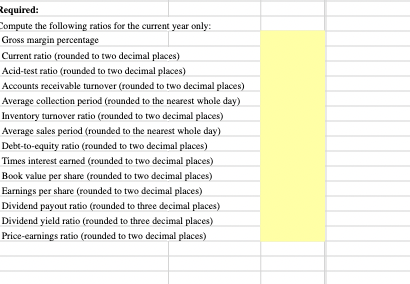

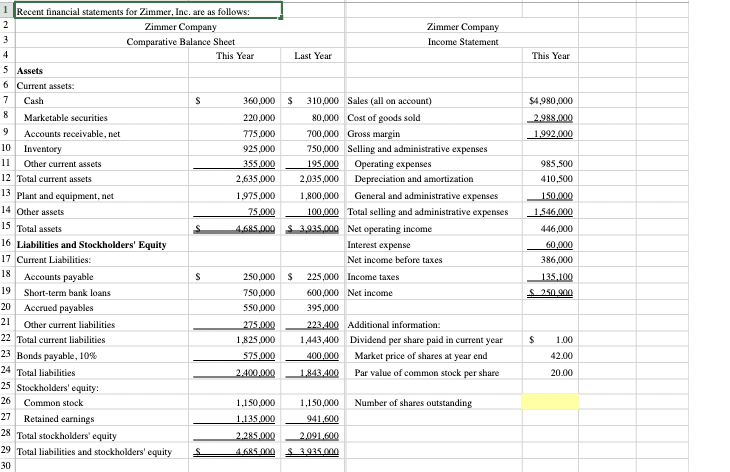

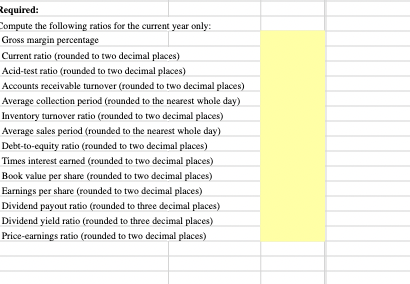

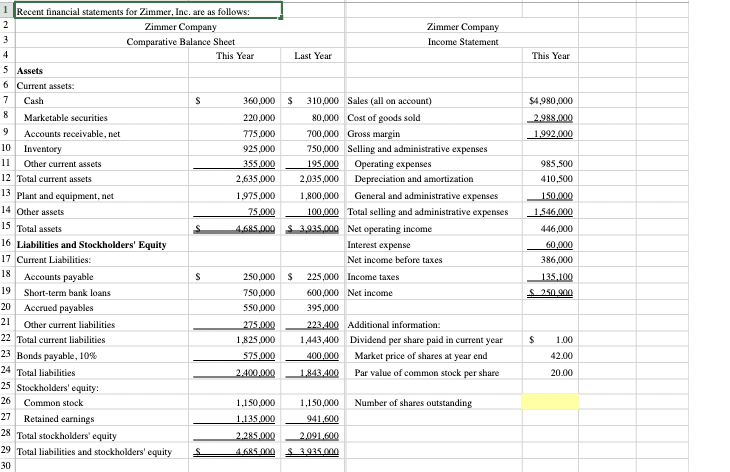

Required: Compute the following ratios for the current year only: Gross margin percentage Current ratio (rounded to two decimal places) Acid-test ratio (rounded to two decimal places) Accounts receivable turnover (rounded to two decimal places) Average collection period (rounded to the nearest whole day) Inventory turnover ratio (rounded to two decimal places) Average sales period (rounded to the nearest whole day) Debt-to-equity ratio (rounded to two decimal places) Times interest earned (rounded to two decimal places) Book value per share (rounded to two decimal places) Earnings per share (rounded to two decimal places) Dividend payout ratio (rounded to three decimal places) Dividend yield ratio (rounded to three decimal places) Price-earnings ratio (rounded to two decimal places) This Year $4,980,000 2.988.000 1.992.000 15 Total assets 1 Recent financial statements for Zimmer, Inc. are as follows: 2 Zimmer Company Zimmer Company Comparative Balance Sheet Income Statement 4 This Year Last Year 5 Assets 6 Current assets: 7 Cash s 360,000 $ 310,000 Sales (all on account) Marketable securities 220.000 80,000 Cost of goods sold 9 Accounts receivable, net 775.000 700.000 Gross margin 10 Inventory 925.000 750,000 Selling and administrative expenses 11 Other current assets 355.000 195,000 Operating expenses 12 Total current assets 2.635,000 2,035,000 Depreciation and amortization 13 Plant and equipment, net 1.975,000 1,800,000 General and administrative expenses 14 Other assets 75.000 100,000 Total selling and administrative expenses S 4.685.000 $3.995.000 Net operating income 16 Liabilities and Stockholders' Equity Interest expense 17 Current Liabilities: Net income before taxes 18 Accounts payable S 250,000 $225,000 Income taxes 19 Short-term bank loans 750.000 600,000 Net income 20 Accrued payables 550.000 395,000 21 Other current liabilities 275.000 223.400 Additional information: 22 Total current liabilities 1.825.000 1,443,400 Dividend per share paid in current year 23 Bonds payable, 10% 575.000 400,000 Market price of shares at year end 24 Total liabilities 2.400.000 1.843.400 Par value of common stock per share 25 Stockholders' equity: 26 Common stock 1,150,000 1,150,000 Number of shares outstanding 27 Retained earnings 1.135.000 941.600 28 Total stockholders' equity 2.285.000 2.091.600 29 Total liabilities and stockholders' equity S 4685 S 3.935.00 30 985,500 410,500 150.000 1,546,000 446,000 60.000 386,000 135,100 S250_900 $ 1.00 42.00 20.00