Question

Required: (A) Prepare a perpetual inventory record for this merchandise, using the first in, first out (FIFO) method of inventory valuation to determine the companys

Required:

(A) Prepare a perpetual inventory record for this merchandise, using the first in, first out (FIFO)

method of inventory valuation to determine the companys cost of goods sold for the quarter and

the value of ending.

(B) Given that selling, distribution and administrative costs associated with the V380PRO brand of

WIFI SMART camera bulbs for the quarter were $27,255, $42,400 and $145,600 respectively,

prepare an income statement for Sim-Jo-La (V380PRO) for the quarter ended June 30, 2020.

(C) Journalize the transactions for the month of April, assuming the company uses a:

- Periodic inventory system

- Perpetual inventory system

(D) One of the managers of the business has indicated that his main objective is to cut back on his tax

liability as much as possible and is of the view that the FIFO method would be best. Do you agree

with him? Explain your answer clearly, with reference to the most popular methods of inventory

valuation.

(E) Universal Enterprise sells a product that cost $450 per unit and has a monthly demand of 5,000

units. The annual holding cost per unit is calculated as 5% of the unit purchase price. It costs the

business $75 to place a single order. Currently the business places 12 orders each year.

i) What is the total stock administrative cost of Universals current inventory policy?

ii) Is this the entitys cost minimizing solution for this product each year? Explain.

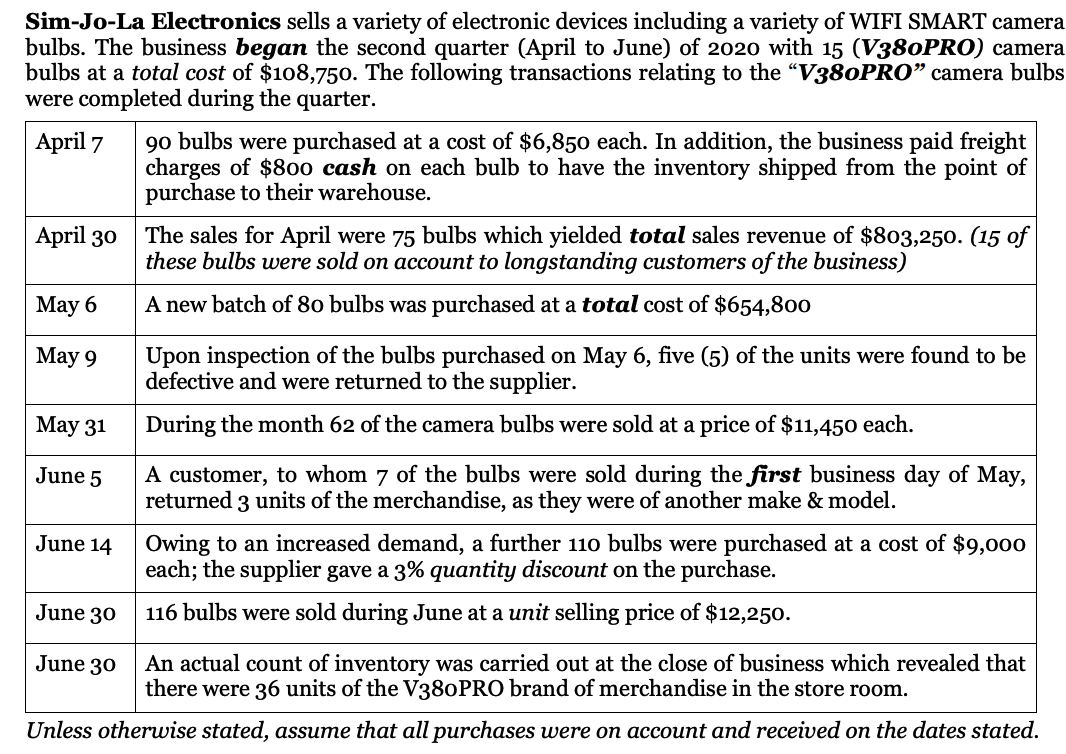

Sim-Jo-La Electronics sells a variety of electronic devices including a variety of WIFI SMART camera bulbs. The business began the second quarter (April to June) of 2020 with 15 (V380PRO) camera bulbs at a total cost of $108,750. The following transactions relating to the V380PRO camera bulbs were completed during the quarter. April 7 90 bulbs were purchased at a cost of $6,850 each. In addition, the business paid freight charges of $800 cash on each bulb to have the inventory shipped from the point of purchase to their warehouse. April 30 The sales for April were 75 bulbs which yielded total sales revenue of $803,250. (15 of these bulbs were sold on account to longstanding customers of the business) A new batch of 80 bulbs was purchased at a total cost of $654,800 May 9 Upon inspection of the bulbs purchased on May 6, five (5) of the units were found to be defective and were returned to the supplier. May 31 During the month 62 of the camera bulbs were sold at a price of $11,450 each. May 6 June 5 June 14 A customer, to whom 7 of the bulbs were sold during the first business day of May, returned 3 units of the merchandise, as they were of another make & model. Owing to an increased demand, a further 110 bulbs were purchased at a cost of $9,000 each; the supplier gave a 3% quantity discount on the purchase. 116 bulbs were sold during June at a unit selling price of $12,250. June 30 June 30 An actual count of inventory was carried out at the close of business which revealed that there were 36 units of the V380PRO brand of merchandise in the store room. Unless otherwise stated, assume that all purchases were on account and received on the dates statedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started