Question

Walmart makes significant investments in operating capacity, primarily via investments in property, plant, and equipment, but also via investments in wholly and partially owned subsidiaries.

Walmart makes significant investments in operating capacity, primarily via investments in property, plant, and equipment, but also via investments in wholly and partially owned subsidiaries. Walmart also has significant non-U.S. operations in its Walmart International segment. The Chapter 8 online appendix provides Walmarts January 31, 2016, Consolidated Financial Statements and accompanying notes, which describe these significant investments.

Required

-

Estimate the average total estimated useful life of depreciable property, plant, and equipment. Does the estimate reconcile with stated accounting policy on useful lives for property, plant, and equipment? Explain.

-

How should an analyst interpret fluctuations in this estimate for a given company over time? How should an analyst interpret differences in this estimate between a company and its competitors?

-

Estimate the average age of depreciable assets, the percentage of PP&E that has been used up, and the remaining useful life. How might an analyst use this information?

-

Has Walmart recognized impairment of property, plant, and equipment or goodwill during the fiscal year ending January 31, 2016? Why is it important for the analyst to know the answer to this question?

-

Under U.S. GAAP, the impairment tests for goodwill and PP&E are different. Describe the main difference.

-

Walmart must consolidate subsidiaries that are partially owned. Evidence of this fact can be found in the income statement, the balance sheet, and the statement of cash flows, where noncontrolling interests in net income, noncontrolling interest in net assets, and cash flows related to noncontrolling interests are referenced. Explain the meaning of the noncontrolling interest in net income and the noncontrolling interest in net assets.

-

Generally speaking, firms, including firms that are partially owned subsidiaries, pay out only a portion of their net income during a period (i.e., the dividend payout ratio is generally less than one). The January 31, 2016, balance sheet reports a decrease in noncontrolling interest in net assets. Do other statements (and note information) provide evidence as to what might have happened?

-

What was the gain or loss from foreign currency translation for the year ended January 31, 2016? Where is it reported, and what is the rationale for reporting it there?

-

What happened to foreign exchange rates during the year?

Translation MethodologyForeign Currency Is Functional Currency

When the functional currency is the currency of the foreign unit, U.S. GAAP requires firms to use the all-current translation method. The rationale for this method is that the firm's investment in the foreign unit is for the long term; therefore, short-term changes in exchange rates should not affect periodic net income. Under the all-current translation method:

-

translate revenues and expenses at the average exchange rate during the period.

-

translate balance sheet items at the end-of-the-period exchange rate.

-

include the resulting translation adjustment (the amount needed to balance the balance sheet) as a component of other comprehensive income rather than net income.

-

recognize the cumulative amount in the translation adjustment account in net income when measuring any gain or loss in the case of a sale or disposal of a foreign unit.

