Required:

a. Prepare all consolidating entries needed to prepare a three-part consolidation worksheet as of December 31, 20X9.

b. Prepare a three-part consolidation worksheet for 20X9.

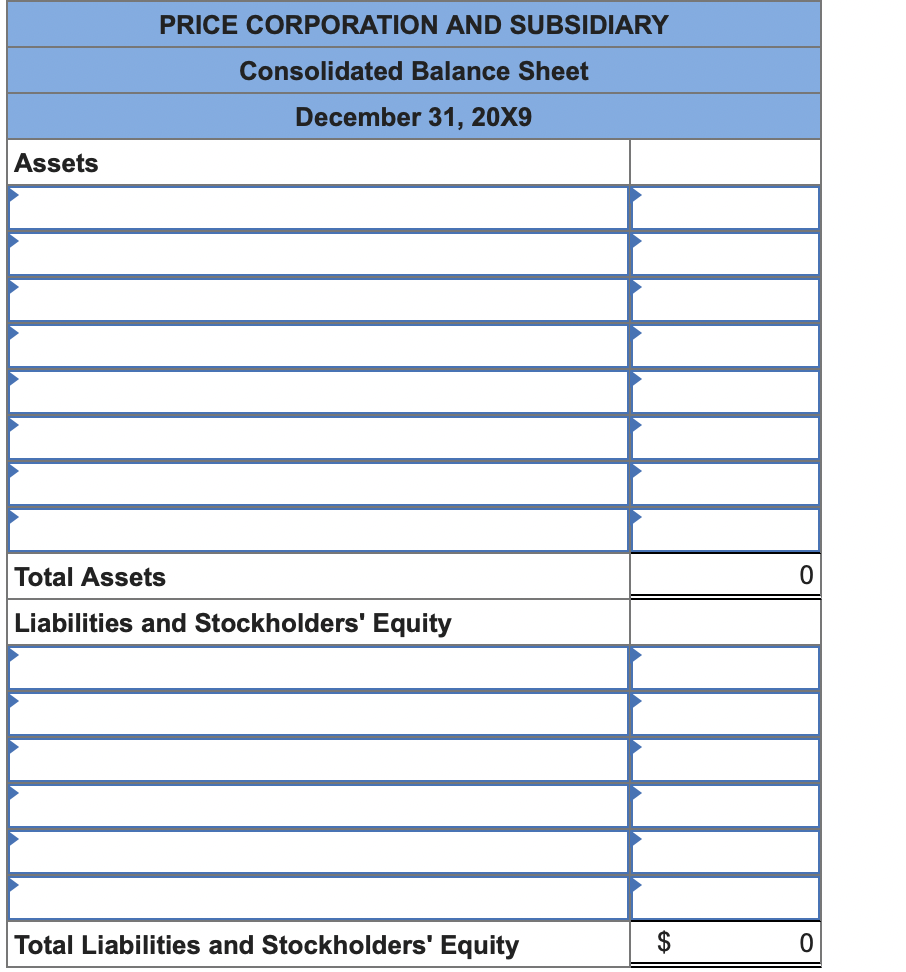

c-1. Prepare a consolidated balance sheet for 20X9.

