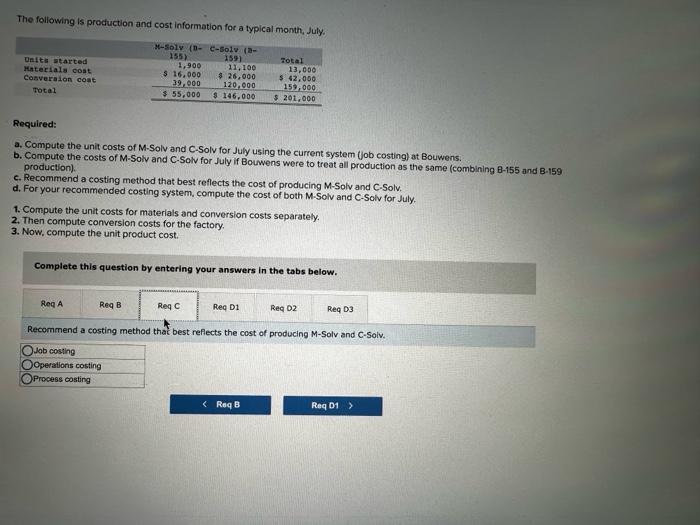

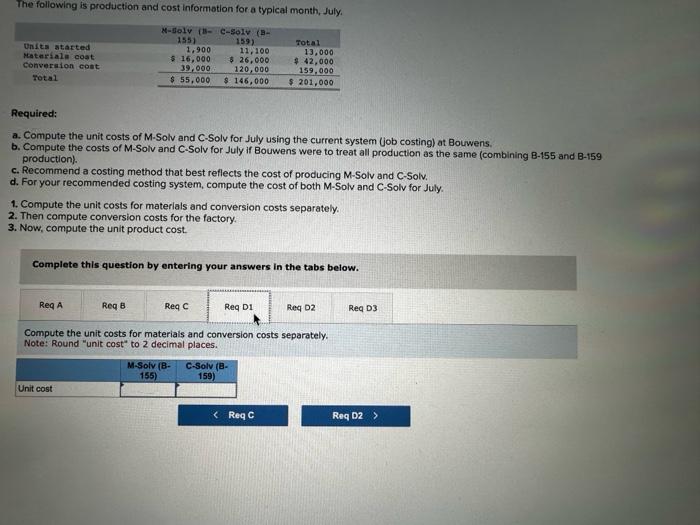

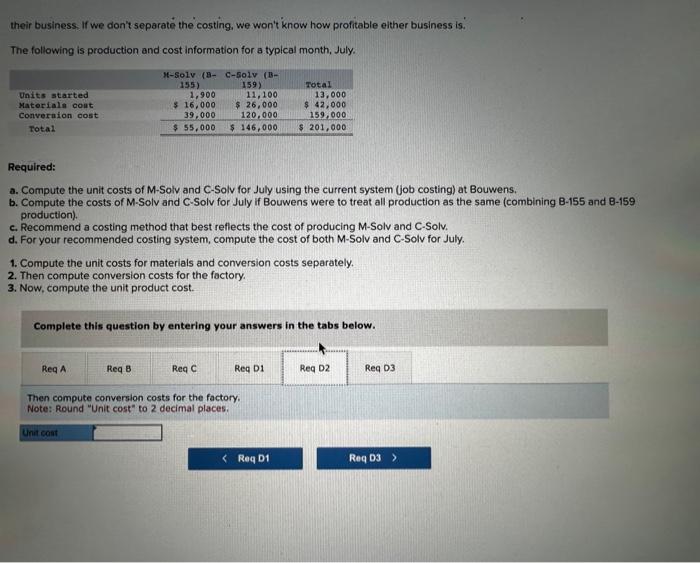

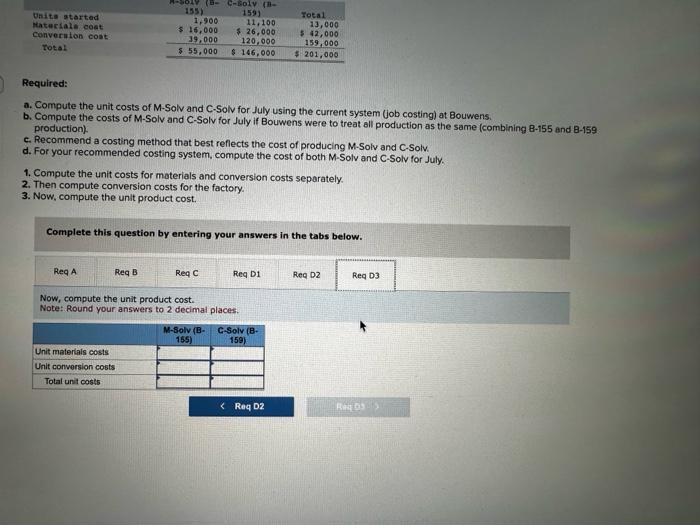

Required: a. Compute the unit costs of M-Solv and C-Solv for July using the current system (job costing) at Bouwens. b. Compute the costs of M-Solv and C-Solv for July if Bouwens were to treat all production as the same (combining 8-155 and B159 production). c. Recommend a costing method that best reflects the cost of producing M-Solv and C-Solv. d. For your recommended costing system, compute the cost of both M-Solv and C-Solv for July. 1. Compute the unit costs for materials and conversion costs separately. 2. Then compute conversion costs for the factory. 3. Now, compute the unit product cost. Complete this question by entering your answers in the tabs below. Compute the costs of M-Solv and C-Solv for July if Bouwens were to treat all production as the same (Combining B-155 and B. 159 production). Note: Round "Unit cost" to 2 decimal places. Required: a. Compute the unit costs of M-Solv and C-Solv for July using the current system (job costing) at Bouwens b. Compute the costs of M-Solv and C-Solv for July if Bouwens were to treat all production as the same (combining B-155 and B-159 production). c. Recommend a costing method that best reflects the cost of producing M-Solv and C-Solv. d. For your recommended costing system, compute the cost of both M-Solv and C-Solv for July. 1. Compute the unit costs for materials and conversion costs separately. 2. Then compute conversion costs for the factory. 3. Now, compute the unit product cost. Complete this question by entering your answers in the tabs below. Now, compute the unit product cost. Note: Round your answers to 2 decimal places. The following is production and cost information for a typical month, July. Required: a. Compute the unit costs of M-Solv and C-Solv for July using the current system (job costing) at Bouwens. b. Compute the costs of M-Solv and C-Solv for July if Bouwens were to treat all production as the same (combining B-155 and B-159 production). c. Recommend a costing method that best reflects the cost of producing M-Solv and C-Solv. d. For your recommended costing system, compute the cost of both M-Solv and C-Solv for July. 1. Compute the unit costs for materials and conversion costs separately. 2. Then compute conversion costs for the factory. 3. Now, compute the unit product cost. Complete this question by entering your answers in the tabs below. Compute the unit costs for materials and conversion costs separately. Note: Round "unit cost" to 2 decimal places. Bouwens Corporation manufactures a solvent used in airplane maintenance shops. Bouwens sells the solvent to both U.S. military services and commercial airlines. The solvent is produced in a single plant in one of two bulldings. Although the solvent sold to the military is chemically identical to that sold to the airlines, the company produces solvent for the two customer types in different buildings at the plant. The solvent sold to the military is manufactured in building 155 (B-155) and is labeled M-Solv. The solvent sold to the commercial airlines is manufactured in bullding 159(B159) and is labeled C-Solv. B-155 is much newer and is considered a model work environment with climate control and other amenities. Workers at Bouwens, who all have roughly equal skills, bid on their job locations (the buildings they will work in) and are assigned based on bids and seniority. As workers gain seniority, they also recelve higher pay. The solvent sold to the two customers is essentially identical, but the military requires Bouwens to use a base chemical with a brand name, MX. The solvent for the commercial airlines is called CX. MX is required for military applications because it is sold by vendors on a preferred vendor list. The company sells solvent for the market price to the airlines. Solvent sold to the military is sold based on cost plus a fixed fee. That is, the government pays Bouwens for the recorded cost of the solvent plus