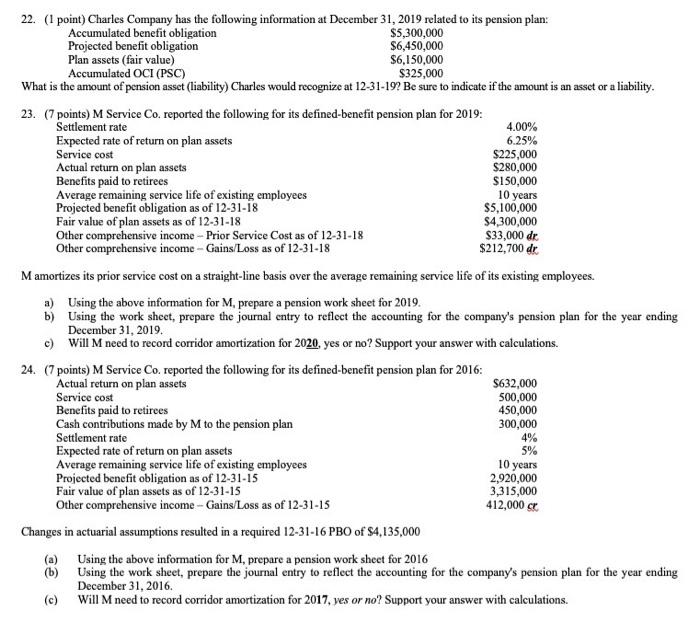

22. (1 point) Charles Company has the following information at December 31, 2019 related to its pension plan: Accumulated benefit obligation $5,300,000 Projected benefit obligation $6,450,000 Plan assets (fair value) $6,150,000 Accumulated OCI (PSC) $325,000 What is the amount of pension asset (liability) Charles would recognize at 12-31-19? Be sure to indicate if the amount is an asset or a liability. 23. (7 points) M Service Co. reported the following for its defined-benefit pension plan for 2019: Settlement rate 4.00% Expected rate of return on plan assets 6.25% Service cost $225,000 Actual return on plan assets $280,000 Benefits paid to retirees $150,000 Average remaining service life of existing employees 10 years Projected benefit obligation as of 12-31-18 $5,100,000 Fair value of plan assets as of 12-31-18 $4,300,000 Other comprehensive income - Prior Service Cost as of 12-31-18 $33,000 de Other comprehensive income - Gains/Loss as of 12-31-18 $212,700 dr M amortizes its prior service cost on a straight-line basis over the average remaining service life of its existing employees. a) Using the above information for M, prepare a pension work sheet for 2019. b) Using the work sheet, prepare the journal entry to reflect the accounting for the company's pension plan for the year ending December 31, 2019. c) Will M need to record corridor amortization for 2020, yes or no? Support your answer with calculations. 24. (7 points) M Service Co. reported the following for its defined benefit pension plan for 2016: Actual return on plan assets $632,000 Service cost 500,000 Benefits paid to retirees 450,000 Cash contributions made by M to the pension plan 300,000 Settlement rate 4% Expected rate of return on plan assets 5% Average remaining service life of existing employees 10 years Projected benefit obligation as of 12-31-15 2,920,000 Fair value of plan assets as of 12-31-15 3,315,000 Other comprehensive income - Gains/Loss as of 12-31-15 412,000 cr Changes in actuarial assumptions resulted in a required 12-31-16 PBO of S4,135,000 (a) Using the above information for M, prepare a pension work sheet for 2016 (b) Using the work sheet, prepare the journal entry to reflect the accounting for the company's pension plan for the year ending December 31, 2016. (c) Will M need to record corridor amortization for 2017, yes or no? Support your answer with calculations