Answered step by step

Verified Expert Solution

Question

1 Approved Answer

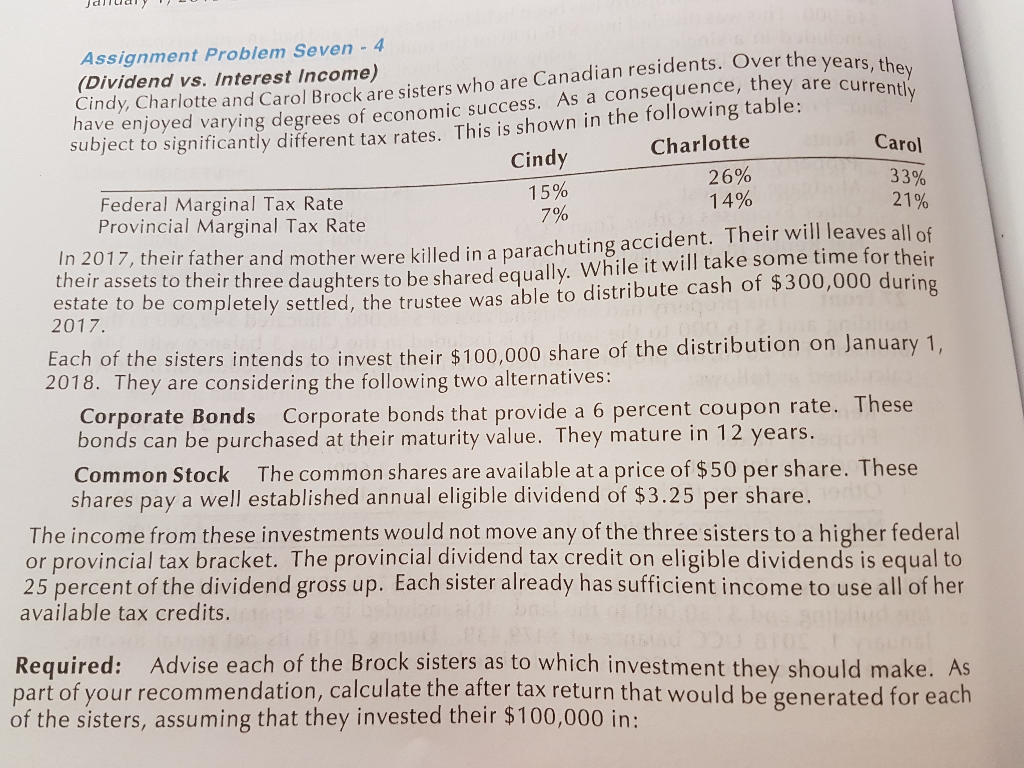

Required: Advise each of the Brock sisters as to which investment they should make. As part of your recommendation, calculate the after tax return that

Required: Advise each of the Brock sisters as to which investment they should make. As part of your recommendation, calculate the after tax return that would be generated for each of the sisters, assuming that they invested their $100,000 in:

a) the corporate bonds

b) the common stock

Comment on any other factors that they should consider in making their choice.

Assignment Problem Seven-4 (Dividend vs. Interest Income Cindy,Charlotte and Carol Brock are sisters who are Canadian residents. Over the years, they have enjoyed varying degrees of economic success. As a consequence, they are currently subject to significantly different tax rates. This is shown in the following table: Carol Charlotte Cindy 15% 7% 26% 14% 33% 21% Federal Marginal Tax Rate Provincial Marginal Tax Rate In 2017, their father and mother were killed in a parachuting accident. Their will leaves all of their assets to their three daughters to be shared equally. While it will take some time for their estate to be completely settled, the trustee was able to distribute cash of $300,000 during 2017. Each of the sisters intends to invest their $100.000 share of the distribution on January 1, 2018. They are considering the following two alternatives: Corporate Bonds Corporate bonds that provide a 6 percent coupon rate. These bonds can be purchased at their maturity value. They mature in 12 years. Common Stock The common shares are available at a price of $50 per share. These shares pay a well established annual eligible dividend of $3.25 per share. The income from these investments would not move any of the three sisters to a higher federal provincial tax bracket. The provincial dividend tax credit on eligible dividends is equal to 25 percent of the dividend gross up. Each sister already has sufficient income to use all of her available tax credits. or Advise each of the Brock sisters as to which investment they should make. As Required: part of your recommendation, calculate the after tax return that would be generated for each of the sisters, assuming that they invested their $100,000 in: Assignment Problem Seven-4 (Dividend vs. Interest Income Cindy,Charlotte and Carol Brock are sisters who are Canadian residents. Over the years, they have enjoyed varying degrees of economic success. As a consequence, they are currently subject to significantly different tax rates. This is shown in the following table: Carol Charlotte Cindy 15% 7% 26% 14% 33% 21% Federal Marginal Tax Rate Provincial Marginal Tax Rate In 2017, their father and mother were killed in a parachuting accident. Their will leaves all of their assets to their three daughters to be shared equally. While it will take some time for their estate to be completely settled, the trustee was able to distribute cash of $300,000 during 2017. Each of the sisters intends to invest their $100.000 share of the distribution on January 1, 2018. They are considering the following two alternatives: Corporate Bonds Corporate bonds that provide a 6 percent coupon rate. These bonds can be purchased at their maturity value. They mature in 12 years. Common Stock The common shares are available at a price of $50 per share. These shares pay a well established annual eligible dividend of $3.25 per share. The income from these investments would not move any of the three sisters to a higher federal provincial tax bracket. The provincial dividend tax credit on eligible dividends is equal to 25 percent of the dividend gross up. Each sister already has sufficient income to use all of her available tax credits. or Advise each of the Brock sisters as to which investment they should make. As Required: part of your recommendation, calculate the after tax return that would be generated for each of the sisters, assuming that they invested their $100,000 inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started