Question

Required a . Set up the following general ledger T accounts: Materials Inventory, Wages Payable, Manufac- turing Overhead, Work in Process Inventory, Finished Goods Inventory,

Required

a. Set up the following general ledger T accounts: Materials Inventory, Wages Payable, Manufac-

turing Overhead, Work in Process Inventory, Finished Goods Inventory, Cost of Goods Sold, and

Sales.

b. Set up T accounts for each of Jobs 16 as job order cost sheets.

c. Noting the accounting procedures described in the first paragraph of the problem, do the

following:

i. Record general journal entries for all transactions. Note that general journal entries are not

required in transactions 3 and 7. Post only those portions of these entries affecting the gen-

eral ledger accounts set up in requirement (a).

ii. Enter the applicable amounts directly on the appropriate job order cost sheets for transac-

tions 3, 4, 7, 8, and 13. Note parenthetically the nature of each amount entered.

d. Present a brief analysis showing that the general ledger accounts for Work in Process Inventory

and for Finished Goods Inventory agree with the related job order cost sheets.

e. Explain in one sentence each what the balance of each general ledger account established in re-

quirement (a) represents

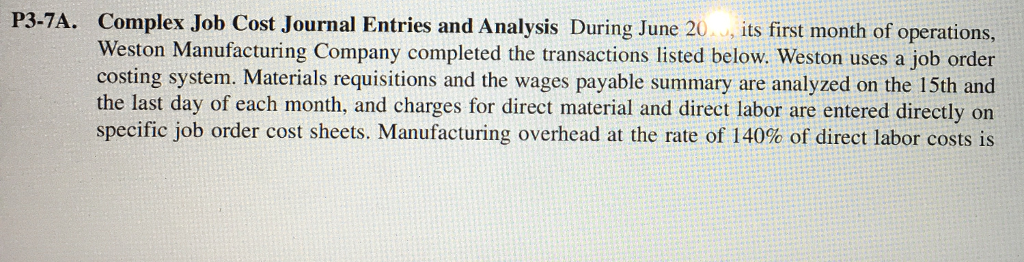

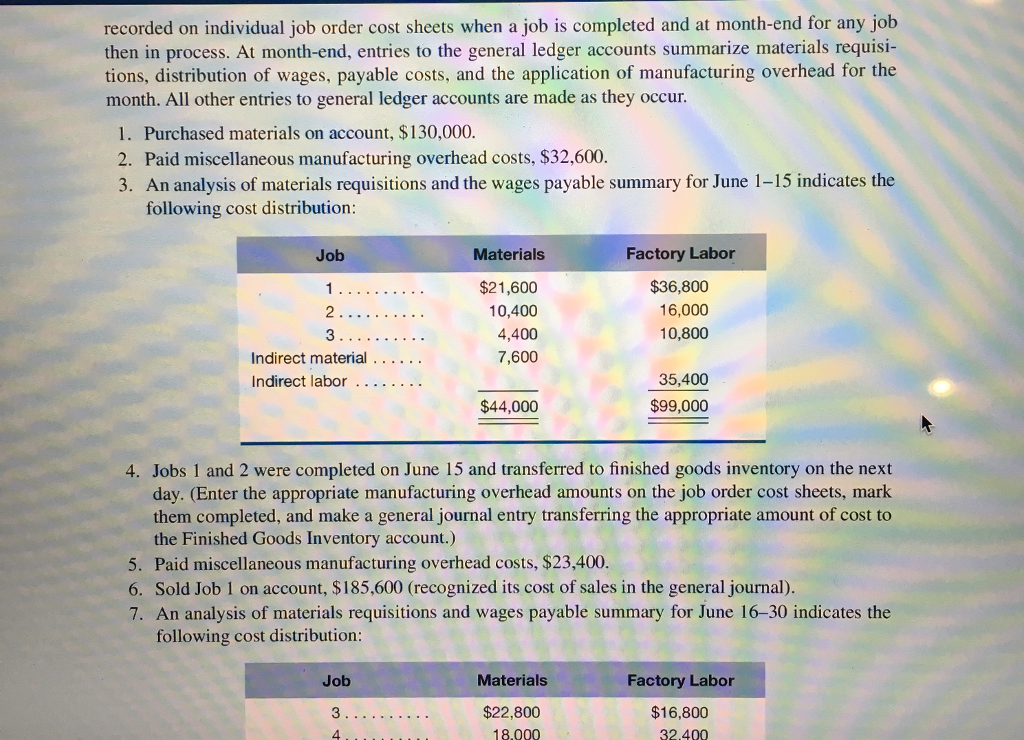

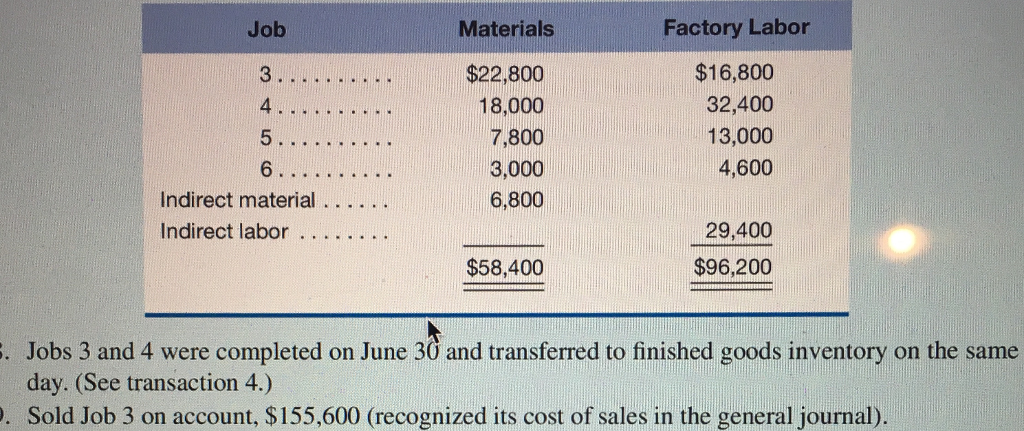

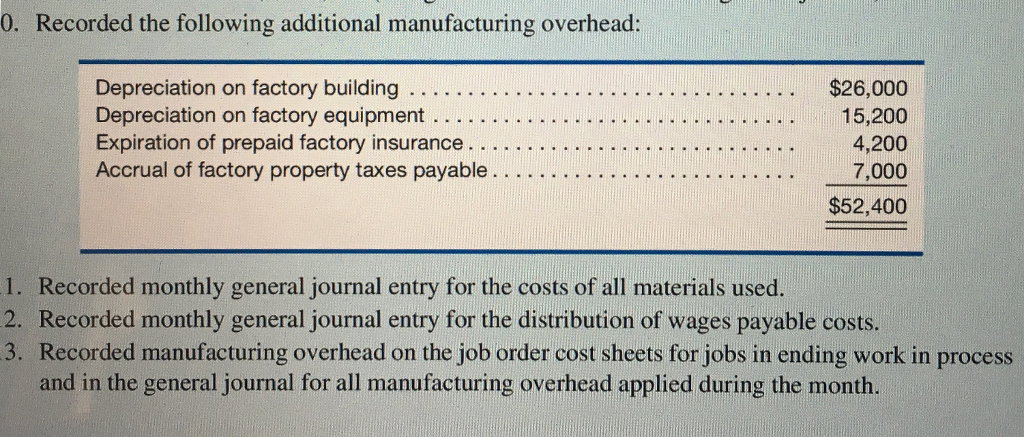

P3-7A. Complex Job Cost Journal Entries and Analysis During June 20, its first month of operations, Weston Manufacturing Company completed the transactions listed below. Weston uses a job order costing system. Materials requisitions and the wages payable summary are analyzed on the 15th and the last day of each month, and charges for direct material and direct labor are entered directly on specific job order cost sheets. Manufacturing overhead at the rate of 140% of direct labor costs is lul recorded on individual job order cost sheets when a job is completed and at month-end for any job then in process. At month-end, entries to the general ledger accounts summarize materials requisi- tions, distribution of wages, payable costs, and the application of manufacturing overhead for the month. All other entries to general ledger accounts are made as they occur. 