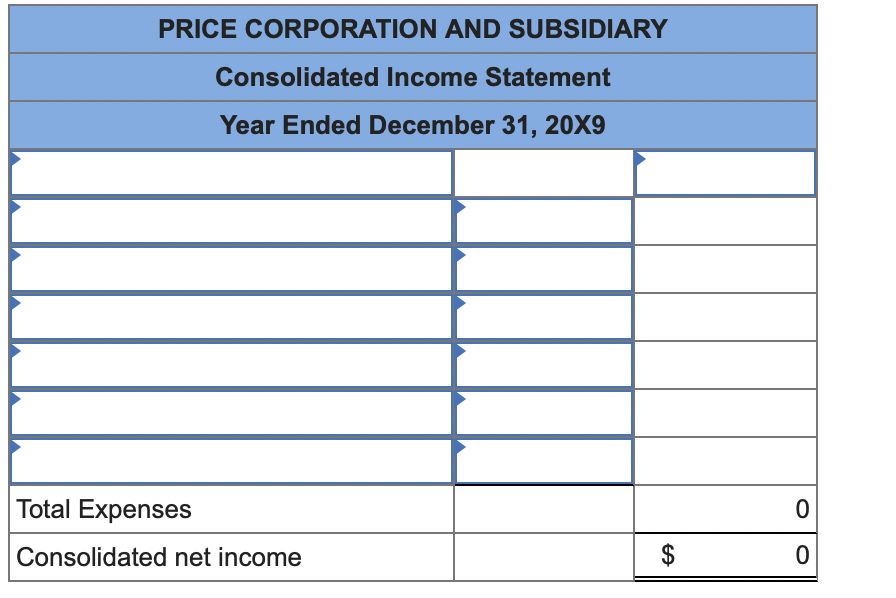

c-2. Prepare a consolidated income statement for 20X9.

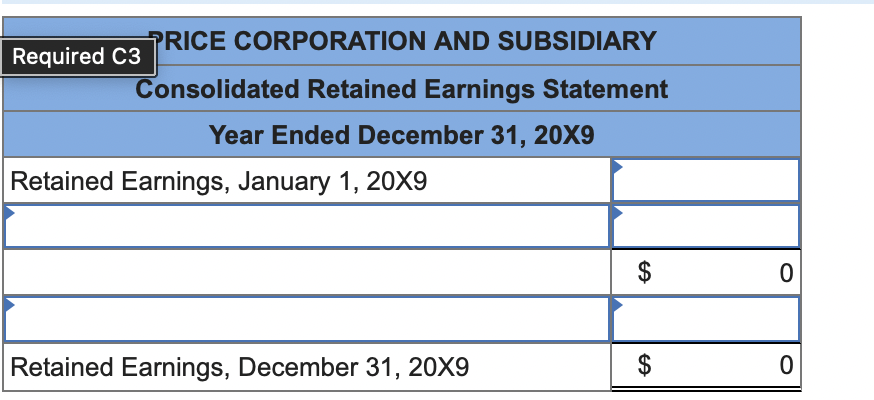

c-3. Prepare a retained earnings statement for 20X9.

