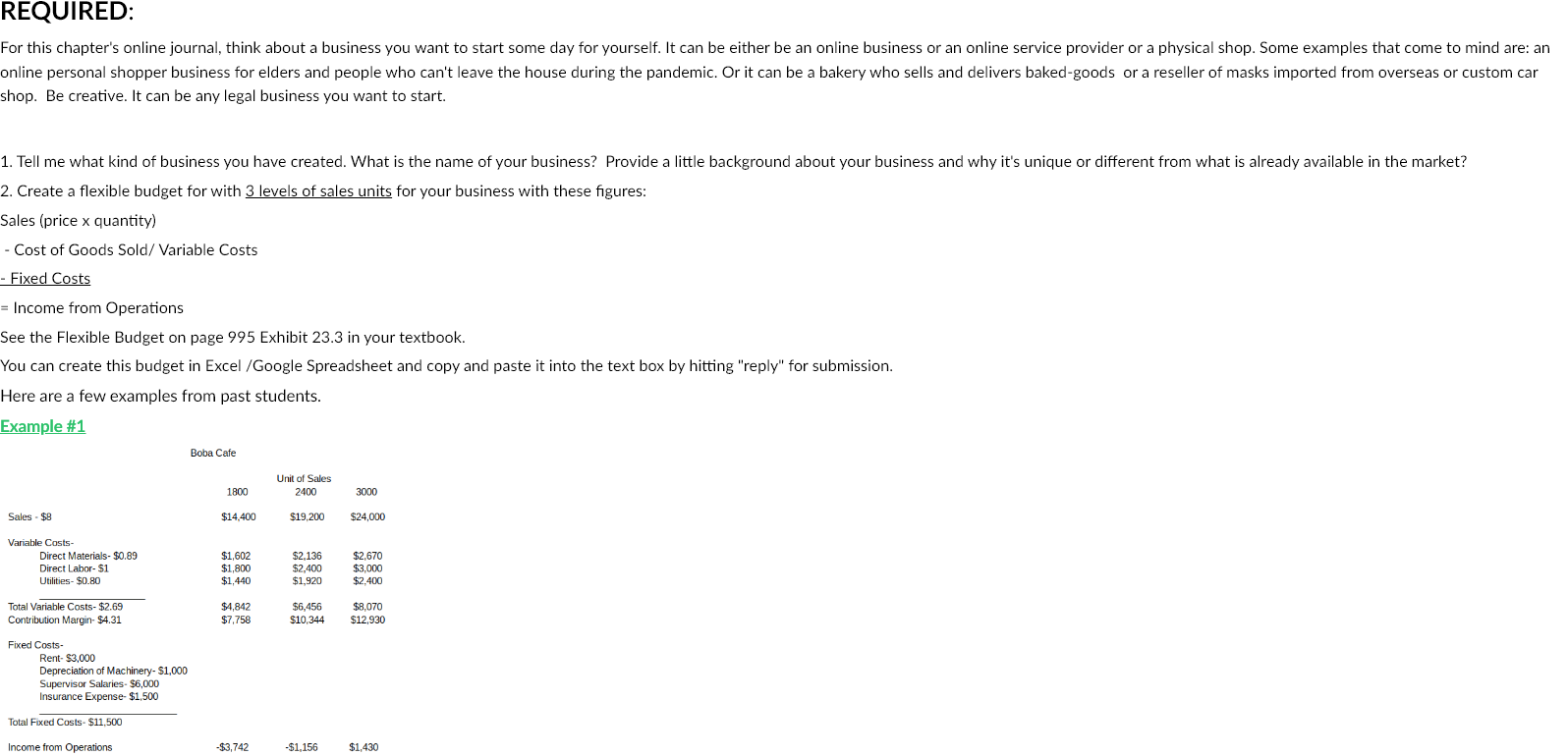

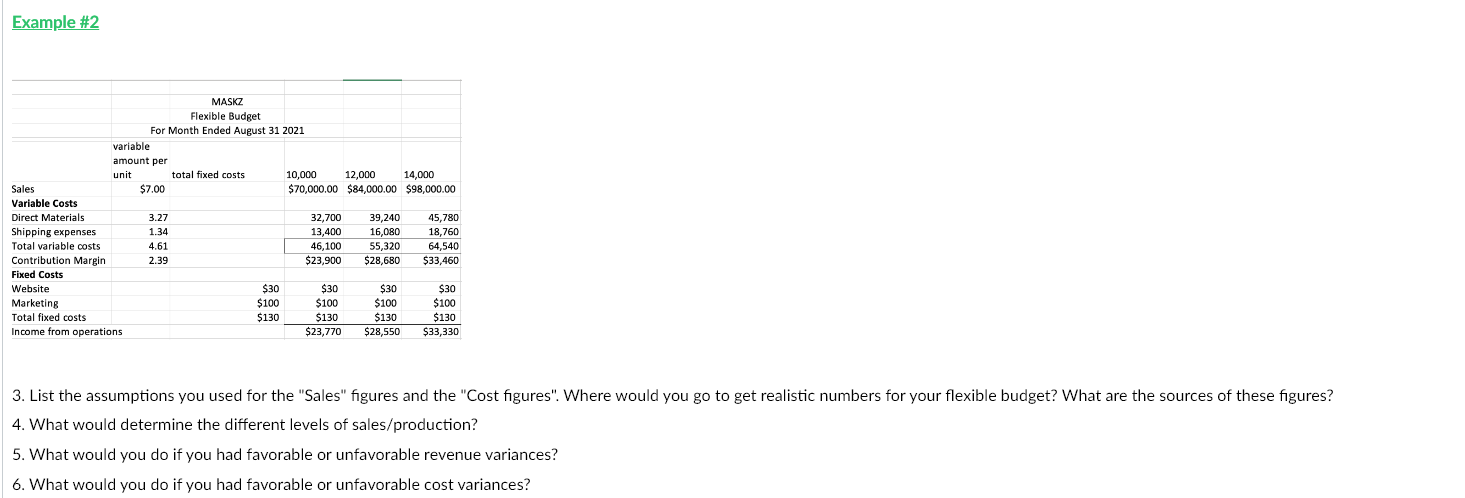

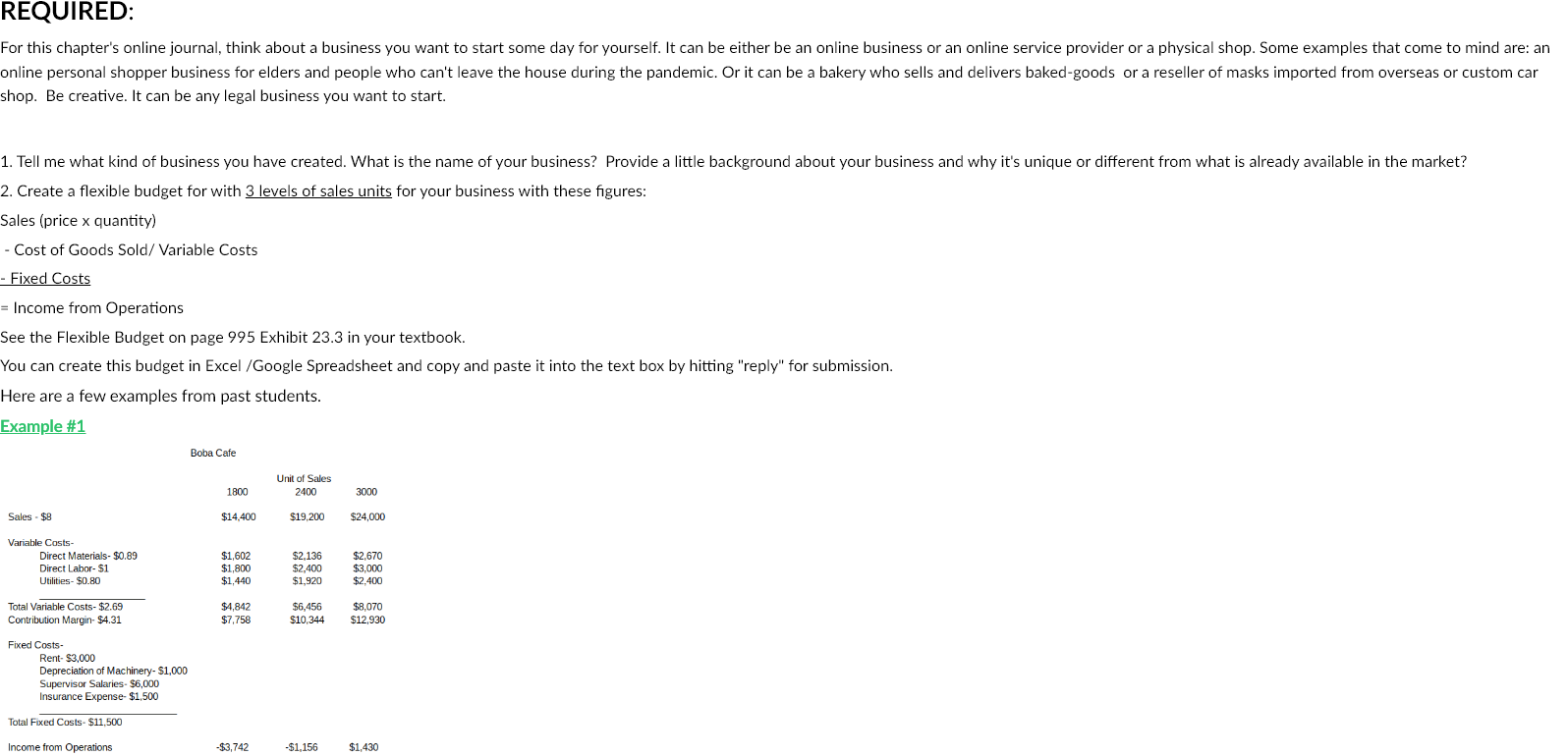

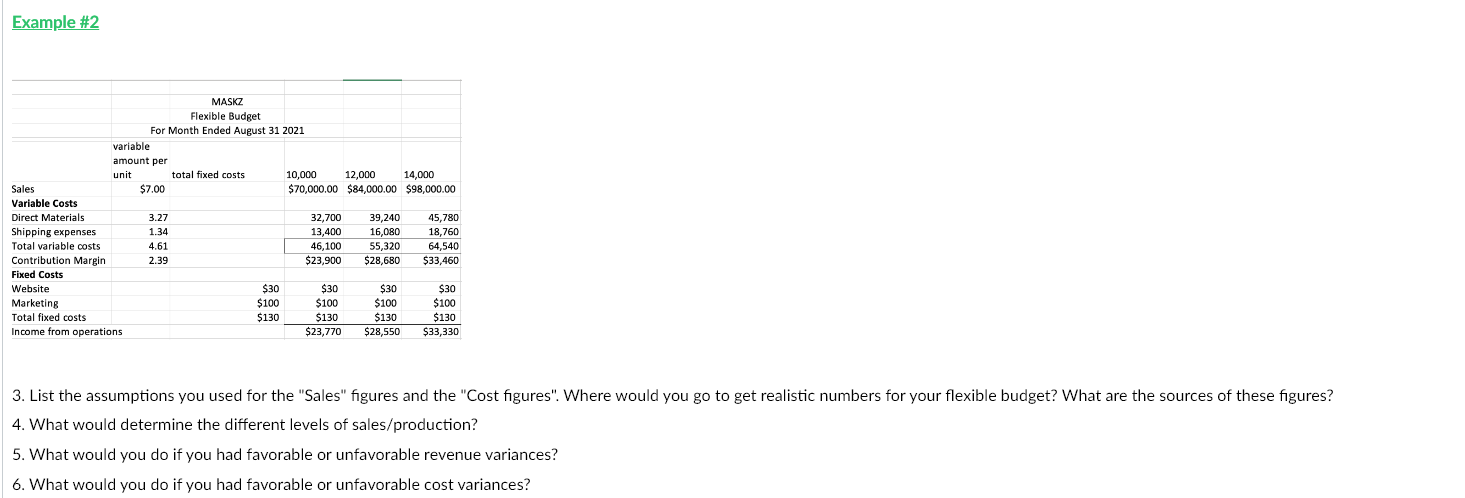

REQUIRED: For this chapter's online journal, think about a business you want to start some day for yourself. It can be either be an online business or an online service provider or a physical shop. Some examples that come to mind are: an online personal shopper business for elders and people who can't leave the house during the pandemic. Or it can be a bakery who sells and delivers baked-goods or a reseller of masks imported from overseas or custom car shop. Be creative. It can be any legal business you want to start. 1. Tell me what kind of business you have created. What is the name of your business? Provide a little background about your business and why it's unique or different from what is already available in the market? 2. Create a flexible budget for with 3 levels of sales units for your business with these figures: Sales (price x quantity) - Cost of Goods Sold/ Variable Costs - Fixed Costs = Income from Operations See the Flexible Budget on page 995 Exhibit 23.3 in your textbook. You can create this budget in Excel /Google Spreadsheet and copy and paste it into the text box by hitting "reply" for submission. Here are a few examples from past students. Example #1 Boba Cafe Unit of Sales 2400 1800 3000 Sales - $8 - $8 $14,400 $19.200 $24,000 Variable Costs- Direct Materials - $0.89 Direct Labor- $1 Utilities - $0.80 $1,602 $1,800 $1,440 $2,136 $2,400 $1,920 $2,670 $3,000 $2,400 Total Variable Costs - $2.69 Contribution Margin- $4.31 $4,842 $7,758 $6,456 $10,344 $8,070 $12.930 Fixed Costs - Rent-$3,000 Depreciation of Machinery- $1,000 Supervisor Salaries - $6,000 Insurance Expense- $1,500 Total Fixed Costs - $11,500 Income from Operations -$3,742 -$1,156 $1,430 Example #2 MASKZ Flexible Budget For Month Ended August 31 2021 variable amount per unit total fixed costs 10,000 12,000 14,000 Sales $7.00 $70,000.00 $84,000.00 $98,000.00 Variable Costs Direct Materials 3.27 32,700 39,240 45,780 Shipping expenses 1.34 13,400 16,080 18,760 Total variable costs 4.61 46.100 55,320 64,540 Contribution Margin 2.39 $23,900 $28,6BC $33,460 Fixed Costs Website $30 $30 $30 $30 Marketing $100 $100 $100 $100 Total fixed costs $130 $130 $130 $130 Income from operations $23,770 $28,550 $33,330 3. List the assumptions you used for the "Sales" figures and the "Cost figures". Where would you go to get realistic numbers for your flexible budget? What are the sources of these figures? 4. What would determine the different levels of sales/production? 5. What would you do if you had favorable or unfavorable revenue variances? 