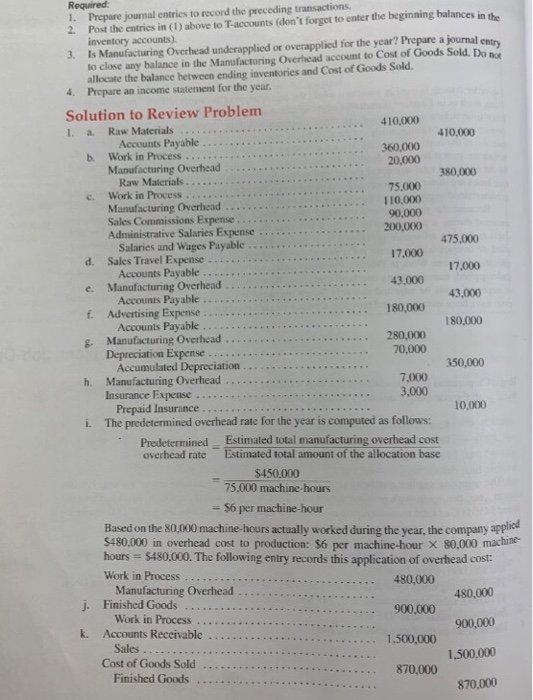

Required I. Prepare journal entries to record the preceding transactions 2. Post the entrics in (1) above to T-accounts (don't forget to enter the beginning halances in the inventory accounts). 3. Is Manufacturing Overhead underapplied or overapplied for the year? Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. Do p allocate the balance between ending inventories and Cost of Goods Sold 4. Prepare an income statement for the year Solution to Review Problem 1. a. Raw Materials 410.000 410.000 360,000 Work in Process Manufacturing Overhead b. 20,000 75,000 90,000 380,000 Raw Materials c. Work in Process Sales Commissions Expense Administrative Salaries Expense... 200,000 17,000 43,000 475,000 17,000 43,000 Salaries and Wages Payable d. Sales Travel Expense Accounts Payable. Accounts Payable Accounts Payable Depreciation Expense e. Manufacturing Overhead f. Advertising Expense 280,000 70.000 . Manufacturing Overhcad... 350,000 Accumulated Depreciation h. Manufacturing Overhead Insurance Expense 3,000 10,000 Prepaid Insurance The predetermined overhead rate for the year is computed as follows: i. Predetermined Estimated total manufacturing overhead cost overhead rate Estimated total amount of the allocation base $450,000 75,000 machine -hours -56 per machine-hour Based on the 80,000 machine-hours actually worked during the year, the company applisod $480.000 in overhead cost to production: $6 per machine-hour X 80,000 machine hours $480.000. The following entry records this application of overhead cost Work in Process 480,000 Manufacturing Overhead. Work in Process Sales 480,000 900,000 1,500,000 870,000 j Finished Goods k. Accounts Receivable 1,500,000 870,000 Required I. Prepare journal entries to record the preceding transactions 2. Post the entrics in (1) above to T-accounts (don't forget to enter the beginning halances in the inventory accounts). 3. Is Manufacturing Overhead underapplied or overapplied for the year? Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. Do p allocate the balance between ending inventories and Cost of Goods Sold 4. Prepare an income statement for the year Solution to Review Problem 1. a. Raw Materials 410.000 410.000 360,000 Work in Process Manufacturing Overhead b. 20,000 75,000 90,000 380,000 Raw Materials c. Work in Process Sales Commissions Expense Administrative Salaries Expense... 200,000 17,000 43,000 475,000 17,000 43,000 Salaries and Wages Payable d. Sales Travel Expense Accounts Payable. Accounts Payable Accounts Payable Depreciation Expense e. Manufacturing Overhead f. Advertising Expense 280,000 70.000 . Manufacturing Overhcad... 350,000 Accumulated Depreciation h. Manufacturing Overhead Insurance Expense 3,000 10,000 Prepaid Insurance The predetermined overhead rate for the year is computed as follows: i. Predetermined Estimated total manufacturing overhead cost overhead rate Estimated total amount of the allocation base $450,000 75,000 machine -hours -56 per machine-hour Based on the 80,000 machine-hours actually worked during the year, the company applisod $480.000 in overhead cost to production: $6 per machine-hour X 80,000 machine hours $480.000. The following entry records this application of overhead cost Work in Process 480,000 Manufacturing Overhead. Work in Process Sales 480,000 900,000 1,500,000 870,000 j Finished Goods k. Accounts Receivable 1,500,000 870,000