IllustrationForeign Currency Is Functional Currency

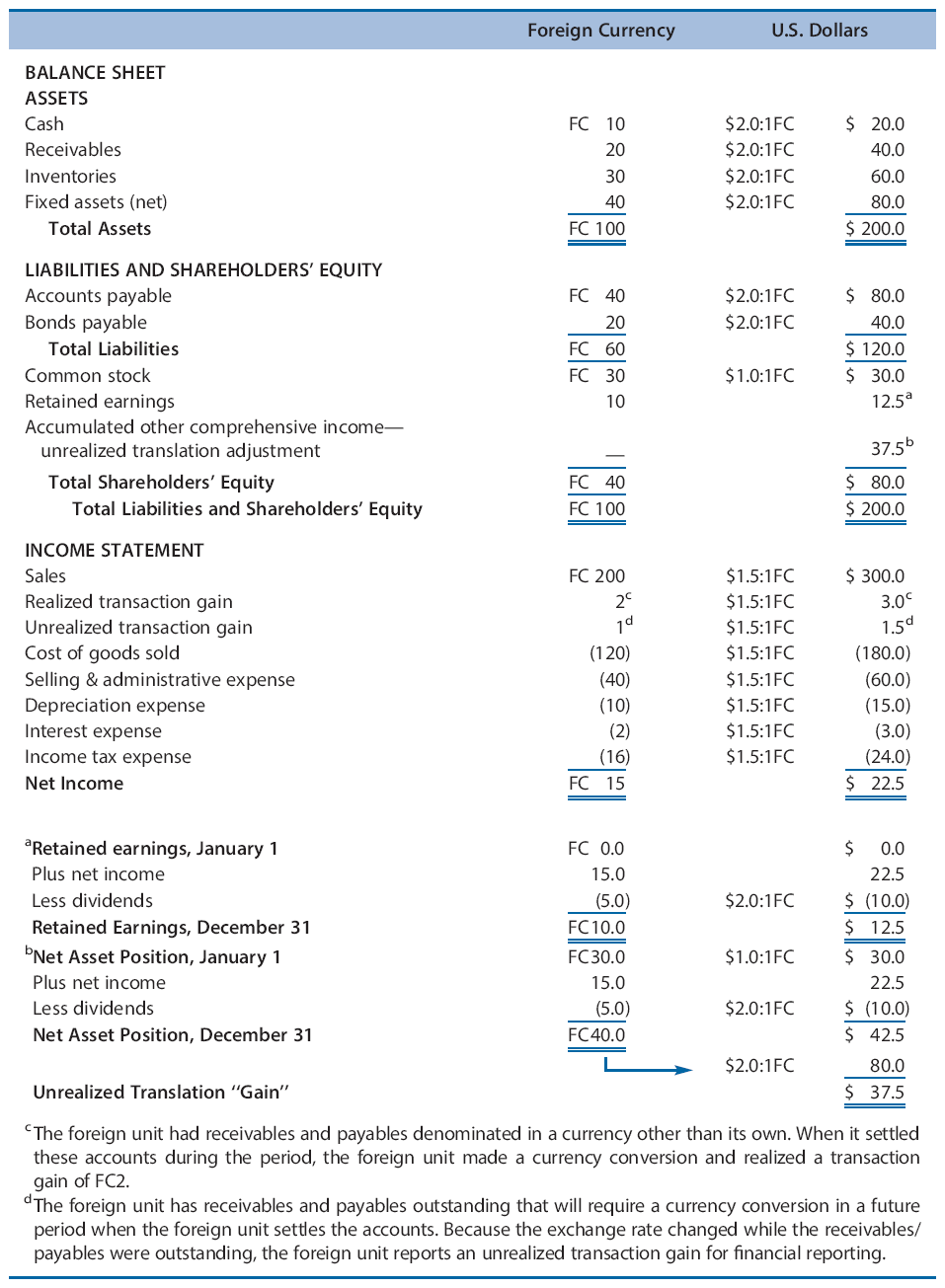

Appendix Exhibit 8.1 illustrates the all-current method for a foreign unit during its first year of operations. The exchange rate was $1.0:1FC (FC = one unit of a foreign currency such as a euro or Singapore dollar) on January 1, $2.0:1FC on December 31, and $1.5:1FC on average during the year. Thus, the foreign currency increased in value relative to the U.S. dollar during the year. The translation process is as follows:

-

The firm translates all assets and liabilities on the balance sheet at the exchange rate on December 31.

-

The firm translates common stock at the exchange rate on the date of issuance.

-

The firm translates all revenues and expenses of the foreign unit at the average exchange rate. The foreign unit realized a transaction gain during the year and recorded it in current income. In addition, the translated amounts for the foreign unit include an unrealized transaction gain arising from exposed accounts that are not yet settled. (These transaction gains and losses are covered in Chapter 9.)

-

The firm takes translated net income and dividends to determine translated retained earnings. Note (a) to Appendix Exhibit 8.1 shows the computation of translated retained earnings. The foreign unit paid the dividend on December 31.

-

The firm uses the translation adjustment account to reflect the cumulative effects of the exchange rate translations on this investment. The amount is determined as shown in note (b) to Appendix Exhibit 8.1.

Note (b) shows the calculation of the translation adjustment. By investing $30 in the foreign unit on January 1 and allowing the $22.5 of earnings to remain in the foreign unit throughout the year while the foreign currency was increasing in value relative to the U.S. dollar, the parent has a potential exchange gain of $37.5. It reports this amount as a component of other comprehensive income on the statement of comprehensive income.