6. What would you do if you had favorable or unfavorable cost variances? REQUIRED: For this chapter's online journal, think about a business you want to start some day for yourself. It can be either be an online business or an online service provider or a physical shop. Some examples that come to mind are: an online personal shopper business for elders and people who can't leave the house during the pandemic. Or it can be a bakery who sells and delivers baked-goods or a reseller of masks imported from overseas or custom car shop. Be creative. It can be any legal business you want to start. 1. Tell me what kind of business you have created. What is the name of your business? Provide a little background about your business and why it's unique or different from what is already available in the market? 2. Create a flexible budget for with 3 levels of sales units for your business with these figures: Sales (price x quantity) - Cost of Goods Sold/ Variable Costs - Fixed Costs = Income from Operations See the Flexible Budget on page 995 Exhibit 23.3 in your textbook. You can create this budget in Excel /Google Spreadsheet and copy and paste it into the text box by hitting "reply" for submission. Here are a few examples from past students. Example #1 Boba Cafe Unit of Sales 2400 1800 3000 Sales - $8 - $8 $14,400 $19.200 $24,000 Variable Costs- Direct Materials - $0.89 Direct Labor- $1 Utilities - $0.80 $1,602 $1,800 $1,440 $2,136 $2,400 $1,920 $2,670 $3,000 $2,400 Total Variable Costs - $2.69 Contribution Margin- $4.31 $4,842 $7,758 $6,456 $10,344 $8,070 $12.930 Fixed Costs - Rent-$3,000 Depreciation of Machinery- $1,000 Supervisor Salaries - $6,000 Insurance Expense- $1,500 Total Fixed Costs - $11,500 Income from Operations -$3,742 -$1,156 $1,430 Example #2 MASKZ Flexible Budget For Month Ended August 31 2021 variable amount per unit total fixed costs 10,000 12,000 14,000 Sales $7.00 $70,000.00 $84,000.00 $98,000.00 Variable Costs Direct Materials 3.27 32,700 39,240 45,780 Shipping expenses 1.34 13,400 16,080 18,760 Total variable costs 4.61 46.100 55,320 64,540 Contribution Margin 2.39 $23,900 $28,6BC $33,460 Fixed Costs Website $30 $30 $30 $30 Marketing $100 $100 $100 $100 Total fixed costs $130 $130 $130 $130 Income from operations $23,770 $28,550 $33,330 3. List the assumptions you used for the "Sales" figures and the "Cost figures". Where would you go to get realistic numbers for your flexible budget? What are the sources of these figures? 4. What would determine the different levels of sales/production? 5. What would you do if you had favorable or unfavorable revenue variances? 6. What would you do if you had favorable or unfavorable cost variances