Answered step by step

Verified Expert Solution

Question

1 Approved Answer

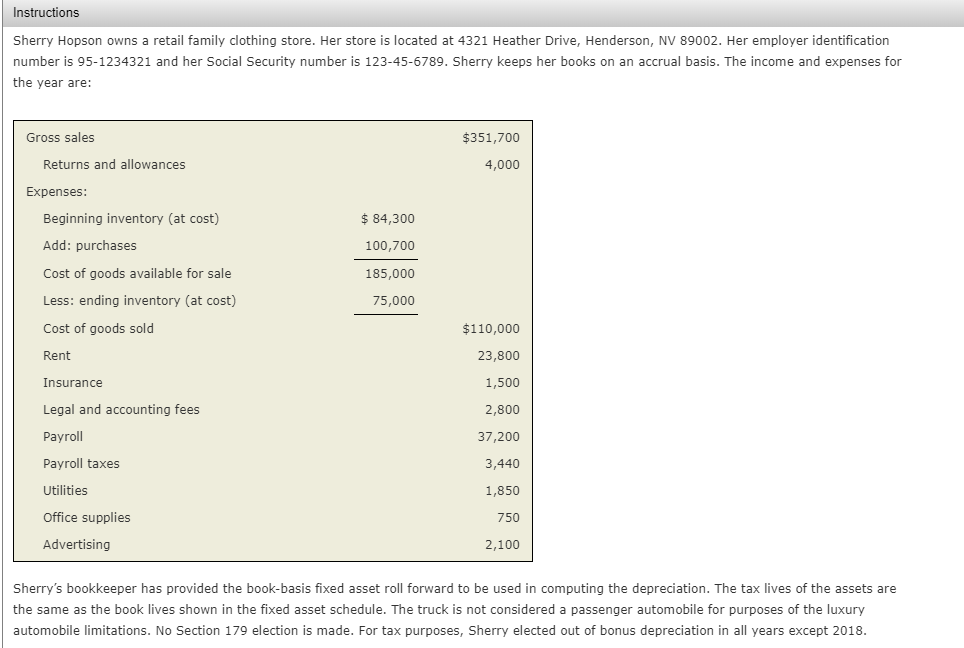

Required: Complete Sherry's Schedule C and Form 4562 Instructions Sherry Hopson owns a retail family clothing store. Her store is located at 4321 Heather Drive,

Required: Complete Sherry's Schedule C and Form 4562

Instructions Sherry Hopson owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95-1234321 and her Social Security number is 123-45-6789. Sherry keeps her books on an accrual basis. The income and expenses for the year are: Gross sales $351,700 Returns and allowances 4,000 Expenses: $ 84,300 100,700 Beginning inventory (at cost) Add: purchases Cost of goods available for sale Less: ending inventory (at cost) Cost of goods sold 185,000 75,000 Rent Insurance $110,000 23,800 1,500 2,800 37,200 3,440 Legal and accounting fees Payroll Payroll taxes Utilities Office supplies Advertising 1,850 750 2,100 Sherry's bookkeeper has provided the book-basis fixed asset roll forward to be used in computing the depreciation. The tax lives of the assets are the same as the book lives shown in the fixed asset schedule. The truck is not considered a passenger automobile for purposes of the luxury automobile limitations. No Section 179 election is made. For tax purposes, Sherry elected out of bonus depreciation in all years except 2018. Instructions Sherry Hopson owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95-1234321 and her Social Security number is 123-45-6789. Sherry keeps her books on an accrual basis. The income and expenses for the year are: Gross sales $351,700 Returns and allowances 4,000 Expenses: $ 84,300 100,700 Beginning inventory (at cost) Add: purchases Cost of goods available for sale Less: ending inventory (at cost) Cost of goods sold 185,000 75,000 Rent Insurance $110,000 23,800 1,500 2,800 37,200 3,440 Legal and accounting fees Payroll Payroll taxes Utilities Office supplies Advertising 1,850 750 2,100 Sherry's bookkeeper has provided the book-basis fixed asset roll forward to be used in computing the depreciation. The tax lives of the assets are the same as the book lives shown in the fixed asset schedule. The truck is not considered a passenger automobile for purposes of the luxury automobile limitations. No Section 179 election is made. For tax purposes, Sherry elected out of bonus depreciation in all years except 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started