1. Purchased materials on account, $130,000 2. Paid miscellaneous manufacturing overhead costs, $32,600. 3. An analysis of materials requisitions and the wages payable summary for June 1-15 indicates the following cost distribution: Factory Labor $36,800 16,000 10,800 Job Materials $21,600 10,400 4,400 7,600 3 35,400 $99,000 Indirect labor. . . . $44,000 4. Jobs 1 and 2 were completed on June 15 and transferred to finished goods inventory on the next day. (Enter the appropriate manufacturing overhead amounts on the job order cost sheets, mark them completed, and make a general journal entry transferring the appropriate amount of cost to the Finished Goods Inventory account.) 5. Paid miscellaneous manufacturing overhead costs, $23,400 6. Sold Job 1 on account, $185,600 (recognized its cost of sales in the general journal). 7. An analysis of materials requisitions and wages payable summary for June 16-30 indicates the following cost distribution: Job 3 4 Materials $22,800 18.000 Factory Labor $16,800 32.400 Job Materials Factory Labor 4 5 6 $22,800 18,000 7,800 3,000 6,800 $16,800 32,400 13,000 4,600 Indirect material Indirect labor.. ... 29,400 $58,400 $96,200 Jobs 3 and 4 were completed on June 30 and transferred to finished goods inventory on the same day. (See transaction 4.) Sold Job 3 on account, $155,600 (recognized its cost of sales in the general journal). 0. Recorded the following additional manufacturing overhead: $26,000 15,200 4,200 7,000 $52,400 Expiration of Accrual of factory property taxes payable....... prepaid factory insurance. 1. Recorded monthly general journal entry for the costs of all materials used. 2. Recorded monthly general journal entry for the distribution of wages payable costs 3. Recorded manufacturing overhead on the job order cost sheets for jobs in ending work in process and in the general journal for all manufacturing overhead applied during the month. P3-7A. Complex Job Cost Journal Entries and Analysis During June 20, its first month of operations, Weston Manufacturing Company completed the transactions listed below. Weston uses a job order costing system. Materials requisitions and the wages payable summary are analyzed on the 15th and the last day of each month, and charges for direct material and direct labor are entered directly on specific job order cost sheets. Manufacturing overhead at the rate of 140% of direct