a fixed amount of profit. The cost can be computed according to "commonly used product cost methods, including job costing or process costing methods using either FifO or weighted-average methods." Competition for the government business is very strong, and Bouwens is always looking for ways to reduce the cost and the price it quotes the government. Currently, Bouwens uses a job costing system in which each month's production for each customer type is considered a "job. "Thus, every month, Bouwens starts and completes one job in B-155 and one job in B-159. (There is never any beginning or ending work in process at Bouwens.) Recently, a dispute arose between Jack, the product manager for the military solvent, and Jili, the product manager for the commercial solvent, over the proper costing system. Jack: It is ridiculous to use job costing for this. We are producing solvent. Everyone knows that the chemicals are the same. The fact the B-155 has high-cost labor is because all the senior employees want to work there. We could produce the same product with the employees in 8-159. We should be using process costing and consider all the production in both buildings for each month as the batch. Jili: Jack, the fact is that the military requires us to use a special chemical, and their contracts require we keep track of the costs for their business. If we don't seporate the costing, we won't know how profitable either business is. The following is production and cost information for a typical month, July. The following is production and cost information for a typical month, July. Required: a. Compute the unit costs of M-Solv and C-Solv for July using the current system (job costing) at Bouwens. b. Compute the costs of M-Solv and C-Solv for July if Bouwens were to treat all production as the same (combining 8155 and B-159 production). c. Recommend a costing method that best reflects the cost of producing M-Solv and C-Solv. d. For your recommended costing system, compute the cost of both M-Solv and C-Solv for July. 1. Compute the unit costs for materlals and conversion costs separately. 2. Then compute conversion costs for the factory. 3. Now, compute the unit product cost. Complete this question by entering your answers in the tabs below. Recommend a costing method that best reflects the cost of producing M-Solv and C-Solv. jab costing Operations costing Prccess costing their business, If we don't separate the costing, we won't know how profitable either business is.' The following is production and cost information for a typical month, July. Required: a. Compute the unit costs of M-Solv and C-Solv for July using the current system (job costing) at Bouwens. b. Compute the costs of M-Solv and C-Solv for July if Bouwens were to treat all production as the same (combining B-155 and B-159 production). c. Recommend a costing method that best reflects the cost of producing M-Solv and C-Solv. d. For your recommended costing system, compute the cost of both M-Solv and C-Solv for July. 1. Compute the unit costs for materials and conversion costs separately. 2. Then compute conversion costs for the factory. 3. Now, compute the unit product cost. Complete this question by entering your answers in the tabs below. Then compute conversion costs for the factory. Note: Round "Unit cost" to 2 decimal places. Required: a. Compute the unit costs of M-Solv and C.Solv for July using the current system (job costing) at Bouwens. b. Compute the costs of M-Solv and C-Solv for July if Bouwens were to treat all production as the same (combining B-155 and B-159 production): c. Recommend a costing method that best reflects the cost of producing M-Solv and C.Solv. d. For your recommended costing system, compute the cost of both M-Solv and C.Solv for July. 1. Compute the unit costs for materials and conversion costs separately. 2. Then compute conversion costs for the factory. 3. Now, compute the unit product cost. Complete this question by entering your answers in the tabs below. Now, compute the unit product cost. Notes Round your answers to 2 decimal places