Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: A. Journalize the transactions in the appropriate journals. B. record in the accounts receivable ledger and post to the general ledger as appropriate. C.

Required:

A. Journalize the transactions in the appropriate journals.

B. record in the accounts receivable ledger and post to the general ledger as appropriate.

C. Prepare a schedule of accounts receivable as September 20, 2023

Please help me.. thanks

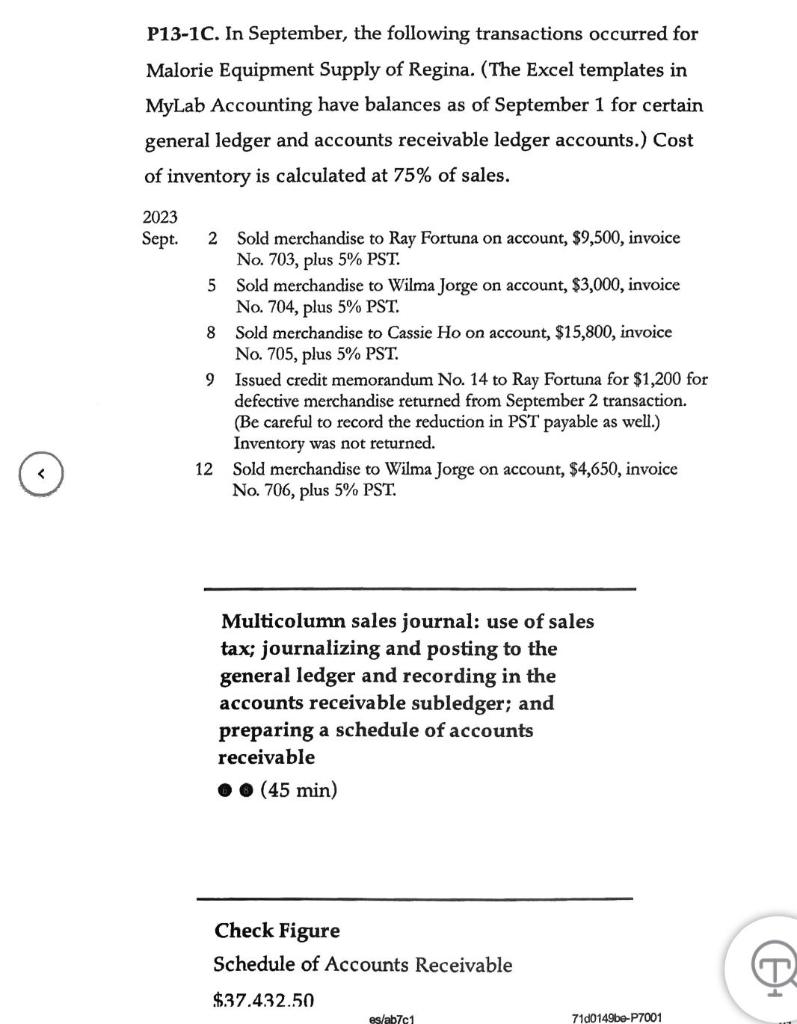

P13-1C. In September, the following transactions occurred for Malorie Equipment Supply of Regina. (The Excel templates in MyLab Accounting have balances as of September 1 for certain general ledger and accounts receivable ledger accounts.) Cost of inventory is calculated at 75% of sales. 2023 Sept. 2 Sold merchandise to Ray Fortuna on account, $9,500, invoice No. 703, plus 5% PST. 5 Sold merchandise to Wilma Jorge on account, $3,000, invoice No. 704, plus 5% PST. 8 Sold merchandise to Cassie Ho on account, $15,800, invoice No. 705, plus 5% PST. 9 Issued credit memorandum No. 14 to Ray Fortuna for $1,200 for defective merchandise returned from September 2 transaction. (Be careful to record the reduction in PST payable as well.) Inventory was not returned. 12 Sold merchandise to Wilma Jorge on account, $4,650, invoice No. 706, plus 5% PST. Multicolumn sales journal: use of sales tax; journalizing and posting to the general ledger and recording in the accounts receivable subledger; and preparing a schedule of accounts receivable . . (45 min) Check Figure Schedule of Accounts Receivable $37.432.50 eslab7c1 7100149be-P7001

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started