labor costs is lul recorded on individual job order cost sheets when a job is completed and at month-end for any job then in process. At month-end, entries to the general ledger accounts summarize materials requisi- tions, distribution of wages, payable costs, and the application of manufacturing overhead for the month. All other entries to general ledger accounts are made as they occur. 1. Purchased materials on account, $130,000 2. Paid miscellaneous manufacturing overhead costs, $32,600. 3. An analysis of materials requisitions and the wages payable summary for June 1-15 indicates the following cost distribution: Factory Labor $36,800 16,000 10,800 Job Materials $21,600 10,400 4,400 7,600 3 35,400 $99,000 Indirect labor. . . . $44,000 4. Jobs 1 and 2 were completed on June 15 and transferred to finished goods inventory on the next day. (Enter the appropriate manufacturing overhead amounts on the job order cost sheets, mark them completed, and make a general journal entry transferring the appropriate amount of cost to the Finished Goods Inventory account.) 5. Paid miscellaneous manufacturing overhead costs, $23,400 6. Sold Job 1 on account, $185,600 (recognized its cost of sales in the general journal). 7. An analysis of materials requisitions and wages payable summary for June 16-30 indicates the following cost distribution: Job 3 4 Materials $22,800 18.000 Factory Labor $16,800 32.400 Job Materials Factory Labor 4 5 6 $22,800 18,000 7,800 3,000 6,800 $16,800 32,400 13,000 4,600 Indirect material Indirect labor.. ... 29,400 $58,400 $96,200 Jobs 3 and 4 were completed on June 30 and transferred to finished goods inventory on the same day. (See transaction 4.) Sold Job 3 on account, $155,600 (recognized its cost of sales in the general journal). 0. Recorded the following additional manufacturing overhead: $26,000 15,200 4,200 7,000 $52,400 Expiration of Accrual of factory property taxes payable....... prepaid factory insurance. 1. Recorded monthly general journal entry for the costs of all materials used. 2. Recorded monthly general journal entry for the distribution of wages payable costs 3. Recorded manufacturing overhead on the job order cost sheets for jobs in ending work in process and in the general journal for all manufacturing overhead applied during the monthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started