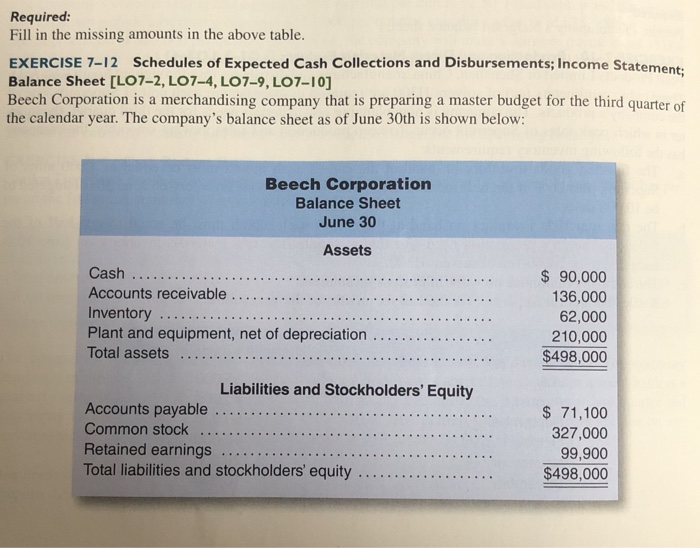

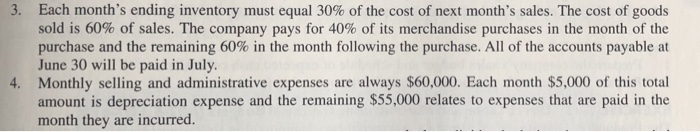

Required Fill in the missing amounts in the above table. EXERCISE 712 Schedules of Expected Cash Collections and Disbursements; Income Statement: Balance Sheet [LO7-2, LO7-4, LO7-9, LO7-10] Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company's balance sheet as of June 30th is shown below: Beech Corporation Balance Sheet June 30 Assets Cash $90,000 136,000 62,000 210,000 $498,000 .. Inventory Plant and equipment, net of depreciation Total assets . . Liabilities and Stockholders' Equity . . Accounts payable Retained earnings.. Total liabilities and stockholders' equity $ 71,100 327,000 99,900 $498,000 .. 3. Each month's ending inventory must equal 30% of the cost of next month's sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July Monthly selling and administrative expenses are always $60,000. Each month $5,000 of this total amount is depreciation expense and the remaining $55,000 relates to expenses that are paid in the month they are incurred h lorde 4. Required Fill in the missing amounts in the above table. EXERCISE 712 Schedules of Expected Cash Collections and Disbursements; Income Statement: Balance Sheet [LO7-2, LO7-4, LO7-9, LO7-10] Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company's balance sheet as of June 30th is shown below: Beech Corporation Balance Sheet June 30 Assets Cash $90,000 136,000 62,000 210,000 $498,000 .. Inventory Plant and equipment, net of depreciation Total assets . . Liabilities and Stockholders' Equity . . Accounts payable Retained earnings.. Total liabilities and stockholders' equity $ 71,100 327,000 99,900 $498,000 .. 3. Each month's ending inventory must equal 30% of the cost of next month's sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July Monthly selling and administrative expenses are always $60,000. Each month $5,000 of this total amount is depreciation expense and the remaining $55,000 relates to expenses that are paid in the month they are incurred h lorde 4