Translation MethodologyU.S. Dollar Is Functional Currency

When the functional currency is the U.S. dollar, firms must use the monetaryonmonetary translation method. The underlying premise of the monetaryonmonetary method is that the translated amounts reflect amounts that the firm would have reported if it had originally made all measurements in U.S. dollars. To implement this underlying premise, it is necessary to distinguish between monetary items and nonmonetary items and translate each item at the appropriate exchange rate:

-

A monetary item is an account whose nominal maturity amount does not change as the exchange rate changes.

-

From a U.S.-dollar perspective, monetary items give rise to exchange gains and losses because the number of U.S. dollars required to settle the fixed foreign currency amounts fluctuates over time with exchange rate changes.

-

Monetary items include cash, marketable securities, receivables, accounts payable, other accrued liabilities, and short-term and long-term debt.

-

Firms translate monetary items using the end-of-the-period exchange rate and recognize translation gains and losses.

-

These translation gains and losses increase or decrease net income each period regardless of whether the foreign unit must make an actual currency conversion to settle the monetary item. The rationale for the recognition of unrealized translation gains and losses in net income is that the foreign unit will likely make a currency conversion in the near future to settle monetary assets and liabilities or to convert foreign currency into U.S. dollars to remit a dividend to the parent. These activities are consistent with foreign units that operate as extensions of the U.S. parent.

-

Nonmonetary items include inventories, fixed assets, common stock, revenues, and expenses.

-

Firms translate nonmonetary items using the historical exchange rate in effect when the foreign unit initially made the measurements underlying these accounts.

-

Inventories and cost of goods sold translate at the exchange rate when the foreign unit acquired the inventory items.

-

Fixed assets and depreciation expense translate at the exchange rate when the foreign unit acquired the fixed assets.

-

Most revenues and operating expenses other than cost of goods sold and depreciation translate at the average exchange rate during the period.

-

The objective is to state these accounts at their U.S.-dollar-equivalent historical cost amounts. In this way, the translated amounts reflect the U.S.-dollar perspective that is appropriate when the U.S. dollar is the functional currency.

-

Translation MethodologyU.S. Dollar Is Functional Currency

When the functional currency is the U.S. dollar, firms must use the monetaryonmonetary translation method. The underlying premise of the monetaryonmonetary method is that the translated amounts reflect amounts that the firm would have reported if it had originally made all measurements in U.S. dollars. To implement this underlying premise, it is necessary to distinguish between monetary items and nonmonetary items and translate each item at the appropriate exchange rate:

-

A monetary item is an account whose nominal maturity amount does not change as the exchange rate changes.

-

From a U.S.-dollar perspective, monetary items give rise to exchange gains and losses because the number of U.S. dollars required to settle the fixed foreign currency amounts fluctuates over time with exchange rate changes.

-

Monetary items include cash, marketable securities, receivables, accounts payable, other accrued liabilities, and short-term and long-term debt.

-

Firms translate monetary items using the end-of-the-period exchange rate and recognize translation gains and losses.

-

These translation gains and losses increase or decrease net income each period regardless of whether the foreign unit must make an actual currency conversion to settle the monetary item. The rationale for the recognition of unrealized translation gains and losses in net income is that the foreign unit will likely make a currency conversion in the near future to settle monetary assets and liabilities or to convert foreign currency into U.S. dollars to remit a dividend to the parent. These activities are consistent with foreign units that operate as extensions of the U.S. parent.

-

Nonmonetary items include inventories, fixed assets, common stock, revenues, and expenses.

-

Firms translate nonmonetary items using the historical exchange rate in effect when the foreign unit initially made the measurements underlying these accounts.

-

Inventories and cost of goods sold translate at the exchange rate when the foreign unit acquired the inventory items.

-

Fixed assets and depreciation expense translate at the exchange rate when the foreign unit acquired the fixed assets.

-

Most revenues and operating expenses other than cost of goods sold and depreciation translate at the average exchange rate during the period.

-

The objective is to state these accounts at their U.S.-dollar-equivalent historical cost amounts. In this way, the translated amounts reflect the U.S.-dollar perspective that is appropriate when the U.S. dollar is the functional currency.

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started