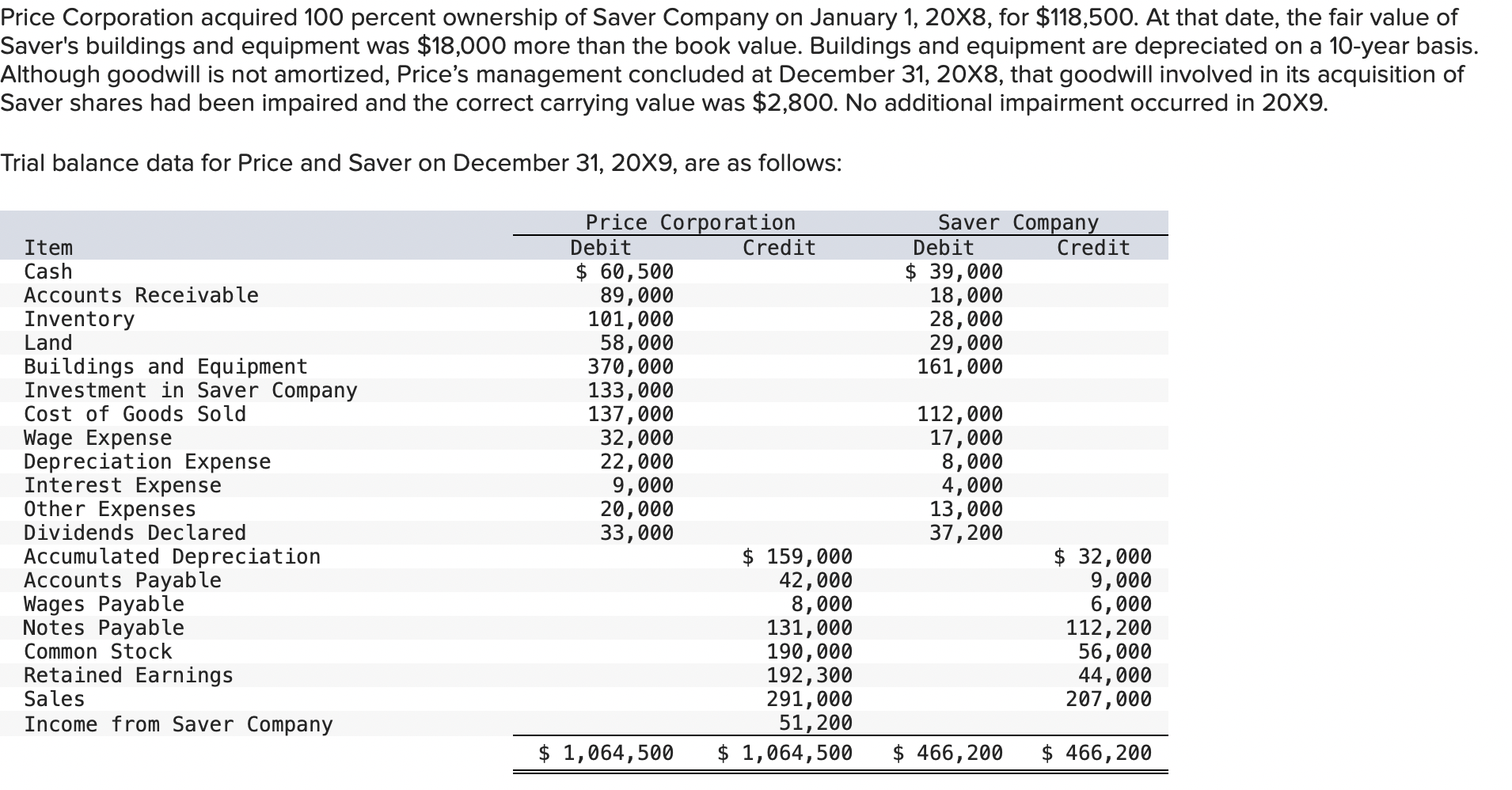

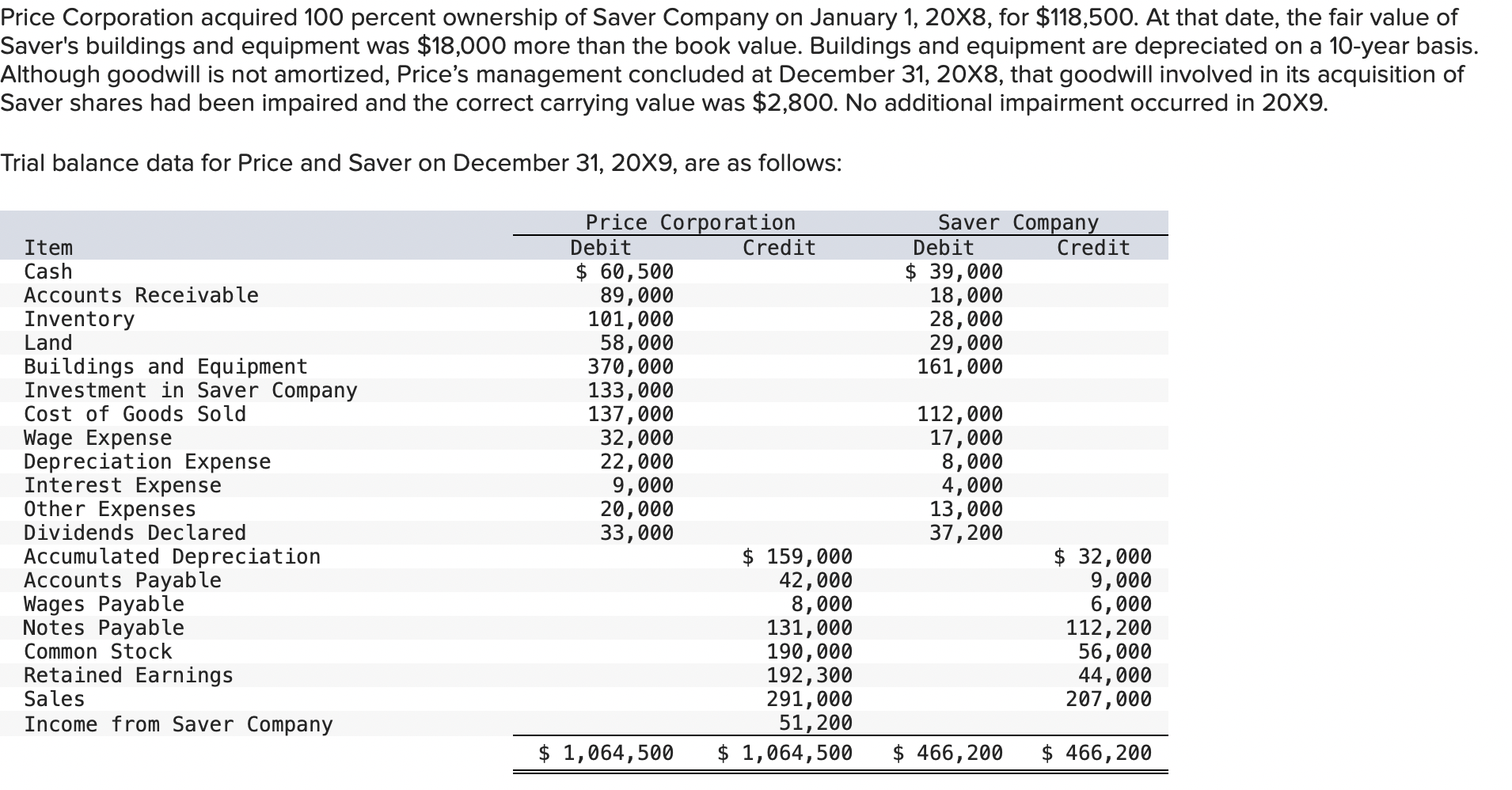

Price Corporation acquired 100 percent ownership of Saver Company on January 1,208, for $118,500. At that date, the fair value of Saver's buildings and equipment was $18,000 more than the book value. Buildings and equipment are depreciated on a 10 -year. Although goodwill is not amortized, Price's management concluded at December 31,208, that goodwill involved in its acquisition of Saver shares had been impaired and the correct carrying value was $2,800. No additional impairment occurred in 209. Trial balance data for Price and Saver on December 31, 20X9, are as follows: \begin{tabular}{|l|l|} \hline \multicolumn{2}{c|}{ PRICE CORPORATION AND SUBSIDIARY } \\ \hline \multicolumn{1}{|c|}{ Consolidated Balance Sheet } \\ \hline December 31, 20X9 & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline Total Assets & \\ \hline Liabilities and Stockholders' Equity & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ PRICE CORPORATION AND SUBSIDIARY } \\ \hline \multicolumn{2}{|c|}{ Consolidated Income Statement } \\ \hline \multicolumn{2}{|c|}{ Year Ended December 31, 20X9 } & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total Expenses & & \\ \hline Consolidated net income & & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Required C3 \\ \hline \multicolumn{2}{|c|}{ Consolidated Retained Earnings Statement } \\ \hline \multicolumn{2}{|c|}{ Year Ended December 31, 20X9 } \\ \hline Retained Earnings, January 1, 20X9 & \\ \hline & $ \\ \hline & \\ \hline Retained Earnings, December 31,209 & $ \\ \hline \hline \end{tabular} Price Corporation acquired 100 percent ownership of Saver Company on January 1,208, for $118,500. At that date, the fair value of Saver's buildings and equipment was $18,000 more than the book value. Buildings and equipment are depreciated on a 10 -year. Although goodwill is not amortized, Price's management concluded at December 31,208, that goodwill involved in its acquisition of Saver shares had been impaired and the correct carrying value was $2,800. No additional impairment occurred in 209. Trial balance data for Price and Saver on December 31, 20X9, are as follows: \begin{tabular}{|l|l|} \hline \multicolumn{2}{c|}{ PRICE CORPORATION AND SUBSIDIARY } \\ \hline \multicolumn{1}{|c|}{ Consolidated Balance Sheet } \\ \hline December 31, 20X9 & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline Total Assets & \\ \hline Liabilities and Stockholders' Equity & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ PRICE CORPORATION AND SUBSIDIARY } \\ \hline \multicolumn{2}{|c|}{ Consolidated Income Statement } \\ \hline \multicolumn{2}{|c|}{ Year Ended December 31, 20X9 } & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total Expenses & & \\ \hline Consolidated net income & & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Required C3 \\ \hline \multicolumn{2}{|c|}{ Consolidated Retained Earnings Statement } \\ \hline \multicolumn{2}{|c|}{ Year Ended December 31, 20X9 } \\ \hline Retained Earnings, January 1, 20X9 & \\ \hline & $ \\ \hline & \\ \hline Retained Earnings, December 31,209 & $ \\ \hline \hline \end{tabular}